| Trading idea for the EUR/USD pair 2020-11-27  The decline in the US dollar, associated with the expectations for a massive stimulus package in the US, carried the EUR / USD pair to 1.19000. According to technical analysis, this movement formed a double bottom on the daily chart, which is a good area to open trading positions.  This area is also perfectly visible on the hourly chart, therefore, some may say it is illogical to short the euro against yesterday's many long positions. However, yesterday was a day off in the United States (due to Thanksgiving), so at that time, market volatility was low because US stock exchanges were closed. Thus, it is only rational to continue working for a fall today, especially based on the price movements in the EUR / USD pair.  As we can see, the quotes have formed three wave patterns (ABC), in which wave "A" is one of the initiatives shown in the chart above. Based on this scenario, it is profitable to open short positions after a 50% retracement from current prices, as such would allow the quotes to break the level of 1.18800. Of course, traders still need to monitor and control the risks to avoid losing profit. Trading is very precarious, but also very profitable if right approaches were used. (Price Action and Stop Hunting were used for the above strategy) Good luck! EUR/USD. Hungarian-Polish alliance gains strength, but pair grows thanks to weak dollar 2020-11-27 The euro-dollar pair continues to show bullish sentiment, despite the unabated political crisis in Europe. The confrontation between Brussels and the so-called "Hungarian-Polish alliance" continues to be on the agenda, exerting background pressure on the euro. But the general weakness of the dollar allows the buyers of EUR/USD to keep the previously occupied price heights: the pair have beset the 19th figure for the third day. Thursday's corrective pullback, which was triggered by the publication of the ECB minutes, was predictable. After two days of recoilless growth, the pair had to adjust for further ascent. However, it is worth emphasizing that the current growth of the pair is due solely to the weakness of the US dollar, while the euro is under the yoke of its own problems: observe, for example, at the dynamics of such cross-pairs as EUR/JPY or EUR/CHF. This suggests that the prospects for the euro-dollar pair will depend on the condition of the dollar index. If it continues to decline, buyers of EUR/USD will be able to get to the middle of the 19th figure or even test the resistance level of 1.1970. If the attractiveness of the US dollar increases, we expect a decline in the area of the 18th figure that is, to the support levels of 1.1870, 1.1830. The euro is currently unable to contain the blow and repel the possible onset of dollar bulls. The political conflict over the EU budget is to blame.

Let me remind you that Hungary and Poland blocked the final approval of the budget, opposing the new EU rules. According to these rules, Brussels can reduce payments to those countries that violate the principles of the rule of law. Human rights activists have often made similar complaints about Budapest and Warsaw: Hungarians are criticized for pursuing a tough policy against illegal migrants, while poles are criticized for judicial reform and control of the media. In other words, under these circumstances, both Hungary and Poland may not receive tens of billions of euros from EU funds. Therefore, they blocked the budget process, demanding either to exclude the above-mentioned mechanism or to postpone its implementation. The preliminary negotiations between Brussels and Germany did not lead to anything. Moreover, the Prime Ministers of Hungary and Poland signed an agreement on Thursday, that they will act as a "united front" on this issue. The EU leadership is threatening to use alternative mechanisms for implementing the budget, while some Polish and Hungarian politicians are talking about the possible collapse of the EU. However, the latter argument is exclusively populist: according to preliminary polls, about 70-80% of Hungarians and Poles are in favor of membership in the European Union. After the implementation of Brexit, political parties or movements appeared in almost every EU country that supports the state's withdrawal from the Alliance. But, as a rule, the relevant ideas are lobbied by either marginal or right-wing (right-wing radical) forces that do not enjoy broad electoral support. Therefore, all talk about the conditional "POLEXIT" is nothing more than talk. Nevertheless, the very fact of a political conflict puts pressure on the euro. Therefore, it is worth repeating that the growth of the EUR/USD pair is due only to the weakness of the dollar. There are several reasons for the USD to feel insecure. The very common one is the increased market interest in risky assets. The US dollar, which has long been used by the market as a protective tool, has ceased to be in demand. In addition, the devaluation of the greenback is explained by other, more specific factors. First of all, is the coronavirus and its "derivative" problems of a political and economic nature. On Thursday, more than 2,000 people died from Covid-19 in the US, which was the highest death rate in the country over the past six months. The daily morbidity rate does not fall below the 170,000 mark. Governors of many States are forced to tighten quarantine restrictions (up to a complete lockdown), and this fact negatively affects the dynamics of macroeconomic indicators. For example, the number of applications for unemployment benefits has been rising for the second week in a row, foreshadowing weak Nonfarms that will be published next Friday. Meanwhile, the issue of accepting a new aid package for the US economy has been hanging in the air since the end of October. After nearly 6 months of negotiations, Democrats and Republicans were unable to find a compromise. At the moment, no one knows when the negotiation process will resume, given the change of power in the White house. Most likely, politicians will return to this issue at the beginning of next year.

Thus, the fundamental background, in general, contributes to the further growth of EUR/USD. On Thursday, the pair's bears tried to go for a correction, amid the growth of the US dollar. But the dollar index showed an upward trend for just a few hours, after which it began to slide down again. The euro-dollar pair, respectively, acted in a mirror way: after a decline to the level of 1.1880, it resumed its growth, returning to the area of the 19th figure. All this suggests that the pair retains the potential for further growth, with the first (and so far main) target of 1.1970 being the upper line of the Bollinger Bands indicator on D1. EUR/USD analysis for November 27 2020 - Breakout of the rising channel and potential for the downside rotation towards 1.1885 2020-11-27 UK's Frost: For a Brexit deal to be possible, it must fully respect UK sovereignty Comments by UK chief Brexit negotiator, David Frost Frost remarks in a tweet thread: Ilook forward to welcoming @MichelBarnier and his team to London and to resuming face-to-face talks tomorrow. We are glad all are safe and well. Some people are asking me why we are still talking. My answer is that it's my job to do my utmost to see if the conditions for a deal exist. It is late, but a deal is still possible, and I will continue to talk until it's clear that it isn't. But for a deal to be possible it must fully respect UK sovereignty. That is not just a word - it has practical consequences. That includes: controlling our borders; deciding ourselves on a robust and principled subsidy control system; and controlling our fishing waters. We look to reach an agreement on this basis, allowing the new beginning to our relationship with the EU which, for our part, we have always wanted. We will continue to work hard to get it - because an agreement on any other basis is not possible. The narrative ahead of the talks in London is that the status quo remains and it is either both sides are still holding out or this just really good political theater. Either way, there isn't anything to get excited about in the next 24-36 hours at least. Further Development

