| | | | | | | Presented By Babbel | | | | Axios Markets | | By Aja Whitaker-Moore ·Feb 26, 2021 | | Morning! Aja here, steering the ship while Dion recharges. (Today's TGIF Smart Brevity count: 1,146 words, 4½ minutes.) ✏️ For the last edition of February, I asked my second grader to write the three most important things she learned during Black History Month. I promised not to edit her. | | | | | | 1 big thing: Yield convergence milestone |  Data: YCharts; Chart: Axios Visuals A milestone was reached in the markets Thursday: The yield on the 10-year Treasury note rose to match the dividend yield on the S&P 500, Axios' Felix Salmon writes. Why it matters: The two yields have been inverted since the beginning of last year, which is historically unusual. How it works: The 10-year Treasury note is a risk-free asset: If you hold it for 10 years, you know exactly how much it's going to return. Right now, that yield is 1.52%. - The S&P 500 dividend yield is normally lower than the risk-free rate. Investors earn less in dividends than you would holding the same amount of money in Treasury bonds, but they hope that rising stock prices will make up the difference.

Context: The Treasury yield was artificially depressed by the flight-to-quality trade during the coronavirus pandemic, as well as by large-scale purchases by the Federal Reserve. Now yields are rising on optimism that aggressive fiscal policy might reignite inflation. The big picture: Much of the rise in the S&P 500 has been driven by high-growth technology stocks. Like all stocks, they're valued according to the net present value of their future earnings — but unlike most stocks, a very large part of today's valuation is arrived at by extrapolating earnings out by more than 10 years. - Those values are arrived at using what's known as a discounted cashflow calculation, where future earnings are discounted by a "discount rate." As interest rates rise, the discount rate goes up and the present value of the future earnings goes down.

The bottom line: As interest rates rise, that's naturally going to apply downward pressure to stock prices — especially when it comes to white-hot emerging tech stocks. - For evidence, look no further than Thursday's 2.5% drop in the S&P 500, which was led by a sell-off in tech shares — and global bonds.

|     | | | | | | 2. Catch up quick | | GameStop and the meme stock trade is back in focus. Shares in the company closed up 19% yesterday after a volatile day of trading that sent the stock up as much as 80%. (Axios) The SEC should consider ways to think "more creatively and broadly" about race and gender diversity, including revisiting disclosure requirements, says the agency's acting chair. (Reuters) |     | | | | | | 3. Rising rates rain on housing parade |  | | | Illustration: Annelise Capossela/Axios | | | | Warning bells about a slowdown in the white-hot housing market are ringing louder thanks to an uptick in mortgage rates and new weakness in pending home sales. Why it matters: Mortgage rates plummeted in 2020 as the economy buckled under the pressure of the coronavirus pandemic. Now that trend is reversing, putting a damper on consumer appetite for homebuying. What's happening: The rate on a 30-year fixed mortgage rose to 2.97%, which is its highest level since August 2020, according to Freddie Mac's weekly survey released Thursday. - Nationally, pending home sales fell 2.8% in January, well below the consensus forecast for no change. The metric, however, was 13% higher than a year ago.

- Consumer confidence overall edged higher in February, but those living in big cities and rural areas are less optimistic about buying or selling their homes because of rising prices, according to the recent BofA US consumer confidence indicator.

What they're saying: "The housing sector is always sensitive to changes in mortgage rates so the latest data is showing a loss in momentum for overall housing," Lawrence Yun, NAR's chief economist, tells Axios. - Home sales will continue to rise modestly but gains are likely to now be in the single digits versus the 20% upticks seen in late 2020, Yun says.

- "Consumers need to understand the absolute low rates in mortgages — those days are over."

Yes, but: Investors are also factoring in Fed chair Jerome Powell's comments this week emphasizing that the Fed is unlikely to tighten monetary policy solely in response to a stronger labor market, Danielle Hale, realtor.com chief economist, noted in a statement. - This may stem some of the upward pressure on interest rates in the upcoming weeks, she added.

