| | | | | | | Presented By OurCrowd | | | | Axios Markets | | By Matt Phillips and Emily Peck · Apr 15, 2022 | | 😅 Phew, we made it. Most U.S. markets are closed today in observance of Good Friday. (Passover starts tonight, too! Emily's got a brisket on deck.) Meantime, seems like nothing is shutting down the Elon Musk/Twitter drama. Read on for more on that from Axios' media and deals experts. Plus, a new Fed vice chair (maybe) and some drill, baby, drill type action. Let's go! Today's newsletter is 1,157 words, 4.5 minutes. | | | | | | 1 big thing: Billionaire ego trip |  | | | Photo illustration: Sarah Grillo/Axios. Photo: Britta Pedersen-Pool/Getty Images | | | | Elon Musk doesn't seem to have much of a vision for how to actually run Twitter if his takeover bid succeeds. He's not alone, Axios' Sara Fischer and Dan Primack write. Why it matters: A small group of tech moguls believe America is in the midst of what they call a "free speech" crisis, and they're investing time and money to change the terms of public discourse. But so far, they've made more headlines than progress. Driving the news: Just hours after announcing his bid, Musk took the stage at the TED conference in Vancouver to explain his takeover rationale and, in doing so, gave Twitter's board ample reason to reject it. - Instead of delivering a distinct plan for Twitter's future, Musk gave meandering and sometimes contradictory answers about how he would address Twitter's content moderation challenges.

- He said Twitter should use human judgment to evaluate free speech, while also saying Twitter should not regulate users' speech, except to follow the laws of the countries it operates in.

- He said he wants Twitter to hold on to as many current shareholders as possible once it goes private. Later he asserted, "I don't care about the economics" that would be paramount to many of those shareholders.

The big picture: Social media companies are increasingly willing to remove certain types of content, and ban those who post it, after years of casting themselves as neutral platforms. - Most of the discourse revolves around Twitter because that's where so many tech moguls, politicians and journalists spend their time.

Conservative billionaires have opted to create or back various versions of their own Twitter-like platforms — like Parler, Gettr and Truth Social. But those apps are tiny compared to mainstream platforms. Yes, but: Not everyone endorsing "free speech" has a history of consistency. - Peter Thiel, who for years has sat on Facebook's board, has put money behind "free speech" YouTube alternative Rumble. But he also financed the lawsuit that bankrupted Gawker. Plus, Facebook has implemented many of the same content moderation policies as Twitter, including banning Donald Trump.

- Truth Social, the new social media app founded by Trump, originally had terms of service that allowed users to be banned for disparaging Truth Social or its team. That clause was later removed.

The bottom line: Rich people want to control terms of discourse. They always have and always will. - But controlling a major social media platform takes more than money: It requires a deep commitment to product and attention to legal and societal expectations around content moderation. So far, few billionaires have cracked that code as well as Silicon Valley titans.

Keep reading. |     | | | | | | 2. Catch up quick | | 💊 Twitter's board considers "poison pill" defense to ward off Elon Musk's takeover bid. (Bloomberg) 🇷🇺 Russia may be in default, Moody's says. (Reuters) 💵 Citadel's Ken Griffin is the top donor to GOP. (WSJ) |     | | | | | | 3. A new Fed bank cop, take two |  | | | Michael Barr in 2010. Photo: Andrew Harrer/Bloomberg via Getty Images | | | | President Biden will nominate Michael Barr to become the nation's most powerful bank regulator, aiming to install a former Obama administration official and leading architect of the Dodd-Frank law as vice chair of the Federal Reserve, Axios' Neil Irwin writes. Why it matters: Fifteen months into his presidency, Biden has had limited success in getting key financial regulatory jobs filled — a track record he aims to change with the Barr nomination. State of play: If confirmed as vice chair for supervision, Barr, currently dean of the University of Michigan's public policy school, would play a lead role shaping regulation of major banks and of the financial system more broadly. - As an assistant secretary in the Obama Treasury, he played a key role in creating the Consumer Financial Protection Bureau.

- While he worked closely with liberal Senator Elizabeth Warren creating the CFPB, he has a reputation for being pragmatic and even-keeled. He was confirmed to his Treasury appointment by a Senate voice vote in 2009.

The backstory: The role of Fed vice chair for supervision was created by the Dodd-Frank Act more than a decade ago, which imbued the position with significant power to oversee banks and the financial system more broadly. - Yet no Democratic president has filled the position. Obama appointee Dan Tarullo fulfilled the role in practice without formally being named to the position. Trump appointee Randall Quarles occupied the job until late last year.

- Sarah Bloom Raskin, Biden's first nominee for the position, withdrew her candidacy last month.

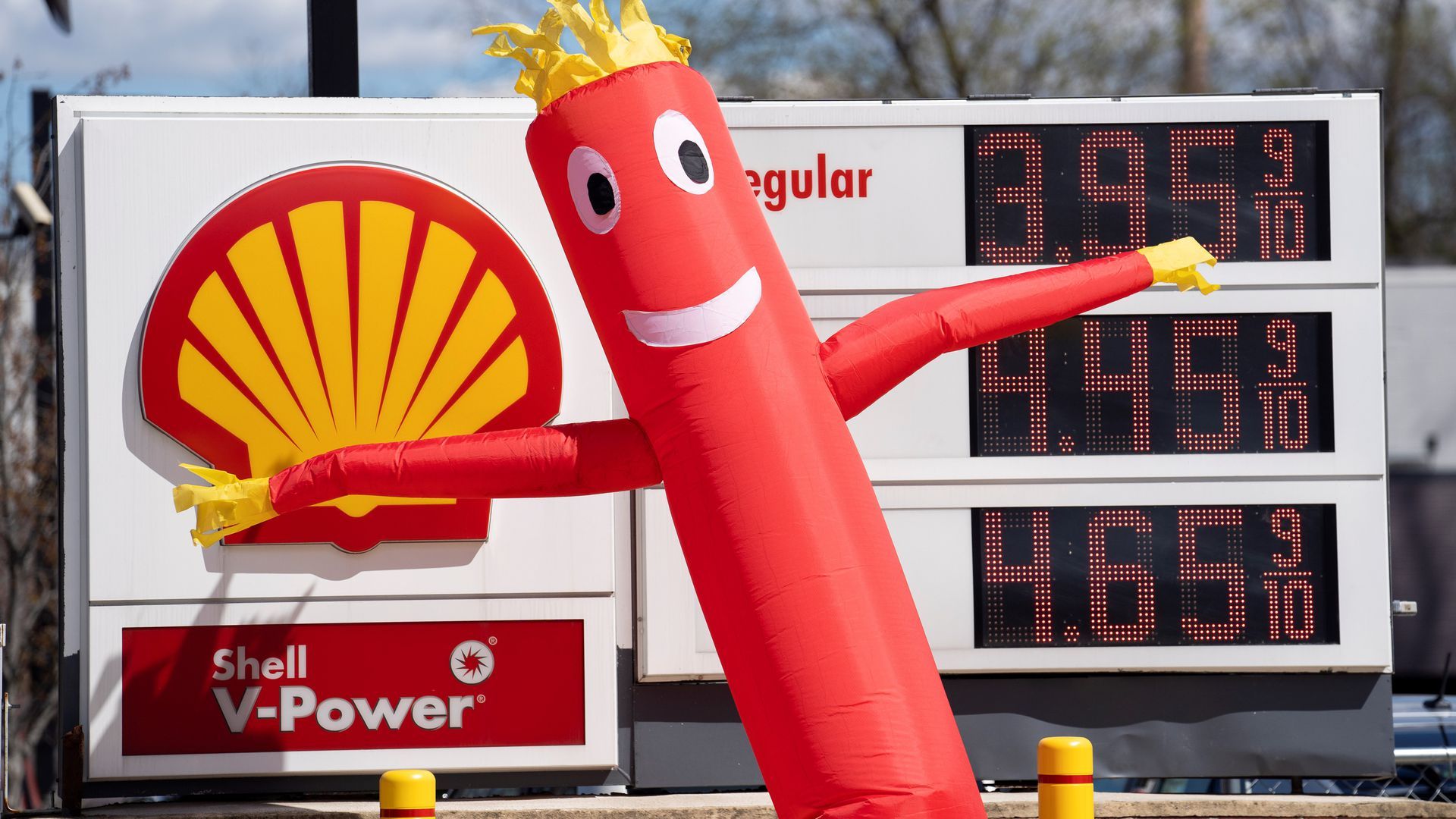

The bottom line: Barr may be able to thread the needle between the liberal and centrist wings of the Democratic coalition, which would enable Biden to finally get his own personnel in place to regulate the financial system. Go deeper. |     | | | | | | A message from OurCrowd | | Fighting online disinformation with AI-powered software | | |  | | | | Cyabra helps companies, from government agencies to global media leaders, navigate online disinformation and uncover consumer insights. Cyabra's AI-powered platform analyzes billions of conversations, using over 600 metrics, to detect authenticity of authors and content. Invest now. | | | | | | 4. Consumers keep chugging along |  | | | Photo: Liu Jie/Xinhua via Getty Images | | | | The American consumer just won't quit spending. Or, at a minimum, didn't do so in March, even as energy prices skyrocketed. That is the lesson from March retail sales numbers released Wednesday morning, Neil writes. Why it matters: A big open question for the economy over the coming months is whether demand destruction occurs — meaning high inflation for staple goods leads consumers to cut back on everything else. So far, that looks more like a risk than a present danger. Details: The Census Bureau said that overall retail sales rose 0.5% in March. That isn't adjusted for inflation, so is heavily influenced by the rise in energy prices. - Indeed, the headline number was driven by sales at gasoline stations, which were up 8.9% as fuel prices soared.

- Excluding gas stations, retail sales were down 0.3%, suggesting there was some pinching of pennies due to higher prices at the pump.

Yes, but: The more telling thing for the economic outlook is that the surge in fuel prices didn't cause a spending drop in major retail categories that reflect discretionary spending, like home furnishings (+0.7%); electronics and appliance stores (+3.3%); and clothing and accessories (+2.6%) The bottom line: The latest retail numbers are more a "so-far-so-good" story than an "all-clear" story as we assess how consumers are grappling with the energy price surge that accelerated with the Ukraine war. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. A lot more U.S. crude is coming — eventually |  Data: Rystad Energy; Chart: Thomas Oide/Axios Growth in drilling permits for new wells in the most prolific U.S. oilfield could signal a coming production surge, the consultancy Rystad Energy said, Axios' Ben Geman writes. Why it matters: Producers face calls to accelerate growth as some buyers shun Russian crude and U.S. gas prices average over $4 per gallon. Driving the news: Permit approvals in the Permian Basin for horizontal drilling — which is key to unlocking shale oil — grew to 904 in March. - It's a record high for the region in West Texas and New Mexico, "driven by elevated oil prices and production demand," Rystad said.

Yes, but: Don't expect an immediate production jump. - Artem Abramov, Rystad Energy's head of shale research, said the permits herald faster output expansion "over the next few months once supply chain bottlenecks ease."

- It "foreshadows a significant increase in supply capacity from early 2023," he said in a research note. But Rystad cautioned that permits don't guarantee drilling or production from specific wells.

Go deeper. |     | | | | | | A message from OurCrowd | | AI-powered software strikes back against online disinformation | | |  | | | | Using AI to analyze billions of conversations across online platforms, Cyabra is disarming disinformation and delivering deep consumer insights to companies. Cyabra is trusted by high-level government agencies, global media companies and more. Explore Cyabra's investment potential. | | |  | It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment