| | | | | | | Presented By Yieldstreet | | | | Axios Markets | | By Sam Ro ·Aug 02, 2021 | | Today's newsletter is 1,212 words, 4.5 minutes. 🍰 of the day: £200 to £300, the estimated price today for a slice of cake from Prince Charles and Princess Diana's wedding in 1981. | | | | | | 1 big thing: Index fund investors saved $357 billion |  | | | Illustration: Sarah Grillo/Axios | | | | Investors who've opted to passively track the stock market haven't just outperformed most active fund managers. They've also saved a ton of money in fees while doing it. Why it matters: There are loads of active fund managers aiming to beat the returns of funds that track indexes like the S&P 500. - Because these fund managers are much more hands-on, closely monitoring activity and trading often, they come with higher costs.

By the numbers: Over the past 25 years, the average active equity fund had an expense ratio of 95 basis points, according to ICI data analyzed by S&P Dow Jones Indices. In other words, they charged $0.95 per every $100 invested. - During that same period, index funds carried an average expense ratio of just 17 basis points, or $0.17 per $100 invested.

- From 1996 to 2020, the amount of money invested in index funds tracking the S&P 500, S&P 400 and S&P 600 ballooned to $5.72 trillion, from $595 billion.

- Had those incremental dollars been invested in actively managed funds, investors would've paid an extra $357 billion in management fees, S&P Dow Jones Indices analysts estimate.

What they're saying: "Lower cost is one of the simplest explanations for the success of passive management," Anu Ganti, senior director of Index Investment Strategy at S&P Dow Jones Indices, tells Axios. Yes, but: Many fund managers will point out that their clients aren't always out there to just beat broad market indices. - "One problem with index investing that low fees can't solve for is the insanely low dividend yields of equity indices," David Bahnsen, chief investment officer, The Bahnsen Group, tells Axios.

- "The yield on the S&P 500 is 1.25%, which is far too low to meet many investors' income needs. Active management costs a tad more in fees, but can generate dividend yields, even after the manager's fees, of 4%, which is more than triple the yield of the broad stock index funds."

Zoom out: Bahnsen's point is that some investors have particular needs, like an S&P 500-like risk profile but with a higher level of income, that may not be offered by the available index funds. The bottom line: Costs vary greatly in the investment business. But so do the objectives provided by the various investment offerings. |     | | | | | | 2: Catch up quick | | Senators released their 2,702-page infrastructure bill on Sunday. (Axios) Square is acquiring Afterpay, a buy now, pay later company, for $29 billion. (Reuters) The core PCE price index increased by 0.4% in June from the month prior. (Axios) |     | | | | | | 3. Defiant shoppers |  Data: Bureau of Economic Analysis via FRED; Chart: Axios Visuals America's consumers will not be stopped. Household spending rose in June even more than economists had expected, according to new government data out Friday. Why it matters: Consumers are dealing with frustration with rising prices, concerns over the spread of COVID-19 variants and the lapsing of stimulus checks. But none of that put a damper on spending. By the numbers: Personal consumption expenditures increased by 1.0% in June, which was notably stronger than the 0.7% gain expected by economists. - Adjusted for inflation, spending was still up 0.5%.

- Consumption is running at an annualized pace of $15.8 trillion, which is well above pre-pandemic levels.

What they're saying: "Inflation didn't stop consumers from spending with abandon," GrantThornton chief economist Diane Swonk said, adding that they "drained their savings." - "Consumers reopened their wallets in June as they embraced a summer of spending," Oxford Economics lead U.S. economist Lydia Boussour said. "They splurged on the high-contact services they greatly missed during the pandemic while shunning away from expensive and harder-to-find goods."

Yes, but: "It remains unclear how much the spread of the Delta variant will put a damper on spending gains in August," Swonk writes. The bottom line: "Consumers defiantly kept spending, even during a surge in outbreaks," Swonk says. "We are learning to live with outbreaks and shift to online and deliveries to avoid contagion. Vaccinations should help to blunt the blow, despite the spread of the Delta variant." |     | | | | | | A message from Yieldstreet | | How to diversify your portfolio like the ultra-wealthy | | |  | | | | You can diversify your investment portfolio while generating passive income with Yieldstreet. Here's how: The platform lets savvy investors go beyond crypto and the stock market, giving them access to alternative investments such as art, real estate and more. Put your money to work. | | | | | | 4. August is the worst |  | | | Illustration: Sarah Grillo/Axios | | | | August is not friendly to investors, according to history. Why it matters: Despite its modest decline on Friday, the stock market continues to trade near all-time highs. In fact, the S&P 500 has booked gains for six consecutive months. - But some experts warn that the market is overdue for a considerable sell-off, especially considering the near-term risks.

By the numbers: Since 2010, the S&P 500 has fallen in August six times, giving it the worst track record of any of the months. - Furthermore, in the past 20 years and in post-election years since 1950, August has delivered losses on average.

- The last time the S&P has fallen by 5% or more from its high was October.