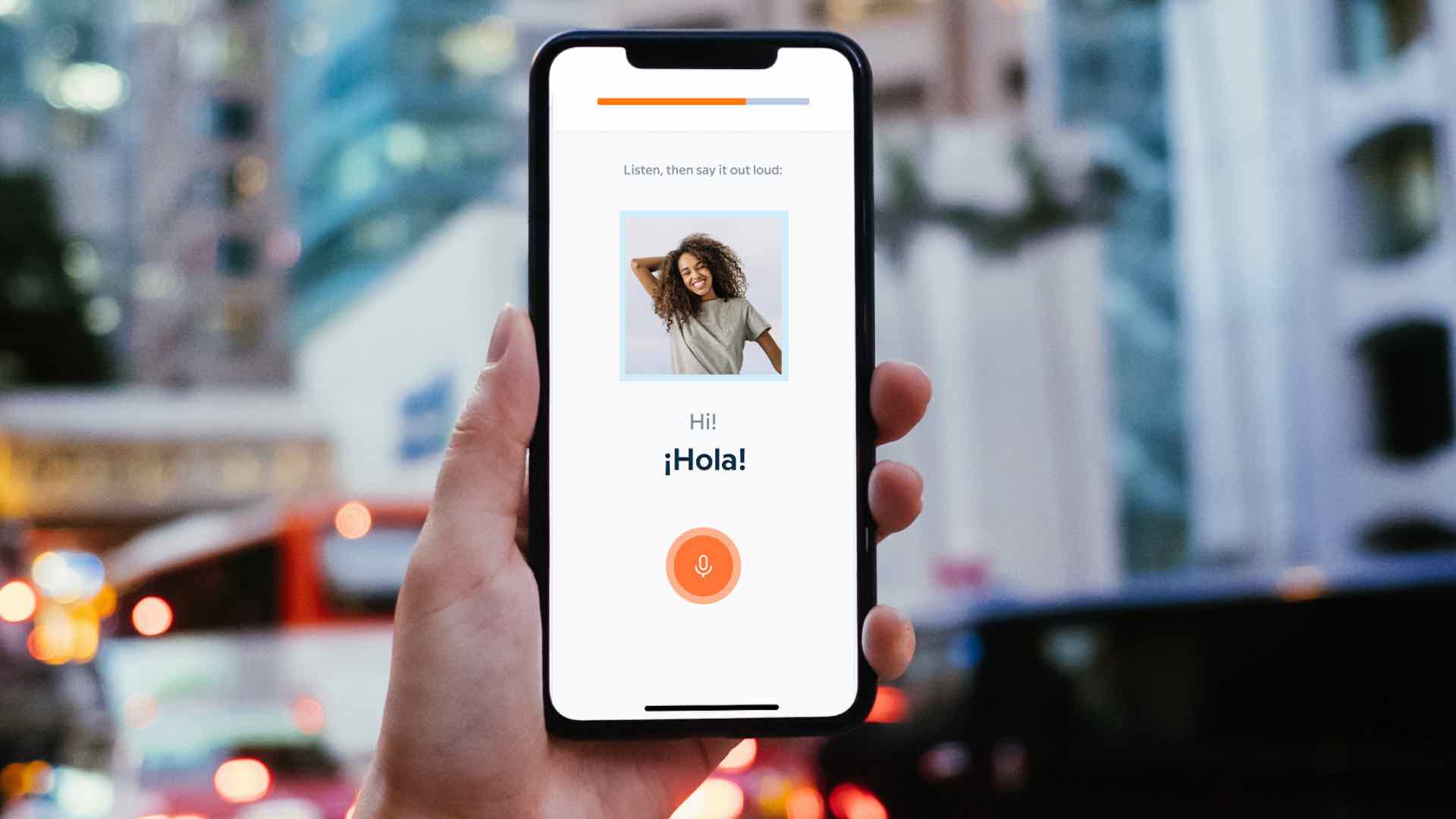

|     | | | | | | A message from Babbel | | How Babbel trains your brain to learn a new language | | |  | | | | Unlike other apps that use machine learning to teach you languages, Babbel takes a human-based approach. What this means: Lessons are built by over 150 linguists and prepare you for situations you'll actually encounter in real-life. No random words or abstract grammar. Sign up and get 50% off. | | | | | | 4. What's really going on with the labor market |  Source: YCharts The labor market is showing some signs of improvement: Jobless claims fell to 730,000 — a dramatic drop from 841,000 the previous week. And the latest jobs report showed a pandemic-era low unemployment rate of 6.3%, writes Axios' Erica Pandey. But, but, but: That's not the full story, experts say. The big picture: Last week's jobless claims are significantly lower compared with the start of the pandemic, but they're still well above pre-pandemic levels. - Add in the fresh filings for the Pandemic Unemployment Assistance program last week — created for gig and self-employed workers — and claims totaled close to 1.2 million.

One possible reason for the drop-off: Winter storms that caused power outages across Texas and beyond may have prevented some from filing for unemployment. - "Claims in Texas fell last week, but some economists say that could have reflected difficulty in filing for benefits," Wall Street Journal's Eric Morath writes.

Between the lines: When you account for the scores of Americans — such as overwhelmed parents and caregivers — who have simply dropped out of the workforce or others who have given up looking for work, the unemployment rate is closer to 10%, notes Nick Bunker, director of economic research at the jobs site Indeed. The bottom line: "The labor market is in a better spot than it was last April, but its recovery is incomplete and unequal," Bunker says. What to watch: Workers that refuse work at unsafe workplaces will now be eligible for unemployment pay, according to a change by the Biden administration on Thursday. |     | | | | | | 5. Silicon Valley darlings beat expectations in debut |  | | | Illustration: Aïda Amer/Axios | | | | Both DoorDash and Airbnb beat analyst revenue expectations on Thursday in their first quarter as public companies. Both also have significant losses, mostly due to IPO-related costs and stock-based compensation, Axios' Kia Kokalitcheva writes. Why it matters: The two companies became Silicon Valley darlings amid the pandemic as they capitalized on resulting consumer trends. Yes, but: The companies will likely face different worlds as COVID-19 gets under control. - Food delivery could be impacted by a return to restaurant dining.

- In an interview with "Axios Re:Cap," DoorDash CEO Tony Xu said that even back in May-June when states like Texas, Georgia and Florida eased restrictions on restaurants, the company's business continued to grow.

- "If you looked at Australia, for example, certain cities like Melbourne actually were even more fully recovered ... and there you saw maybe a 20% drop from the COVID-19 highs in terms of our business," he added.

Meanwhile, Airbnb is readying for a rebound in travel. "In 2021, people ... said they miss travel more than any other out-of-home activity," Airbnb CEO Brian Chesky told "Axios Re:Cap." - "More than 50% of people said this year, they intend to travel, or they're already planning to travel ... they will travel as soon as they feel safe to do so."

By the numbers: - Airbnb revenue: $859 million compared to $748 million expected, per Refinitiv. Revenue is down 22% year over year.

- Airbnb loss: Net loss of $3.89 billion, compared to $352 million in the year-ago quarter, and a $11.24 loss per share.

- DoorDash revenue: $970 million compared to $938 million expected, per Refinitiv. Revenue is up 226% year over year.

- DoorDash loss: Net loss of $312 million, compared to $134 million in the year-ago quarter, and a $2.67 loss per share.

|     | | | | | | A message from Babbel | | The human-based approach to learning a new language | | |  | | | | Make 2021 the year you learn a new language with Babbel, the app that's sold over 10 million subscriptions. - Their human-based approach provides customized lessons built by over 150 linguists. All you need is 15 minutes a day to start learning.

Sign up and get 50% off today. Get Started. | | | | 📝 The three most important lessons my 7-year-old learned this Black History Month ... - So, Harriet Tubman helped a lot of people escape from slavery.

- Ella Fitzgerald: she once sang at a ball.

- Jackie Robinson taught us to be brave and strong.

Thank you for starting your day with me! Hit me up with any feedback or tips at aja.moore@axios.com or @AjaWMoore on Twitter | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment