Dear Reader,

In the first half of the year, stocks sustained their worst decline in 52 years, and there’s nothing the Fed can do to stop it.

How far could your stocks fall?

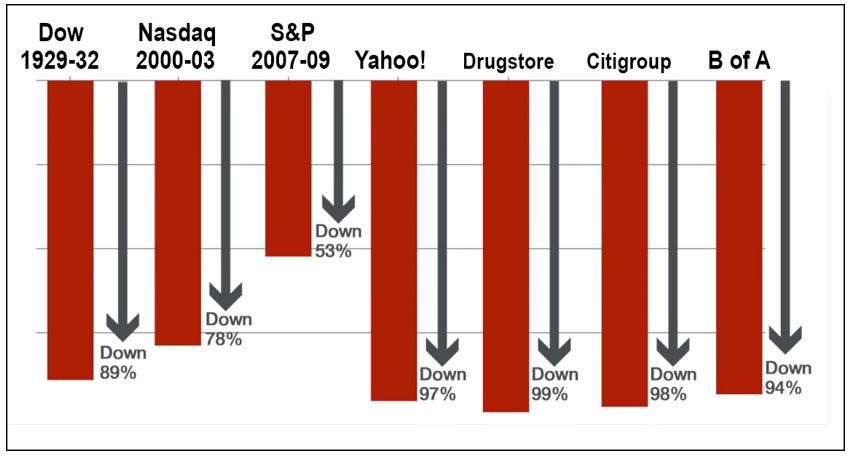

History provides the best answers:

In the Crash of 1929 and the big decline that followed, the average stock in the Dow Jones Industrial fell 89%.

In the early 2000s, the average stock in the Nasdaq Composite Index fell by 78%.

And in the 2008 Debt Crisis, the average stock in the S&P 500 fell 53%.

That’s bad enough, right?

But notice I said “average” stock, and not all stocks are average.

In the early 2000s, Yahoo! was down 97%, and Drugstore.com fell 99%. Many other — supposedly “great” internet companies — lost 100% of their value.

In the 2008 Debt Crisis, shares in the largest bank holding company in the United States, Citigroup, were down 98%.

Shares in the second-largest, Bank of America, fell 94%.

But here’s the thing: These doomed companies and failed banks were on our Endangered Lists many months before they sank, a key reason to heed my warning right now.

I predict that …

If you hold stocks or exchange-traded funds, depending on which ones they are and how this crisis unfolds, history tells us you could lose anywhere from half your money to almost all your money.

That’s why I’ve just released a special video, The Next Black Swans: How to Protect Your Money and Wealth Swiftly.

In it, I show you …

- How to get immediate access to our Endangered Lists.

- Six simple steps to protect your money immediately.

- Two ways to gain directly from market declines, including trades with gains ranging from 100% to 1,300%.

To watch my briefing now, click here.

See you there!

|

| Martin D. Weiss, PhD

Weiss Ratings Founder |

No comments:

Post a Comment