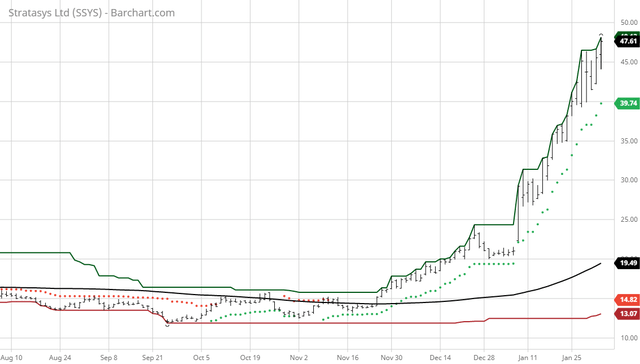

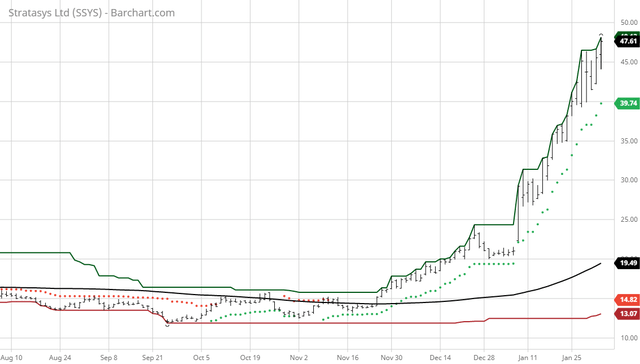

The Barchart Chart of the Day belongs to the 3-D printing company Stratasys (NASDAQ:SSYS). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 11/11 the stock gained 223.52% . Stratasys Ltd. provides 3D printing and additive manufacturing solutions for individuals, businesses, and enterprises. Its 3D printing systems utilize its fused deposition modeling (FDM) and inkjet-based PolyJet technologies to enable the production of prototypes, tools used for production, and manufactured goods directly from 3D CAD files or other 3D content. The company offers entry-level desktop 3D printers to systems for rapid prototyping, and production systems for direct digital manufacturing. It also provides 3D printing consumable materials, including FDM cartridge-based materials, PolyJet cartridge-based materials, non-color digital materials, and color variations. In addition, the company offers GrabCAD Print software that provides job programming, scheduling, monitoring, and analytics across various 3D printing technologies; and GrabCAD Workbench, a cloud-based project data management solution. Further, it operates Thingiverse, an online community for sharing downloadable digital 3D designs; and GrabCAD Community for mechanical engineers, designers, manufacturers, and students to best practices through tutorials, discussion forums, and design/print challenges. Additionally, the company offers customer support, basic warranty, and extended support programs, as well as strategy, operations, and engineering consultancy services; leases or rents 3D printers and 3D production systems; produces prototypes and end-use parts for customers from a customer-provided CAD file; and offers plastic and metal parts for rapid prototyping and production processes, as well as related professional services, carbon-fiber based printers, and elastomeric materials. Its products and services are primarily used in the automotive, aerospace, medical, dental, education, and consumer goods markets. The company sells its products through a network of resellers and independent sales agents worldwide. Stratasys Ltd. was founded in 1989 and is headquartered in Eden Prairie, Minnesota.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signals

- 225.49+ Weighted Alpha

- 167.39% gain in the last year

- Trend Spotter by signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 132.03% in the last month

- Relative Strength Index 79.10%

- Technical support level at 42.92

- Recently traded at 47.16 with a 50 day moving average of 25.22

Fundamental factors: - Market Cap $2.58 billion

- Revenue expected to grow 6.50% next year

- Earnings estimated to increase 118.40% next year and continue to compound at an annual rate of 36.00% for the next 5 years

- Wall Street analysts issued 1 strong buy, 2 buy, 10 hold and 4 sell recommendations on the stock

- The individual investors following the stock on Motley Fool voted 1,322 to 58 that the stock will beat the market

- 58,890 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis. |

No comments:

Post a Comment