| | | | | | | Presented By MOXY | | | | Axios Markets | | By Matt Phillips and Emily Peck · Jan 10, 2023 | | Happy Tuesday folks. Another day, another chance for the stock market to appropriately discount future earnings! - Email me if you've got market-related thoughts, feelings, hopes and dreams at matt.phillips@axios.com. (Hard-won, bitter bits of market wisdom are also welcome.)

Today's newsletter is 1,128 words, 4.5 minutes. | | | | | | 1 big thing: How a Silicon Valley nonprofit became worth billions |  | | | Illustration: Natalie Peeples/Axios | | | | There are various different ways to make hundreds of millions of dollars, but historically "starting a nonprofit" has not been one of them. Silicon Valley, however, has managed to find a way, at ChatGPT creator OpenAI, Axios' Felix Salmon writes. Why it matters: OpenAI pivoted from nonprofit to for-profit status in 2019, a mere four years after it was founded with $1 billion of donations from Elon Musk and others. It's now reportedly in talks to raise $10 billion from Microsoft, much of which is likely to go straight into shareholders' pockets. The big picture: As Karen Hao explained in an excellent article for MIT Technology Review in 2020, OpenAI's charter, drafted in 2018, is the core of everything that the company stands for. - Under the terms of the charter, which was written when the move to for-profit status was already being planned, OpenAI is "committed to providing public goods," while its "primary fiduciary duty is to humanity."

Between the lines: The stated reason for moving to for-profit status was that the cost of AI research was so incredibly high that only a for-profit could raise the requisite amount of cash. - Axios' Dan Primack and Ina Fried reported on Friday that Microsoft — a company very much in the business of selling private goods so that its shareholders make a lot of money — is a natural buyer for OpenAI.

- A slew of big-name for-profit venture capital firms, including Founders Fund, Andreessen Horowitz, Sequoia, and Tiger Global, are investing in OpenAI. All of them, by their nature, are going to want some kind of exit.

Be smart: The company is structured so that the maximum return to early investors is 100x — if you put in $10 million, you can't take out more than $1 billion. All returns above that go to a nonprofit arm. - That's a way of OpenAI trying to have its cake and eat it — to generate the kind of returns that its VC backers need, while also staking a quasi-plausible claim to the moral high ground that caused researchers to flock there in the first place.

It's hard to see how OpenAI can be worth even hundreds of billions of dollars if it's genuinely committed to providing public goods, per its charter. - Public goods are things like GPS, or TCP/IP, that are given to all of humanity sans any licensing fee. Both of those technologies have helped to power many billions of dollars in value, but neither of them has any financial value itself.

The bottom line: OpenAI is a very valuable for-profit company, expertly using hype cycles to maximize the value of its shares. - It has lost the moral high ground, however — and everybody who funded it while it was a nonprofit has the right to feel a bit aggrieved that they were unwittingly providing seed capital to make Sam Altman and his colleagues even richer than they already were.

|     | | | | | | 2. Catch up quick | | 💸 House GOP passes bill to slash IRS funding in first act of new Congress. (Axios) 🛑 Coinbase to slash 20% of workforce in second round of cuts. (CNBC) 🏭 U.S. carbon emissions from energy and industry rose 1.3% in 2022. (NYT) |     | | | | | | 3. Eurozone unemployment at record low |  Data: FactSet; Chart: Axios Visuals Despite the economic shock brought on by Russia's war on Ukraine, unemployment on the continent remains at a historic low, Matt writes. Driving the news: The unemployment rate for the 20 nations sharing the euro remained at 6.5% in November, the same as the previous month. - The jobless rate is the lowest for the eurozone on record, going back to 1998.

- And European stocks are on a tear. They're up more than 5% in 2023, better than the roughly 1.4% gain for the S&P 500.

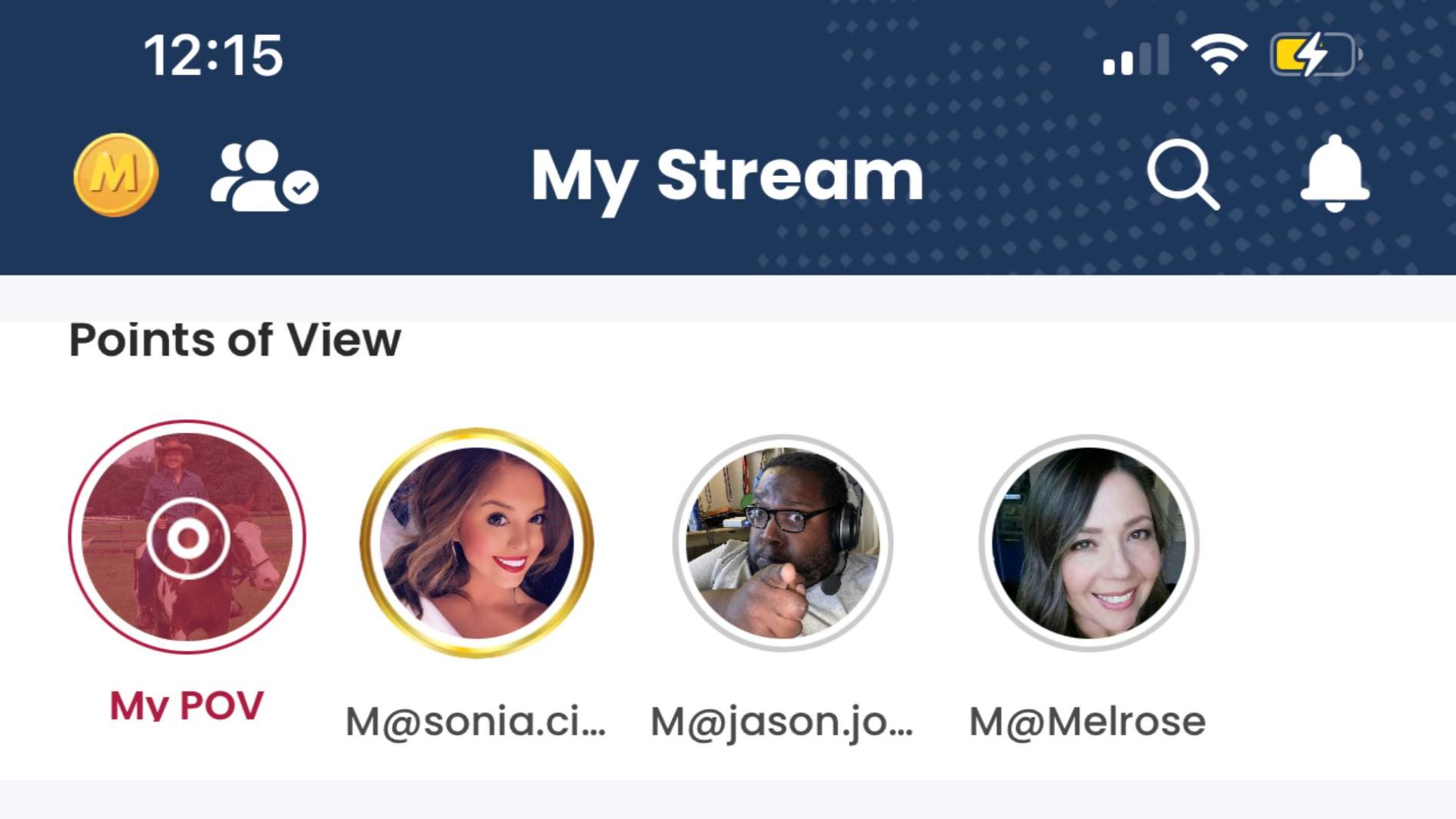

The intrigue: The numbers defy expectations for a sharp downturn on the continent among economists, who have expected that surging prices for natural gas and other fuels would take a huge toll on the economy. |     | | | | | | A message from MOXY | | Tired of the Ranting Echo Chambers? | | |  | | | | MOXY puts real political savvy at your fingertips with: - Issue-based forums.

- Personalized politician directory.

- Legislation

- And much more.

Try MOXY Free for 30 days or get a MOXY Premium 60-day upgrade with our compliments using code AXIOS2023. Get started. | | | | | | 4. What goes up... |  Data: S&P/Case-Shiller Home Price Indices via FRED; Chart: Axios Visuals Home prices could decline by between 4% and 10% before hitting bottom, per a new note from analysts at Barclays, Emily writes. - "The likelihood of a sharp house price correction has intensified," the authors write, emphasizing that the uncertainty in the market right now is around the trajectory of interest rates.

Why it matters: Home prices shot up like a rocket since the beginning of the pandemic — now the key question is whether they'll crash and burn, or just gently drift a bit downward. - Home prices soared an astonishing 42% between February 2020 and their peak in June 2022. Since then prices have fallen month over month.

- "With house prices having already turned down this summer, the question now is not whether house prices will fall, but by how much," the Barclays analysts wrote.

The bottom line: Home prices have only just begun their descent from the stratosphere. All eyes are on the Fed now to determine what happens next. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. SEC eyes VC diligence (or lack thereof) |  | | | Illustration: Aïda Amer/Axios | | | | The SEC is reportedly considering taking action against institutional investors in bankrupt crypto exchange FTX for failing to conduct adequate due diligence, Axios Crypto author Brady Dale writes. Flashback: Chamath Palihapitiya, of Social Capital, claimed that he was shut out of one of FTX's funding rounds when he asked that the firm form a board, among other suggestions. - That could be a self-serving statement — but it squares with what others, like Orthogonal Credit, have said about FTX-linked hedge fund Alameda Research.

Zoom out: Venture markets can be somewhat like real estate markets. Some periods favor buyers and some favor sellers. - A bull market tends to be a sellers' market — that is, it favors startups.

- The very hottest startups can demand extremely favorable terms from venture firms when the market is hot.

In times like that, venture executives get excoriated by their limited partners when they fail to get a piece of a hot round. No one wants those phone calls. Quick take: It would be very weird if the SEC started punishing firms for making bad investments. Most venture investments are bad. That's the business. - However, if the SEC ends up showing specific ways FTX's investors took shortcuts on their normal process, that could weirdly be good for venture funds.

- Then, they would have an excuse to give their LPs for passing on rounds with certain unreasonable terms, and a way to insist on full diligence in rounds for even the most-wanted startups.

The bottom line: If new rules are hastened by the FTX meltdown and if the SEC is focused on the right issues, it has the potential to make the next investing boom — in crypto and elsewhere — slightly saner. |     | | | | | | A message from MOXY | | Real political savvy at your fingertips | | |  | | | | Tired of the ranting echo chambers? MOXY has smarter discourse via issue-based forums, a broad-spectrum newsfeed, personalized politician directory, legislation, ballot info, surveys and more. Try MOXY Free for 30 days or get a MOXY Premium 60-day upgrade with our compliments using code AXIOS2023. Learn more. | | | | Was this email forwarded to you? Sign up here to get Axios Markets in your inbox. Today's newsletter was edited by Kate Marino and copy edited by Mickey Meece. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

To stop receiving this newsletter, unsubscribe or manage your email preferences. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment