| | | | | | | Presented By Aon | | | | Axios Markets | | By Sam Ro ·Aug 17, 2021 | | Today's newsletter is 1,082 words, 4 minutes. Join Axios' Dan Primack and Courtenay Brown tomorrow at 12:30pm ET for an event on IPOs, and how and why companies go public. Guests include Nasdaq president Nelson Griggs and Bill Gurley, general partner at Benchmark. Register here. Situational awareness: The July U.S. retail sales report will be released at 8:30am ET. Walmart and Home Depot will announce quarterly results before the opening bell. 💰 of the day: $6.6 million, the record-breaking sale price for a T206 Honus Wagner baseball card. | | | | | | 1 big thing: An early warning from New York |  Date: New York Fed; Chart: Axios Visuals Manufacturing activity growth decelerated sharply in New York. Why it matters: The slowdown could signal a reaction to the growing spread of the Delta variant. And activity in New York generally moves in tandem with other regions of the U.S. State of play: The Empire State Manufacturing Survey, which tracks activity in New York, is the first of a series of monthly manufacturing reports published by the regional Federal Reserve banks. - The August surveys are of particular interest because they occurred amid a spike in COVID infections, the impact of which was not fully captured in the July economic reports.

By the numbers: The survey's general business conditions index plunged to 18.3 in August from 43.0 in July. A positive number signals growth, but the drop represents a sharp deceleration in activity. - This August print was much worse than the 28.0 expected by economists.

- The shipments, employment and new orders subindexes all deteriorated significantly.

What they're saying: "The weakening in the Empire State survey data in August could have been some payback from the very strong July data," JPMorgan economist Daniel Silver says. - "The survey also could be picking up a response to recent virus-related developments," he adds.

What to watch: For more up-to-date color on manufacturing activity, the Philadelphia Fed's survey will be released on Aug. 19, the Richmond Fed's on Aug. 24, the Kansas City Fed's on Aug. 26, and the Dallas Fed's on Aug. 30. - "We expect constraints on pandemic-stricken supply chains and labor markets to gradually ease in the coming months, but these headwinds risk staying strong amid the rapid spread of the Delta variant," Oxford Economics lead U.S. economist Oren Klachkin said in a report.

|     | | | | | | 2. Catch up quick | | China tightened its grip on tech companies, publishing rules banning unfair competition. (Reuters) Berkshire Hathaway sold shares of drugmakers Biogen, Abbvie, Bristol-Myers Squibb and Merck during Q2. (Reuters) BHP Group will end the dual listing of its shares and shift to a single listing in Australia. (Bloomberg) |     | | | | | | 3. Small business struggles |  | | | Illustration: Trent Joaquin/Axios | | | | Small businesses aren't thriving quite like their large corporate counterparts. Why it matters: It's a signal of the bifurcated pandemic recovery, in which the biggest U.S. companies have reported record earnings growth as they leveraged higher wages to help recruitment and used their scale to make cost cuts. - Meanwhile, small businesses have had limited capacity to execute like their larger competitors.

By the numbers: This sentiment was echoed in the National Federation of Independent Business (NFIB) July jobs survey, which found 63% of small businesses were hiring and 89% of that group said there were few or no qualified applicants. - In another July survey, the NFIB found most small businesses said the last three months' worth of earnings were lower than the prior three months worth of earnings. A top reason for this was disappointing sales volumes.

What they're saying: When asked why there's been such a stark contrast between small business and S&P 500 earnings in recent months, Holly Wade, executive director of the NFIB Research Center, tells Axios that staffing issues explain a lot, but not all of, the bottom line woes. - "Small businesses have a harder time absorbing increased costs and passing them along" while staying competitive, she says.

Between the lines: It may seem like the obvious solution is to just raise pay more aggressively. - But raising pay for new applicants often means having to raise pay for other existing employees, which is costly.

- Also, raising pay now gives employers less cost flexibility in the future as employers would rather avoid having to cut pay down the road.

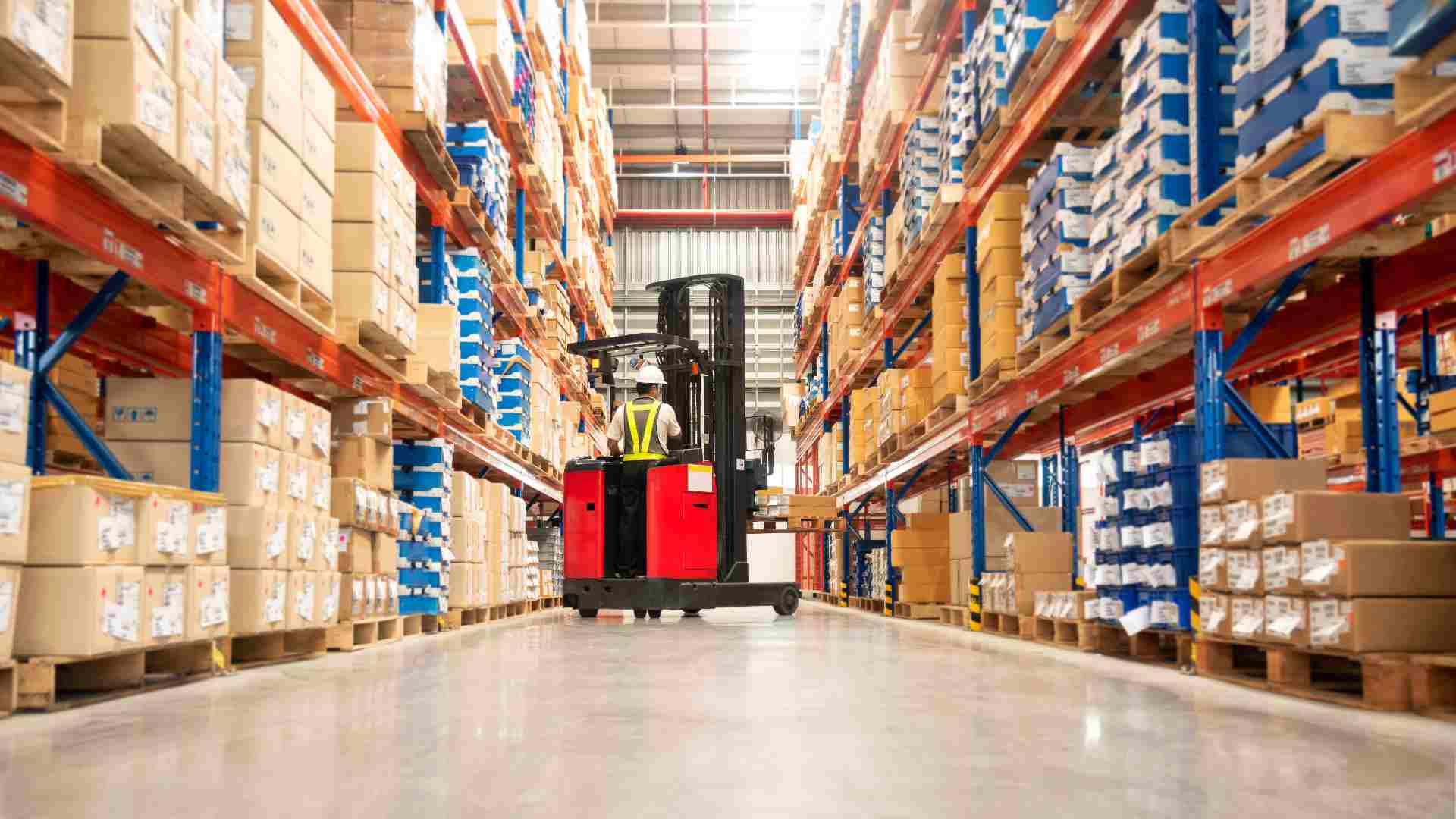

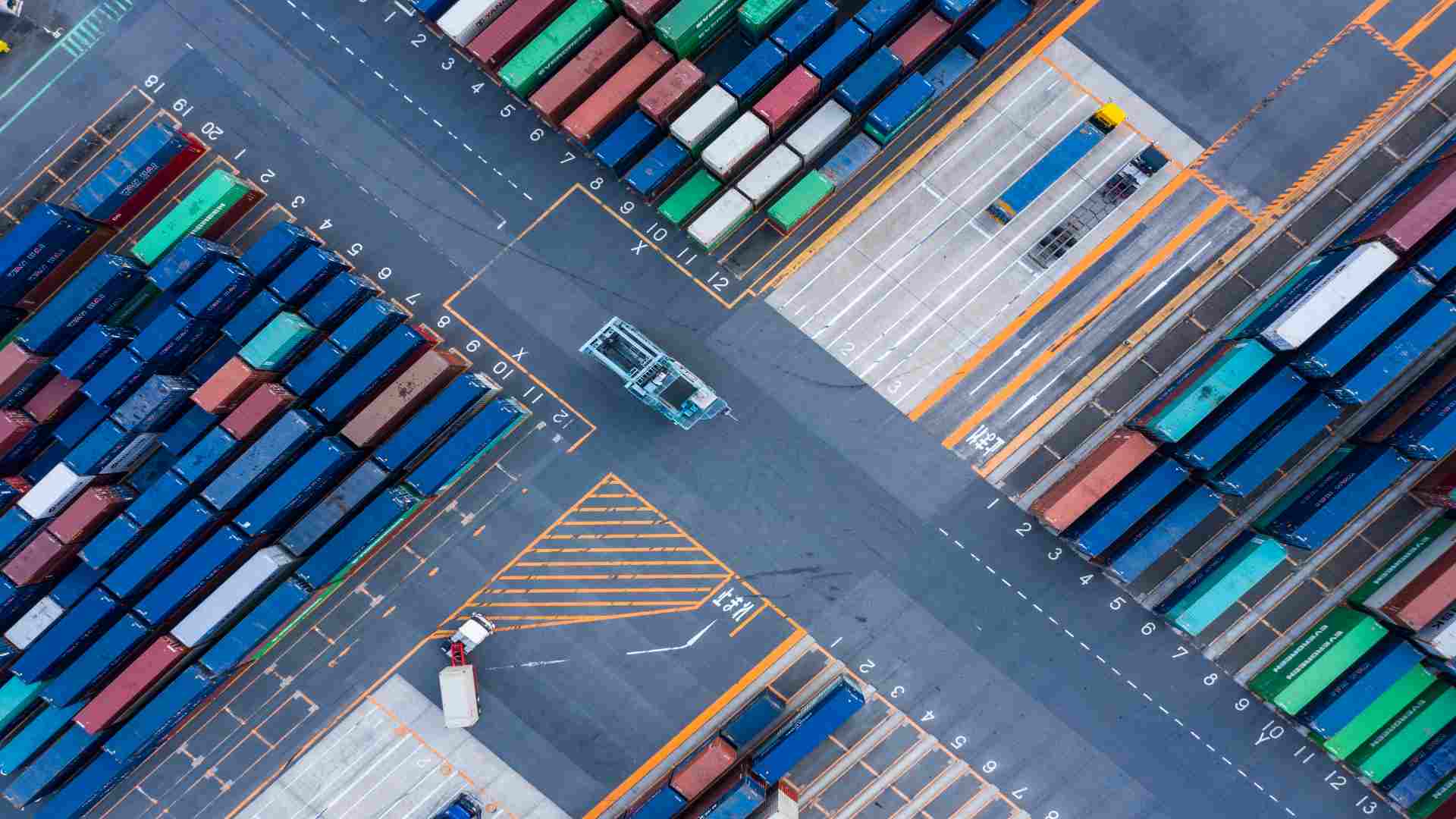

The bottom line: Even in a booming economy, many small businesses will find themselves at a disadvantage relative to larger corporations if they have to compete for scarce resources like labor. |     | | | | | | A message from Aon | | How to protect your supply chain in a highly volatile world | | |  | | | | The COVID-19 pandemic has brought to light the volatility of the global supply chain. Are you prepared for what's next? Many companies are not prepared for "grey swan" events — risks like pandemics and natural disasters that wreak havoc on organizations that are not ready. Find out how Aon is helping businesses minimize the risk of supply chain disruptions. | | | | | | 4. Accessing the Afghan central bank's reserves |  | | | The Da Afghanistan Bank on Aug. 6, 2013. Photo: Victor J. Blue, Bloomberg via Getty Images | | | | The Taliban's declaration that it had taken control of Afghanistan on Monday put central bank watchers around the world on alert. Driving the news: The nation's central bank, Da Afghanistan Bank, held $9.4 billion in international reserves as of April, according to the International Monetary Fund. Why it matters: International observers are concerned about what the Taliban would do with the funds if it got its hands on the central bank's assets. Yes, but: "The vast majority of the Afghan Central Bank assets are not currently held in Afghanistan," a person familiar with the matter tells Axios. - "Any Central Bank assets the Afghan government have in the United States will not be made available to the Taliban," an administration official tells Axios.

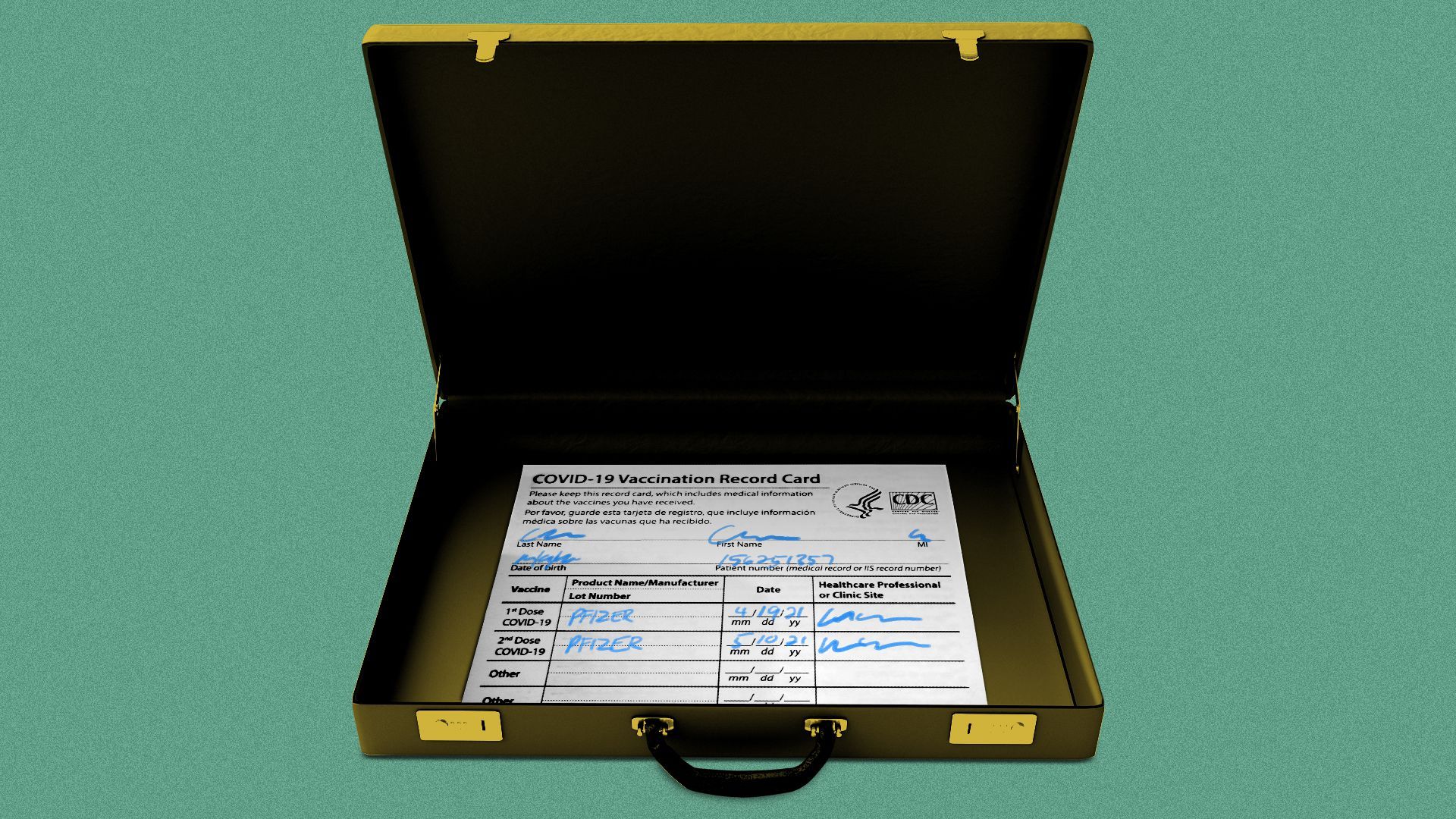

Central banks usually hold reserves in gold, or a widely held currency like the U.S. dollar. These reserves are used for transactions between central banks. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. The unvaccinated need not apply |  | | | Illustration: Brendan Lynch/Axios | | | | Companies are acting where government is not and pushing workers to get the jab to get the job, Axios' Erica Pandey writes. Driving the news: The share of job postings on Indeed requiring vaccination has jumped 90% in just the last month. The big picture: Vaccination rates in the U.S. are climbing, but hesitancy remains high in certain places. And the Delta variant is foiling companies' return-to-work plans. - Now, it's not just front-line jobs at restaurants and shops requiring vaccination. Postings for jobs in software development, marketing and sales are mandating that applicants have the shot too.

What's happening: At the beginning of the year, there were basically zero office jobs asking workers to get the vaccine. But even if workers are 100% remote, they'll have to come on-site at some point to meet with colleagues — and firms don't want to take risks. And even though the overall number of job postings requiring vaccination is still quite small — just about 1,200 per 1 million postings — they're increasing at a rapid clip. "This is incredible growth," says Indeed economist AnnElizabeth Konkel. - The share of software development jobs postings requiring vaccination has skyrocketed 12,400%, from a minuscule 3.5 per million to 438 per million.

- Marketing jobs have seen an 11,100% jump to 1,110 per million, and sales a 4,100% increase to 374 per million.

- Big companies that are now requiring vaccines include Google, Facebook, Netflix, Disney, Morgan Stanley, Lyft and the Washington Post.

Even jobs that already tended to require vaccination — like those in education, retail and hospitality — are doing so at even higher rates. The bottom line: This is yet another example of companies acting like governments. - Even if cities, states or the federal government choose not to mandate vaccination, firms can throw their weight around and effectively set policy by requiring it for their employees or customers — or both.

|     | | | | | | A message from Aon | | How to prepare for "grey swan" events | | |  | | | | Twenty-first-century risks require 21st-century innovation. As the severity of threats like cyber attacks and natural disasters worsens, Aon can help organizations prepare for what's next. Learn more from Aon's report analyzing 40 years of reputation crises. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment