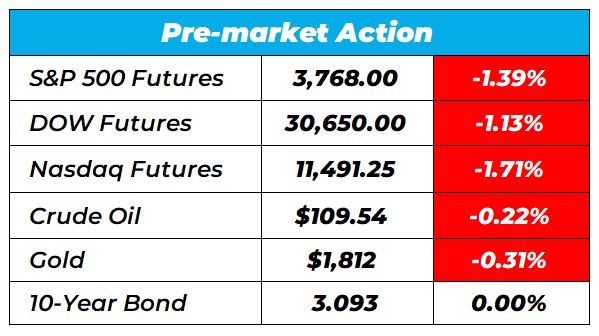

Duck Creek expects revenue in the range of $72.8 million to $74.8 million, while analysts were estimating $80.4 million. Good morning Wake-Up Watchlisters! While you're chugging diner coffee you'll see US futures extended stock-market losses. The slide comes after central bankers issued warnings on inflation and recession. Overall, traders are currently betting the global economy will buckle under the bank's tightening campaigns. In the current markets, everyone could use more income. That's why our friend Marc Lichtenfeld is giving away his Top Five Dividend Stocks for FREE. No credit card required. No gimmicks. Here you'll learn how to time dividend stocks properly, which can lead to staggering results! Click here to download his Top Five Dividend Stocks – for FREE. Here's a look at the top-moving stocks this morning. Duck Creek Technologies (Nasdaq: DCT)Duck Creek Technologies is down 19.07% premarket after the company tripped over its revenue outlook for the full year, missing the consensus estimates. The company reported adjusted EPS of 1 cent, down from 3 cents in the year-ago period. For the next quarter, Duck Creek expects revenue in the range of $72.8 million to $74.8 million, while analysts were estimating $80.4 million. Duck Creek is looking volatile. With more stocks going into the red, investors will need to adopt strategies that work in a bull market. That's why we're pounding the table on 'The Perfect Timing Pattern' in the War Room. This chart pattern has helped us clobber the S&P by 922% since 2019 – and it works during bull and bear markets. Click here to learn about the 'Perfect Timing Pattern.' Acuity Brands (NYSE: AYI)Acuity Brands is up 7.23% premarket after the company reported third quarter results that rose above expectations. The company reported strength in its lighting and lighting controls business. Net income for the quarter to May 31 rose to $105.7 million, or $3.07 a share, from $85.7 million. Adjusted earnings per share came in at $3.52, beating the FactSet consensus of $2.96. Keep an eye on Acuity Brands going forward. RH (NYSE: RH)RH is down 6.88% premarket after cutting 2022 sales forecast as consumer demand drops. The high-end furniture chain said full-year sales are expected to between 2% and 5% from 2021 levels. The company cited 'deteriorating macroeconomic environment' as the main reason for the cut. RH is looking volatile. Starwood Property Trust (NYSE: STWD) Starwood Property Trust is up 4.41% premarket. The commercial and residential lending company has seen its 2022 earnings estimates revised 12.2% upward to $2.30 over the past two months, according Zacks Consensus Estimates. Its year-over-year revenue is also estimated to uptick 9.9%. Keep an eye on Starwood Property Trust going forward. Do Your Stocks Meet These 5 Success Factors? As inflation and interest rates rise, there will be a new set of criteria for successful stocks going forward. Our Head Trading Fundamental Karim Rahemtulla breaks down the 5 most important factors for success in the current markets. Click here to read more. Those are the top market movers today. Happy trading! The Wake-Up Watchlist Research Team |

No comments:

Post a Comment