| | | | | | | Presented By BlackRock | | | | Axios Markets | | By Matt Phillips and Emily Peck · Jun 23, 2022 | | ⛽️ Good morning, everyone. Hope you're properly caffeinated because today we're all about power — from the $$$ gas that fuels our cars to the leverage we have with the boss. - Oh, and Matt goes deep on what he's dubbed, "one of the most unsightly financial terms of our time:" crack spreads.

Today's newsletter, edited by Kate Marino, is 1,141 words, 4.5 minutes. | | | | | | 1 big thing: White House targets gas prices |  | | | Illustration: Aïda Amer/Axios | | | | The White House is showing a renewed focus on hammering down gasoline prices — including calling oil company executives to Washington for face-to-face talks today, Matt writes. - They will likely get an earful from Energy Secretary Jennifer Granholm, though it remains unclear what combination of carrots and sticks could coax the industry into pumping more crude and selling it more cheaply.

Why it matters: Prices at the pump have become a central focus for increasingly cranky consumers, and a ubiquitous reminder of the administration's fecklessness on inflation, their top concern. State of play: The risk that runaway gas prices pose politically has prompted a flurry of activity. - President Biden yesterday called for Congress to suspend the Federal gas tax (though that could be counterproductive).

- Administration officials are not ruling out restrictions on energy exports (tricky in light of the need to help supply European allies facing the loss of Russian supplies).

- And next month, Biden is expected to travel to Saudi Arabia — a country he once vowed to make "a pariah" on the world stage — to try to cajole more crude out of the kingdom.

What they're saying: "With the world now focused on the risks for high and rising energy inflation, the likelihood of policy correction is rising," wrote Goldman Sachs analysts in a client note this week, referring to government efforts to stimulate oil production. - Rising production out of Saudi Arabia and Russia — amid falling political will globally to blackball purchases from both — could help lower prices, per Goldman.

The impact: Market prices for wholesale crude oil and gasoline have started to roll over. - U.S. benchmark West Texas Crude is down about 8% this month, to just above $105 per barrel.

- It's down about 14% from its recent peak of $122.

Yes but: This isn't just about what the administration is doing. Much of the decline is also related to the growing odds that the Federal Reserve's rate hikes could push the country into a recession over the next year to 18 months, which would mean lower demand for oil. - And continued weakness in China — including a new lockdown in Shenzhen this week — is expected to be a drag on global growth.

The bottom line: Soaring gas prices are a killer for politicians. It only makes sense that the administration tries to do something about them. |     | | | | | | 2. Charted: Massive margins for oil refiners |  Data: U.S. Department of Energy, FactSet; Chart: Axios Visuals Crack spreads — a proxy for the profits oil refiners pocket — have soared this year as gasoline demand outstrips supply, Matt writes. The big picture: These spreads measure the gap between the cost of crude oil and the prices of refined products like gasoline — and are a key contributor to both profits at oil refiners and to the prices we pay at the pump. - Crack spreads could come under pressure as the Biden administration does everything in its power to push gas prices lower.

State of play: Shares for major oil refiners got clobbered yesterday, leading up to Secretary Granholm's meeting with top industry executives today. - Marathon Oil fell 7%, Phillips 66 dropped 6%, and ConocoPhillips tumbled 6%. Chevron and Exxon both fell about 4%.

- President Biden publicly urged an increase in gas production, saying bluntly, "I'm calling on the industry to refine more oil into gasoline and to bring down gas prices."

Yes, but: Earlier this year, as crack spreads soared, so did the stock prices of major American refining companies. They're up an astonishing 38% since January, even as the overall market entered bear territory. The intrigue: While surging margins for gasoline makers opens the industry up to charges of gouging, industry officials argue that they are producing as much gas as possible. - Industry capacity utilization is running at roughly 94% currently, the highest since 2018 when it hit 97%.

- But a recent government report also showed overall refining capacity has fallen in the last two years. In fact, it's now back down to where it was in 2014, meaning that supply will remain strained even if refineries were running at 100%.

The bottom line: With little chance of bringing new sources of gasoline online anytime soon, the administration's best chance to lower prices will likely come from leaning on refiners to accept smaller profit margins. - That's an unpleasant prospect for shareholders and the source of some consternation for investors in oil companies.

|     | | | | | | 3. Catch up quick | | 🚘 Musk says Tesla factories are "losing billions." (Axios) 📈 FTSE Russell is rebalancing its indexes; Meta is a "value" stock. (WSJ) ™️ The Ohio State gets its trademark. (Axios) |     | | | | | | A message from BlackRock | | Invested in the future of retirees | | |  | | | | All across the country, people are working hard to build a better future. So, we are hard at work, helping them achieve financial freedom. At BlackRock, we are proud to manage the retirement plan assets of over 35 million Americans. Learn more. | | | | | | 4. Power shift |  Data: Indeed; Chart: Axios Visuals Welp, nothing gold can stay, Emily writes, channeling Robert Frost. There are increasing signs that workers' power — a consequence of the hot COVID-era economy — is leveling off or even eroding in some sectors. Why it matters: The super-tight labor market has been great for working people but a little too spicy for the Fed's taste — chair Jerome Powell has cited it as a factor driving inflation. Now there are signs his rate hikes are having the intended cooling-off effect. What they're saying: "It's not that workers have lost power, it's just that they're not increasingly gaining it," says Nick Bunker, economic research director at Indeed. Details: There are still way more job listings on Indeed than there were before the pandemic started — a clear sign of high demand for workers — but postings are coming back down from the highs of last year. - The tech sector, where we've seen the most layoffs over the past month, is notching some noticeable declines. Listings for "software developers" fell about 7% over the past four weeks, Bunker says.

- The folks at the Layoffs tracker website noted 109 layoff events so far in June, compared to 75 the prior month and just 17 in March.

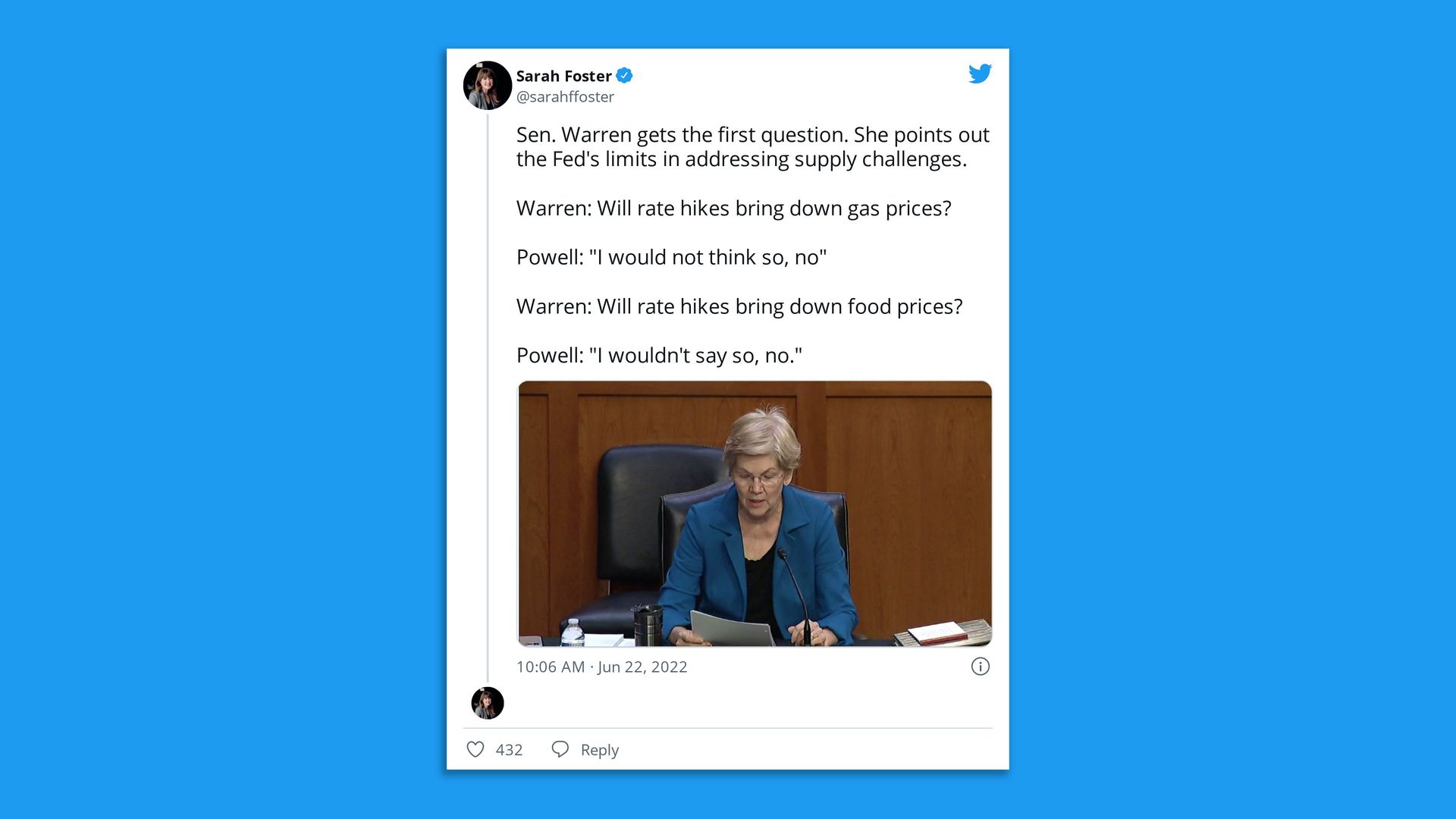

Fear factor: You can't discount the role psychology is playing in the power equation. Employers fearing a recession are pulling back postings, Bloomberg wrote earlier this week. At the same time, workers are starting to worry about job security, as we reported. And yet: Remember, the unemployment rate is still really low! What to watch: Whether the quits rate starts to ebb, Bunker says. So far it's held relatively steady, a sign that workers are still feeling that leverage — confident enough to risk a new job. The next report is due out from the Labor Department in July. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. 💬 Quoted: Powell just says "no" |  | | | Screenshot: @Sarahffoster (Twitter) | | | | The exchange above between Sen. Elizabeth Warren (D-Mass.) and Federal Reserve chair Jerome Powell kind of sums up the key conundrum of the moment. Why it matters: There's a strong feeling right now that policymakers must ACT to tamp down inflation, but their tools are limited. - Powell has essentially one blunt instrument to use to cool demand but monetary policy isn't going to end a war and bring oil prices back down.

|     | | | | | | A message from BlackRock | | Invested in the future of Americans | | |  | | | | At BlackRock, we are proud to help eliminate the barriers to investing for millions of Americans with our simple, low-cost ways to invest. Through BlackRock's iShares® funds, we offer more ETFs than anyone else. Learn more on our website. | | | | 📖 1 book Emily loves: "The Outsiders," S.E. Hinton's 1967 novel about the class struggles of a group of boys growing up in Tulsa, Oklahoma — the poor greasers battle with the snotty and rich "Socs." It's where I learned the Robert Frost quote I used above. I must've reread her book — incredibly Hinton wrote it when she was still in high school — approximately one-bajillion times growing up. I haven't picked it up since, but it still holds a place in my heart. Readers, did you have a favorite book growing up? Have you read it as an adult? Reply to this email and let me know. |  | It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment