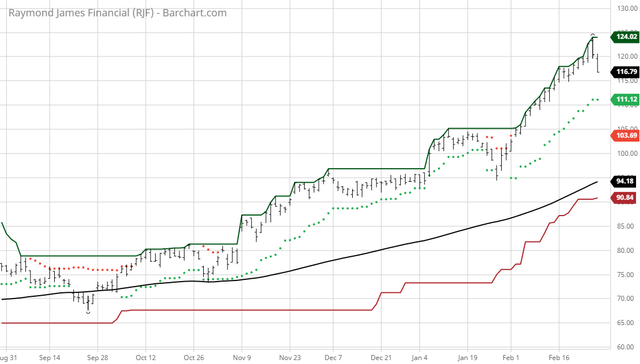

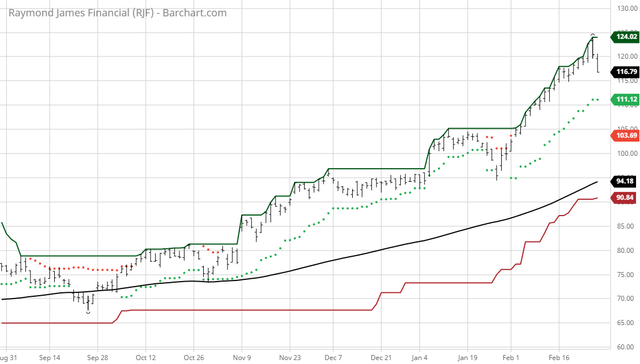

The Barchart Chart of the Day belongs to the financial services company Raymond James Financial (NYSE:RJF). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 2/2 the stock gained 11.98%. Raymond James Financial, Inc., through its subsidiaries, engages in the underwriting, distribution, trading, and brokerage of equity and debt securities in the United States, Canada, and Europe. The Private Client Group segment offers securities transaction services, including the sale of equities, mutual funds, fixed income products, and insurance and annuity products to retail clients; mutual funds; investment advisory and margin loan services; custodial, trading, research, and other support services; diversification strategies and alternative investment products; and borrowing and lending of securities to and from other broker-dealers, financial institutions, and other counterparties. The Capital Markets segment provides equity products to institutional clients; investment banking services, including public and private equity financing for corporate clients, merger and acquisition advisory services, and strategic and financial advisory services; and taxable and tax-exempt fixed income products, such as municipal, corporate, government agency and mortgage-backed bonds, and whole loans. This segment also offers public finance and debt underwriting services, interest rate derivatives, and tax credit funds; and publishes research on companies of various industries. The Asset Management segment offers asset management, portfolio management and related administrative services to retail and institutional clients; and administrative support services, such as record-keeping. The RJ Bank segment provides insured deposit accounts; commercial and industrial, commercial real estate (CRE) and CRE construction, tax-exempt, residential, securities-based, and other loans; and loan syndication. The Other segment engages in the private equity activities, including various direct and third-party private equity investments; and private equity funds. The company was founded in 1962 and is headquartered in St. Petersburg, Florida.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signals

- 79.86+ Weighted Alpha

- 30.76% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 19.33% in the last month

- Relative Strength Index 64.47%

- Technical support level at 118.71

- Recently traded at 117.98 with a 50 day moving average of 104.01

Fundamental factors: - Market Cap $16.58 billion

- P/E 19.02

- Dividend yield 1.27%

- Revenue expected to grow 10.30% this year and another 5.40% next year

- Earnings estimated to increase 28.60% this year, an additional 6.20% next year and continue to compound at an annual rate of 11.26% for the next 5 years

- Wall Street analysts issued 4 strong buy and 2 hold recommendations on the stock

- The individual investors following the stock on Seeking Alpha voted 83 to 20 that the stock will beat the market

- 5,720 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis. |

No comments:

Post a Comment