| | | | | | | | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Jun 23, 2022 | | ☕ Good morning! Today's newsletter, edited by Mickey Meece, has a Smart Brevity count of 1,238 words, 5 minutes. 📬 Did a friend send you this newsletter? Welcome, please sign up. 🎸 Neil Young & Crazy Horse's live album "Year of the Horse" just turned 25 and provides today's churning intro tune... | | | | | | 1 big thing: Biden's gas price predicament |  | | | Illustration: Maura Losch/Axios | | | | The Biden administration needs gas prices to come down fast. But that could require supporting greater oil and gas production over the long term — a collision with White House climate goals, Andrew writes. Why it matters: The result so far has been mixed messages and rising tensions with the energy industry, whose help the White House needs to bring gas prices down. - The relationship between the industry and the White House has real-world ramifications — when it is contentious and frayed, it can be harder to bring relief at the pump.

The big picture: The Biden administration has asked the oil industry to boost production and refinery output in the near term, while the White House insists it is committed to shifting away from fossil fuels over the long term to reduce the severity of climate change. - "We can deal with this immediate crisis of high gas prices and still seize the clean energy future," Biden said yesterday.

- The oil industry doesn't see White House interest in policies that encourage more drilling or refining capacity — steps executives call needed to boost supply enough to bring prices down.

Between the lines: The industry has been clear about its wish list. It wants more drilling permits on public lands, pipeline approvals, and other steps — while refraining from certain regulatory moves, to encourage putting more money into energy infrastructure. - Bob McNally, of Rapidan Energy, told Axios in an interview the White House's view is that: "I need more oil right now. I need more refining capacity right now," without "blessing new, long-term infrastructure" due to the need to move toward clean energy sources.

Zoom in: In addition, the industry is skittish about spending money now to pump more oil. It wasn't that long ago that oil prices plunged during the first coronavirus lockdowns. The intrigue: The friction with industry was apparent, for example, in Chevron CEO Mike Wirth's written response to Biden's letter to refiners. - "Addressing this situation requires thoughtful action and a willingness to work together, not political rhetoric," Wirth wrote.

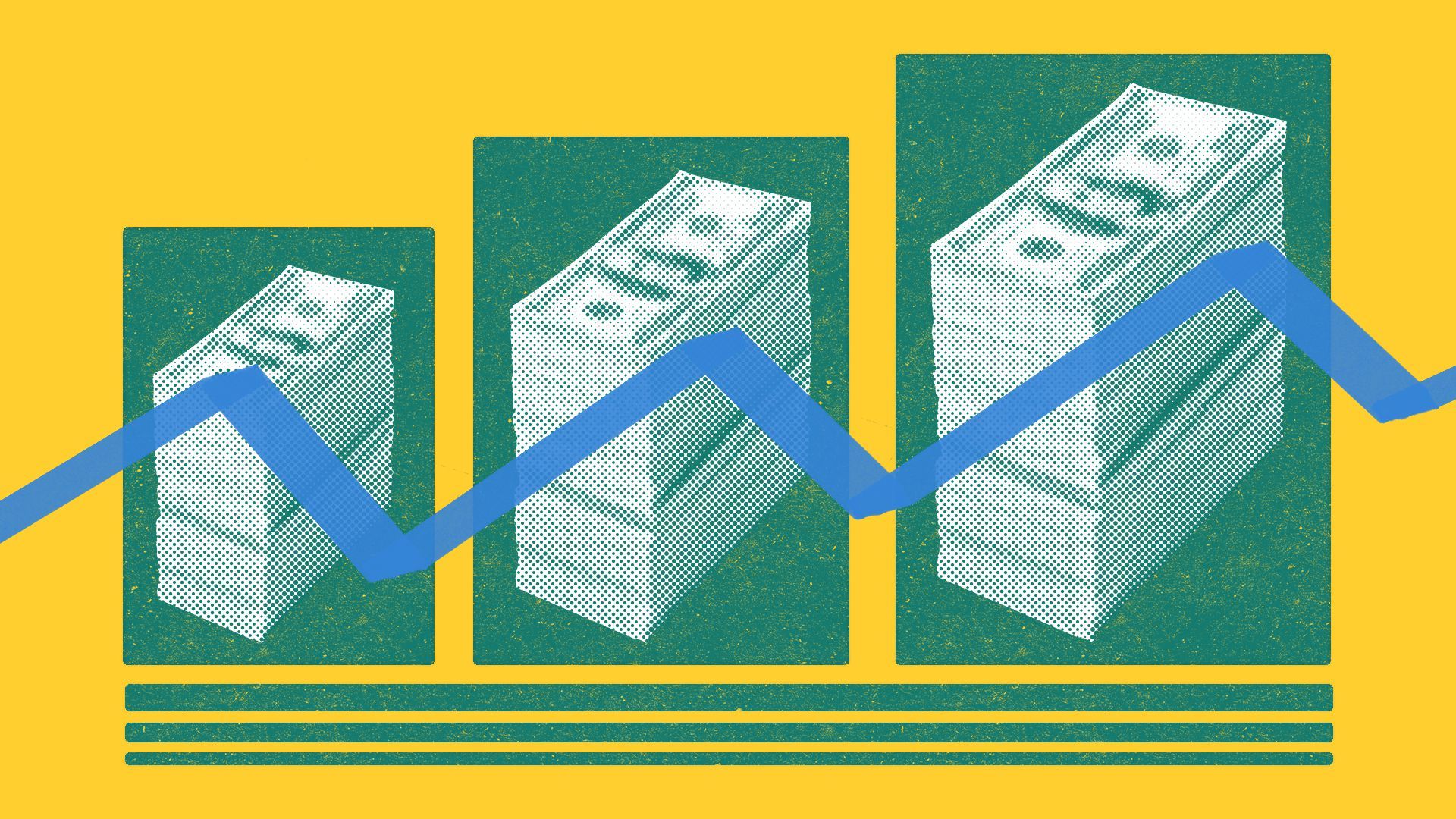

Read the whole story. |     | | | | | | Bonus: Massive margins for oil refiners |  Data: U.S. Department of Energy, FactSet; Chart: Axios Visuals Crack spreads — a proxy for the profits oil refiners pocket — have soared this year as gasoline demand outstrips supply, Axios' Matt Phillips reports. The big picture: These spreads measure the gap between the cost of crude oil and the prices of refined products like gasoline. - They're a key contributor to both profits at oil refiners and to the prices we pay at the pump.

- Crack spreads could come under pressure as the Biden administration looks to push gas prices lower.

Read more in Axios Markets. |     | | | | | | 2. First Look: Salesforce joins AT&T in cutting IoT emissions |  | | | Illustration: Allie Carl/Axios | | | | Salesforce and AT&T are teaming up to cut greenhouse gas emissions from Internet of Things (IoT) connected devices, such as construction equipment and transportation infrastructure, Andrew writes. Driving the news: AT&T said it's joining Salesforce's Net Zero Cloud, which allows users to track their carbon emissions. Why it matters: The partnership could bring AT&T closer to fulfilling its Connected Climate Initiative, it said. The telecom's goal is to slash greenhouse gas emissions by 1 billion metric tons by 2035 using connectivity-based solutions. The big picture: AT&T focuses its emissions tracking work on sectors that have large carbon footprints, such as manufacturing, energy and transportation, according to a company statement. - Heavy machinery equipment outfitted with AT&T's IoT devices allows companies to obtain data on their performance, such as engine hours, fuel consumption, and increasingly, emissions as well, the company said.

- Such data can now be funneled into the Net Zero Cloud, allowing emissions to be calculated and tracked, it said.

What they're saying: Patrick Flynn, global head of sustainability at Salesforce, told Axios in an interview that the partnership will get "better-trusted data" to customers, "so they can use their purchasing power even more effectively to provide a tailwind for decarbonization strategies." Context: Salesforce built its Net Zero Cloud to keep tabs on its own emissions, but now it is marketed to others, Flynn said. - This makes it a deep-pocketed competitor to carbon accounting companies attracting venture funding, such as Sweep, Persefoni and Arcadia.

|     | | | | | | A message from Chevron | | It's only human to help power a brighter future | | |  | | | | At Chevron, we believe the future of transportation is lower carbon, and hydrogen fuel can help us get there. We're partnering with vehicle makers and commercial truck fleet operators to scale the hydrogen fuel industry, because we believe innovation can help power a brighter future. | | | | | | 3. Hydrogen is riding an investment wave |  | | | Illustration: Brendan Lynch/Axios | | | | A startup aiming to produce hydrogen using renewables to power its industrial process has landed $198 million in Series B financing from big-name investors, Ben writes. Driving the news: Fifth Wall Climate Tech led the investment in Electric Hydrogen. It was joined by Amazon, Equinor and Rio Tinto, and prior backers like Bill Gates-led Breakthrough Energy Ventures (to name a few). Bloomberg has more. Why it matters: So-called green hydrogen, if scaled, could play a key role in cutting emissions from hard-to-decarbonize heavy industries, shipping and elsewhere. The big picture: The Series B round is the latest sign of capital flows into companies and projects looking to produce low-emissions hydrogen via renewables or capturing CO2 from fossil inputs. Zoom in: The International Energy Agency's new look at energy investment trends finds... - EU plans to abandon Russian fossil fuels could "supercharge" hydrogen finance globally to the tune of $1 trillion in project investments by 2030.

- Of note: IEA compiled a list of 33 public companies whose success depends in various ways on clean hydrogen growth.

- The portfolio is now worth around $40 billion — four times higher than at the end of 2019 (pages 92-93 in the report).

|     | | | | | | 4. The SEC's brewing 1st Amendment fight |  | | | Illustration: Eniola Odetunde/Axios | | | | Federal mandates on corporate disclosure of climate risks may touch off a First Amendment battle over the reach of the Securities and Exchange Commission requirements, Ben writes. Driving the news: The American Petroleum Institute, in comments to the SEC, said its draft rules may run afoul of constitutional protections against "compelled speech" unless significantly scaled back. - API says the rules require information that's not relevant to companies' finances and results and also involves subjective estimates.

- The refining industry's main trade group, the U.S. Chamber of Commerce, conservative attorneys general and other critics make similar claims.

Yes, but: A dozen law professors who specialize in the First Amendment called the concerns misplaced. - Such disclosures do not typically raise First Amendment concerns, and anyway, the draft rules meet the "deferential standard or review" that applies to similar requirements, they write in the letter organized via Columbia University's Knight First Amendment Institute.

- One point: "[T]he rules do not require companies to convey a message to which they are morally or religiously opposed, or to make an admission of moral culpability."

Why it matters: Comments periods often preview litigation. Various submissions to the SEC also make other legal claims. Take the docket for a spin. |     | | | | | | 5. Charted: coal's staying power |  Data: IEA; Chart: Skye Witley/Axios The International Energy Agency's wide-ranging new global finance report is something of a choose-your-own-adventure, but the chart above gets to one important storyline, Ben writes. The big picture: Investment in the coal supply chain rose 10% in 2021 and it's climbing the same amount this year — even as every path to limiting temperature rise calls for ditching the most carbon-heavy fuel. China and India are leading the investment increase. Why it matters: "This is a long way from the market situation implied by international climate goals and the Glasgow commitment to 'phase down' coal," IEA states. |     | | | | | | 6. Quote of the day | | "It's really like a giant roaring sound, which is the sound of money on fire." — Elon Musk That's the Tesla CEO calling new factories in Texas and Germany "gigantic money furnaces right now." Read more |     | | | | | | A message from Chevron | | It's only human to help power a brighter future | | |  | | | | At Chevron, we believe the future of transportation is lower carbon, and hydrogen fuel can help us get there. We're partnering with vehicle makers and commercial truck fleet operators to scale the hydrogen fuel industry, because we believe innovation can help power a brighter future. | | | | 🙏Thanks for reading and we'll see you back here tomorrow. |  | It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment