| |

| |

| |

| Presented By Global X ETFS |

| |

| Axios Generate |

| By Ben Geman and Andrew Freedman · Jun 15, 2022 |

| 🐪 It's Wednesday! Today's newsletter, edited by Mickey Meece, has a Smart Brevity count of 1,208 words, 5 minutes. 🚨 ICYMI: Half of Yellowstone National Park cannot support visitation due to catastrophic flooding, a likely sign of a changing climate. Read more 🕷️ Fifty years ago tomorrow David Bowie dropped "The Rise and Fall of Ziggy Stardust and the Spiders from Mars," which provides today's intro tune... |

| |

| |

| 1 big thing: Biden's new gas price outreach |

|

|

| Illustration: Sarah Grillo/Axios |

| |

| President Biden is telling CEOs of the nation's largest oil companies today that he's considering invoking emergency powers to boost U.S. refinery output, according to letters obtained by Axios, Ben and Andrew write. Why it matters: Biden's direct engagement with the oil giants is part of an ongoing White House effort to tame fuel prices despite limited options — and cast oil companies as responsible for consumers' higher bills. - The letters, which press the companies to boost output, signal how gasoline and diesel prices have become both an economic and political shock reaching the highest levels of the administration.

What he's saying: Biden tells seven big refiners and fuel companies that he's "prepared to use all reasonable and appropriate Federal Government tools and emergency authorities to increase refinery capacity and output in the near term." - "I understand that many factors contributed to the business decisions to reduce refinery capacity, which occurred before I took office," he writes. "But at a time of war, refinery profit margins well above normal being passed directly onto American families are not acceptable."

- "With prices for your product where they are today, you have ample market incentive to take these actions, and I recognize that some of you have already begun to do so," Biden writes.

Adding an olive branch, the letter — sent to the heads of ExxonMobil, Chevron, BP America, Shell USA, Phillips 66, Marathon and Valero — calls for them to offer "concrete, near-term solutions." - Biden says he wants ideas to address inventory, price and refinery capacity issues in the coming months, as well as transportation measures to bring fuel to market.

Between the lines: In seeking help from the oil industry, Biden is walking a political tightrope, eager to lower the cost at the pump without alienating his base, which backs policies to combat climate change. Zoom out: Average U.S. gasoline prices have risen above $5 per gallon — fueling wider inflation, hitting consumers, and creating political peril for Democrats ahead of the midterm elections. The other side: The industry's biggest trade group says it's ready to work with the administration. But industry officials also say White House policies discourage new investments in fossil fuel supply. Read the whole story. |

|

| |

| |

| 2. Breaking: GM stakes offshore wind startup |

|

|

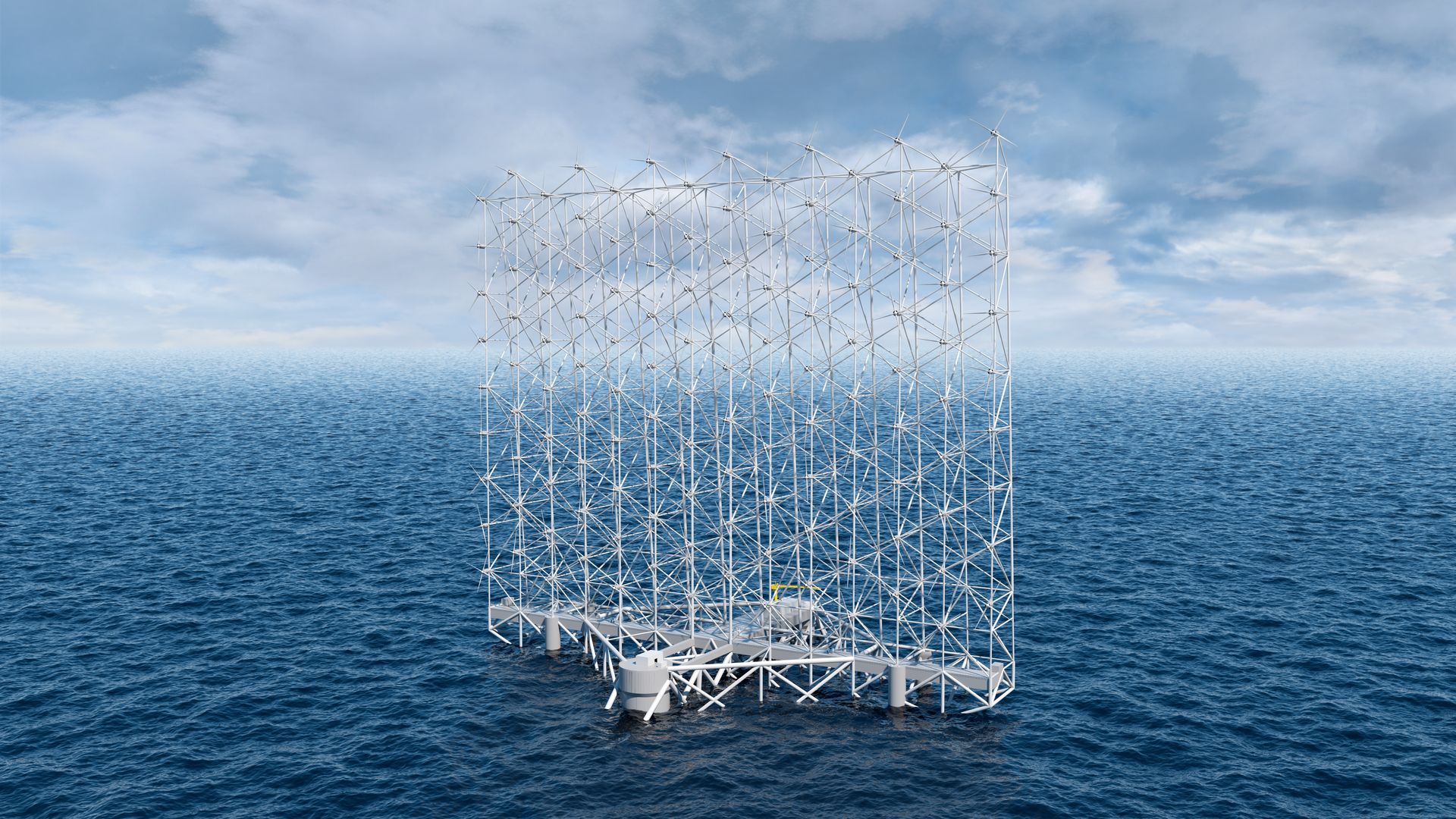

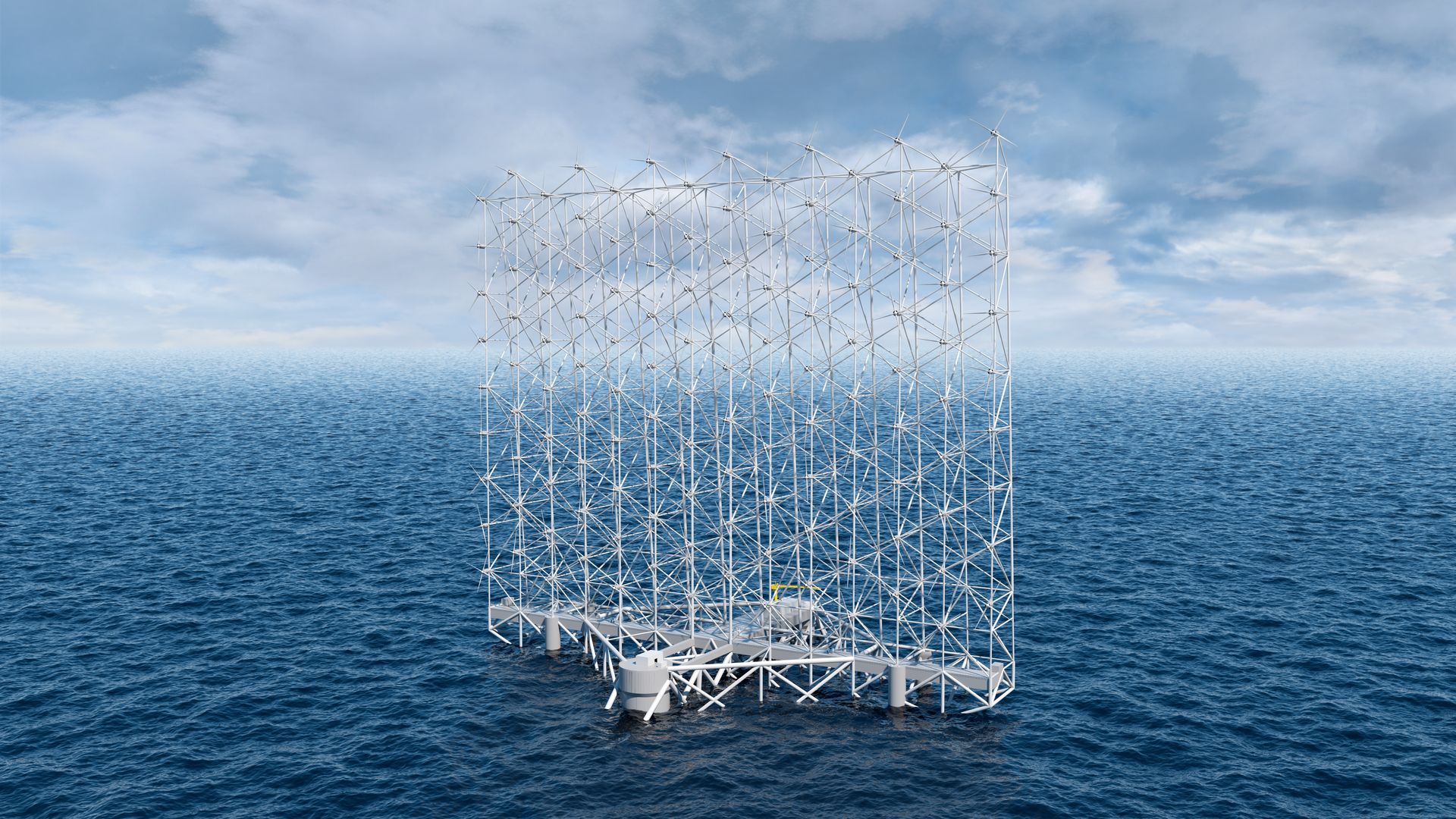

| Image courtesy of Wind Catch Systems |

| |

| General Motors' VC arm is the lead investor on a $10 million Series A funding round for Wind Catching Systems, a Norwegian startup looking to commercialize next-wave floating offshore wind designs, Ben writes. Why it matters: It's GM Ventures' first funding for a renewable power startup and a move that the auto giant calls complementary to its widening rollout of electric cars. As GM moves deeper into EVs, it's "critical that we simultaneously drive the transition of the grid to low-carbon energy sources," GM chief sustainability officer Kristen Siemen said in a statement. Driving the news: Oslo-based WCS says its multiturbine system — seen via an artist's rendering above — cuts acreage needed for offshore wind by 80% and operates more efficiently than today's floating tech. - Beyond the funding, GM and WCS have a "strategic agreement" to collaborate on tech development, project execution and more, they said.

- The funding round also includes Norwegian firms Ferd AS, North Energy ASA and Havfonn AS. WCS hopes to launch its first commercial project by 2027.

The big picture: EVs help fight global warming by displacing oil. But the cleaner the grid they're charging from, the greater the climate advantage over traditional drivetrains. |

|

| |

| |

| 3. Oil supply may "struggle" to match demand in '23 |

|

|

| Illustration: Sarah Grillo/Axios |

| |

| The tight oil market may loosen up later this year but producers could face fresh challenges to keep up with rising consumer use in 2023, the International Energy Agency said, Ben writes. What they're saying: "[S]lowing demand growth and a rise in world oil supply through the end of the year should help world oil markets rebalance," its closely watched monthly report states. However, it adds this could be "short-lived" as sanctions squeeze Russian supply, Chinese demand returns from pandemic restrictions and oil-producing nations face limits on output increases. Threat level: "Global oil supply may struggle to keep pace with demand next year," IEA analysts write. By the numbers: IEA sees world oil demand growing by 2.2 million barrels per day (mbd) next year to reach 101.6 mbd, "surpassing pre-pandemic levels." That's compared to full-year 2022 demand that is projected to be up 1.8 mbd over the prior year. S&P Global has more. |

|

| |

| |

| A message from Global X ETFS |

| Build a greener investment portfolio |

| |

|

| |

| Government policies and private sector commitments to combat climate change are driving demand for more sustainable buildings. We recently explored the long-term investment case for companies involved in the development, management, and technology powering green buildings. Learn more. |

| |

| |

| 4. Fire at key LNG plant throws gas markets |

Data: Yahoo Finance; Chart: Simran Parwani/Axios U.S. natural gas price dropped sharply Tuesday after Freeport LNG said it may not restart operations for 90 days or resume full operations until late this year thanks to the recent fire at its Texas plant, Ben writes. The big picture: "The U.S. natural gas market will now be temporarily oversupplied as 2 bcf/d or a little over 2% of demand for U.S. natural gas has been abruptly eliminated," Tortoise Capital analyst Rob Thummel said via CNBC. The benchmark U.S. futures price, however, remains at its highest level in over a decade. The intrigue: In a sign of growing linkages between U.S. supplies and global markets as exports have grown, the news helped send already high European prices upward even further. Freeport provides about 10% of Europe's total LNG imports, per Rystad Energy. |

|

| |

| |

| 5. Oil giants BP and TotalEnergies up their hydrogen bets |

|

|

| Illustration: Aïda Amer/Axios |

| |

| Two of the world's largest oil companies have unveiled big new investments in hydrogen over the last day, Ben writes. Driving the news: BP is buying a 41% stake in the big Asian Renewable Energy Hub in Australia and will operate the proposed development. - It envisions using wind and solar power to produce "green hydrogen" or "green ammonia" — the labels used for making those products with clean energy inputs. Reuters has more.

Separately, TotalEnergies announced a deal yesterday to acquire a 25% stake in India's Adani New Industries Limited to produce green hydrogen there. Why it matters: Oil giants — especially European-headquartered multinationals — are increasingly diversifying their portfolios, even though fossil fuel remains their dominant business line. What they're saying: "The tide is turning on hydrogen investments in Asia," Wood Mackenzie vice president Prakash Sharma said in a note. "After a 100-fold jump in low carbon hydrogen project announcements over the past three years, major energy players now seem willing to raise the game on green investments." |

|

| |

| |

| 6. VC spotlight: New support for 24/7 clean power |

|

|

| Illustration: Aïda Amer/Axios |

| |

| Granular, a startup aimed at helping companies match energy consumption with zero-carbon power around the clock, landed $2 million in pre-seed money led by Seedcamp, Ben writes. Why it matters: Funding for the Paris-based startup is the latest sign of growing interest in tech that can help solve a tricky problem. - Some buyers have initiatives to obtain enough clean power to match their annual demand, often via "renewable energy certificates." But that still means pulling power from grids with fossil fuels.

- Now major users ranging from Google to the U.S. government are seeking to move toward round-the-clock matching as a way to help decarbonize grids.

How it works: Granular's platform offers services to help match buyers and producers with clean power on a more, well, granular market basis. - "Users will be able to verify, for the first time, the origin of their electricity on an hourly basis and have the option to trade these certificates to improve their level of hourly matching," Seedcamp's announcement states.

- Revent and Powerhouse Ventures also took part. Granular's certificates market will launch in Europe's Nord Pool power market, per Powerhouse.

|

|

| |

| |

| A message from Global X ETFS |

| Build a greener investment portfolio |

| |

|

| |

| Government policies and private sector commitments to combat climate change are driving demand for more sustainable buildings. We recently explored the long-term investment case for companies involved in the development, management, and technology powering green buildings. Learn more. |

| |

| 📬 Did a friend send you this newsletter? Welcome, please sign up. Thanks for reading and we'll see you back here tomorrow. |

| It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | |

No comments:

Post a Comment