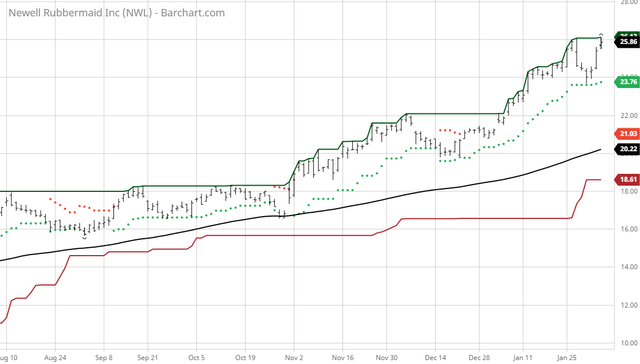

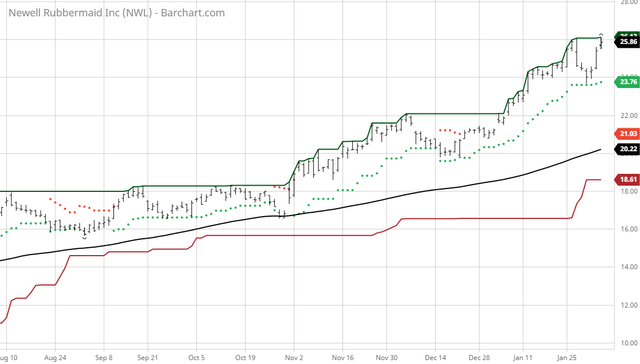

The Barchart Chart of the Day belongs to he consumer products company Newell Rubbermaid (NASDAQ:NWL). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 12/22 the stock gained 23.03% . Newell Brands Inc. designs, manufactures, sources, and distributes consumer and commercial products worldwide. The company operates through four segments: Appliances and Cookware, Food and Commercial, Home and Outdoor Living, and Learning and Development. The Appliances and Cookware segment offers household products, including kitchen appliances, gourmet cookware, bakeware, and cutlery under the Calphalon, Crock-Pot, Mr. Coffee, Oster, and Sunbeam brands. The Food and Commercial segment offers food storage and home storage products, and fresh preserving products, vacuum sealing products, commercial cleaning and maintenance solutions, hygiene systems, and material handling solutions under the Ball, FoodSaver, Rubbermaid, Sistema, Rubbermaid Commercial Products, Mapa, Quickie, and Spontex brands. The Home and Outdoor Living segment offers products for outdoor and outdoor-related activities, home fragrance, and connected home and security products under the Chesapeake Bay Candle, Coleman, Contigo, ExOfficio, First Alert, Marmot, WoodWick, and Yankee Candle brands. The Learning and Development segment offers writing instruments, including markers and highlighters, pens, and pencils; art products; activity-based adhesive and cutting products; labeling solutions; and baby gear and infant care products under the Aprica, Baby Jogger, Dymo, Elmer's, EXPO, Graco, Mr. Sketch, NUK, Paper Mate, Parker, Prismacolor, Sharpie, Tigex Waterman, and X-Acto brands. It markets its products to clubs, department stores, drug/grocery stores, mass merchants, specialty retailers, distributors and e-commerce companies, home centers, sporting goods retailers, warehouse clubs, office superstores and supply stores, contract stationers, and travel retail, as well as sells directly to consumers via on-line. Newell Brands Inc. was formerly known as Newell Rubbermaid Inc. and changed its name to Newell Brands Inc. in April 2016. The company was founded in 1903 and is based in Atlanta, Georgia.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signals

- 55.20+ Weighted Alpha

- 31.68% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 22.26% in the last month

- Relative Strength Index 70.30%

- Technical support level at 24.68

- Recently traded at 25.76 with a 50 day moving average of 22.35

Fundamental factors: - Market Cap $10.78 billion

- P/E 14.78

- Dividend yield 3.77%

- Revenue expected to grow 4.60% next year

- Earnings estimated to increase .60% next year and continue to compound at an annual rate of 4.94% for the next 5 years

- Wall Street analysts issued 3 strong buy, 7 buy and 6 hold recommendations on the stock

- 20,560 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis. |

No comments:

Post a Comment