The Question You Should Ask Whenever You're Wrong | | Sponsored Content Elon Musk's "A.I. Day" Announcement Will Open a Brief Wealth Window Elon Musk has cracked open a radical wealth building opportunity set to create a slew of new millionaires... This narrow window will close when Elon holds his upcoming "A.I. Day." We're now on the final stretch before Elon's new project becomes mainstream to the public. A Silicon Valley insider has revealed everything you need to know about this wealth window before it shuts.

Click here now to discover how to profit before the huge public announcement | | | "Never bet on the end of the world. It only comes once, which is pretty long odds." -- Arthur Cashin, New York Stock Exchange Floor Manager ("Maxims of Wall Street," p. 110)

Since Joe Biden gave his State of the Union (or shall we say "Disunion") speech last week, I've encountered a plethora of negative comments about the future of America.

Is the American Dream Over?

"If Biden is re-elected, it will be the end of the American Dream as we know it," said one pundit on Fox News.

The critics are out in force. Supply-side economist Steve Moore writes, "Biden is intentionally trying to dismantle the American economy with his imbecile energy, climate change, crime, border, inflation, debt and high tax policies."

Glenn Beck, the host of Blaze TV, recently warned that America may face multiple terrorist attacks in one day, similar to 9/11, given the open borders policy of the Biden Administration.

Recently, I attended a private meeting of political leaders and pundits who thought that President Biden's address was the most polemical, shrill and divisive talk they had ever heard.

I've been watching State of the Union addresses all my adult life, by both Republicans and Democrats, and in many ways they are always polemical and divisive. What was amazing to me is how "sleepy" Joe Biden performed. He must have been well rested and jacked up with some pretty incredible drugs to do as well as he did.

President Biden did say some things that were crazy, such as when he asserted that voting for former president Donald Trump is a "vote against democracy."

Hey, wasn't it the Democrats who want to remove Trump from the November ballot in Colorado and other states? Talk about anti-democratic! I was glad to see the Supreme Court ruled 9-0 against the Colorado decision. Let the people decide. Isn't that what democracy is all about?

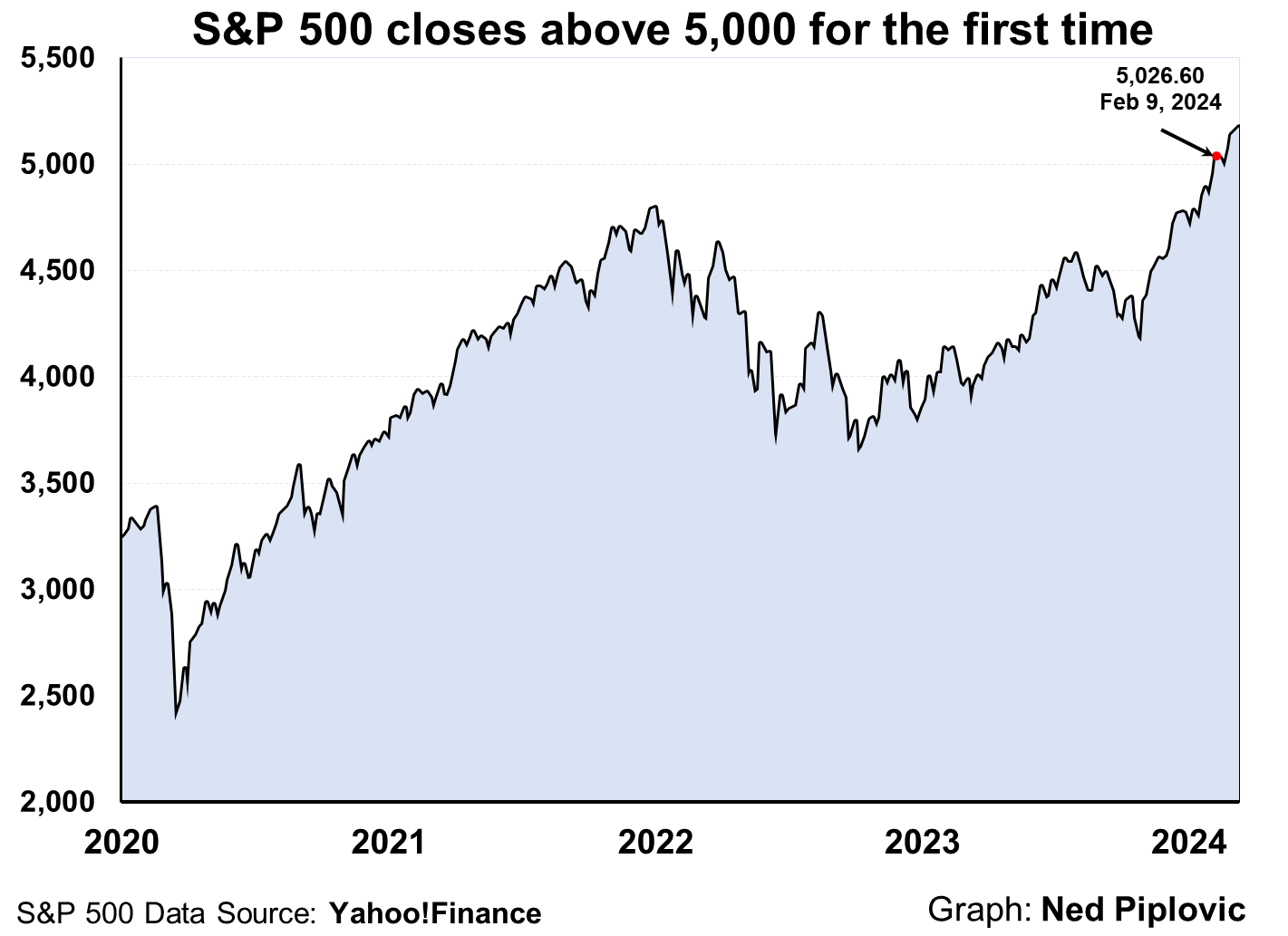

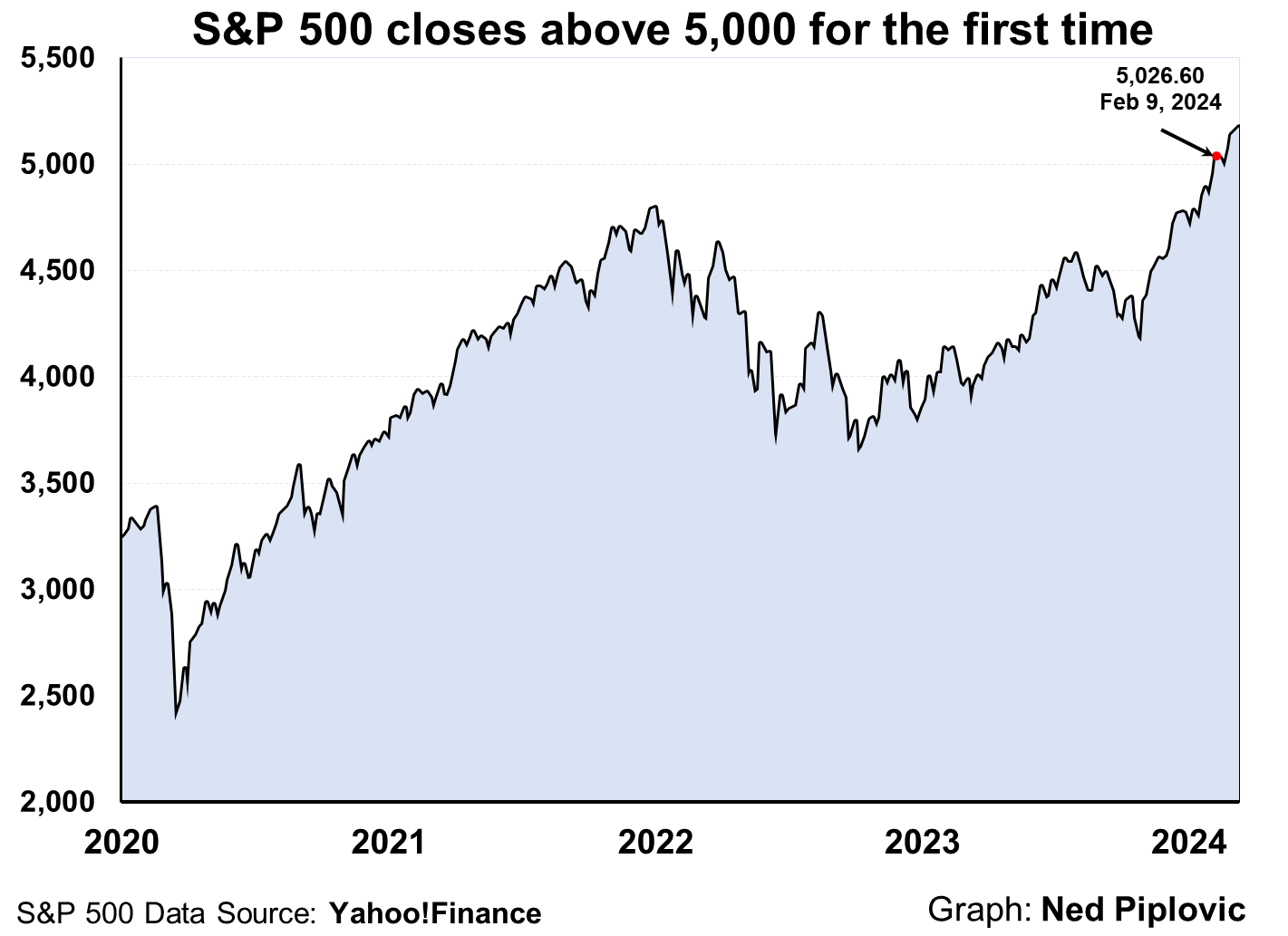

Why Then Is the Stock Market at an All-Time High?

Kevin Roberts, the new president of the Heritage Foundation, recently declared, "The American Dream is being threatened as never before!"

If that is true, why is the stock market at or near an all-time high? What are the prophets of doom and gloom missing?

That's the question I always ask when I'm wrong about something:

"What am I missing?"

Wall Street is a good bellwether of what is going on the country. So far, the benefits outweigh the costs. The economy is recovering from the Covid pandemic, inflation is coming down, corporate profits are strong, new technologies are being introduced and there's a strong movement to reverse the "cancel" and "woke" culture in the United States.

We have gridlock on Capitol Hill that is keeping a lot of bad legislation from becoming law. The Supreme Court has reversed many bad decisions by the lower courts.

We Remain Fully Invested

So, all is not lost after all. In my newsletter, Forecasts & Strategies, we remain fully invested, despite occasional corrections in the market.

We are also well diversified in some "contrarian" investments such as Bitcoin and gold, both of which continue to outperform and offset any selloffs in the stock market.

By remaining positive and fully invested, we have made good money in 2024.

The American Obituary Has Been Written Many Times

The American economy has been left for dead many times, only to be resuscitated with renewed vigor. We have survived civil and world wars, the Great Depression, the inflationary 1970s, terrorist attacks and more.

As J.P. Morgan once said, "The man who is a bear on the United States will eventually go broke" ("Maxims," p. 111).

I encourage you to read my favorite J.P. Morgan story found on pp. 218-219 in "The Maxims of Wall Street." See www.skousenbooks.com.

American exceptionalism is alive and well. We are still the Promised Land with millions wanting to live and work here. | | You Won't Believe What Biden Has Planned For 2024 You won't believe what Joe Biden has planned for his 2024 re-election bid…

By the looks of things, he's put together a desperate plan to endear himself to the

American public ahead of the election…

One that involves pumping the economy with $15.7 trillion in new wealth.

Click here to learn how to profit. | | | Solving Our Unfunded Liability Problem: Look to Canada!

One serious problem in America is the irresponsible, out-of-control deficit spending and national debt, created by both Republican and Democratic leaders over the years. The trouble is getting worse, with rising interest rates to pay the debt and the growing unfunded liabilities from Social Security and Medicare.

Robert Poole of the Reason Foundation warns:

"The Congressional Budget Office (CBO)'s latest 10-year projection is frightening. CBO projects annual federal budget deficits to increase steadily, exceeding $2.5 trillion by 2034, assuming current policies continue… The federal government is projected to borrow an additional $20 trillion over the next decade, the CBO estimates.

"One driving factor is the impact of higher interest rates on the current $34 trillion (and growing) national debt… By 2034, annual interest expense is projected to be $1.6 trillion -- more than one-fourth of all federal tax revenue.

"The Penn Wharton Budget Model suggests that the United States has about 20 years to fix this debt/deficit problem -- 'after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt.'

"On August 2, 2023, Fitch Ratings downgraded the federal government's long-term debt rating from AAA to AA+. And on November 10, 2023, Moody's Investors Service reduced its outlook on the U.S. credit rating from 'stable' to 'negative.' Standard & Poor's did its downgrade in 2011. These are warning shots across the ship of state's bow."

Sounds ominous. What to do?

Canada faced a similar problem back in the mid-1990s. Deficits were getting out of hand, and the Canadian dollar was sinking. The Conservative Party and the Liberty Party of Canada worked together and resolved to cut government spending, lay off federal workers and then went on a supply-side tax-cutting program that resulted in economic growth and deficit reduction.

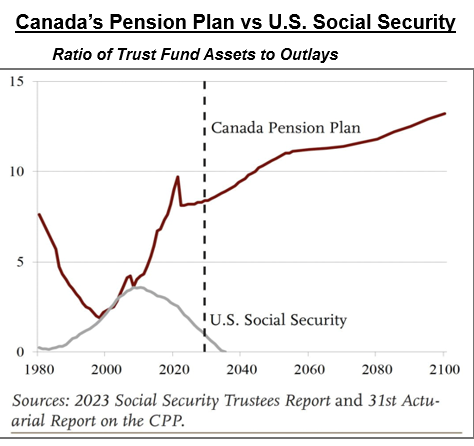

What about the unfunded liability problem, which causes national bankruptcy? Again, Canada offers an incredible example of solving the issue.

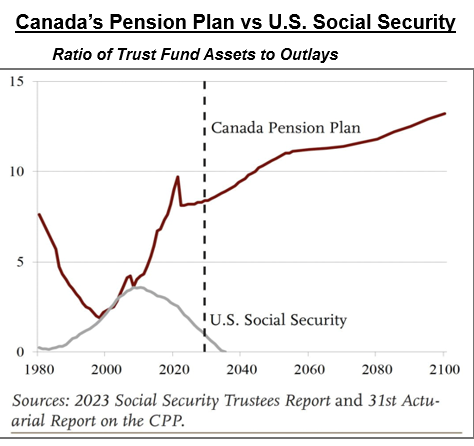

Last week, Andy Puzder and Terrence Keeley wrote an op-ed in The Wall Street Journal on the success of the Canadian social security system, which has earned a 9.3% annualized return over the past 10 years (versus almost zero return in our Social Security Trust Fund). They wrote:

"The Canada Pension Plan's superiority stems from its asset allocation. The fund invests about 57% of its assets in equities and 12% in bonds; the rest is divided among real estate, infrastructure and credit. Over the past 10 years, the Canada Pension Plan has realized a 9.3% annualized net return. Similarly to how Social Security works, Canadian citizens pay into the program and are guaranteed lifetime benefits."

At some point, the United States will need to imitate the Canadian model. Here is a chart on the difference between the two:

In sum, there are solutions to all of our problems -- if we know where to look and remain optimistic. | | Learn to Trade Like Interest Rates Don't Matter As February overflows with interest rate headlines, here's a fresh perspective for you: Learn to trade like interest rates don't matter. Whether you're a stock trader, options trader, swing trader, or day trader, this A.I. "Brain" is predicting market movements days in advance.

Don't Miss This FREE Live Class to Learn How > | | | Sound Advice from the 'Investment Bible'

In my home, I have a whole section of my library devoted to dozens of books written by doomsayers and Cassandras, such as "The Coming Deflation"…. "How to Prosper During the Coming Bad Years"… "Bankruptcy 1995"… "The End of Inflation" and so on.

I've also collected a bunch of quotes on doomsayers and Cassandras in "The Maxims of Wall Street."

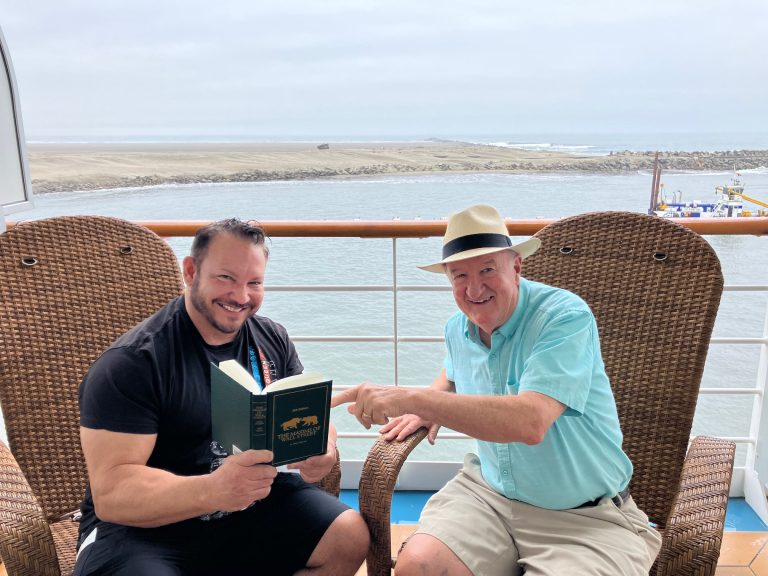

Jim Woods, my colleague at Eagle Publishing, is a big fan.

Jim states, "I've always felt that a collection of wisdom from the best brains in that industry has been most special to me. And on this front, there is no better 'how to' anthology than the one by my friend, fellow Fast Money Alert co-editor and brilliant economist, Dr. Mark Skousen. The 'Maxims of Wall Street' is a collection of some of the greatest wisdom ever to flow from the biggest and brightest names on Wall Street. Great investors such as Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch and John Templeton are just a sneak peek at some of the names you'll discover in this fantastic collection. Then, there is profundity from the likes of Ben Franklin, John D. Rockefeller, Joe Kennedy, Bernard Baruch, John Maynard Keynes, Steve Forbes and numerous other luminaries too copious to mention."

If you don't have an autographed copy of my collection of quotes, stories and wisdom of the world's top traders and investors, please order a copy now.

It is in its 10th edition, having sold nearly 50,000 copies. It has been endorsed by Warren Buffett, Kevin O'Leary, Jack Bogle, Kim Githler, Bert Dohmen, Richard Band and Gene Epstein in Barron's.

I offer it cheaply to my Skousen CAFÉ readers: Only $21 for the first copy, and all additional copies are $11 each (they make a great gift to clients, friends, relatives and your favorite broker or money manager). I sign and number each one, then mail it at no extra charge if you live in the United States. If you order an entire box (32 copies), the price is only $327. As Hetty Green, the first female millionaire, once said, "When I see a good thing going cheap, I buy a lot of it!"

To order, go to www.skousenbooks.com.

Good Investing, AEIOU,

Mark Skousen

Doti-Spogli Endowed Chair of Free Enterprise, Chapman University

Wikipedia

Newsletter and trading services

Personal website

FreedomFest | | Friedrich Hayek Won the Nobel Prize 50 Years Ago By Mark Skousen

Editor, Forecasts & Strategies

"Mises and Hayek articulated and vastly enriched the principles of Adam Smith at a crucial time in this century." -- Vernon Smith (2002 Nobel prize in economics)

March 23 is the anniversary of the passing of a giant in economics -- the Austrian economist Friedrich Hayek (1899-1992).

He is most famous for his bestselling book "The Road to Serfdom," written near the end of World War II, an admittedly a pessimistic book, warning the West that its move toward socialism, fascism and communism was indeed a "road to serfdom."

Then, when he won the Nobel prize in economics in 1974, he warned again of the dangers of "accelerating inflation," which he said, were "brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things."

Fortunately, we have moved away from the road to serfdom, especially after the collapse of the Berlin Wall and the Soviet socialist central planning model.

But the road to freedom has been a checkered one, and we must always be alert to losing our liberties in the name of inequality, fairness and social justice.

Last month, Tom Woods interviewed me in honor of the 50th anniversary of Hayek's winning the Nobel prize. Watch the interview here.

Mark Skousen, Friedrich Hayek and Gary North in Austria, 1985

I had the pleasure of interviewing Hayek for three hours in the Austrian alps in 1985. He was especially happy to hear I resurrected his macroeconomic model in developing gross output (GO). See www.grossoutput.com, a measure of Hayek's triangles.

This week, Larry Reed, former president of the Foundation for Economic Education, wrote this wonderful tribute to Hayek.

Highly recommended. | | | About Mark Skousen, Ph.D.:

Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. | | | | | |

No comments:

Post a Comment