What they're saying: "You could say markets have become more illiquid since the [global financial crisis] and perhaps holidays in August exacerbate this so that any negative news that takes place is amplified," Deutsche Bank strategist Jim Reid writes. What to watch: According to a recent survey conducted by Deutsche Bank, 32% of financial professionals said they expected to take more time off this summer than during a normal year, and so "liquidity will likely be even lower than usual." The bottom line: Major market sell-offs are hard to predict, and when they happen they aren't necessarily the beginning of prolonged bear markets. Nevertheless, history says it's good to be prepared for one, especially after extended periods of low market volatility. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. What to do when you don't know what's coming |  | | | Photo: Michael Nagle/Bloomberg via Getty Images | | | | Turn on the TV any time these days, and you may hear someone sounding pretty certain about their view on the direction of inflation. That someone won't be Howard Marks, veteran investor and billionaire co-founder of hedge fund Oaktree Capital. - Marks admits he doesn't know what's next for inflation. And he says in a memo that investors should put little weight in forecasts about the economy because he's "convinced the macro future isn't knowable."

Why it matters: The outlook for inflation is probably the most hotly debated topic in markets right now. Marks acknowledges that the chance of persistent inflation is among many risks that could lead to a market correction. Catch up quick: Many, including Fed chair Jerome Powell, argue that elevated levels of inflation are transitory. - Others believe it's much more long-lasting and may warrant the Fed to tighten monetary policy soon.

What he's saying: In the memo, Marks examines whether inflation will prove transitory or permanent at great length and he concludes: "it's impossible to know the answer." - "[T]he truth is that we know very little about inflation including its causes and cures," he writes. "That makes life tough for investors at the moment, because inflation and its impact on interest rates constitute the most important wildcards."

- "It may be hard to admit — to yourself or to others — that you don't know what the macro future holds, but in areas entailing great uncertainty, agnosticism is probably wiser than self-delusion."

The bottom line: It doesn't make sense to cut back on market exposure based on inflation predictions that may — or may not — come true, Marks writes. - "The most important rule in investing is that we should commit for the long run, remaining fully invested unless the evidence to the contrary is absolutely compelling."

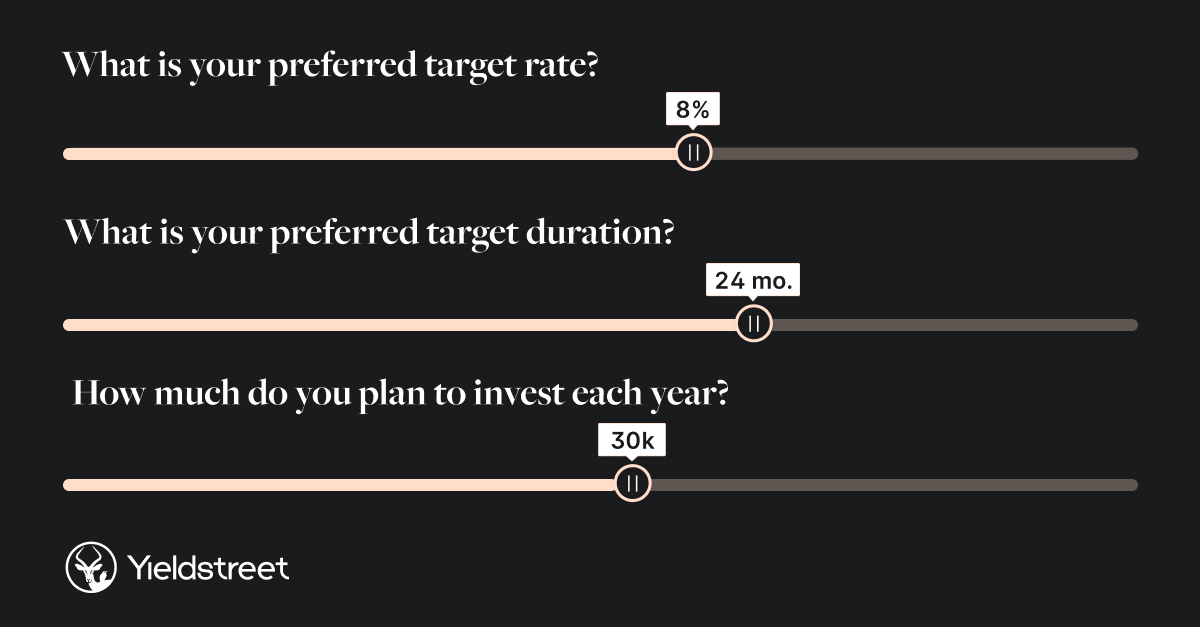

|     | | | | | | A message from Yieldstreet | | Now you can invest like the ultra-wealthy | | |  | | | | Yieldstreet, an alternative investment platform, has returned over $1 billion in principal and interest to investors to date. More info: Their deals typically have short durations — three months to five years — and target annual yields of 3-15%. Join 300,000+ members today. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment