From Third World to First World: Who Offers the Best Model of State Capitalism? | | Sponsored Content Will This New Tech Replace AI as We Know It? Experts are predicting that in as little as three months, AI as we know it could be totally blown away. And that means ChatGPT could be replaced by a new AI model that's thousands of times more powerful... something that could cause expensive tech stocks like Microsoft, Google and Nvidia to double - maybe even triple - in price in the months ahead.

Click here for all the details. | | | "Little else is required to carry a state from the lowest barbarism to the highest degree of opulence but peace, easy taxes and a tolerable administration of justice." -- Adam Smith (1755)

My wife Jo Ann and I are on the Regent Seven Seas Navigator on the Forbes Cruise to Asia, where I am a speaker along with Steve Forbes, Rich Karlgaard (Forbes editor at large) and Kenny Polcari from SlateStone Wealth management firm. The Forbes conference is hosted by Forbes and Kim Githler of the MoneyShow.

The #1 Freest Economy in the Middle East

We flew from L.A. to Bali, Indonesia, with an eight-hour stopover in Dubai, so I've now visited 80 countries in my life. Dubai is the most populous city of the United Arab Emirates (UAE), and is now the number one tourist destination in the world.

Dubai is a classic example of what an oil-rich country like United Arab Emirates can do when they use their wealth productively in creating a pro-market and pro-growth paradise in the desert. UAE is ranked the 22nd freest economy in the world and first in the Middle East, slightly ahead of Israel. Interesting that it has zero personal and corporate income tax!

In contrast, Saudi Arabia is ranked 69th in the world Economic Freedom Index, and sixth in the Middle East. | | Top 20 Living Economist Shares the Largest Position in His Personal IRA Investing legend Dr. Mark Skousen recently gave a talk to a small group in the heart of Washington, D.C. In it, he revealed the cornerstone of his retirement plan -- and the one investment that helped make him a millionaire. Click here to watch Dr. Skousen's presentation -- and learn about "the best way to become a millionaire in America." | | | Indonesia Is Progressing but Still Feels Like a Third-World Country

We spent several days in Bali, Indonesia, before getting on the Regent cruise ship. It reminded me a lot of Latin America, third-world poverty with an enclave of first-class resort hotels among the mountain villages. (We stayed two days at the beautiful Hilton Bali Resort.) It's hot and humid there. Along the way, we saw lots of small homes and retail stores, with innumerable chickens, stray dogs and cats. Traffic jams are so common that most Indonesians get around on scooters. On the positive side, there is little to no homelessness in Indonesia, and everyone there seems to have a job. Indonesia is the fourth most populated country in the world, dominated by Muslims and Hindus. It is ranked 10th in terms of economic freedom in Asia.

Communist China's Rise and Fall

After Indonesia, we came to the city-state Singapore, ranked number one in the Economic Freedom Index. For years, Hong Kong was ranked number one by both the Fraser Institute and the Heritage Foundation, but after the Chinese communists clamped down on Hong Kong, it became part of China, now ranked second in terms of economic freedom.

My wife and I had the opportunity to have dinner with the legendary financial guru Jim Rogers, who lives in Singapore. He wanted to teach his two daughters Mandarin Chinese because he believed China would be the dominant military and economic powerhouse of the 21st century. He still thinks that China will the number one Superpower nation in this century so far.

Meeting Jim Rogers at the famous Raffles Hotel.

It hasn't turned out that way. In my lecture on the Forbes cruise, I noted that economic growth and population growth have almost disappeared in China; their central planning model of state capitalism has failed, generating massive inflation and malinvestments. They have developed great infrastructure throughout China, and a thriving export market to the United States and elsewhere, but their civil and human rights abuses are coming back to haunt them. President Xi Jinping has become a dictator and is anything but benevolent in his military aggression and domestic demands.

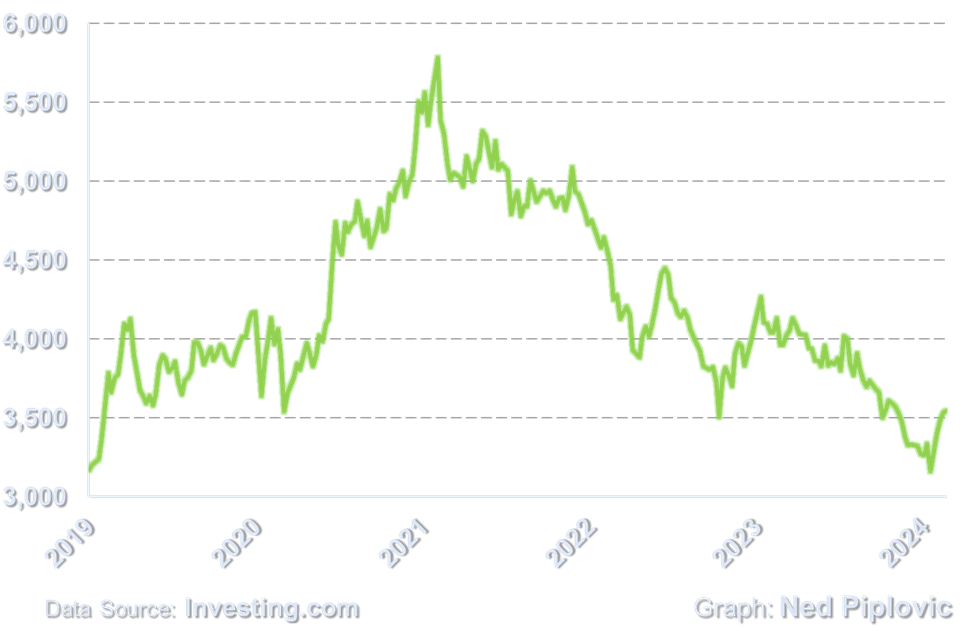

China's stock market tells the story.

The Shanghai index has collapse in the past six years, despite alleged double-digit-percentage growth in the economy. Jim Rogers thinks it may have bottomed out, but it is not a market I would play until fundamental changes occur. | | Your Recession Shield is A.I. You don't have the time to just sit around for the "interest rate" to play out. All professionals have their "tools" to improve success. And more and more traders are embracing Artificial Intelligence to forecast market trends 1 - 3 days in advance with up to 87.4% proven accuracy.

Come See the Stocks Set To Skyrocket In A Brave New World> | | | Singapore Is Now #1 in Economic Freedom Index

Singapore more qualifies as a "benevolent dictator" under Lee Kwan Yew (1923-2015). He was trained as a socialist, but after becoming prime minister is 1965, he toured the world and discovered that only market economies were thriving. He rejected the Marxist model of nationalization and exploitation and invited major foreign corporations to use Singapore as a base, taking advantage of the deep port there. He worked hard to suppress corruption and crime. He also insisted on building a first-class infrastructure, including an efficient transportation system.

He also developed an industrial policy that was largely successful without creating a bloated bureaucracy (government spending as a percentage of GDP is half that of the United States and Europe).

Singapore adopted free trade, being forced to import almost all of its food, water and energy needs.

The results have been amazing. Singapore is booming, and all citizens have benefited. It has the highest per capita income in the world, and is the only country in Southeast Asia that is considered as a "developed" nation.

Its financial stability and military security (it has a strong military and a U.S. base there) is so strong that Singapore now surpasses Switzerland as the number one investment destination in the world.

With instability increasing in China and Hong Kong, Singapore is being inundated with expatriates and flight capital. Real estate prices have increased 50% in the past year, and the cost of living is sky high.

On the positive side, they have the best healthcare system in the world called Medisave, which includes market incentives (health saving accounts). As a result, Singapore spends only 5% of GDP on healthcare versus 18% in the United States. It also has the highest life expectancy in the world (84.5 years).

I highly recommend Sean Flynn's book about Singapore's program: "The Cure That Works: How to Have the World's Best Healthcare -- at a Quarter of the Cost," available on Amazon.

The U.S. Medicare and Medicaid programs could learn a lot from this city-state.

It also uses education savings accounts and has the highest level of educational achievement among its citizens.

It also encourages high saving rates with its personal investment accounts in the Central Provident Fund. It's a form of forced self-reliance.

Poverty is gradually declining and now represents less than 10% of the population. The government has developed a variety of programs to combat poverty, including education subsidies and low-cost public housing. Nearly 90% of citizens own their own home.

This is not to say Singapore is some kind of laissez-faire paradise. Government plays an active role in public housing, education, healthcare and infrastructure. It has many government-linked corporations, with subsidies to favored domestic companies.

Singapore Is Culturally Conservative

The country is culturally extremely conservative, with limits on free speech (comedians have to be approved in advance; protests against Israel were denied), strict rules against littering and shoplifting and capital punishment for possession of illegal drugs.

I was told that for me to give a lecture at the National University of Singapore, I would have to receive government approval, which may take months.

One commentator from Singapore told me, "Most importantly, Singapore is like a large shopping mall where people would rather spend their time and money eating, drinking, shopping and attending Taylor Swift concerts. It's an intellectually sterile and regressive culture."

