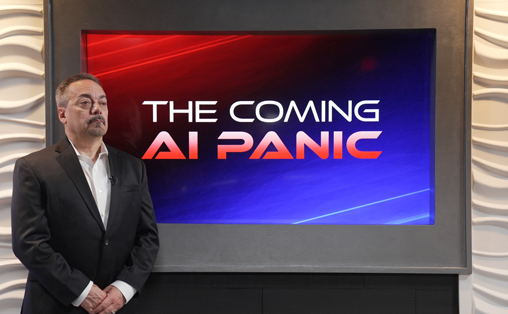

| Charles Sizemore

Chief Investment Strategist, The Freeport Society | SPONSORED  Are AI stocks a bubble ready to pop?

Is it too late to buy Nvidia?

Or is this AI boom just getting started?

Tomorrow, July 9, at 8 p.m. ET, legendary trader Tom Gentile is hosting an urgent strategy session to answer these questions.

Click here to see the details and save your seat because…

Tom predicted the rise of AI in early 2019… and gave his readers a chance to turn $10,000 into as much as $325,000 in shares of Nvidia.

Don’t Miss Out, Save Your Seat Here

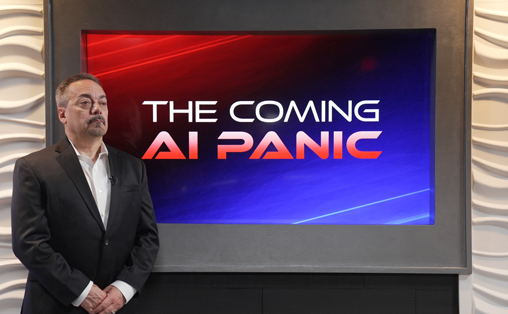

(By clicking the link, your email address will automatically be added to the Event RSVP list.) | By James Hickman, Schiff Sovereign There is a well-known modern proverb (often attributed to the novelist G. Michael Hopf) that goes, "Weak men create hard times, hard times create strong men, strong men create good times, good times create weak men." The saying sums up the cyclical nature of the rise and fall of societies… and it's a topic in which I have tremendous personal interest. Having recently reached middle age, I can comfortably say with the benefit of hindsight that I grew up during the American prime time… that period during which the wealthiest and most powerful country in the history of the world was at its peak. The U.S. is still an incredible country with so much prosperity and opportunity. But it would be completely naive and ignorant to claim that America is not in substantial decline. Financial challenges keep piling up, from the insolvency of Social Security… to the $35 trillion national debt… to the inflation problem that just won't go away. And social divisions, many of which have been bizarrely self-inflicted, seem to grow more tense by the day. Fortunately, America's decline began from a historically high peak. So even in its diminished state, again, it is still wealthy and powerful. But the real concern isn't where the country is today. It's the trend… where the country will end up in 10 years' time if it stays on the current course. I've spent the past 15 years studying similar cases throughout history. The U.S. is far from alone on the peak-and-decline roller coaster. And one of the best works on the subject I've ever read is The Collapse of Complex Societies, by anthropologist Joseph Tainter. Generally, "collapse" is a strong word and conjures images of anarchy and death. Tainter's definition is more precise. For him, "collapse" doesn't mean that a society or nation ceases to exist, but that it experiences a steep decline in political, social, and economic stability. This is what (I believe it's clear) the U.S. is going through right now, and the trend is accelerating. Tainter's book examines the common factors of how different societies throughout history declined, from ancient Mesopotamia to the Western Roman Empire. And his analysis shows that one of the key culprits for collapse is the inability of a government to recognize problems… or to solve them. Many ancient Roman emperors were legendary for failing to recognize the horrible problems brought on by their policies and incompetence… such as inflation, invasion, etc. This pretty much describes the U.S. federal government in a nutshell. Politicians can barely talk about problems in a civil and rational manner. Quite often they refuse to even acknowledge them. We've seen this over again with issues such as inflation, the southern border, crime, and Social Security. For example, the Social Security trustees publish a report each year stating plainly that the program is going to run out of money by 2033. Yet no one in Washington wants to talk about it. Joe Biden has even pledged to veto ANY efforts to reform the program. It's the same dysfunction with federal spending. These people can't even acknowledge that a $35 trillion national debt is catastrophic. Most politicians happily ignore it, and others come up with more outrageous spending to further the debt spiral. They cannot admit to the problem, let alone discuss it rationally. Merely passing a budget now routinely devolves into a crisis. Our view of where this trend leads is clear. We expect to see the five following eventualities… | SPONSORED  Are AI stocks in a massive bubble that’s ready to pop?

Will this AI boom end in tears, just like the dot-com bust in 2000?

Should you buy AI stocks like Nvidia…

Or is it too late?

Click here to see the answers from the legendary trader who predicted the rise of AI stocks five years ago. | Eventuality #1: Inflation Sticks There’s little hope of responsible spending. The government’s own projections forecast an extra $20 trillion in new debt over the coming decade, and frankly that’s optimistic.

History shows that explosions in national debt are financed by the Federal Reserve creating new money, which ultimately causes inflation.

When the Fed created $5 trillion of new money during the pandemic, we got 9% inflation. How much inflation will $20-plus trillion cause?

And the worse inflation becomes, the more urgency the rest of the world will have to replace the dollar as the global reserve currency… which will result in even MORE inflation in the U.S.

It’s a vicious cycle. Eventuality #2: Social Security Failure Social Security is not a political problem. It’s an arithmetic problem. And the math just doesn’t add up.

Every year the U.S. Secretary of Treasury signs the report saying plainly that, by 2033, Social Security’s trust funds will run out of money.

Benefits will have to be permanently cut by 25% and then become worse over time. Eventuality #3: Higher Taxes, Guaranteed Politicians love claiming that people should pay their “fair share” but can never quite define how much that means.

And they have already moved the goalposts on who exactly owes society more – the “billionaires” became the top 1%, then quickly shot up to the top 5%, then 10%, and soon it will be the top 25%.

Higher taxes won’t just be federal. State and local taxes – from sales tax to property tax – are very likely to rise, while our governments provide much less. Eventuality #4: Social Chaos Every time it feels like the lack of civility and unity across Western Civilization can’t get any worse, something new erupts.

Recently, it was university students screaming “from the river to the sea” and “Just Stop Oil” while defacing artwork and public monuments.

Rising tides of socialism and racial animosity never seem to ebb, and idiotic wokeness just won’t go away.

These social divisions will likely continue to grow. Eventuality #5: Bigger Geopolitical Disruptions As the financial and social decline of the U.S. becomes increasingly obvious to the rest of the world, adversaries are becoming more emboldened. Nations like China, Russia, North Korea, and Iran are likely to grow more assertive, and there will be significant calls to replace the dollar as the global reserve currency. Soft-war incidents like spy balloons and cyberattacks will persist. If we're very lucky, there won't be a shooting war. I give it 50/50. It's exasperating. Anybody over the age of 35 remembers a time when it wasn't like this. Yet now chaos is the norm. I'm not saying this to be dramatic. I'm simply being intellectually honest. That means acknowledging that, again, the U.S. is still a great country with an incredibly powerful economy, boasting some of the most valuable businesses in the world. And Americans still enjoy an extremely high standard of living, albeit one that has been disrupted in recent years by the combination of inflation, crime, and social chaos. The most exasperating part is that these problems are fixable. The U.S. government could spend responsibly and encourage capitalism and innovation to grow the economy, and its debt problems would melt away. The dollar would remain valuable. U.S. leadership might even earn back global trust. But with the current people in charge, I wouldn't hold my breath. I also wouldn't put all my hopes and dreams on the voters smartening up anytime soon. Yet there are still plenty of solutions that independent-minded individuals can execute without relying on the government. Here are some… Problem: Future inflation will pose a major problem to your savings. Solution: Invest in assets that do well during – or even benefit from – inflation. Real assets such as energy, mining, and productive technology. Right now many of these are selling for record-low prices, yet poised for substantial growth. Problem: An overrun border and rising crime rates threatening cities and living standards. Solution: Get a second residency in a foreign country where you really enjoy spending time, or even obtain a second passport. This way you and your family will always have a place to go if the need ever arises. Problem: Social Security's trust funds will run out of money within a decade. Solution: Maximize contributions to retirement accounts – including a special type of 401(k) that could allow you to double contributions and direct where funds are invested. This lowers your taxable income, puts more money away for retirement, and allows the investments to grow tax-free. There are solutions for people who, unlike the government, are willing to recognize the problems and actually do something about it. To your freedom, James Hickman Co-Founder, Schiff Sovereign P.S. Thank you, James, for letting us share these thoughts. If you'd like to read more from him, visit Schiff Sovereign. Also, here's one solution to the problem of the U.S. dollar losing its reserve currency status. |

No comments:

Post a Comment