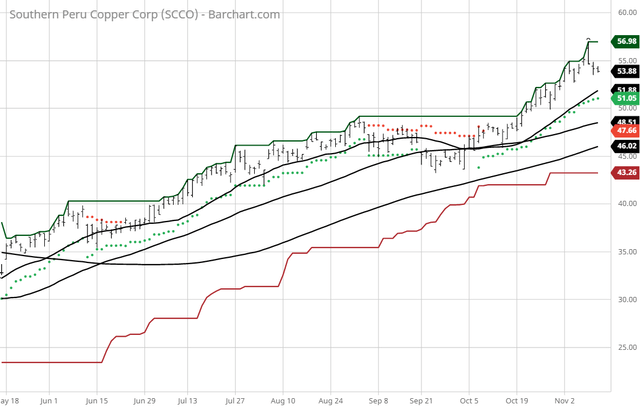

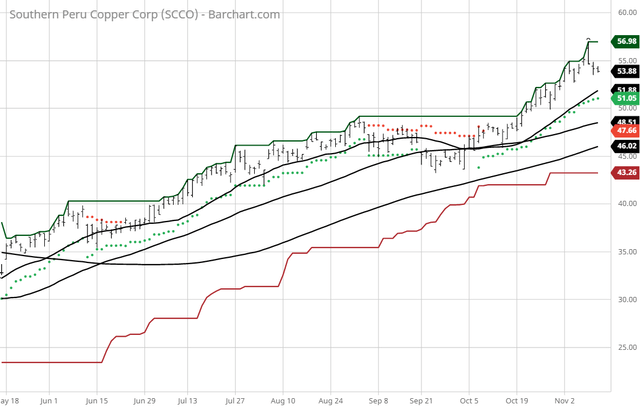

The Barchart Chart of the Day belongs to the mining company Southern Peru Copper (NYSE:SCCO). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 10/9 the stock gained 12.19%. Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc and lead. It operates the Toquepala and Cuajone open-pit mines, and a smelter and refinery in Peru; and La Caridad, an open-pit copper mine, as well as a copper ore concentrator, a SX-EW plant, a smelter, refinery, and a rod plant in Mexico. The company also operates Buenavista, an open-pit copper mine, as well as two copper concentrators and three SX-EW plants in Mexico. In addition, it operates five underground mines that produce zinc, lead, copper, silver, and gold; a coal mine that produces coal and coke; and a zinc refinery. The company has interests in 37,622 hectares of exploration concessions in Peru; 147,974 hectares of exploration concessions in Mexico; 63,453 hectares of exploration concessions in Argentina; 42,615 hectares of exploration concessions in Chile; and 7,298 hectares of exploration concessions in Ecuador. Southern Copper Corporation was founded in 1952 and is based in Phoenix, Arizona. Southern Copper Corporation is a subsidiary of Americas Mining Corporation.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signal

- 57.90+ Weighted Alpha

- 41.56% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 12.12% in the last month

- Relative Strength Index 63.83%

- Technical support level at 53.49

- Recently traded at 53.84 with a 50 day moving average of 48.52

Fundamental factors: - Market Cap $41.87 billion

- P/E 32.73

- Dividend yield 2.93%

- Revenue expected to grow 3.00% this year and another 9.80% next year

- Earnings estimated to increase 34.70% next year

- Wall Street analysts gave the stock 2 buy, 5 hold and 5 under perform recommendation.

- 17,940 investors monitor the stock on Seeking Alpha

|

No comments:

Post a Comment