| | | | | | | Presented By Babbel | | | | Axios Markets | | By Dion Rabouin ·Jan 21, 2021 | | Salutations (that's a fancy way of saying hello)! Was this email forwarded to you? Sign up here. (Today's Smart Brevity count: 1,139 words, 4 minutes.) 🏜 I'm headed to Sedona, Arizona, for a long weekend with some family. Courtenay Brown will be in your inbox tomorrow. - If you've got tips for anything fun to do or places to go or the best hikes, please send them my way! (Dion@Axios.com or just reply to this email.)

🎙 "Proceed, great chief, with virtue on thy side. Thy ev'ry action let the goddess guide. A crown, a mansion, and a throne that shine. With gold unfading, Washington! be thine."- See who said it and why it matters at the bottom. | | | | | | 1 big thing: First glimpse of the Biden market |  | | | Photo: Jonathan Ernst-Pool/Getty Images | | | | Investors made clear what companies they think will be winners and which will be losers in President Joe Biden's economy on Wednesday, selling out of gun makers, pot purveyors, private prison operators and payday lenders, and buying up gambling, gaming, beer stocks and Big Tech. What happened: Private prison operator CoreCivic and private prison REIT Geo fell by 7.8% and 4.1%, respectively, while marijuana ETF MJ dropped 2% and payday lenders World Acceptance and EZCorp each fell by more than 1%. - On the other side: Penn National gained 5.5% with DraftKings up 3.7%, and the cigarettes, booze and gambling ETF VICE gained 1.6%. The Nasdaq 100 rose 2.3%.

Why it happened: Biden issued an executive order freezing the OCC's fair access rule, which required banks to service all companies, including those in industries such as private prisons, chemical companies and gun makers. - And Trump appointee Kathy Kraninger resigned as director of the Consumer Financial Protection Bureau, giving Biden the all-clear to nominate FTC Commissioner Rohit Chopra, an acolyte of Sen. Elizabeth Warren who worked with her on establishing the CFPB, as its next director.

That was followed by a report from the WSJ that Biden was set to name former Obama Treasury official Michael Barr as Comptroller of the Currency, the major regulator of big banks. - If true, "Barr would be part of a pattern where Biden selects moderates for the cabinet and other top jobs but chooses progressives for second-tier posts," notes Jaret Seiberg, financial services and housing policy analyst for Cowen Washington Research Group.

- "Issue for us is whether that trend continues through to summer when Biden must pick a new vice chair for supervision at the Federal Reserve and to fall when he must pick a new Federal Reserve chairman."

The big picture: Biden has set out an ambitiously progressive agenda that is in line with the policies he pitched when competing for the Democratic presidential nomination against far-left-leaning Sens. Bernie Sanders, Kamala Harris and Warren. - That's in contrast to the moderate centrist he pitched himself as during the general election campaign against Trump.

Don't sleep: Seiberg adds that he's expecting additional economic policy orders from Biden today. That could include a campaign proposal to provide $15,000 in tax credits to first-time homebuyers. - Such a policy would pour gasoline on the already blazing housing market, as record-low mortgage rates have already brought down the monthly cost of homeownership significantly.

- For first-time buyers who only need to put down 3% on a conventional mortgage, $15,000 would provide the down payment to purchase a $500,000 home.

|     | | | | | | Bonus chart: More help for the markets |  Data: Investing.com; Chart: Axios Visuals Biden also unveiled an executive order directing the Department of Housing and Urban Development and the Federal Housing Finance Agency to refrain from foreclosing on borrowers who are not repaying loans backed by government loan guarantors like Fannie Mae, Freddie Mac and the rural housing service. - That will help keep housing stable through the pandemic, but will also likely add to the constraint on housing supply and further push prices higher.

Biden also ordered the Department of Education to freeze the repayment of government-issued student loans through Sept. 30. Watch this space: Halting student loan payments should free up additional income for borrowers, but will also likely juice the housing and stock markets. Watch this space too: Biden's expected big bank regulator Barr would be yet another leading official with cryptocurrency cachet, joining SEC chair nominee Gary Gensler. |     | | | | | | 2. Catch up quick | | China plans to push tougher regulations for the nonbank payment industry, according to a release from the People's Bank of China following a trend of stepped-up enforcement on online and nonbank payments since Ant Group's failed IPO. (Reuters) The number of U.S. companies buying back shares of their own stock is up 46% from this time a year ago, but corporate insiders are selling, with the sell to buy ratio at the highest level on record dating back to 1988. (Bloomberg) Retail investors' participation in U.S. equity order flows increased to nearly 20% in 2020 from 15% in 2019, while orders from long-only funds fell to 6.4% last year from 9.7% in 2019, data from UBS showed. (Reuters) While the sample size is very small, FactSet notes that Q4 earnings have been well above expectations so far, with the estimated earnings decline for the S&P 500 now 5.9%. - That's well above the 12.7% decline expected at the start of the quarter and the 8.8% decline expected just before the unofficial start of earnings season last week.

- Nearly 91% of S&P companies that have reported have beaten consensus earnings expectations, compared to the 75% average over the last four quarters.

- In aggregate, companies are reporting earnings 21.5% ahead of expectations, ahead of the 11.5% average positive surprise rate over the last four quarters.

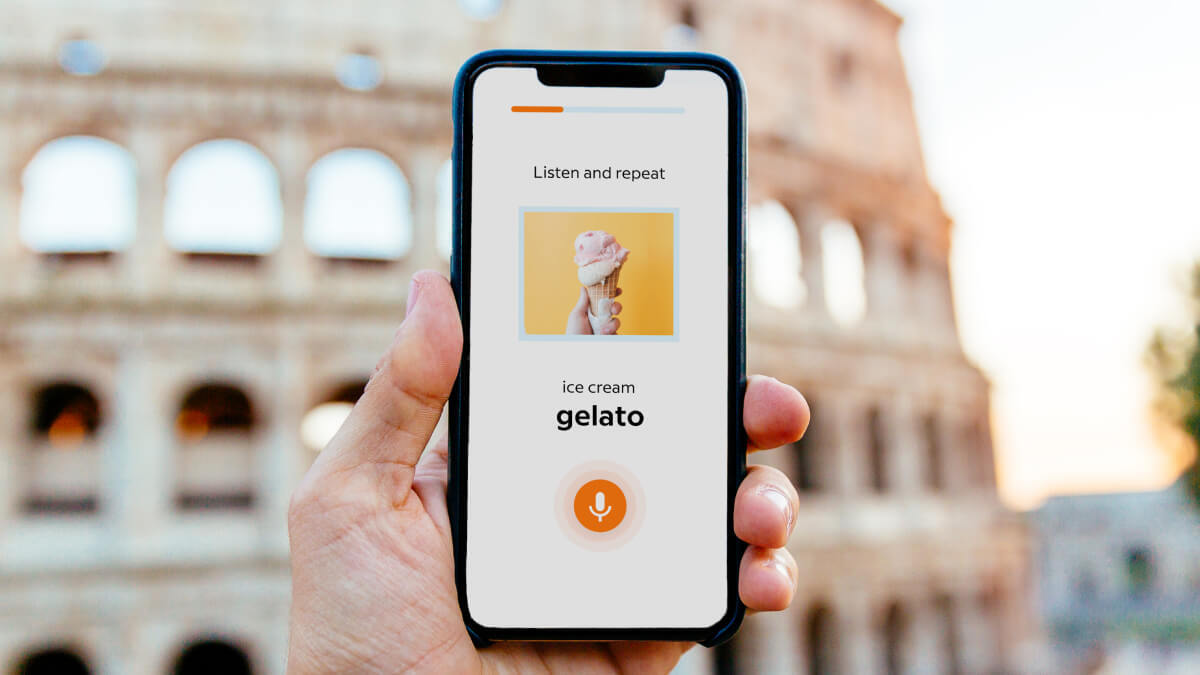

|     | | | | | | A message from Babbel | | Start speaking a new language in three weeks | | |  | | | | In 2021, let language take you places with Babbel. The background: This language learning app gives you bite-sized, manageable lessons in a variety of languages. It'll have you speaking the basics in three weeks. Sign up today and get 60% off. | | | | | | 3. Small businesses say they can't pay rent |  Data: Alignable; Chart: Axios Visuals Nearly half (49%) of all minority small business owners and a third (33%) of all small business owners were unable to pay their rent this month, according to the latest survey from Alignable. - 35% of women-owned businesses reported an inability to pay rent as well.

Between the lines: For the first time in the survey's history, at least 40% of respondents in 10 business categories said they couldn't afford to pay their rent. - That's up from six business categories in December and just two in November.

Why you'll hear about this again: "Based on this analysis, it's clear to see that COVID's negative affects are becoming more widespread as we start 2021," analysts noted in the survey. |     | | | | | | 4. Short seller calls out hydrogen fuel company Plug Power |  Data: Investing.com; Chart: Axios Visuals Plug Power's share price fell 6% on Thursday and slipped another 1% in after-hours trading following a Hindenburg Research-esque short seller report on the company from Kerrisdale Capital. What they're saying: "We are short shares of Plug Power, a $40 billion provider of hydrogen fuel-cell solutions that's set to generate a paltry $300 million in revenue in 2020 and trades at 40x its own aggressive revenue projection for 2024." - "The company's stock has almost doubled in just the last few weeks, and has risen by 15x in the last year, on the naïve excitement of uninformed investors over the prospects of the 'hydrogen economy,' or the idea that hydrogen and the fuel-cells (FCs) it can power will be a critical part of the transition from fossil fuels to 'green' energy."

- "But it's all just a pipe dream, because 'green' hydrogen is too expensive and too inefficient to produce, store, transport, and burn."

The intrigue: In contrast to Hindenburg's scathing report on electric truck manufacturer Nikola, Kerrisdale doesn't allege that Plug is necessarily deceiving investors, just that for it to ever be profitable the company's technology would need to overcome the laws of physics. Why it matters: While Nikola seemed to be a case of a company asserting its vehicles did things that they couldn't, Plug's seems to simply be a case of a company whose revenues and potential revenues don't justify its valuation. - But the market has shown that in 2021 such concerns may be irrelevant.

- Plug is up 1400% over the past year.

Go deeper: A Short Seller Pans Plug Power Stock. But Wall Street Disagrees. (Barron's) |     | | | | | | A message from Babbel | | Start the new year with a new language | | |  | | | | In 2021, let language take you places with Babbel. The background: This language learning app gives you bite-sized, manageable lessons in a variety of languages. It'll have you speaking the basics in three weeks. Sign up today and get 60% off. | | | | Thanks for reading! Quote: "Proceed, great chief, with virtue on thy side. Thy ev'ry action let the goddess guide. A crown, a mansion, and a throne that shine. With gold unfading, Washington! be thine." Why it matters: On Jan. 21, 1773, poet Phillis Wheatley, a literary prodigy and the first African-American author of a published book of poetry, was freed from slavery. - FYI: George Washington, whom she references in the poem quoted above, was an admirer of her work and in 1776 sent her a letter noting, in part, "the style and manner exhibit a striking proof of your great poetical Talents."

| | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment