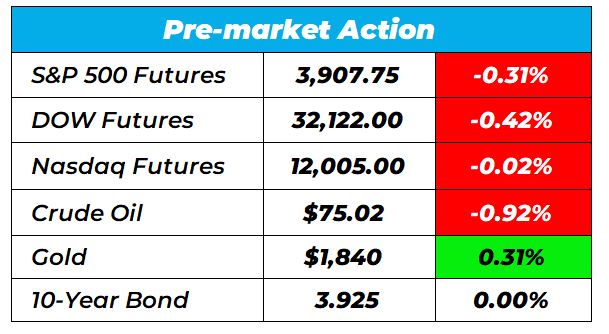

| Good morning Wake-Up Watchlisters! While you're sipping coffee you'll see stock futures inched lower on Friday. Investors are looking at upcoming job data for clues on how the Federal Reserve might behave going forward. Banking stocks also plunged (more on that below) and stocks in the Asia-Pacific also fell on similar factors. Attention Traders: We Have a New Pro on The Team! His name is Nate Bear, and he recently took $37,000 and generated over $2.7 million in verified trading profits! For the first time… he's going to show you the secret behind his success. He's inviting you to watch his trading process LIVE as he seeks to turn $37k into ANOTHER million-dollar portfolio – right before your eyes. It all begins Wednesday, March 15th at 2 p.m. ET. Click here to claim your FREE tickets to Nate's Livestream. Here's a look at the top-moving stocks this morning. SVB Financial Group (Nasdaq: SIVB) SVB Financial is down 44.03% premarket as fears of a potential run on the bank continue. The bank saw its stock tumble after reports late Thursday that multiple funds were advising their clients to take out their money. The company said it's raising 2.24 billion through a three-part share sale. The first involves 1.25 billion in common stock to investors. The second consists of $500 billion in convertible preferred shares. All of that plus concern about funding is what is tanking those shares today. With so many stocks tanking as of late, now is the opportunity to find companies that are primed to weather the storm and come out stronger than ever. Our Head Fundamental Tactician Karim Rahemtulla has been touting this under $1 stock for over a year now. It has everything he looks for, including a foothold in major emerging technology sectors. It even recently spiked 40% and all signs show it's just starting its climb. Click here to discover "The Last Great Value Stock." Docusign, Inc. (Nasdaq: DOCU) Docusign is down 11.16% premarket after its investors were optimisic margins would improve faster after it reduced staff by 10% last month. The electronic signature solutions company reported fourth-quarter net income of $4.86 million, or 2 cents per share, compared with a loss of $30.45 million, or 15 cents a share, in the year-ago period. The Gap, Inc. (NYSE: GPS) The Gap is down 7.17% premarket after reporting a fourth quarter loss. Revenue came in at $4.24 billion vs. the estimate of $4.36 billion. This compares to a loss of $0.02 per share a year ago. Its guidance for nexf year is also down 5%. Overall, the company it still doesn't have a permanent CEO, which could be playing a role in its instability. Knowing how to play down stocks can really increase your trading confidence. In The War Room, one of our favorite strategies is "overnight trading." It's simple, fast and proven to help traders make increase their odds of making gains in less than 24 hours. Click here to learn more about overnight trading. Oracle Corporation (NYSE: ORCL) Oracle Corporation is down 4.51% premarket after increasing its dividend by 25% to 40 cents per share. However, three P sales just missed expectations and investors weren't impressed with its cloud revenue and its losses came in at 5%. Those are the biggest stock movers for today. Happy trading! The Wake-Up Watchlist Research Team |

No comments:

Post a Comment