| |

| |

| |

| Presented By ExxonMobil |

| |

| Axios Generate |

| By Ben Geman and Andrew Freedman ·Feb 14, 2022 |

| ☕ Good morning. Today's Smart Brevity count is 1,280 words, 5 minutes. 🎶 Tomorrow marks the 1975 release date of Rush's album "Fly by Night," which provides today's iconic intro tune... |

| |

| |

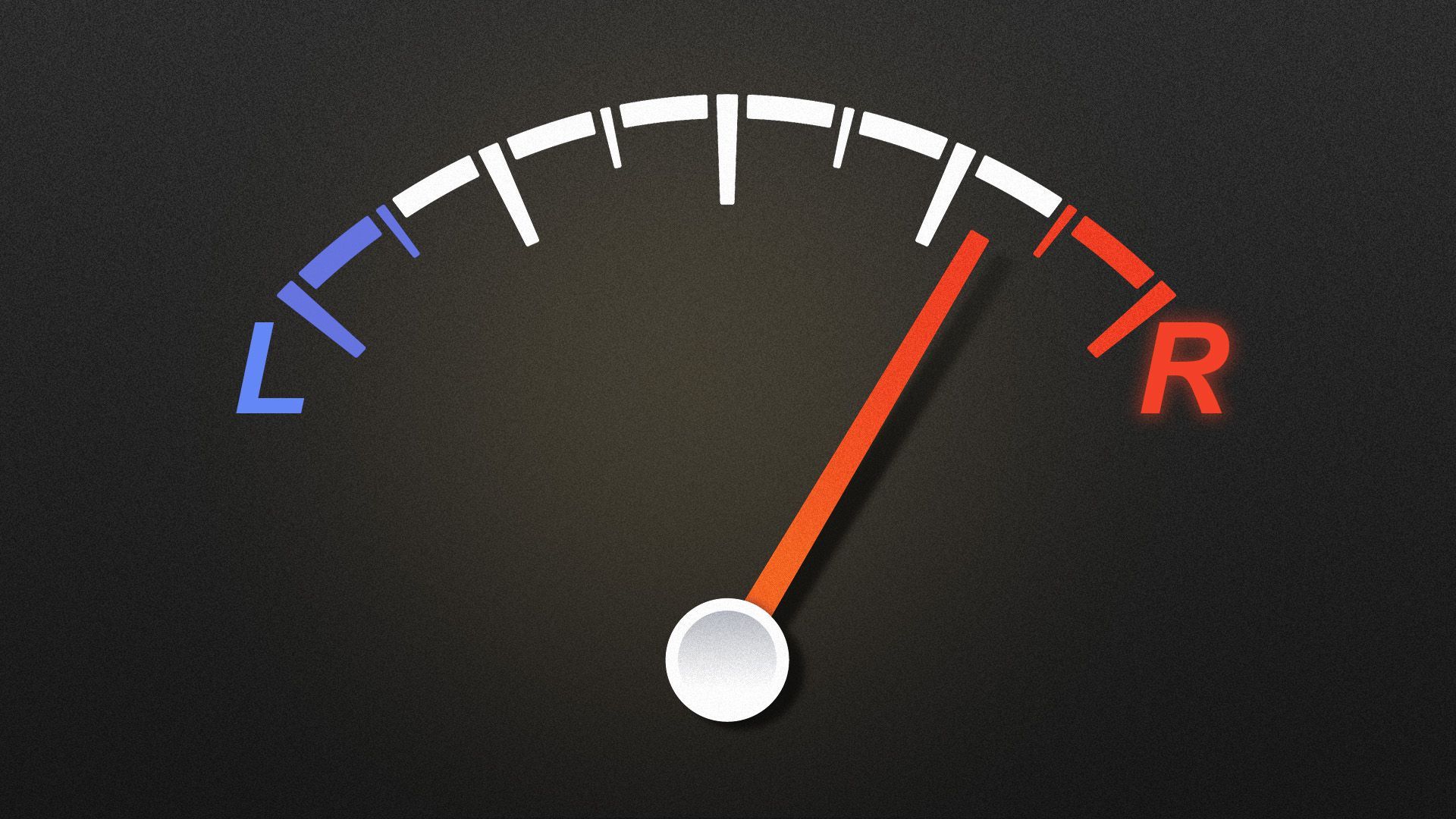

| 1 big thing: Volatile oil markets eye Ukraine crisis |

|

|

| Illustration: Shoshana Gordon/Axios |

| |

| Oil prices this morning have slipped off seven-year highs reached earlier in the session as markets brace for Russia's invasion of Ukraine that would likely send prices soaring above $100 per barrel, Ben writes. Why it matters: The potential invasion — which U.S. National Security Adviser Jake Sullivan says could happen "any day" — is putting upward pressure on already-high prices amid the demand recovery from COVID and tight supply. - A Russian move against Ukraine and the economic response could affect energy from Russia, Europe's largest source of natural gas and the world's third-largest oil producer.

- Oil prices moving even higher would have spillover effects on U.S. gasoline prices, which are already a political headache for Democrats.

What they're saying: "Market participants are concerned that a conflict between Russia and the Ukraine could disrupt supply," said UBS analyst Giovanni Staunovo, per Reuters. Where it stands: The global benchmark Brent crude is trading at $93.90 after going above $96 earlier in the session. Go deeper: Why Russian Invasion Peril Is Driving Oil Prices Near $100 (WSJ) |

|

| |

| |

| Bonus: U.S. drilling jumps |

Data: Baker Hughes; Chart: Axios Visuals The number of active U.S. oil drilling rigs — a leading but rough indicator of future output — spiked by 19 last week, Ben writes. Why it matters: The data from Baker Hughes was the largest weekly jump in four years. Overall, the rig count has been steadily rising since the fall of 2020 after going off a cliff earlier that year when COVID crushed demand. The big picture: High prices and the demand recovery are spurring more activity. "Citigroup Inc. warned that shale explorers are poised to boost spending by almost 40% this year, showing all signs of abandoning promises to hold the line on drilling budgets," Bloomberg reports. By the numbers: The Energy Information Administration projects domestic production to continue its recovery by averaging 12 million barrels per day this year and 12.6 million bpd in 2023. That 2023 figure would break the 2019 annual record, though not the absolute U.S. peak in late 2019. |

|

| |

| |

| 2. Judge halts use of social cost of carbon |

|

|

| Illustration: Lazaro Gamio/Axios |

| |

| A federal judge is barring the Biden administration from using the social cost of carbon put into place on Jan. 20, 2021. The decision, issued Friday, affects the interim figure in place now, as well as an updated metric expected to be issued later this month, Andrew writes. Driving the news: The social cost of carbon is a dollar estimate of the damages caused by emitting one additional metric ton of greenhouse gases into the air. What's happening: The case, brought by 10 states including Louisiana and West Virginia, challenged the interim metric, arguing that it was arbitrarily set and would increase the costs of energy production and other activities. - Judge James D. Cain Jr. of the U.S. District Court for the Western District of Louisiana, a Trump appointee, agreed with the states, and issued an injunction that not only bars the use of the interim metric, but would prevent the new task force figure from being used.

- The plaintiffs did not challenge a particular use of the Biden administration's social cost figure, but rather its potential applications.

What they're saying: "This injunction is extraordinarily broad," Max Sarinsky, an attorney at the Institute for Policy Integrity at NYU Law School, told Axios. "I think it will receive very, very close scrutiny on appeal." |

|

| |

| |

| A message from ExxonMobil |

| Advancing climate solutions in support of a net-zero future |

| |

|

| |

| At ExxonMobil, we aim to achieve net-zero emissions (Scope 1 and 2) from operated assets by 2050. How do we intend to get there? With a comprehensive approach, detailed emission-reduction roadmaps and supportive policy to accelerate deployment of technologies needed to support a net-zero future. |

| |

| |

| 3. Breathing life into the infrastructure law |

|

|

| Illustration: Aïda Amer/Axios |

| |

| Federal agencies are acting on several fronts to transform energy provisions of the bipartisan infrastructure law into tangible funding programs, Ben writes. Driving the news: The Energy Department took three steps just late last week. - On Friday it published preliminary information about $3 billion in funding intended for advanced battery manufacturing and recycling projects.

- A separate notice seeks information on how to stand up a $6 billion incentive program to help ensure the continued operation of existing nuclear plants.

- That followed Thursday's move by the Energy and Transportation departments to open applications for states to use $5 billion for electric vehicle charging projects.

Why it matters: The infrastructure plan signed into law in November provided the Energy Department with roughly $62 billion for a constellation of programs, per DOE's tally. - But transforming the law into tangible deployment of new demonstration and commercial-scale projects requires an immense amount of detailed bureaucratic work.

- It's prompting DOE moves to reorganize its structure and create new offices.

|

|

| |

| |

| 4. Tesla's political risk |

|

|

| Illustration: Sarah Grillo/Axios |

| |

| Tesla is losing its status as a liberal darling, Axios' Nathan Bomey reports. Why it matters: CEO Elon Musk's electric vehicle maker generated a legion of liberal fans ages ago for its full-throated contribution to the fight against climate change. The intrigue: Tesla has angered progressives on several occasions in recent months, as the company faces accusations of racism, anti-unionism and conservative positioning on COVID-19. - California sued Tesla last week, accusing it of enabling a racist work culture, slurs and discrimination.

- Musk last year moved Tesla's headquarters to Texas after complaining about California's business environment, including its pandemic restrictions.

- Musk criticized COVID-19 vaccine mandates, which Democrats widely favor, though he is personally vaccinated.

- Musk has also sparred with prominent Democrats, calling President Biden a "🧦 puppet in human form" on Twitter. He's also mocked progressive icons Sens. Elizabeth Warren of Massachusetts and Bernie Sanders of Vermont.

- The National Labor Relations Board accused Tesla, a non-union company, of intimidating prospective union organizers, which Tesla denied.

Threat level: The developments threaten to dampen enthusiasm for the Tesla brand among progressive loyalists. Yes, but: Demand for Tesla vehicles shows no signs of abating. The company's vehicle sales rose 71% to 308,600 in the fourth quarter, compared with a year earlier. Keep reading |

|

| |

| |

| 5. SEC boss on climate rule: We're getting there |

| Source: Giphy Securities and Exchange Commission chairman Gary Gensler said he's working with other commissioners on details of a draft climate risk disclosure mandate — and he's dropping fresh hints about its direction, Ben writes. Why it matters: The rule is part of a wider push by Biden-appointed financial regulators to expand analysis and disclosure of risks to various kinds of companies. Driving the news: Gensler's posted a Twitter thread Friday that comes as he's under pressure to unveil the plan initially slated for release by the end of 2021. - Bloomberg reported that the SEC's Democratic majority is divided over the structure of the closely watched proposal.

The big picture: Gensler said it should enable investors to make apples-to-apples evaluations. - "Like the Olympics, fans compare skiers across heats, countries, & generations. Investors today are asking for the ability to compare companies w/ each other," he tweeted.

- He stressed the need for "sufficient quantitative & qualitative detail" because "generic boilerplate" isn't helpful.

The intrigue: Environmentalists want the SEC to require detailed disclosures about companies' reliance on emissions offsets to meet climate targets. - A new letter to the SEC from the Sierra Club and Public Citizen says offset markets have "significant environmental, accounting and social integrity problems that jeopardize fulfillment of corporate climate pledges."

|

|

| |

| |

| 6. "Love to see the mob going green!" |

| That's actress and comedian Wanda Sykes, tweeting about General Motors' Sopranos-themed Super Bowl ad for the electric Chevy Silverado, Ben writes. Catch up fast: It was among a whole bunch of EV ads in the big game as automakers corralled major stars — like Arnold Schwarzenegger playing Zeus in the BMW spot and Mike Myers reviving Dr. Evil in a separate GM ad. Why it matters: The suite of expensive ads shows how automakers are increasingly devoting marketing dollars to new and upcoming electric models, although cars with a plug remain for now a small share of total sales. |

|

| |

| |

| A message from ExxonMobil |

| Reducing emissions in support of a net-zero future |

| |

|

| |

| At ExxonMobil, we aim to achieve net-zero emissions (Scope 1 and 2) from operated assets by 2050. How do we intend to get there? With a comprehensive approach, detailed emission-reduction roadmaps and supportive policy to accelerate deployment of technologies needed to support a net-zero future. |

| |

| Bring the strength of Smart Brevity® to your team — more effective communications, powered by Axios HQ. | | |

No comments:

Post a Comment