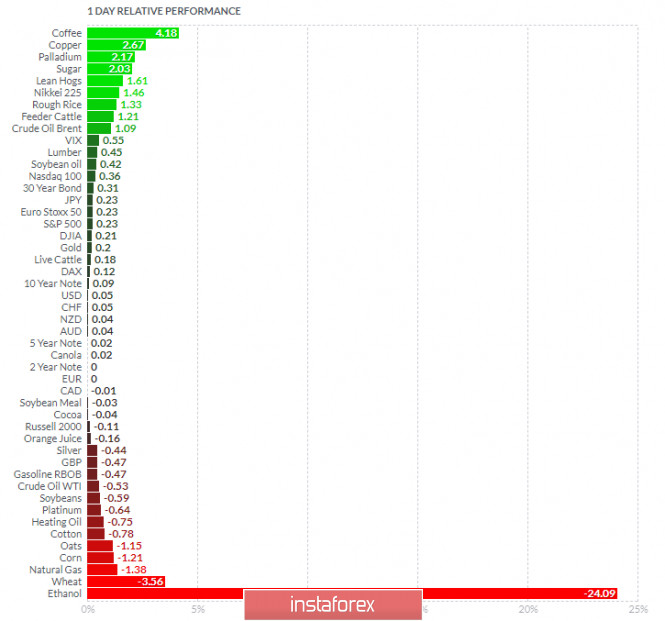

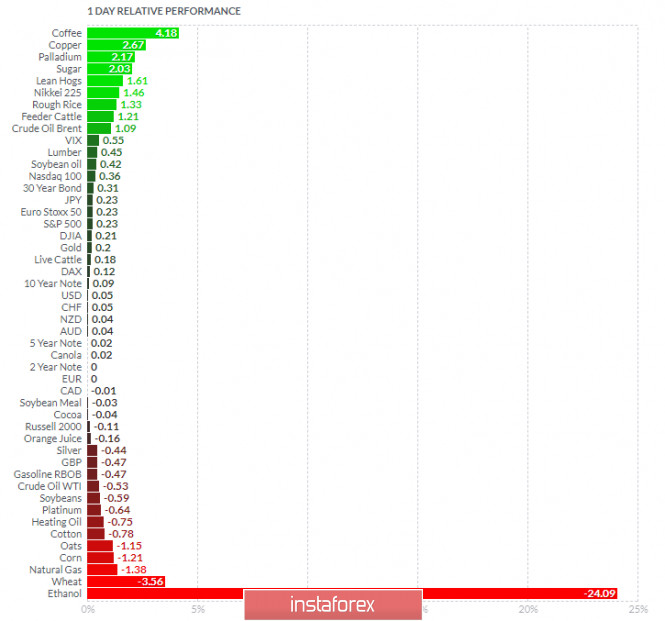

Analyzing the current trading chart of EUR/USD, I found that the buyers got exhausted today and that there is downside breakout of the upward channel, which is good sign for the downside continuation. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Coffee and Cooper today and on the bottom Ethanol and Wheat. Key Levels: Resistance: 1,1932 Support levels: 1,1885 and 1,1855. Analysis of Gold for November 27,.2020 - Potential for the downside rotation towards $1.800 and $1.786 2020-11-27 Eurozone November final consumer confidence -17.6 vs -17.6 prelim Economic confidence 87.6 vs 86.0 expected - Prior 90.9; revised to 91.1

- Industrial confidence -10.1 vs -10.9 expected

- Prior -9.6; revised to -9.2

- Services confidence -17.3 vs -16.3 expected

- Prior -11.8; revised to -12.1

Euro area economic confidence slumped on the month amid tighter restrictions across the region and that highlights the struggle with the recovery towards the year-end. As the restrictions look set to continue until the closing stages of the year, it makes for a very uncertain outlook going into Q1 2021 if the virus situation isn't contained.

Further Development

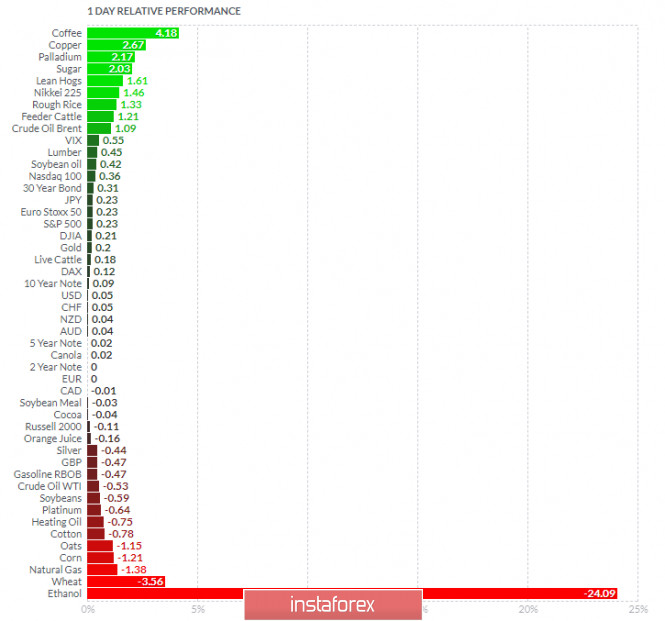

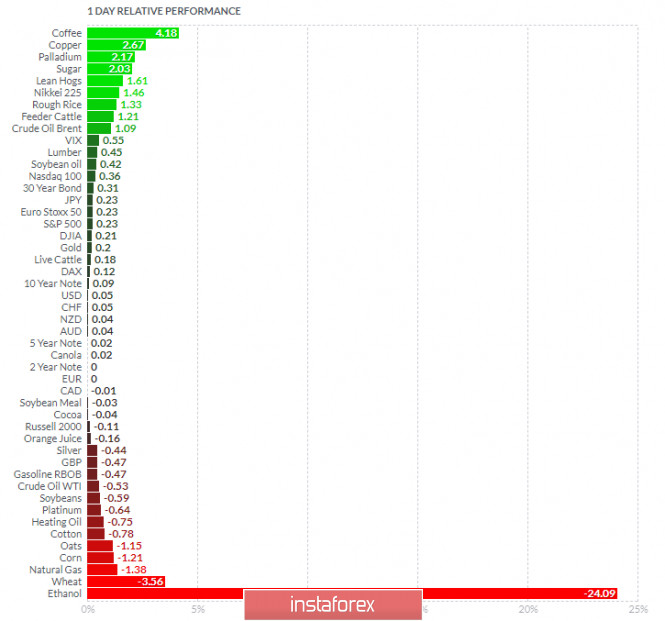

Analyzing the current trading chart of Gold, I found that Gold is doing consolidation at the price of $1,807 but there is still chance for the downside continuation. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Coffee and Cooper today and on the bottom Ethanol and Wheat. Gold is flat on the list.... Key Levels: Resistance: 1,1932 Support levels: $1,799 and $1,786.

Author's today's articles: Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Irina Manzenko  Irina Manzenko Irina Manzenko Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Andrey Shevchenko

Andrey Shevchenko  Irina Manzenko

Irina Manzenko  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment