| Investor Report: Essential Elements Powering the Tech Revolution (ad) |

Semiconductor chips are in everything from your smartphone, car, to the very satellites that keep us connected...and they cannot be manufactured without Rare Earth elements (REEs). The writing is on the wall, no Rare Earth elements = no semiconductor chips = no AI and other advanced technologies.

Learn how this presents a unique opportunity for savvy investors. |

|

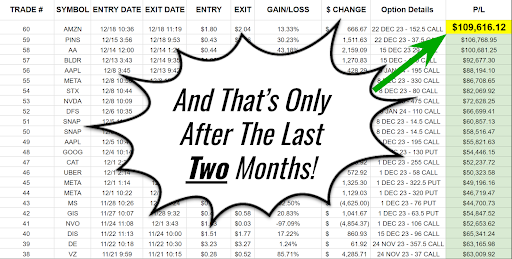

| $25,000 into $109,616 in two months? (ad) |

Today I want to show you how our research shows you could've grown a $25,000 account into $109,616.12 within the last TWO months.

You see, former multi-million dollar hedge fund manager Roger Scott spent the better half of 2023 developing what might be the most advanced trading tool that exists…

It's a revolutionary software system that tracks the moves of institutional investors…. in real time…

Go here to watch the most recent trading workshop video at no charge. |

|

Apple Inc. (AAPL) Apple Inc. (AAPL)    Amazon.com, Inc. (AMZN) Amazon.com, Inc. (AMZN)    Barker Minerals Ltd (BML) Barker Minerals Ltd (BML)  - No Headlines, Ratings, Earnings Results, Dividends, Insider Trades, Options Activity, Company Press Releases or Headlines Today

Meta Platforms, Inc. (META) Meta Platforms, Inc. (META)    Microsoft Co. (MSFT) Microsoft Co. (MSFT)   - Albemarle (NYSE:ALB) was upgraded by analysts at Berenberg Bank from a "hold" rating to a "buy" rating. They now have a $160.00 price target on the stock, up previously from $130.00. This represents a 26.5% upside from the current price of $126.50.

- Ashland (NYSE:ASH) was upgraded by analysts at Wells Fargo & Company from an "equal weight" rating to an "overweight" rating. They now have a $112.00 price target on the stock, up previously from $100.00. This represents a 16.2% upside from the current price of $96.41.

- C.H. Robinson Worldwide (NASDAQ:CHRW) was upgraded by analysts at Wolfe Research from an "underperform" rating to a "peer perform" rating.The current price is $72.62.

- Chevron (NYSE:CVX) was upgraded by analysts at Scotiabank from a "sector perform" rating to a "sector outperform" rating. They now have a $195.00 price target on the stock, up previously from $170.00. This represents a 21.9% upside from the current price of $159.93.

- DoorDash (NASDAQ:DASH) was upgraded by analysts at Moffett Nathanson from a "neutral" rating to a "buy" rating. They now have a $164.00 price target on the stock, up previously from $118.00. This represents a 17.5% upside from the current price of $139.59.

- EQT (NYSE:EQT) was upgraded by analysts at Scotiabank from a "sector perform" rating to a "sector outperform" rating. They now have a $52.00 price target on the stock. This represents a 40.1% upside from the current price of $37.11.

- Warrior Met Coal (NYSE:HCC) was upgraded by analysts at Citigroup Inc. from a "neutral" rating to a "buy" rating. They now have a $75.00 price target on the stock, up previously from $60.00. This represents a 19.8% upside from the current price of $62.58.

- Hamilton Insurance Group (NYSE:HG) was upgraded by analysts at Wells Fargo & Company from an "equal weight" rating to an "overweight" rating. They now have a $16.00 price target on the stock. This represents a 25.2% upside from the current price of $12.78.

- Gartner (NYSE:IT) was upgraded by analysts at UBS Group AG from a "neutral" rating to a "buy" rating. They now have a $550.00 price target on the stock, up previously from $484.00. This represents a 16.8% upside from the current price of $471.07.

- Monopar Therapeutics (NASDAQ:MNPR) was upgraded by analysts at Jonestrading from a "hold" rating to a "buy" rating. They now have a $2.00 price target on the stock. This represents a 150.0% upside from the current price of $0.80.

- NIKE (NYSE:NKE) was upgraded by analysts at Bank of America Co. from a "neutral" rating to a "buy" rating. They now have a $113.00 price target on the stock, up previously from $110.00. This represents a 23.9% upside from the current price of $91.18.

- Occidental Petroleum (NYSE:OXY) was upgraded by analysts at Scotiabank from a "sector perform" rating to a "sector outperform" rating. They now have a $90.00 price target on the stock. This represents a 31.2% upside from the current price of $68.61.

- PPG Industries (NYSE:PPG) was upgraded by analysts at Wells Fargo & Company from an "equal weight" rating to an "overweight" rating. They now have a $163.00 price target on the stock, up previously from $150.00. This represents a 17.9% upside from the current price of $138.20.

- SoundHound AI (NASDAQ:SOUN) was upgraded by analysts at Cantor Fitzgerald from an "underweight" rating to a "neutral" rating. They now have a $4.90 price target on the stock. This represents a 11.1% upside from the current price of $4.41.

- StepStone Group (NASDAQ:STEP) was upgraded by analysts at JPMorgan Chase & Co. from a "neutral" rating to an "overweight" rating. They now have a $49.00 price target on the stock, up previously from $40.00. This represents a 33.4% upside from the current price of $36.73.

- Atlassian (NASDAQ:TEAM) was upgraded by analysts at Barclays PLC from an "equal weight" rating to an "overweight" rating. They now have a $275.00 price target on the stock, up previously from $235.00. This represents a 30.3% upside from the current price of $211.01.

- T. Rowe Price Group (NASDAQ:TROW) was upgraded by analysts at Keefe, Bruyette & Woods from an "underperform" rating to a "market perform" rating. They now have a $120.00 price target on the stock, up previously from $106.00. This represents a 2.7% upside from the current price of $116.88.

- Vertex Pharmaceuticals (NASDAQ:VRTX) was upgraded by analysts at Evercore ISI from an "in-line" rating to an "outperform" rating. They now have a $438.00 price target on the stock. This represents a 9.5% upside from the current price of $400.00.

- View today's most recent analysts' upgrades at MarketBeat.com

| Biden to Launch "FedNOW" [Move Your Money Now] (ad) |

Earlier this year President Biden signed the death warrant for America…

Executive Order 14067 will essentially cancel your money.

You see Biden and the Fed have teamed up to create a controllable, traceable, programmable digital currency to replace the dollar...

Get your free information kit NOW, before it's too late. |

|

- EOG Resources (NYSE:EOG) was downgraded by analysts at Scotiabank from a "sector outperform" rating to a "sector perform" rating. They now have a $155.00 price target on the stock. This represents a 14.3% upside from the current price of $135.55.

- Exelixis (NASDAQ:EXEL) was downgraded by analysts at Barclays PLC from an "overweight" rating to an "equal weight" rating. They now have a $25.00 price target on the stock. This represents a 10.3% upside from the current price of $22.67.

- Fidelity National Information Services (NYSE:FIS) was downgraded by analysts at BNP Paribas from an "outperform" rating to a "neutral" rating. They now have a $72.00 price target on the stock. This represents a 0.2% upside from the current price of $71.86.

- Genesis Healthcare (NYSE:GEN) was downgraded by analysts at Barclays PLC from an "overweight" rating to an "equal weight" rating. They now have a $25.00 price target on the stock, down previously from $28.00. This represents a 11.9% upside from the current price of $22.34.

- Hamilton Lane (NASDAQ:HLNE) was downgraded by analysts at JPMorgan Chase & Co. from an "overweight" rating to a "neutral" rating. They now have a $115.00 price target on the stock. This represents a 1.1% upside from the current price of $113.74.

- Robinhood Markets (NASDAQ:HOOD) was downgraded by analysts at Citigroup Inc. from a "neutral" rating to a "sell" rating. They now have a $16.00 price target on the stock, up previously from $13.00. This represents a 12.8% downside from the current price of $18.35.

- Marsh & McLennan Companies (NYSE:MMC) was downgraded by analysts at Wells Fargo & Company from an "overweight" rating to an "equal weight" rating. They now have a $212.00 price target on the stock. This represents a 6.3% upside from the current price of $199.41.

- Murphy Oil (NYSE:MUR) was downgraded by analysts at Scotiabank from a "sector outperform" rating to a "sector perform" rating.The current price is $47.43.

- AVITA Medical (NASDAQ:RCEL) was downgraded by analysts at BTIG Research from a "buy" rating to a "neutral" rating.The current price is $9.98.

- Range Resources (NYSE:RRC) was downgraded by analysts at Scotiabank from a "sector outperform" rating to a "sector perform" rating. They now have a $45.00 price target on the stock. This represents a 25.9% upside from the current price of $35.74.

- Reliance (NYSE:RS) was downgraded by analysts at Citigroup Inc. from a "buy" rating to a "neutral" rating. They now have a $380.00 price target on the stock. This represents a 15.5% upside from the current price of $329.04.

- Redwood Trust (NYSE:RWT) was downgraded by analysts at Wedbush from an "outperform" rating to a "neutral" rating.The current price is $5.83.

- Saia (NASDAQ:SAIA) was downgraded by analysts at Wolfe Research from an "outperform" rating to a "peer perform" rating.The current price is $580.99.

- Southwestern Energy (NYSE:SWN) was downgraded by analysts at Scotiabank from a "sector outperform" rating to a "sector perform" rating. They now have a $9.50 price target on the stock. This represents a 29.1% upside from the current price of $7.36.

- Walker & Dunlop (NYSE:WD) was downgraded by analysts at Wedbush from an "outperform" rating to a "neutral" rating. They now have a $95.00 price target on the stock, down previously from $130.00. This represents a 5.8% upside from the current price of $89.82.

- View today's most recent analysts' downgrades at MarketBeat.com

| Explore the Future: Unlock the Top 3 AI Stocks for 2024 Report (ad) |

Eager to enhance your investment strategies with foresight? Dive into our intriguing report: "The Top 3 AI Stocks for 2024." Gain profound insights and uncover the secrets with just a click!

Why This Report Is Your Gateway to Success:

* Expertly Curated: Delve into the AI stocks handpicked by our market analysts for 2024's success story.

* In-Depth Analysis: Dive deep into comprehensive profiles and explore each top stock.

(**By clicking the link you are subscribing to The Wealthiest Investor Newsletter and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy. Full disclosures found here.)

[Get Your Insights Now] |

|

- Airbnb (NASDAQ:ABNB) is now covered by analysts at Benchmark Co.. They set a "buy" rating and a $190.00 price target on the stock. This represents a 17.4% upside from the current price of $161.90.

- Applied Materials (NASDAQ:AMAT) is now covered by analysts at Deutsche Bank Aktiengesellschaft. They set a "hold" rating and a $225.00 price target on the stock. This represents a 7.7% upside from the current price of $209.01.

- AnaptysBio (NASDAQ:ANAB) is now covered by analysts at Wells Fargo & Company. They set an "overweight" rating and a $56.00 price target on the stock. This represents a 125.2% upside from the current price of $24.87.

- Aquestive Therapeutics (NASDAQ:AQST) is now covered by analysts at Piper Sandler. They set an "overweight" rating and a $10.00 price target on the stock. This represents a 136.4% upside from the current price of $4.23.

- ATI (NYSE:ATI) is now covered by analysts at Deutsche Bank Aktiengesellschaft. They set a "buy" rating and a $70.00 price target on the stock. This represents a 36.6% upside from the current price of $51.25.

- Saul Centers (NYSE:BFS) is now covered by analysts at B. Riley. They set a "buy" rating and a $43.50 price target on the stock. This represents a 19.4% upside from the current price of $36.43.

- BRT Apartments (NYSE:BRT) is now covered by analysts at B. Riley. They set a "buy" rating and a $19.50 price target on the stock. This represents a 16.7% upside from the current price of $16.71.

- Carisma Therapeutics (NASDAQ:CARM) is now covered by analysts at BTIG Research. They set a "buy" rating and a $6.00 price target on the stock. This represents a 204.0% upside from the current price of $1.97.

- Ciena (NYSE:CIEN) is now covered by analysts at BNP Paribas. They set an "outperform" rating and a $57.00 price target on the stock. This represents a 21.5% upside from the current price of $46.91.

- Creative Media & Community Trust Co. (NASDAQ:CMCT) is now covered by analysts at B. Riley. They set a "neutral" rating and a $4.00 price target on the stock. This represents a 5.0% upside from the current price of $3.81.

- Chartwell Retirement Residences (OTCMKTS:CWSRF) is now covered by analysts at Desjardins. They set a "buy" rating and a $15.00 price target on the stock. This represents a 57.9% upside from the current price of $9.50.

- Walt Disney (NYSE:DIS) is now covered by analysts at JPMorgan Chase & Co.. They set an "overweight" rating and a $140.00 price target on the stock. This represents a 20.0% upside from the current price of $116.68.

- EastGroup Properties (NYSE:EGP) is now covered by analysts at JPMorgan Chase & Co.. They set a "neutral" rating and a $190.00 price target on the stock. This represents a 10.7% upside from the current price of $171.67.

- First Citizens BancShares (NASDAQ:FCNCA) is now covered by analysts at Barclays PLC. They set an "equal weight" rating and a $1,850.00 price target on the stock. This represents a 17.7% upside from the current price of $1,572.38.

- FactSet Research Systems (NYSE:FDS) is now covered by analysts at Wolfe Research. They set an "underperform" rating and a $430.00 price target on the stock. This represents a 1.1% upside from the current price of $425.40.

- FirstService (NASDAQ:FSV) (TSE:FSV) is now covered by analysts at Scotiabank. They set a "sector perform" rating and a $170.00 price target on the stock. This represents a 10.8% upside from the current price of $153.45.

- Harrow Health (NASDAQ:HROW) is now covered by analysts at Craig Hallum. They set a "buy" rating and a $24.00 price target on the stock. This represents a 88.2% upside from the current price of $12.75.

- Isabella Bank (OTCMKTS:ISBA) is now covered by analysts at Piper Sandler. They set a "neutral" rating and a $20.00 price target on the stock. This represents a 10.5% upside from the current price of $18.10.

- KLA (NASDAQ:KLAC) is now covered by analysts at Deutsche Bank Aktiengesellschaft. They set a "buy" rating and a $800.00 price target on the stock. This represents a 15.5% upside from the current price of $692.47.

- Kenvue (NYSE:KVUE) is now covered by analysts at Sanford C. Bernstein. They set an "underperform" rating and a $18.00 price target on the stock. This represents a 7.6% downside from the current price of $19.49.

- Lam Research (NASDAQ:LRCX) is now covered by analysts at Deutsche Bank Aktiengesellschaft. They set a "hold" rating and a $1,000.00 price target on the stock. This represents a 3.5% upside from the current price of $966.37.

- Lavoro (NASDAQ:LVRO) is now covered by analysts at Oppenheimer Holdings Inc.. They set an "outperform" rating and a $11.00 price target on the stock. This represents a 78.0% upside from the current price of $6.18.

- Sienna Senior Living (OTCMKTS:LWSCF) is now covered by analysts at Desjardins. They set a "buy" rating and a $15.50 price target on the stock. This represents a 61.0% upside from the current price of $9.63.

- Mastercard (NYSE:MA) is now covered by analysts at TD Cowen. They set a "buy" rating and a $545.00 price target on the stock. This represents a 17.1% upside from the current price of $465.59.

- Merit Medical Systems (NASDAQ:MMSI) is now covered by analysts at CL King. They set a "buy" rating and a $88.00 price target on the stock. This represents a 20.1% upside from the current price of $73.28.

- Matterport (NASDAQ:MTTR) is now covered by analysts at Northland Securities. They set an "outperform" rating and a $3.50 price target on the stock. This represents a 78.6% upside from the current price of $1.96.

- Nasdaq (NASDAQ:NDAQ) is now covered by analysts at Barclays PLC. They set an "overweight" rating and a $76.00 price target on the stock. This represents a 21.4% upside from the current price of $62.58.

- Alpine Income Property Trust (NYSE:PINE) is now covered by analysts at Alliance Global Partners. They set a "buy" rating and a $19.00 price target on the stock. This represents a 25.2% upside from the current price of $15.18.

- Q32 Bio (NASDAQ:QTTB) is now covered by analysts at Oppenheimer Holdings Inc.. They set an "outperform" rating and a $50.00 price target on the stock. This represents a 131.2% upside from the current price of $21.63.

- Snowflake (NYSE:SNOW) is now covered by analysts at KeyCorp. They set an "overweight" rating and a $185.00 price target on the stock. This represents a 17.9% upside from the current price of $156.91.

- Visa (NYSE:V) is now covered by analysts at TD Cowen. They set a "buy" rating and a $320.00 price target on the stock. This represents a 16.9% upside from the current price of $273.70.

- View today's most recent analysts' new coverage at MarketBeat.com

| Get 30 Days of MarketBeat All Access Free | | Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools: |

| - Best-in-Class Portfolio Monitoring

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. - Stock Ideas and Recommendations

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report. - Advanced Stock Screeners and Research Tools

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

| START YOUR 30-DAY FREE TRIAL  |

|

| Upgrade Your Subscription |

Upgrade to MarketBeat All Access and receive your premium edition of MarketBeat Daily at 9:00 AM ET. UPGRADE NOW  |

|

View and add up to five holdings to your watchlist.

VIEW MY PORTFOLIO  |

|

Join MarketBeat's free stock discussion and trading idea group on Facebook.

JOIN NOW  |

|

Thank you for subscribing to MarketBeat! We empower individual investors to make better trading decisions by providing real-time financial information and objective market research. MarketBeat is a small business and email is a crucial tool for us to share information, news, trading ideas and financial products and services with our subscribers (that's you!). If you have questions about your subscription, feel free to contact our U.S. based support team via email at contact@marketbeat.com. If you would like to unsubscribe or change which emails you receive, you can manage your mailing preferences or unsubscribe from these emails. © 2006-2024 MarketBeat Media, LLC. 345 N Reid Place, Suite 620, Sioux Falls, SD 57103 . United States. Today's Bonus Content: Break Through in Crypto Investing: 2024 Insights Inside (Click to Opt-in)  |

|

No comments:

Post a Comment