| Andy Snyder

Founder

Manward Press |

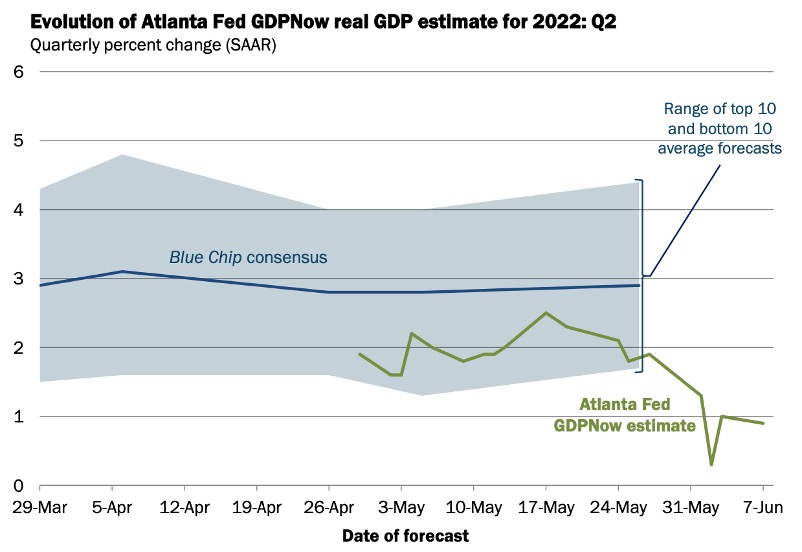

Here we go again... The dopes in Washington are working to distort the truth... one more time. If these folks were as good at managing the economy as they are at making up excuses... we'd never have to pick up our pen again. But alas, they're economic dolts - proving the liars figure and figures lie. [Strange Space Device Next Medical Miracle? Details Here.] Since late last year, we've said a recession would come in the second half of the year. Peak employment... a drop in consumer savings... and an inflationary hangover from printing trillions of dollars will put an economy in retreat. So far, we've been 100% right. In news that came as a shock to many in D.C., the economy shrank during the year's first quarter. The nation's GDP fell back 1.5%. And now that the Federal Reserve's supposedly real-time GDP tracker is showing more signs of a slowdown, the fine folks in charge of things are walking back their definition of a recession. Go figure. Backing UpFirst... the numbers. Things are falling fast. On June 1, the GDPNow model had the economy growing at a 1.3% clip during the second quarter. On Tuesday, it cut that figure to just 0.9%. The trend doesn't look good... With just weeks left in the second quarter, a negative print is looking quite likely. It's important to note here that at no time during the first three months of the year did this gauge ever point to a negative figure... despite the final growth number coming in well into negative territory. If we get another negative print, it'll be the second in a row. That's the classic, standard definition of a recession. In fact, every period in the past with two consecutive quarters of negative growth has been deemed a recession. But dear friend, this time may be different. Now we're living in a world where reality and truth have evaporated from the public sphere. [The No. 1 Trick to Win in THIS Market? Former Fox News Juggernaut Breaks It Down for Investors... CLICK HERE] Fun With WordsAs you could probably guess, talk of a recession and key midterm elections don't mix well. So it's no surprise the fine folks at the National Bureau of Economic Research (NBER) are working to walk back their definitions. A recession isn't necessarily a recession, they say. "Most of the recessions identified by our procedures do consist of two or more consecutive quarters of declining real GDP, but not all of them," the group says. "There are several reasons. First, we do not identify economic activity solely with real GDP, but consider a range of indicators. Second, we consider the depth of the decline in economic activity." Hmm... Instead, the NBER defines a recession as "a significant decline in economic activity that is spread across the economy and that lasts more than a few months." This shady definition gives the political class plenty of room to maneuver. "Oh, no," they'll say. "This is hardly a blip on the radar. It's the Putin slowdown. Things were so hot we ran out of stuff to sell. It's totally out of our control." Meanwhile... demand for mortgages just hit the lowest level in 22 years, and credit card usage has surged. When we predicted a recession was coming, we said all that stimulus money would burn out quickly, leaving quite a hole in the foundation of the economic house of cards. That hole is here. "You Crazy"But here's the thing... why it pays to sound a little crazy and go out on a limb all by ourselves... Look at the chart above again. The consensus estimate still doesn't bake in a recession. Despite cries from Elon Musk - and his "super bad feeling" - and Jamie Dimon's calls for an economic hurricane... most banks and big-name investors are calling for fair winds and a "soft landing." Even Washington's most popular commentators (sorry, Fauci), Janet Yellen and Jay Powell, are saying things will be just fine. Won't they be surprised when they're soon forced to point to an alternative definition of a recession. And won't Mr. Market be stunned when the talks of tightening turn, once again, into talks of stimulus and perpetually cheap money. Indeed, today's buyers aren't crazy. They see this situation for what it is. They see the truth in the numbers. The downturn is here. The pumping is near. Dow 100K... here we come! Be well, Andy Editor's Note: As the market gets ready to turn north once again, Bill O'Reilly and our good friend Alexander Green are about to go live with a FREE online event at 8 p.m. ET tonight. They're going to reveal a way to make more profits in a shorter amount of time... with one of the best investing strategies out there. Manward readers will know it well... since Andy's a HUGE fan of it. Click here for more details and to reserve your spot. Want more content like this? | | | |

Andy Snyder | FounderAndy Snyder is the founder of Manward Press, the nation's premier source of unfiltered, unorthodox views on money and what it means for a free society. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. He's been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms. | | |

|

No comments:

Post a Comment