However, Jim Rogers and his wife Paige beg to differ. Cultural programs are expanding in Singapore, including the local symphony, theater productions, concerts and sports. I also saw lots of bookstores; Kinokuniya bookstores are twice of size of Barnes & Noble bookstores in the United States.

Overall, Singapore leaders, from Lee Kwan Yew onward, have rejected the "tax-and-spend" model of the United States and Western nations, and rely more and more on market forces rather than government mandates.

To learn more, I recommend this report: https://www.realitiesofsocialism.org/singapore#about

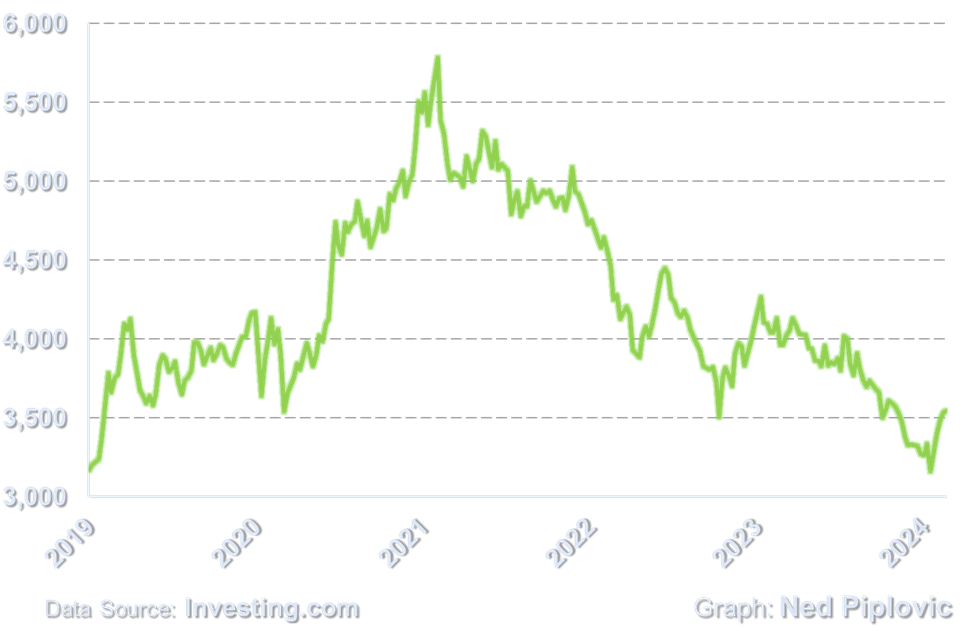

Despite all the good news coming out of Singapore, its stock market has lost its luster for the past 15 years:

In my experience, emerging markets have never done very well when it comes to investing. They are good for trading, but long-term investors are likely to be disappointed. I prefer to stay invested in dynamic, multi-national companies based in the United States, which continue to outperform. American exceptionalism is still alive!

Good Investing, AEIOU,

Mark Skousen

Doti-Spogli Endowed Chair of Free Enterprise, Chapman University

Wikipedia

Newsletter and trading services

Personal website

FreedomFest | | The New York Stock Exchange Continues a Christian Tradition By Mark Skousen

Editor, Forecasts & Strategies

Tomorrow is Good Friday, and all the stock markets in the United States are closed in celebration of Holy Week for Christians -- the traditional day that Jesus Christ was crucified. It's called "good" Friday because, in Christian doctrine, Christ became the Savior of the world on that day, dying for the sins of the world and thus bringing salvation to all who seek him.

I'm glad to see that some traditional holidays are still officially being recognized as "holy days" and not just "holidays." The secular world has gradually destroyed the original significance of Easter and Christmas, and turned it into a commercial feast.

When we lived in Winter Park, Florida, my wife would organize a special family tradition. Since we lived on a lake overlooking Rollins College, she would wake me and our five children and gather us in our boat before the sun rose for a "Sunrise Service." She would put on some religious music and we would take the boat out in the middle of the lake, turn off the motor and read the story of Easter from the Bible as the sun rose from the East.

John, Chapter 20 (and other chapters in Matthew, Mark and Luke), tells the Easter story, the first day of the week (Sunday) that celebrates the glorious resurrection of the Lord and Savior Jesus Christ. Today, Christianity is the world's largest religion because it teaches something that no other major religion teaches, that their prophet returned from the dead to become a resurrected being.

It was always a memorable way to start the day -- before the Easter egg hunt! | | | About Mark Skousen, Ph.D.:

Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. | | | | | |

No comments:

Post a Comment