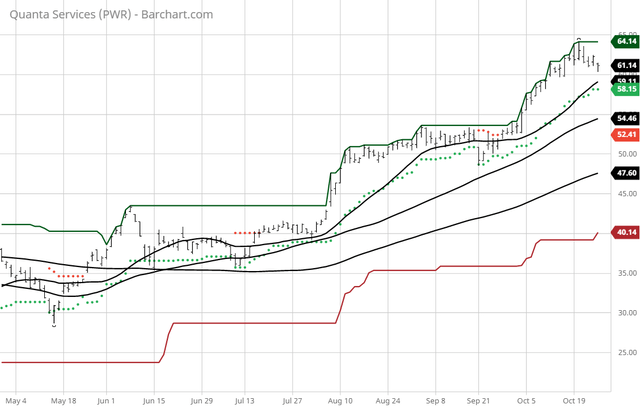

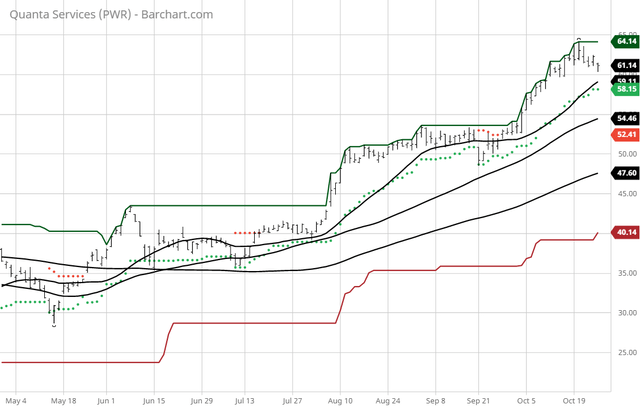

The Barchart of the Day belongs to the energy infrastructure contractor Quanta Services (NYSE:PWR). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 9/28 the stock gained 15.60%. Quanta Services, Inc. provides specialty contracting services in the United States, Canada, Australia, Latin America, and internationally. Its Electric Power Infrastructure Services segment designs, installs, upgrades, repairs, and maintains electric power transmission and distribution infrastructure, and substation facilities, as well as provides other engineering and technical services; designs, installs, maintains, and repairs commercial and industrial wiring; and operates a postsecondary educational institution. It also offers emergency restoration services, including the repair of infrastructure damaged by inclement weather; installation, maintenance, and upgrade of electric power infrastructure; and installation of smart grid technologies on electric power networks. In addition, this segment provides services related to development of solar, wind, and various natural gas generation facilities, as well as related switchyards and transmission infrastructure; and construction of electric power generation facilities. The company's Pipeline and Industrial Infrastructure Services segment designs, installs, repairs, and maintains pipeline transmission and distribution systems, gathering systems, production systems, storage systems, and compressor and pump stations, as well as offers related trenching, directional boring, and mechanized welding services; and designs, installs, and maintains fueling systems, and water and sewer infrastructure. This segment also provides pipeline protection, integrity testing, and rehabilitation and replacement, as well as pipeline support systems, and related structures and facilities fabrication services; and high-pressure and critical-path turnaround, electrical, piping, fabrication, and storage tank services. It serves electric power, energy, and communications companies, as well as commercial, industrial, and governmental entities. The company was founded in 1997 and is headquartered in Houston, Texas.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signal

- 70.80+ Weighted Alpha

- 47.54% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 18.24% in the last month

- Relative Strength Index 63.85%

- Technical support level at 60.49

- Recently traded at 61.10 with a 50 day moving average of 54.46

Fundamental factors: - Market Cap $8.65 billion

- P/E 20.79

- Revenue expected to grow 6.50% next year

- Earnings estimated to increase 21.30% next year and continue to compound at an annual rate of 10.02% for the next 5 years

- Wall Street analysts issued 6 strong buy, 8 buy and 2 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 427 to 15 that the stock will beat the market

- 7,070 investors are monitoring the stock on Seeking Alpha

The #1 strategy that could have sent you 20 years with no losing years… Trophy Trades have already proven to have the potential to earn you as much as $13.5 million dollars… But it’s never been released to the public before - now that changes for you

More on this symbol: |

No comments:

Post a Comment