Should One Tech Firm Be Worth More Than All Energy Stocks Combined?| By Herb Greenberg |  |

Have you heard of 'SWaB'? More than 100 countries around the world are rolling out a system called "SWaB" that could have a bigger impact than the Internet in the days ahead. Here in the U.S., it's already being implemented in 38 states and counting. This year, massive investments are pouring into this innovation from some of the richest people in the world – like Elon Musk, Jeff Bezos, and Warren Buffett. Even the world's most powerful companies, like Apple, Microsoft, and Google, are spending billions to onboard it. That's because every single modern technology – 5G, artificial intelligence, blockchain technology, IoT, robotics, quantum computers, and EVs will have to switch over to SWaB to stay relevant. Get the details here. |

|

Over the past year, I have become a big fan of the folks at market research firm Kailash Concepts... Over the past year, I have become a big fan of the folks at market research firm Kailash Concepts...

And that's not just because I have since become an ambitious user of their data. I also like the way they think and – perhaps more important – who they are. And while I'm no longer formally a journalist, I still get a kick out of finding under-the-radar stocks, ideas, and people. Truth be told, I had never heard of Kailash until a year ago, when I stumbled on a tweet highlighting a chart and analysis of what then were the outrageous price-to-sales (P/S) ratios of too many companies. I subsequently used it as the centerpiece of the December 7 Empire Financial Daily... and I've been liberally quoting from Kailash's reports ever since.  The research simply isn't the same old stuff you find out there from market research firms... The research simply isn't the same old stuff you find out there from market research firms...

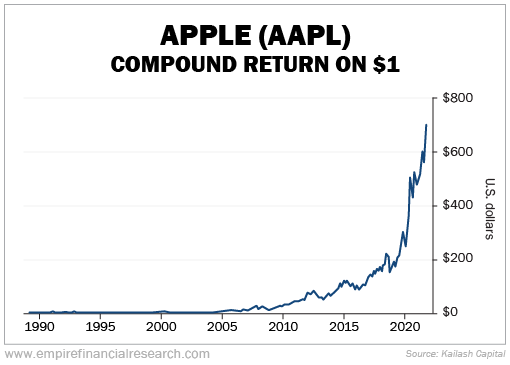

Such as a report back in January on Apple (AAPL), just before it was clear the stock was starting to roll over. The headline said it all: "Apple II Flashback: The Fantasy of Predicting the Future." The report started with these two questions... Why is it that some of the most influential CEOs and Fund Managers only predict "exponential returns" and bright futures for some of the market's most expensive stocks? Can they only find the future in stocks where there is overwhelming consensus and exorbitant valuations? Kailash went on to include a chart of Apple's stock, with the line, "Hindsight is the greatest investor [our company] has ever seen..."  It looks so easy... It looks so easy...

But as Kailash continues... You just had to avoid investing in Packard Bell, Gateway, Compaq, Leading Edge, Magnavox, NCR, or the endless other ill-fated and kinda melty PC makers that went under or were pushed to the sidelines. There was also that bit where Steve Jobs recruited the CEO of Pepsi, John Sculley, to run Apple, and the two had a huge falling out. The point is that you really never know which company will be the one. And don't ask Kailash... because as the folks there put it, their firm "has precisely zero idea who the next big hit like Apple will be and doubts anyone else does either." An even bigger question is whether Apple is still the one... or if it should still be the one.  Think about it this way, as Kailash did on Twitter recently... Think about it this way, as Kailash did on Twitter recently...

Apple, which once never discounted anything, ran a Black Friday promotion that offered a gift card for up to $250 on certain products. It's not the first time Apple has offered up promotional gift cards, but this is a big one, and it does raise the question... Could margins be vulnerable? Even if they're not, after seven consecutive years of being a top pick and generating a 1,000% return, Apple's ranking by Kailash tumbled, starting in January. As Kailash wrote at the time... The odds that Apple can mimic the last decade of returns over the next 10 years seems unlikely to us. Our model will tell you that Apple is a great company. The model will also tell you that, unlike in 1989, everyone agrees it is a great company today; an effect captured in the firm's elevated valuation.  This gets us to where we are today... This gets us to where we are today...

Apple is a great company – no question about that. Kailash isn't short Apple's stock... but it's not long the stock, either. That opens up the door to an enormous disconnect, or if I was writing a promotion for myself – in classic newsletter-promotion style – I'd call it "The Great Disconnect." On one side is Apple... and on the other side are energy stocks – exemplified by the Energy Select Sector SPDR Fund, an exchange-traded fund ("ETF") better known by its ticker symbol "XLE." Kailash is a big fan of energy stocks, as are we here at Empire Financial Research. Independent of Kailash, we strongly believe – despite the rise in many of the stocks in the sector – that it remains an under-invested, misunderstood, and misvalued corner of the market. (In fact, we even created a 10-stock portfolio designed to take advantage of this incredible setup in the energy sector: Energy Supercycle Investor. Don't miss out on this historic new bull market – you can find out how to access Energy Supercycle Investor and all 10 recommendations right here.)  Here's where it gets interesting... Here's where it gets interesting...

Despite the recent surge in energy stocks and a correction in Apple, as Kailash pointed out as of the end of September, "the vaunted iPhone maker's valuation dwarfs the collective market cap of energy stocks by nearly $1 trillion." And after that post-pandemic boom in anything and everything – including iPhone sales, which led to record margins for Apple – Kailash noted that "Apple's sales are $1 trillion lower than the entire energy sector."  Let that sink in... Let that sink in...

The market cap of XLE is $1 billion less than Apple – a single sock – yet the collective revenue of the stocks in XLE is $1 billion greater. Put another way: As part of the S&P 500 Index, Apple is nearly 7%, while the energy stocks as a group are a shade above 5%. Yet as Kailash noted... Buying a new iPhone is nice. Keeping your home warm and eating food requires energy. That is non-negotiable. The world is structurally short of hydrocarbons due to the explosion of ESG investing and empirically failed government policies. The environmental crowd accidentally became "pro-famine." While the intentions are good, the consequences are dire. The world needs more energy. It does not need more Teslas and other environmental solutions that are rapidly failing the tests of basic physics. Putting it all together, Kailash wonders: Could XLE stocks be a cheap way to hedge out geopolitical stress while the Nifty 5 stocks are a dying bet on consumer discretionary spending? Who knows, but what we do know is this: These kind of disconnects between fundamentals and price have a way of correcting. This time will not be different. As always, feel free to reach out via e-mail by clicking here. I look forward to hearing from you. Regards, Herb Greenberg

November 29, 2022

If someone forwarded you this e-mail and you would like to be added to the Empire Financial Daily e-mail list to receive e-mails like this every weekday, simply sign up here. |

No comments:

Post a Comment