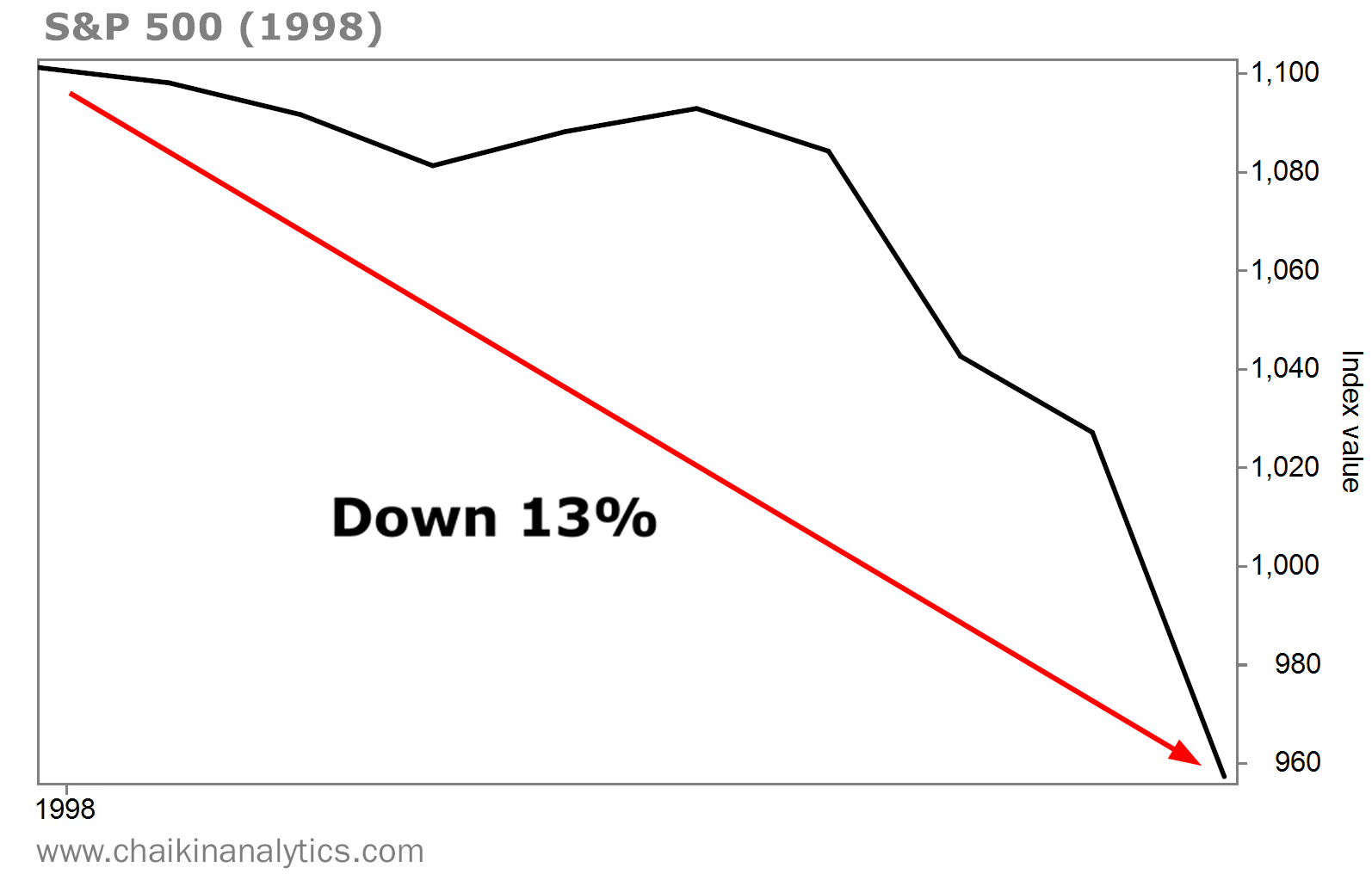

Dear Reader, At Chaikin Analytics, we don't believe that "buy and hold" is always the right approach... It's how we were able to call the COVID crash months in advance... its staggeringly fast recovery... the 2022 crash... and even 2023's unexpected stock surge... all in advance. I even stepped forward in January this year to predict that the stock market would go up 18% this year – and by July it had done exactly that. And while many people will tell you average investors aren't "smart enough" to time the market, it's simply not the case. Each of these predictions was based on the analysis of historical data, and what I was seeing in my Power Gauge at the time. Well, the prediction I'm issuing today is no different. It's supported by a data set that goes back 96 years. It shows that stocks typically fall as summer comes to a close – often dramatically and quickly. In fact, this time in 1998, we saw stocks begin to plummet 13% in just two weeks:

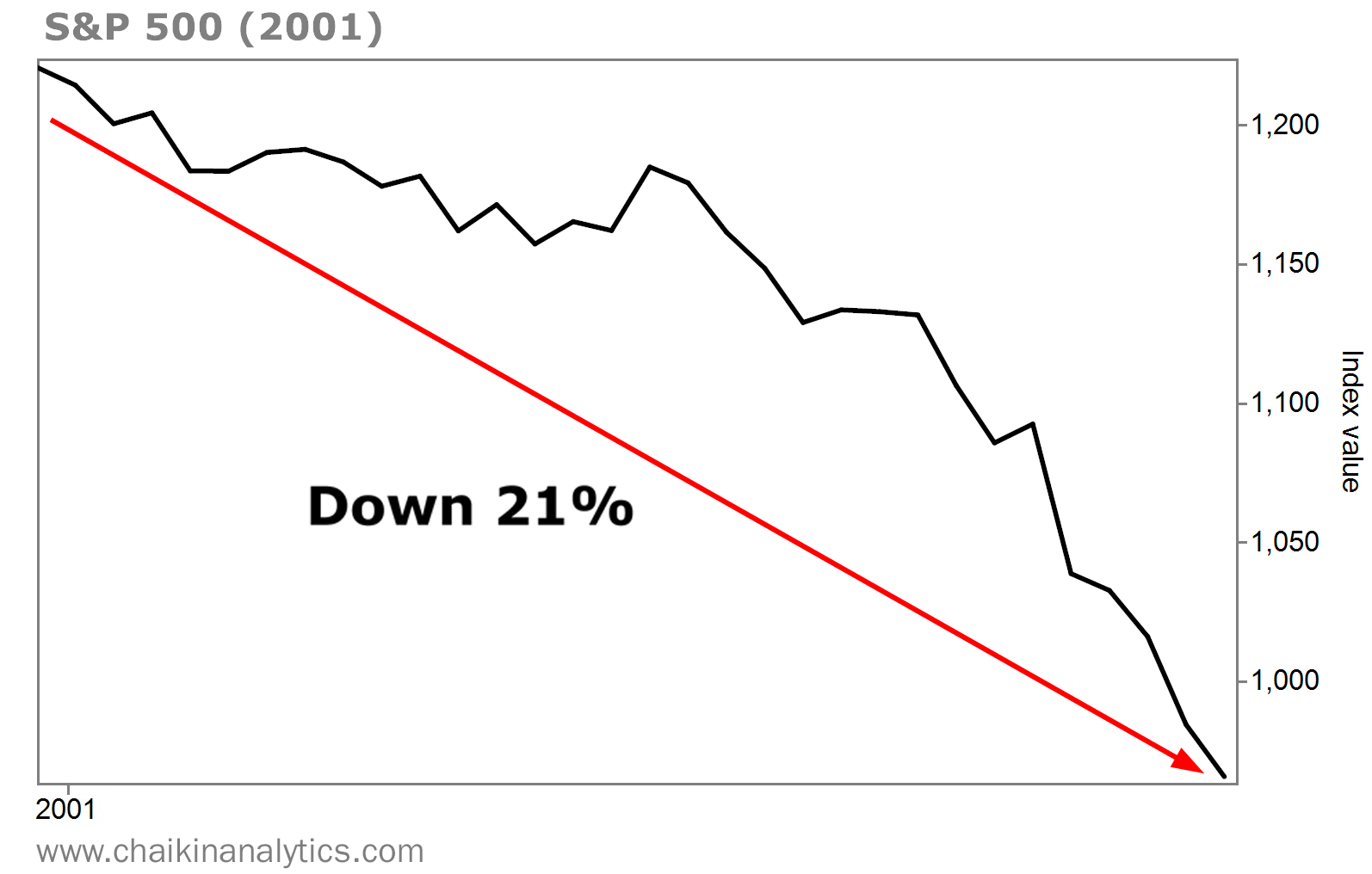

In 2001, stocks dropped 21% starting around this time:

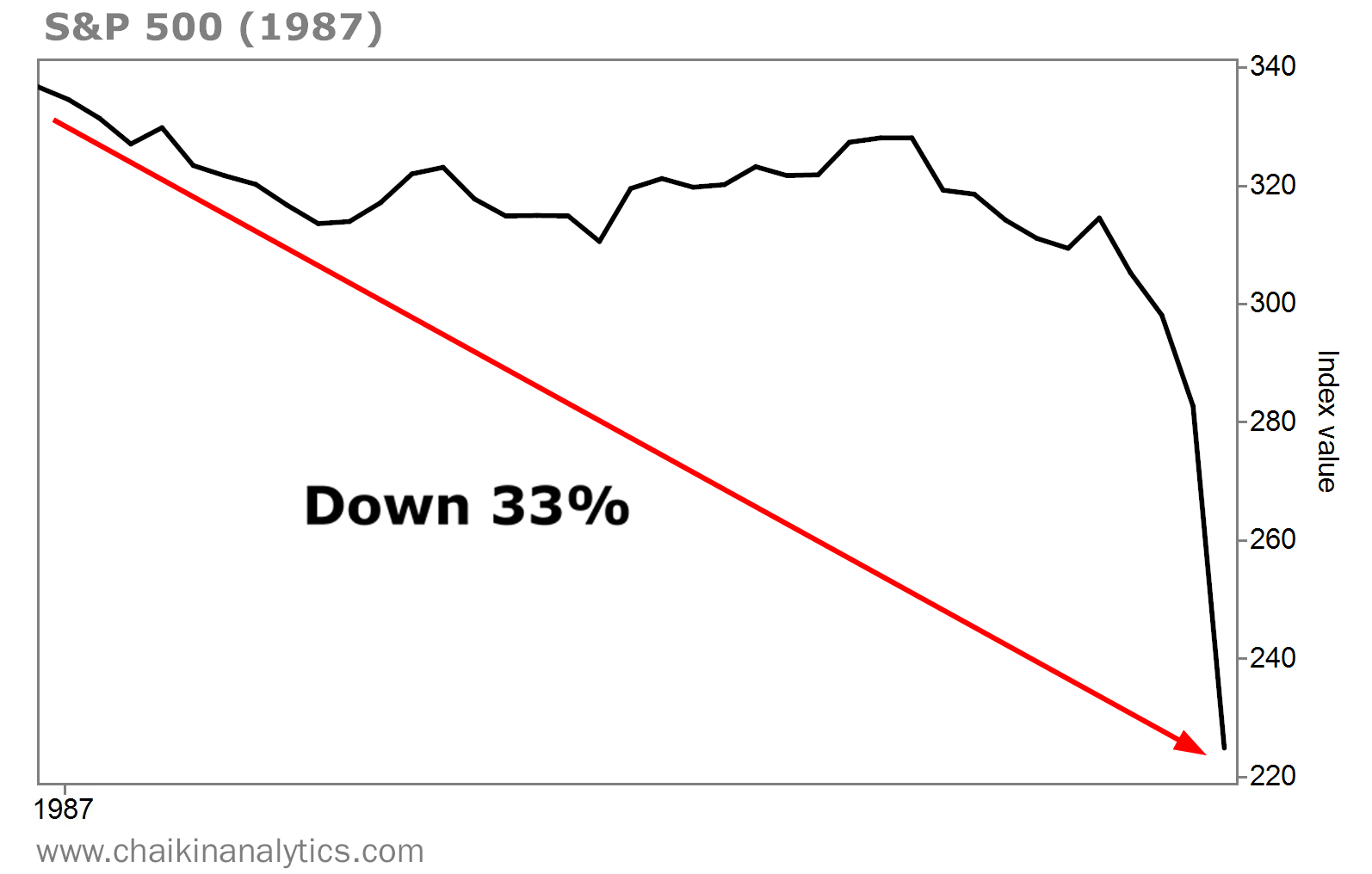

And in late August of 1987, the market started its brutal 33% fall:  This phenomenon almost always occurs around this time. And while the market shed nearly $3 trillion in just over two weeks in August... Based on 96 years of historical data, I believe more volatility is to hit the market again. And if this goes anything like it's gone in the past, it could result in tremendous losses for investors who don't prepare their investments accordingly. Luckily, there's a strategy I helped pioneer in the 1970s that could allow you to turn the whole situation to your advantage. Click here to learn what could trigger another wave of volatility in the days ahead, and my No. 1 way to play it. Sincerely, Marc Chaikin

Founder, Chaikin Analytics |

Post a Comment

0Comments