| | | | | | | | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Oct 24, 2022 | | 👋 Hi, readers! Welcome back. Today's newsletter has a Smart Brevity count of 1,324 words, a 5-minute read. 🎶 And happy birthday to R&B great Monica, who has this week's first intro tune... | | | | | | 1 big thing: Big Oil looks into the great wide open |  Data: Yahoo Finance; Chart: Axios Visuals Oil giants have regained their financial mojo but nonetheless face tricky strategic decisions on capital deployment, Ben writes. Why it matters: Two years after COVID prompted huge losses, the commodity surge has helped bring a reversal of fortune. Exxon's stock reached all-time highs last week. What's next: Exxon, Shell, TotalEnergies and Chevron are among the companies reporting third-quarter earnings later this week. - Profits are again expected to be robust, albeit less than Q2, when several companies saw record hauls.

What we're watching: One is the majors' outlooks on oil production growth as European countries prepare to further thwart Russian sales. - But what are slated to be strong earnings reports also arrive amid gathering global economic clouds that are slowing oil demand growth forecasts.

- "I think the biggest thing that most of these companies are going to be worrying about is really the prospect of recession," CFRA analyst Stewart Glickman tells Axios.

The big picture: Companies flush with cash are peering into a hard-to-read future in the short, medium and long term. - Russia's war on Ukraine has, to say the least, made for volatile and unpredictable markets.

- Future oil and gas demand is hard to gauge — and that's especially true amid competing analyses of whether the Russia crisis will speed or slow climate efforts worldwide.

- The 2024 election could bring seismic shifts in U.S. policy.

The intrigue: Executives' earnings calls will be the first since the big U.S. climate law passed. - I'll be looking to see whether new and expanded tax credits will influence the majors' U.S. plans.

- The law includes wider incentives for carbon-trapping projects, a focus of Exxon's and Chevron's diversification efforts.

- The European-headquartered majors have more interest in renewables, which also receive expanded subsidies.

|     | | | | | | 2. First look: HUD to give $6.8M for Ian homelessness |  | | | Illustration: Eniola Odetunde/Axios | | | | A new Department of Housing and Urban Development program is allocating $6.8 million to Florida to fight post-disaster displacement following Hurricane Ian, officials told Axios. The big picture: The Rapid Unsheltered Survivor Housing program is a response to gaps in disaster federal funding distribution, which typically leave populations already experiencing homelessness displaced and under-resourced, Axios' Ayurella Horn-Muller reports. Driving the news: Florida will receive $3 million from the program, with the remaining divided between the seven localities most impacted by Ian. The backstory: RUSH was created to address the unequal impacts of the housing crisis that follows disasters for the already unhoused. - Officials say the program is also indirectly a response to growing climate change impacts on extreme weather events.

- "This program is a response to the inequities in a system for people who experience homelessness and have natural disasters," Joseph Carlile, senior adviser of budget policy and programs at HUD, told Axios. "But let's be honest here, natural disasters are getting more frequent because of climate change."

Between the lines: $6.8 million doesn't promise to make much of a dent in the demand following a multibillion dollar disaster. - "It's not endless," HUD's acting general deputy assistant secretary for community planning and development, Jemine Bryon, told Axios. "But we're not FEMA. We don't have an endless pot."

Read the whole story |     | | | | | | 3. Climate tops list of "future risks" |  | | | Illustration: Sarah Grillo/Axios | | | | For the first time in nine years of surveying, global experts in every region of the world ranked climate change as the top future risk facing society, according to the AXA Future Risks Report out today, Andrew writes. Why it matters: The report depicts an increasingly perilous combination of climate change, geopolitical strife and energy concerns facing policy makers. Zoom in: The surveys underlying the analysis, which incorporate expert opinion as well as public polling, show that both risk experts and the public place climate change higher on the list of global concerns than just a year or two ago. - "The obvious global impacts of climate change on biodiversity, health and the economy can no longer be ignored," the report states.

- The analysis, conducted by the insurance company AXA in conjunction with IPSOS and the Eurasia Group, also picks up on some of the shockwaves emanating from the Ukraine war.

- Energy concerns rose sharply in 2022, given the sharp price spikes and fears of energy shortages in Europe and elsewhere.

- An overwhelming majority of risk experts said physical risks from climate change concern them most, such as extreme weather events.

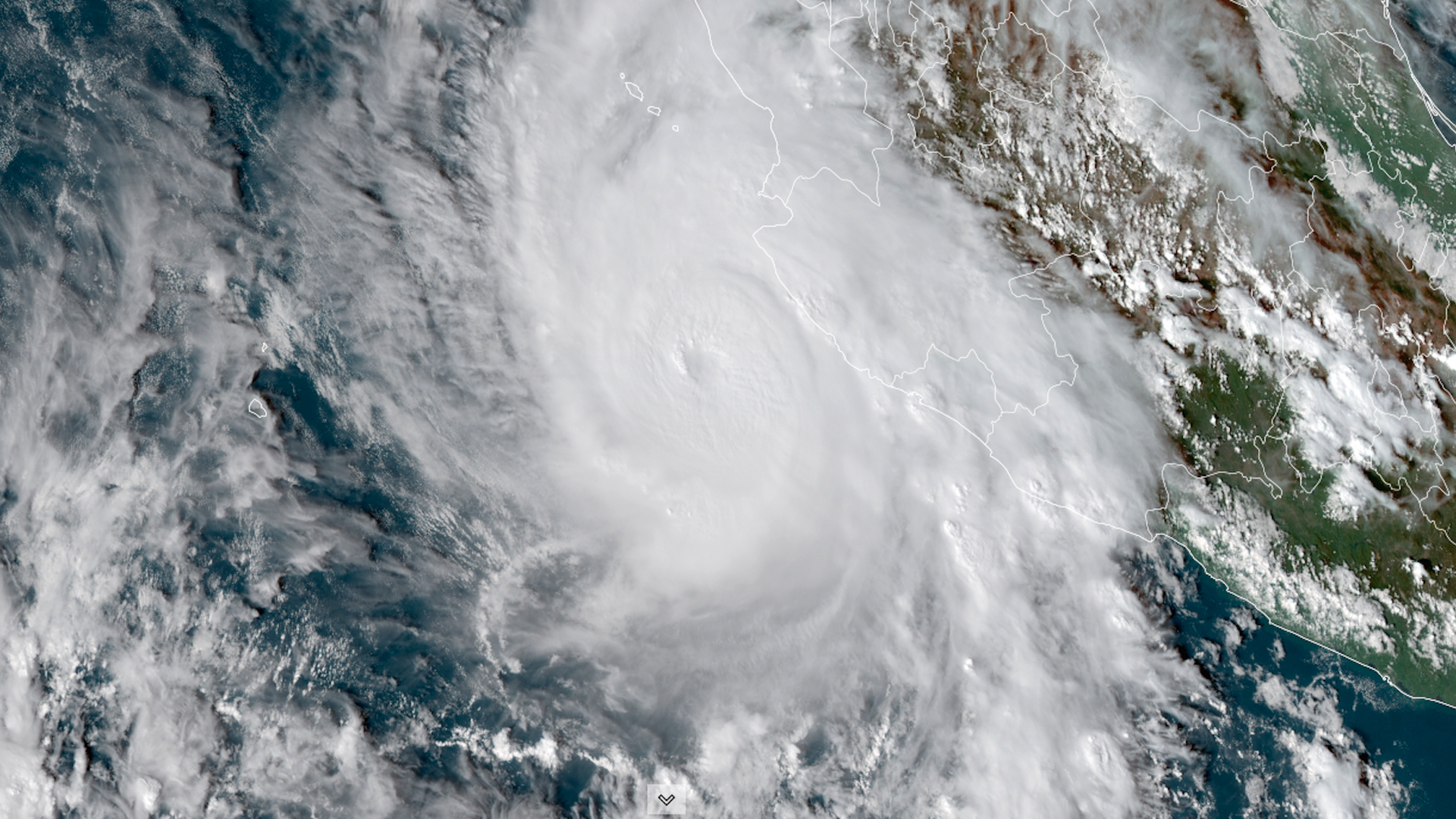

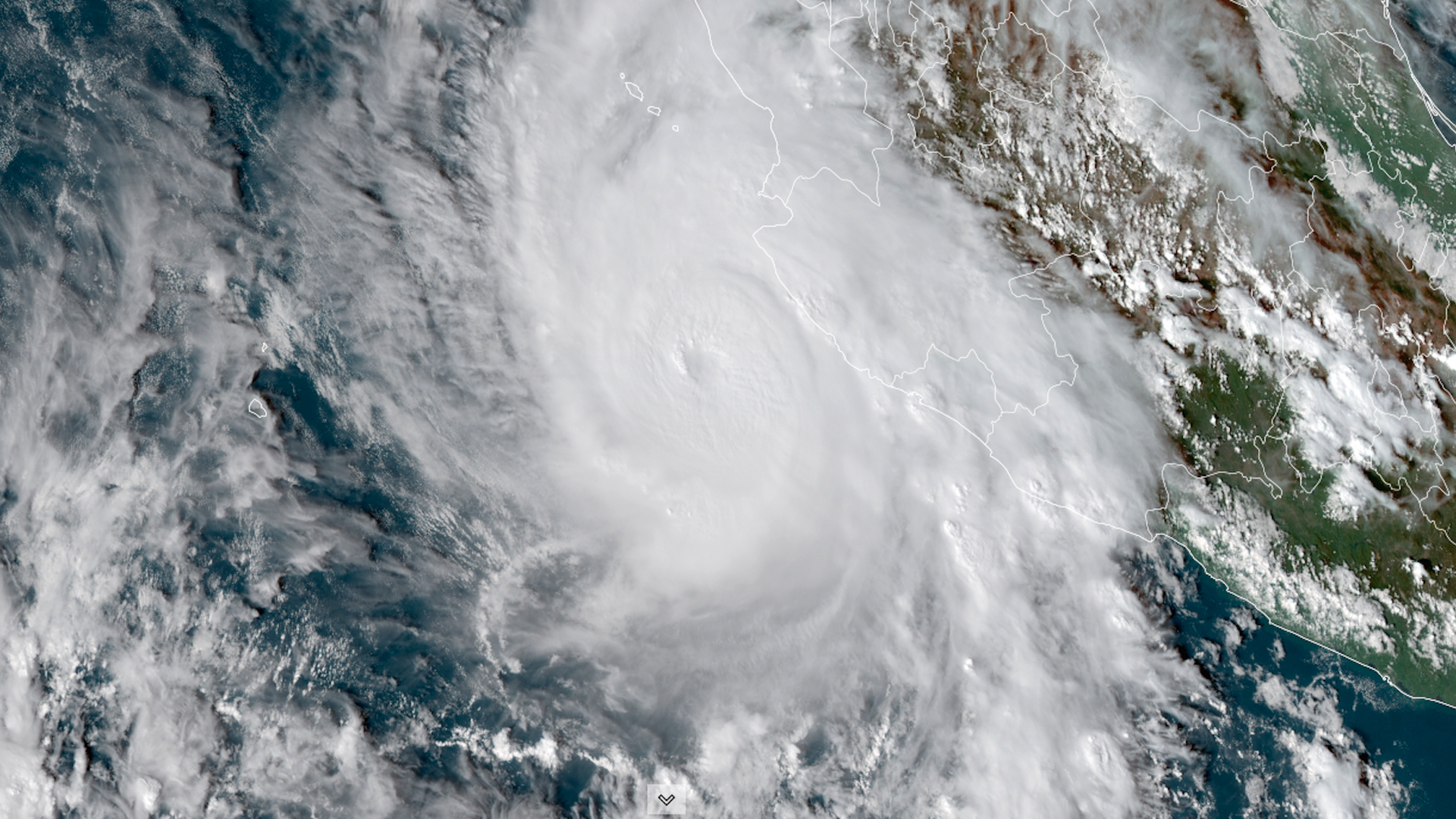

State of play: Experts and the public indicated they are losing confidence in the ability of public and private sector actors to solve major challenges, including climate change. This poses a legitimacy test for institutions working on these issues. |     | | | | | | A message from Chevron | | The fuels of the future can come from anywhere | | |  | | | | Chevron is exploring unexpected sources of energy to help create a lower carbon future. We're working with partners in California to convert the methane from cow waste into renewable natural gas that, one day, can help fuel trucks across the nation. Because it's only human to keep innovating. | | | | | | Bonus: Hurricane demonstrates physical risks |  | | | Satellite view of Hurricane Roslyn approaching Mexico on Oct. 22. Image: CIRA/RAMMB | | | | Hurricane Roslyn pulled off an extraordinary feat of rapid intensification in the eastern Pacific before hitting the Mexican coast north of Puerto Vallarta on Sunday morning, Andrew writes. By the numbers: The storm intensified from a Category 1 to Category 3 hurricane in just six hours between Friday night and Saturday morning. - Its 24-hour intensification rate was about 65 mph, nearly double the definition for rapid intensification.

Context: Such jumps in storm intensity may be occurring more frequently due to human-caused climate change, studies show, and this can be especially dangerous when it occurs shortly before landfall. Go deeper: Drones and satellites are making better, life-saving hurricane forecasts. |     | | | | | | 4. Seaweed deal taps into Indigenous knowledge |  | | | Photo illustration: Sarah Grillo/Axios. Photos: Lanks/Classicstock, Halil Fidan/Anadolu Agency via Getty Images | | | | A New Zealand First Nations tribe has just signed a Trans-Pacific seaweed research and farming deal with Blu3, a California-based climate tech company, Ayurella reports. Why it matters: The joint venture represents a way for the Te Whānau-ā-Apanui to preserve tribal sovereignty and build economic resilience while innovating solutions to mitigating climate change. How it works: It will focus on the potential of seaweed to capture and store carbon, and on ways it can be used in food, bioenergy, construction and biopharmaceuticals. For the Te Whānau-ā-Apanui tribe, who are Māori, leading the deal is an opportunity to be central to conservation solutions and help mitigate the effects of climate change on New Zealand's Indigenous peoples, like rising seas and declines in marine species. - "We have a spiritual, religious relationship with the sea and its space," Rikirangi Gage, member of the Te Whānau-ā-Apanui and a Te Huata Trustee, told Axios.

State of play: Seaweed farming is low-impact, and seaweed stores around 175 million tons of carbon dioxide every year. Yes, but: There is uncertainty regarding the carbon storage capabilities of seaweed. A peer-reviewed 2022 study found that seaweed ecosystems may actually be a net source of carbon emissions. Read the whole story |     | | | | | | 5. 🏃🏽♀️Catch up fast: Courts, LNG, drilling, methane | | ⚖️ A federal appeals court has rejected several states' bid to block the Biden administration's interim tally of the "social cost of carbon," Ben writes. - Why it matters: The social cost is a metric for estimating harms from global warming. The U.S. Court of Appeals for the Eight Circuit called the case unripe because it doesn't challenge specific rules or policy decisions.

- Context: The Fifth Circuit previously thwarted a challenge. "[J]ust as the Supreme Court showed no interest in reviewing the Fifth Circuit's decision...it is unlikely to show any interest in reviewing this case either," attorney Jonathan Adler writes in Reason.

🦋 Schlumberger, the world's biggest oilfield services company, this morning rebranded as SLB in a move that signals the industry's moves to diversify into low-carbon sectors. Reuters has more. 🤝 "Shell Plc is investing about $1.5 billion in Qatar's latest gas development, months after buying into another of the Gulf nation's massive expansion projects," Bloomberg reports. 🐨 Australia has joined the non-binding Global Methane Pledge to cut methane emissions by 30% by 2030, its climate minister announced. - Why it matters: Australia's "significant agriculture and gas sectors will have to step up efforts" to curb the powerful greenhouse gas, Argus Media notes.

|     | | | | | | 6. 🧮 Energy number of the day: 25% | | Offshore wind will account for 25% of global renewables investments in 2030, up from 6% in 2020, the consultancy Wood Mackenzie estimates. The intrigue: Analyst Simon Flowers' note calls it the renewables source best suited to oil majors' skillsets. Several are investing already, Ben writes. - It could be the "dividend machine of the future," but Flowers notes competition from incumbents like Ørsted and Iberdrola.

|     | | | | | | A message from Chevron | | The fuels of the future can come from anywhere | | |  | | | | Chevron is exploring unexpected sources of energy to help create a lower carbon future. We're working with partners in California to convert the methane from cow waste into renewable natural gas that, one day, can help fuel trucks across the nation. Because it's only human to keep innovating. | | | | 🙏Thanks to Phoebe Neidl and David Nather for edits to today's newsletter. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment