| | | | | | | Presented By Fidelity Investments | | | | Axios Generate | | By Ben Geman and Andrew Freedman ·Aug 03, 2021 | | 🌞 Welcome back! Today's Smart Brevity count is 1,322 words, 5 minutes. 📊 Data point of the day: 100 billion tons, which is the estimated carbon emissions from wildfires in Siberia's Sakha Republic so far this summer. 🚨 Situational awareness: "Financial firms including British insurer Prudential, lenders Citi and HSBC and BlackRock Real Assets are devising plans to speed the closure of Asia's coal-fired power plants in order to lower the biggest source of carbon emissions." (Reuters) 🎸 Midnight Oil's searing "Diesel and Dust" is turning 34 and provides today's intro tune... | | | | | | 1 big thing: The glass is barely half full on clean energy capital |  Data: BloombergNEF; Chart: Danielle Alberti/Axios New data shows that combined global investment in renewable energy companies and projects just had its best first half of any year, Ben writes. Driving the news: The first six months of 2021 saw the investment of $174 billion amid record amounts of public market financing, venture capital and private equity, per the research firm BloombergNEF. "A decline in investment in new renewables projects was offset by a jump in equity offerings of renewable energy companies," the analysts note. The big picture: More aggressive deployment of mature clean sources and investment in emerging tech is needed to start forcing carbon emissions downward. - The BloombergNEF report puts fresh data behind an important trend: A lot of money is flowing into clean energy, but the activity lags behind what's needed to reach global climate goals.

- "Renewable energy investment has withstood the effects of the global pandemic, in contrast to other sectors of the energy economy where we have seen unprecedented volatility," BloombergNEF head of analysis Albert Cheung said in a statement alongside the data.

- But Cheung added: "However, a 1.8% year-on-year increase is nothing to write home about. An immediate acceleration in funding is needed if we are to get on track for global net zero."

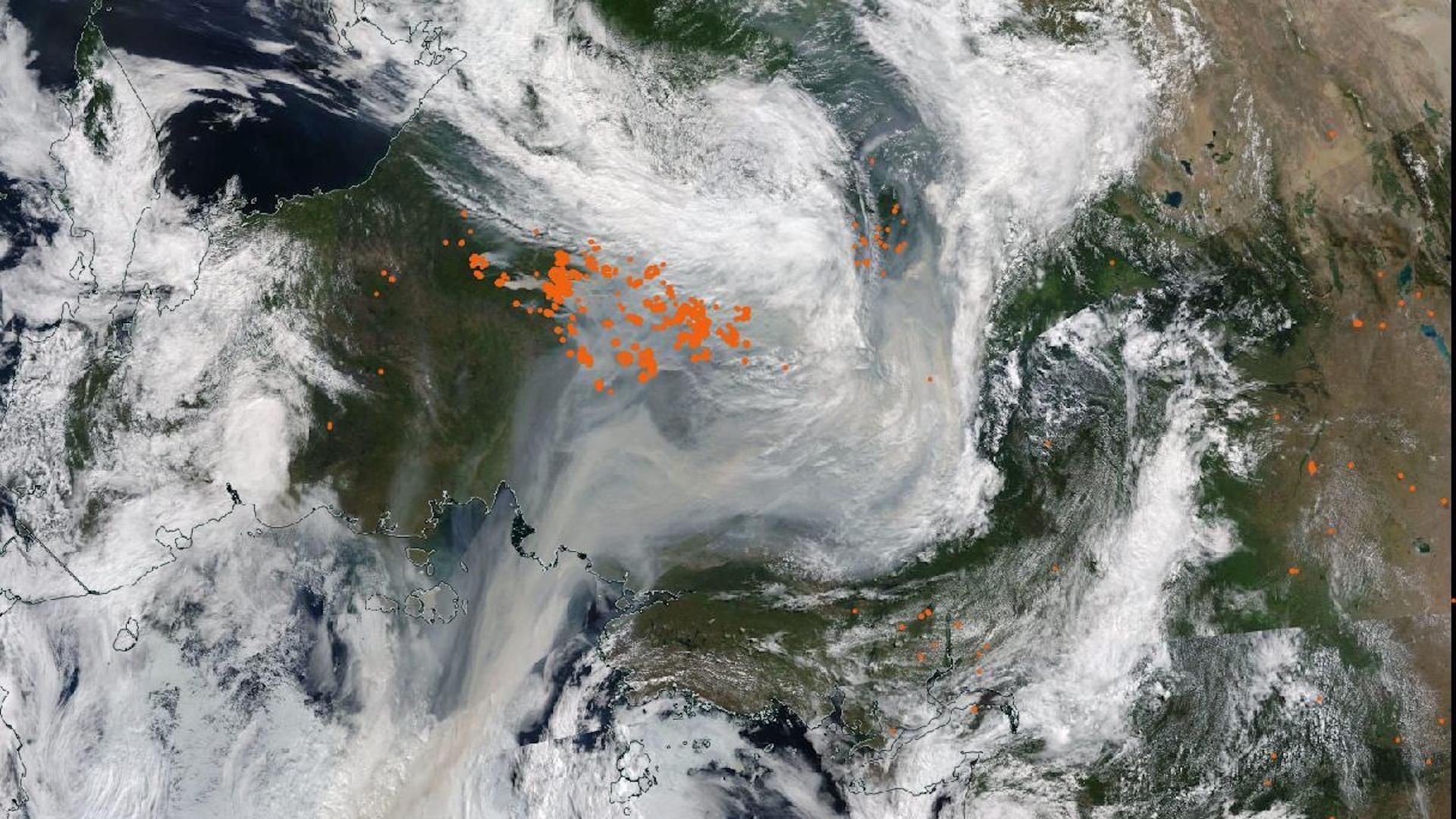

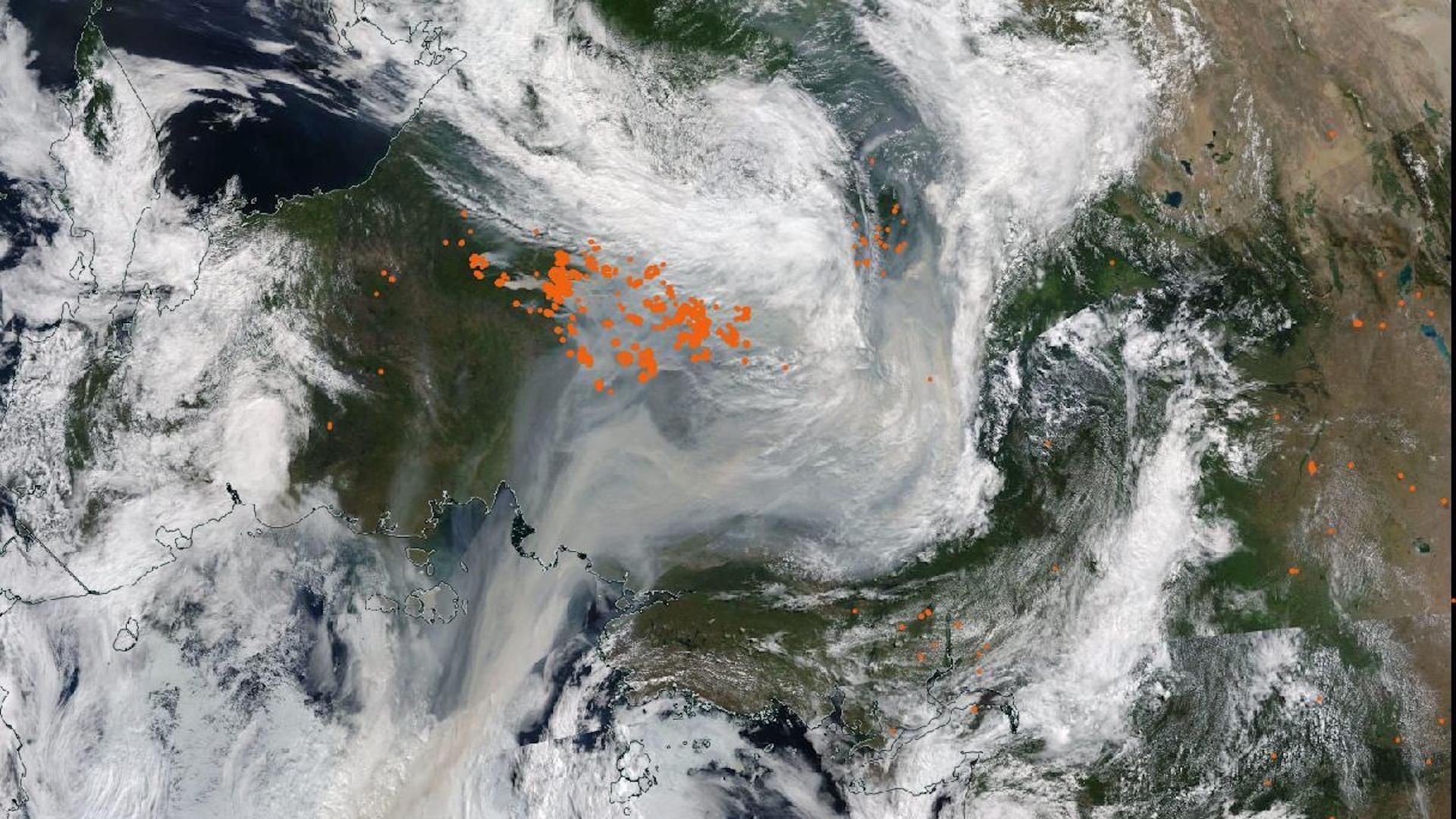

By the numbers: Companies raised over $28 billion in public markets and nearly $6 billion in VC and private equity commitments in the first half of this year. Investment in solar power projects was almost $79 billion, up 9% compared to the same period last year, but wind project finance was around $27 billion lower. |     | | | | | | 2. Wildfire smoke reaches the North Pole |  | | | Top-down view of smoke moving north from wildfires in Siberia (orange dots) toward the North Pole on Aug. 2, 2021. (NASA Worldview) | | | | Widespread wildfires burning across Siberia's Sakha Republic sent a plume of smoke all the way to the North Pole on Sunday into Monday, as seen by scientists tracking the blazes, Andrew writes. Why it matters: The fires have been raging since early spring, and while this region is known for seasonal fires, there are signs they are becoming more intense, starting earlier and lasting longer due to human-caused climate change. Driving the news: The wildfires in Siberia have shrouded communities in hazardous smoke. - The northernmost blazes have threatened to disturb the layer of permafrost that rings the Arctic, which would release enormous quantities of greenhouse gases.

- A study published Monday raises the prospect that such feedbacks are already occurring, though in ways that were unanticipated.

Details: According to Mark Parrington, who monitors global fire activity for the Copernicus Atmospheric Monitoring Service, Sakha Republic wildfires have set a record for estimated carbon emissions for the period from June 1 to Aug. 1. - "Two-thirds through, this season is already the highest seasonal total for [the] Sakha Republic," Parrington told Axios via email, cautioning that this is not yet an annual record.

- "I expect that a new record for the annual total will be set this year the way it is continuing," he said.

- While it's not unusual for smoke to be transported across large distances, polar transport is relatively rare.

The bottom line: The Siberian fires are likely to continue for another two months, and their intensity during this period will determine how unusual this season's carbon emissions look in hindsight. - Meanwhile, people living in the region will continue to suffer from health ailments caused by smoke exposure.

|     | | | | | | 3. BP caps Big Oil's earnings recovery | | BP posted a $2.8 billion Q2 profit and said it's raising dividends and expanding share buybacks, joining several other oil majors announcing multibillion-dollar net earnings and new investor payouts, Ben writes. Why it matters: The company's report caps off a Big Oil earnings season that shows how large producers are recovering from the pandemic that hammered prices and demand last year. - BP said the result was "driven by higher oil prices and margins offset by a lower result in gas marketing and trading."

- The company is raising dividends by 4% and plans to buy back $1.4 billion in shares during Q3.

The big picture: It's the latest in a string of multibillion-dollar Q2 hauls from majors including Chevron, Shell, Exxon and TotalEnergies. - Those reports, aside from Exxon's, came with various announcements of higher dividends and share repurchases.

- "Their goal is to woo investors who are becoming increasingly wary about the future of the fossil fuels in a changing climate," Bloomberg reports.

|     | | | | | | A message from Fidelity Investments | | Invest in the companies leading sustainable change | | |  | | | | The new Fidelity Sustainability U.S. Equity Fund uses insights from the Fidelity research team to invest in companies with strong growth potential and positive impact. Why it's important: Robust sustainability practices can be critical to an investment's long-term success. Find out more. | | | | | | 4. DHL's new foray into electric aviation |  | | | DHL Express's electric cargo plane. Photo: Courtesy of DHL Express | | | | Logistics provider DHL Express is adding electric cargo planes to its fleet, becoming the first customer for Eviation, a Seattle-based electric aviation company, Axios' Joann Muller reports. Why it matters: As delivery on demand explodes, shipping and logistics providers face pressure to make every mode of their operations more sustainable — aircraft, trucks, last-mile delivery vans, and even their buildings. DHL has committed 7 billion euros ($8.3 billion at today's rate) by 2030 for steps to reduce its CO2 emissions, on its way to a zero-emissions target by 2050. Driving the news: DHL said today it has ordered 12 fully electric Alice cargo planes from Eviation and expects to take delivery in 2024. How it works: Alice, which can be configured for cargo or passengers, requires 30 minutes or less to charge per flight hour and has a maximum range of about 500 miles. - It can be flown by a single pilot and carry up to 2,600 pounds. As with electric automobiles, fewer moving parts means reduced maintenance costs and increased reliability, according to Eviation.

- A first flight is scheduled for later this year.

What to watch: DHL plans to build several zero-emission Alice feeder networks in the U.S., targeting the West Coast and Southeast U.S. |     | | | | | | 5. A broad coalition pushes for carbon capture funding | | A coalition of groups sent a letter to House and Senate leaders Tuesday morning calling for the infrastructure bills moving through Congress to bolster nascent carbon capture and storage ventures, Andrew writes. Why it matters: This may be the broadest coalition yet put together to advocate for carbon capture and storage policies (CCS). - The letter is backed by major unions, including United Steelworkers and the AFL-CIO, along with big corporations like United Airlines, Equinor and Shell.

- In addition, the environmental groups Nature Conservancy, National Wildlife Federation and Clean Air Task Force are also signatories.

Details: In the letter, the groups call for changes to tax credits for CCS projects as well as direct funding of commercial-scale pilot projects and carbon storage pipelines and facilities. - The changes to tax credits endorsed in the letter are not yet in the infrastructure bill as unveiled Monday, according to Brad Crabtree, director of the Carbon Capture Coalition.

- It also backs direct air capture technologies, which, currently at early stages of research, are a potential tool to help the U.S. get to net-negative emissions by the second half of the century.

- "Carbon capture technologies have suffered a significant lack of federal investment compared to historic levels of support for other clean energy technologies," the letter states.

|     | | | | | | 6. Dems press Treasury on climate plans |  | | | Illustration: Sarah Grillo/Axios | | | | Three Democratic senators including Elizabeth Warren hope to shake loose information about Treasury Department plans to harden the financial system against climate risks and mobilize climate finance, Ben writes. Why it matters: Treasury's response to their new letter could provide details about what's planned and underway at the department that's slated to play a key role in the White House climate agenda. Driving the news: The senators' letter to John Morton, who leads Treasury's climate "hub" unveiled in April, says they've seen "few reports" of how it's working. Warren, Kirsten Gillibrand and Chris Van Hollen want details by Aug. 16 on questions including... - How Treasury is coordinating financial regulators on climate risk and its timeline for those steps.

- Whether Treasury has provided risk guidance to the financial sector, and the contents if so.

Quick take: The senators' public letter looks like an effort to keep pressure on Treasury to keep climate high on its agenda. Catch up fast: Treasury Secretary Janet Yellen's public remarks and meetings offer a window into Treasury's efforts. - For instance, Yellen met recently with heads of multilateral development banks to push for more climate finance.

- In May she outlined how she plans to work with the Treasury-led Financial Stability Oversight Council on climate-related financial risks.

|     | | | | | | A message from Fidelity Investments | | Green opportunities to help diversify your portfolio | | |  | | | | The new Fidelity Environmental Bond Fund invests in projects that are driving positive environmental impact, with the income potential of a bond. The background: Sustainable investing helps you align your investments to environmental, social or governance (ESG) factors. Find out more. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment