| | | | | | | | | | | Axios Markets | | By Emily Peck and Matt Phillips · Jun 06, 2022 | | Happy Monday. It's getting much harder to escape talk about inflation and the economy: R&B artist Ciara's new song became an unintended anthem for historic gas prices. And rapper Cardi B wants to know when a recession is coming. Stay safe out there, folks. Today's newsletter, edited by Kate Marino, is 1,090 words, 4.5 minutes. | | | | | | 1 big thing: America's new labor market |  Data: Committee for a Responsible Federal Budget, U.S. Bureau of Labor Statistics; Chart: Simran Parwani/Axios More warehouse workers, fewer waiters. More health store employees, fewer in public schools. The overall job market is nearly back to full strength, but it looks strikingly different, Axios' Courtenay Brown writes. Why it matters: Pandemic-era disruptions have shaken up the composition of the labor force — with big implications for how industries will have to adjust to a longer-term worker shortfall. What they're saying: "I'm not looking for recovery to pre-pandemic levels in each industry. Some workers have left for greener pastures and that's a good thing," Ellen Gaske, an economist at PGIM Fixed Income, tells Axios. - "There is more opportunity for workers to return to new jobs — where the industries are growing and the outlook is potentially brighter. That churning is what offers up a possibility of stronger productivity gains and increased standard of living."

What's new: With May's payroll gains, roughly 96% of jobs lost during the pandemic are back. - Stunning stat: The private sector has recovered 99% of all jobs lost, but the public sector has regained just 58% — one illustration of the gaping hole that persists in certain areas of the economy.

- Other industries have recovered and then some: The transportation and warehousing sector — think package couriers or truckers — has never made up a bigger share of the workforce, reflecting, for one, the historic appetite for goods.

What's happening: A collision of forces — some structural, some cyclical and some already underway before the pandemic hit — is pushing workers away from some jobs and toward others, according to a recent report by the Burning Glass Institute, a research firm. Among the changes ... - The remote work allure: "The pandemic created this huge wedge. People want to move out of in-person roles — leisure and hospitality or education — and move toward the kinds of occupations and industries with more flexibility," Julia Pollak, chief economist at ZipRecruiter, tells Axios.

- The goods spending boom: At the onset of the pandemic, stuck-at-home consumers bought more goods than services. But economists expect employment in consumer goods to cool off as spending on services continues to boomerang back.

- Where the wages are: "Private sector employers have an advantage in this environment. They can adjust their compensation plan and policies very quickly," says Pollak. The public sector has been slower to respond, one factor perhaps pushing these workers to other gigs.

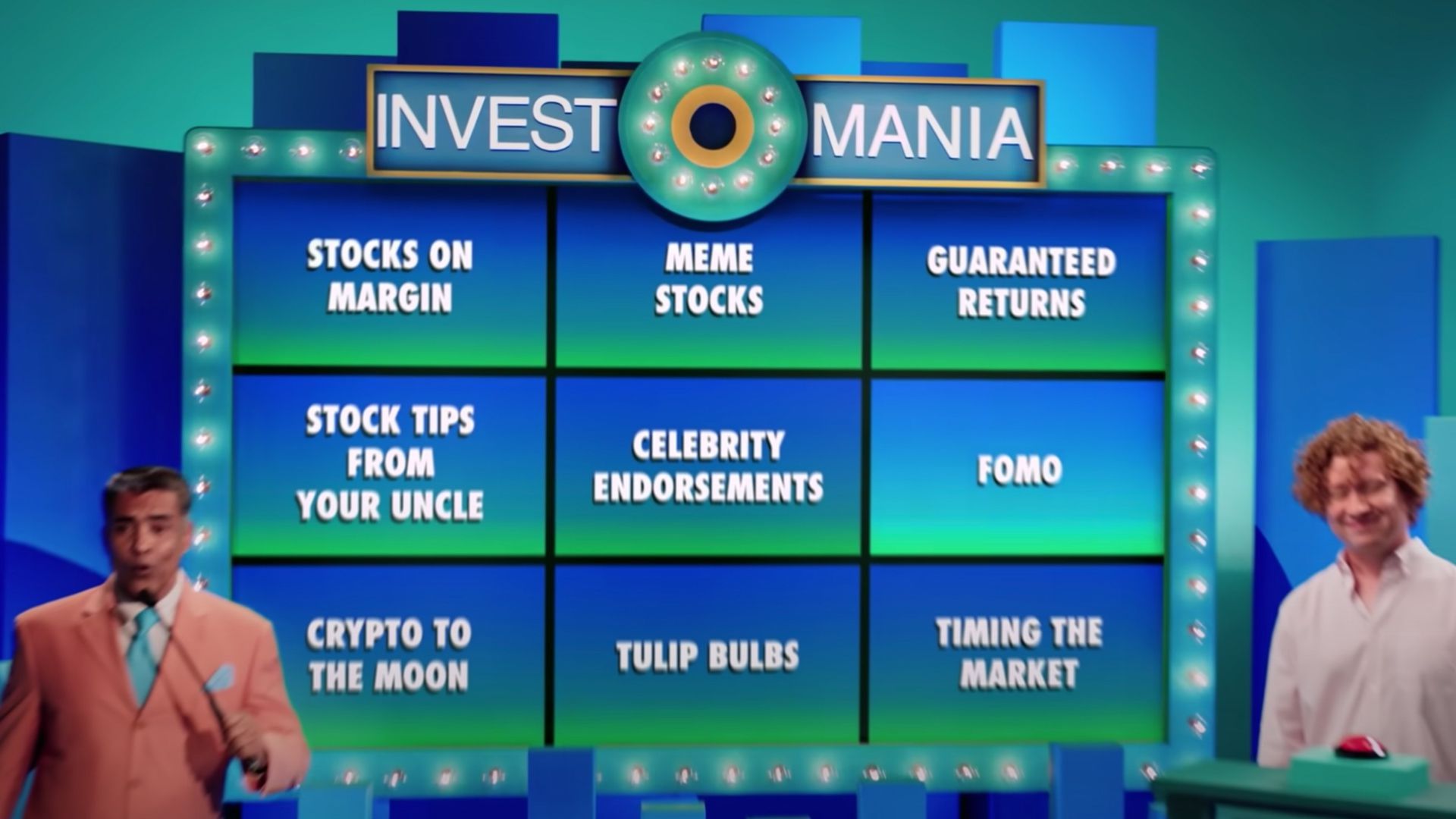

The bottom line: America's labor market recovery has been swift. The next test is which industries fully recover — and which don't. |     | | | | | | 2. Catch up quick | | 🌾 Russia seeks buyers for stolen Ukrainian grain, a dilemma for African countries in need of cheap food. (NYT) 💰 U.S. considers lifting some Trump-era China tariffs to fight inflation. (Reuters) ⚖️ Elliott Management sues London exchange over canceled nickel trades. (WSJ) |     | | | | | | 3. When investors do their own research |  | | | Screenshot: YouTube | | | | Investors have lost at least a billion dollars on crypto scams, and a new ad campaign from the SEC wants to help them avoid such pitfalls, Axios' Felix Salmon writes. Why it matters: The ads encourage skepticism toward faddish investments, but also urge individuals to "do your own research" — a phrase associated with conspiracy theories and mistrust of official messaging. Driving the news: The SEC's ads' targets include internet rumors, celebrity endorsements, stock tips from your uncle, crypto to the moon, "FOMO," meme stocks, tulip bulbs, and guaranteed returns. - In one ad, a celebrity touts crypto. "Be careful where you get your advice," it says. "Do your own research at investor.gov."

- In another, a game-show contestant wins by saying that she's "going to do some research first." The "research" seems to involve little more than tapping at her phone.

What they're saying: "My heart is with the SEC on this," Tom Nichols, author of "The Death of Expertise," tells Axios. "I just wish they hadn't used a bad phrase. 'Do your own research' is exactly how people end up buying meme stocks." Background: In the crypto world, "do your own research" — often abbreviated to DYOR — is a meme in itself, a way for people to disclaim responsibility for the actions of anybody who follows their advice. - It's also shorthand for investors who abjure traditionally trusted sources of information — including investor.gov — and turn instead to dank corners of Reddit and beyond.

The big picture: The kind of people who "YOLO" into speculative assets are, almost by definition, the very people least likely to take advice from investor.gov— or from any other officially sanctioned authority. - As one Redditor put it, "This video from the SEC makes me want to double down on MEME STONKS!"

|     | | | | | | A message from Axios | | Get smarter, faster on Cryptocurrencies | | |  | | | | Axios Crypto brings you daily updates on the most consequential trends in cryptocurrency and the blockchain Subscribe for free | | | | | | 4. Best and worst states for LGBTQ+ equality |  Data: Out Leadership; Chart: Erin Davis/Axios Visuals A new report evaluates the business climate for LGTBQ+ people across the U.S., aiming to help leaders make equitable decisions about where to operate — in an increasingly polarizing country, Emily writes. Why it matters: Doing business in a state that's hostile to LGBTQ+ rights can be costly. - Disney learned this lesson this year after Florida passed what came to be known as the "Don't Say Gay" law and the company became embroiled in a big PR dustup.

- Disney found itself caught between its Florida employees — many angered by the bill — and its relationship with the state government.

The big picture: Companies may have trouble attracting employees in regions that are openly hostile to LGBTQ+ rights — especially with heightened competition for talent among employers. - "LGBTQ friendly environments are business-friendly environments," said Todd Sears, a former investment banker, who founded Out Leadership, which launched its report four years ago.

Details: To arrive at the business climate scores, Out Leadership looked at data across a few categories, including... - State laws that impact LGBTQ+ people like protections in housing, the workplace and foster care.

- The index also considers work environment and employment, looking at incidences of harassment, assault, mistreatment, and the overall employment rates and incomes of LGBTQ+ workers.

State of play: The report finds ever-widening differences between the best and worst states: The good are getting better, and the less friendly are passing more anti-LGTBQ+ laws. - Michigan saw a 7.5 point increase in its score on the index from last year because of new workplace anti-discrimination laws meant to protect workers' rights.

- Montana saw the biggest decrease, from 30th place in 2021 to 41st. Last year, the state passed a law banning schools from teaching about sexual orientation and gender identity without parental consent, and another, banning transgender athletes from playing on teams that align with their gender identity.

What's next: Expect more tension between businesses and local governments to come; at least 20 states are looking at passing laws similar to Florida's. |     | | | | | | A message from Axios | | Get smarter, faster on Cryptocurrencies | | |  | | | | Axios Crypto brings you daily updates on the most consequential trends in cryptocurrency and the blockchain Subscribe for free | | |  | It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment