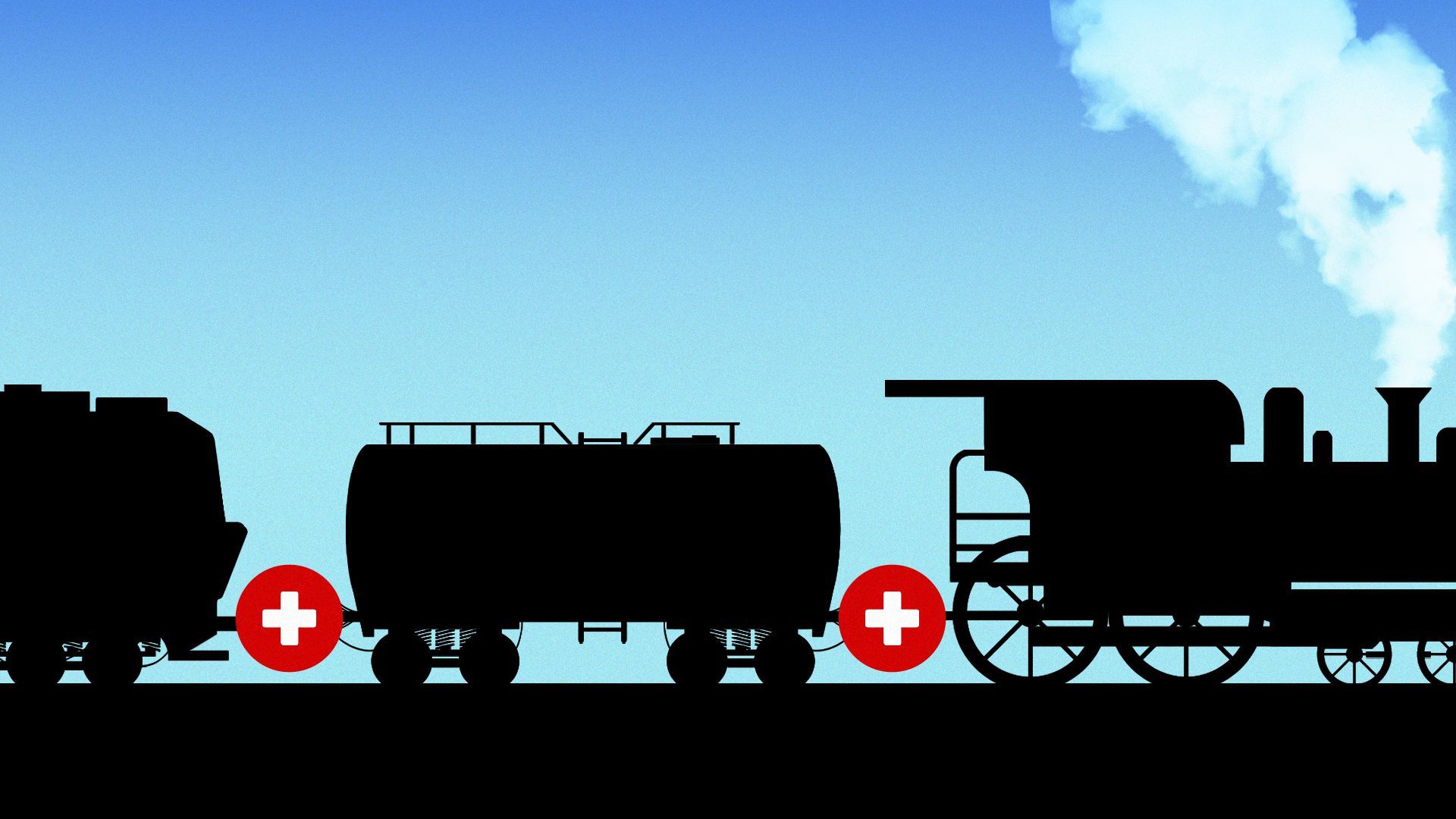

| A standoff over paid sick leave between railroad companies and their third largest union is raising the prospect of a worker strike — and Christmastime economic disaster — even after the White House brokered a deal to avoid that fate, Emily writes. Why it matters: It's a sign of the changed landscape for labor in the post-pandemic era that the state of the nation's economy now hangs on worker demands for a fairly basic benefit — paid time off for illness. - Even though railroad unions were able to negotiate a substantial pay raise in their agreement, they say it doesn't address certain intolerable workplace conditions.

Driving the news: Last week, negotiators for the railroad companies rejected the Brotherhood of Maintenance of Way Employes (BMWE) Division of the International Brotherhood of Teamsters' demand for seven paid sick days. The parties will likely continue negotiating this week. Catch up quick: The railroads and their 12 unions have been negotiating a new contract for more than two years. Last month, the Biden administration brokered a deal, which the unions are now voting on. Six voted yes. - A surprise "no" vote came in earlier this month from BMWE; they wanted a better deal.

What they're saying: The railroads say it's too late to negotiate over sick leave. "It's not something to be slapped on in the waning days of a bargaining round that's lasted for over two years," Ian Jefferies, the CEO of the Association of American Railroads, an industry trade group, tells Axios. The other side: Sick leave has long been a point of contention and is why some members voted down the deal, Peter Kennedy, director of strategic coordination at BMWE, tells Axios. - He recognized the stakes: "We don't want to harm the economy. But we also don't want our members to be without basic human protection."

Meanwhile: Even the rail companies' customers say they should give workers what they need. - "To say the paid sick leave policy for rail workers is woefully inadequate would be an understatement," wrote the CEO of the National Association of Chemical Distributors in SupplyChainDive last week.

What we're watching: On November 17, the two largest unions announce their votes, and a few days later the deadline for BMWE's cooling off period expires. The possibility of a holiday strike looms. Read more |

No comments:

Post a Comment