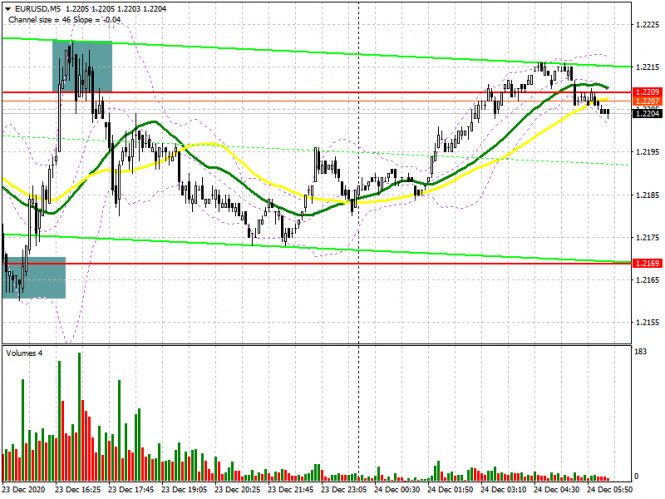

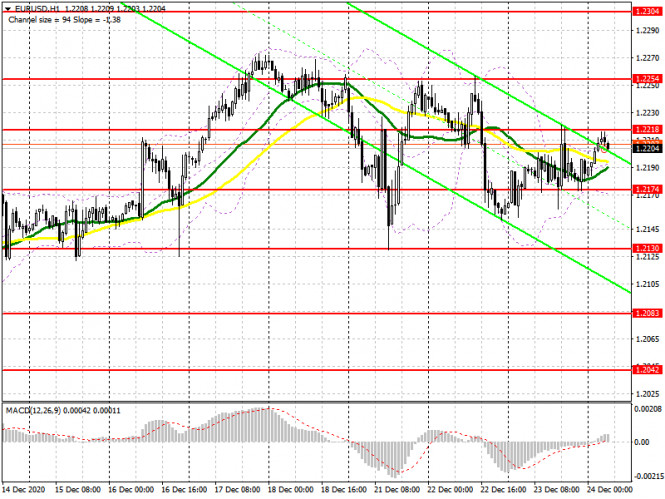

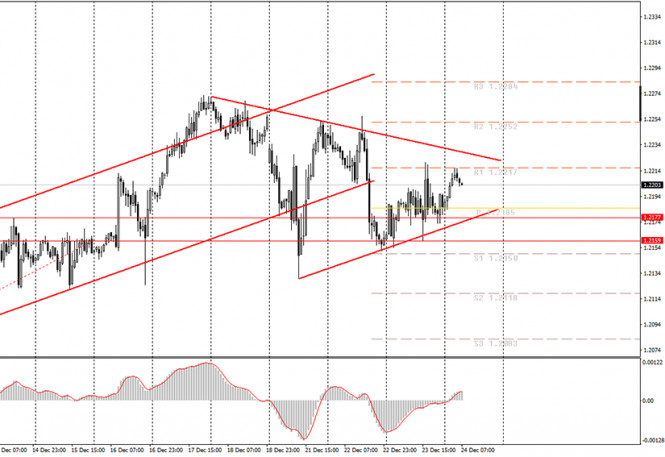

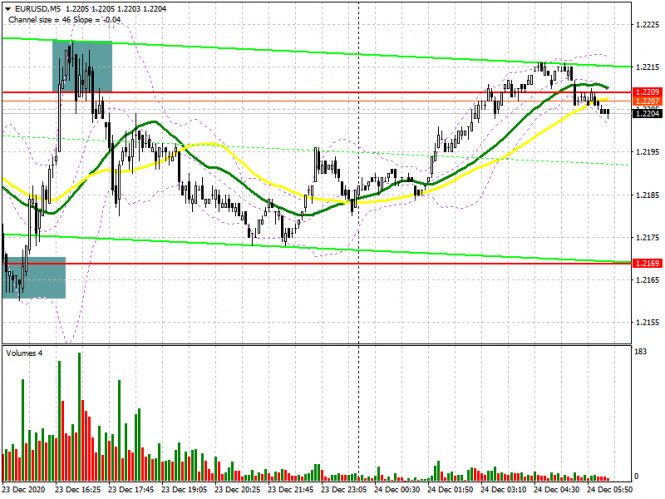

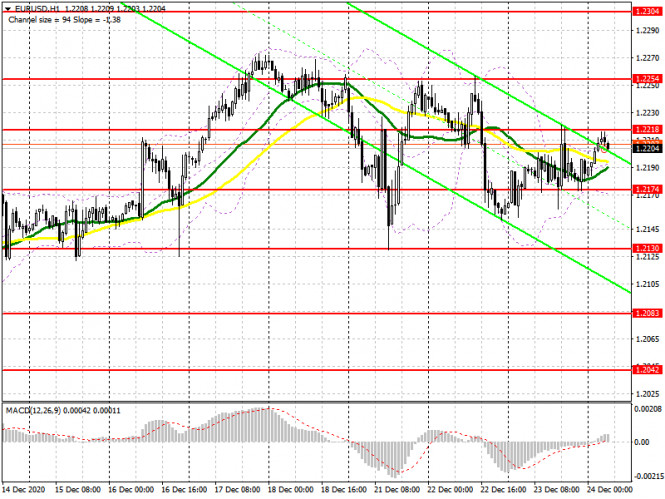

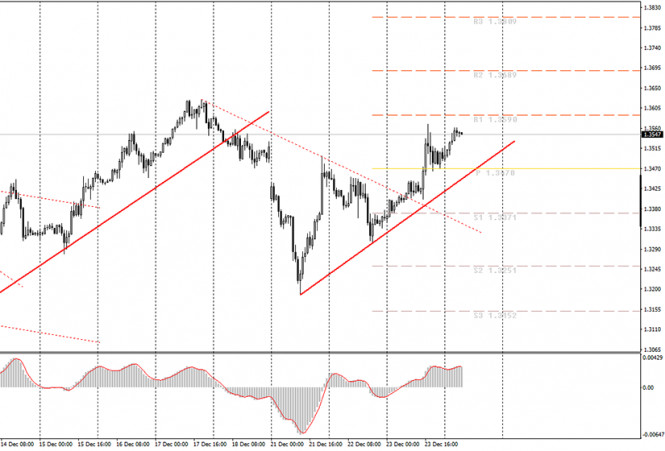

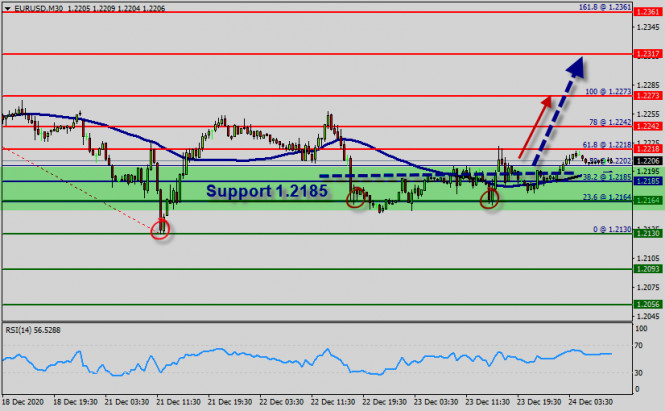

| EUR/USD: plan for the European session on December 24. COT reports. Volatility eases ahead of Christmas. Bulls focused on surpassing resistance at 1.2218 2020-12-24 To open long positions on EUR/USD, you need: There were no deals in the first half of Wednesday. Several signals for entering the market appeared when fundamental reports on the US economy were finally published, which indicated a slowdown in growth. In my review, I repeatedly drew attention to the false breakout of support at 1.2169, which happened. On the 5-minute chart, you can clearly see how the bulls defended this area, bringing the pair back to this level quickly after the bears failed to settle below it. This creates the first entry point for long positions. Rising to the 1.2209 area brings around 40 points of profit. Then, by the middle of the US session, the bears did the same thing as the bulls, but at the 1.2207 level, which pushes the euro back to the support area of 1.2169. Falling from 1.2209 yielded around 30 points.

As of today, the technical picture has only slightly changed, since the nearest support and resistance levels were adjusted based on yesterday. Buyers are now focused on protecting support at 1.2174. Forming a false breakout there in the first half of the day, similar to yesterday's purchase from 1.2169, which I analyzed above, will result in forming a signal to open long positions in the euro. However, given the lack of important fundamental repor bts and since the markets will work less in connection with Christmas, then buyers are most likely not in a hurry to be active. In the absence of any action when EUR/USD returns to support at 1.2174, I recommend postponing long positions until the week's low has been updated in the 1.2130 area. It is also possible to buy the euro immediately on a rebound from a new local low in the 1.2083 area, counting on a correction of 20-25 points within the day. We can only say that buyers of the euro have managed to regain control of the market when the pair has finally surpassed and settled above resistance at 1.2218. Testing this level from top to bottom creates an additional signal to buy the euro with the main goal of returning to resistance at 1.2254, where I recommend taking profits. To open short positions on EUR/USD, you need: Sellers of the euro aim to regain control over the 1.2174 level. Getting the pair to settle below this range and testing it from the other side will raise the pressure on the pair, which creates a good entry point for short positions. In this case, the main target will be this week's low at 1.2130. It is difficult to surpass this area at the end of the week. However, if this happens, falling towards the 1.2083 area is not excluded, and the key target at the end of the year will be the 1.2042 area, where I recommend taking profits. An equally important task for the bears is to protect resistance at 1.2218, near which trade is currently being conducted. Forming a false breakout there, similar to the sale, which I analyzed above, creates a good entry point to short positions, as we aim to return to the support area of 1.2174. If bears are not active at the 1.2218 level, I recommend postponing short positions until a high at 1.2254 has been tested, or you can sell EUR/USD immediately on a rebound from the resistance of 1.2304, counting on a correction of 20-25 points within the day.

The Commitment of Traders (COT) report for December 15 showed an increase in short positions and a reduction in long ones. Although buyers of risky assets believe that the bull market will proceed, especially amid expectations of vaccinations in the eurozone, which will begin from December 25 to 27, however, the rush to buy at current highs has obviously decreased. Thus, long non-commercial positions fell from 222,521 to 218,710, while short non-commercial positions increased from 66,092 to 76,877. The total non-commercial net position fell from 156,429 to 141,833 a week earlier. The growth of the delta, which was observed for three consecutive weeks, has stopped, so one can hardly count on the euro's rapid growth at the end of this year. There will be no further major recovery until European leaders negotiate a new trade agreement with Britain. Indicator signals: Moving averages Trading is carried out in the area of 30 and 50 moving averages, which indicates market uncertainty ahead of the weekend. Note: The period and prices of moving averages are considered by the author on the H1 chart and differs from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the lower border of the indicator in the 1.2174 area will increase pressure on the euro. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

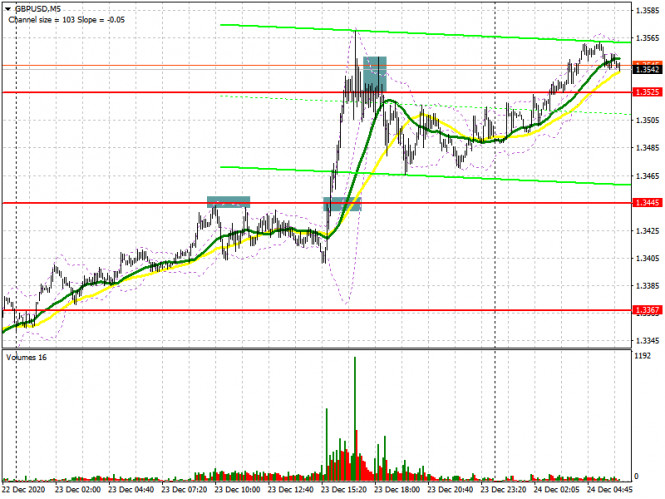

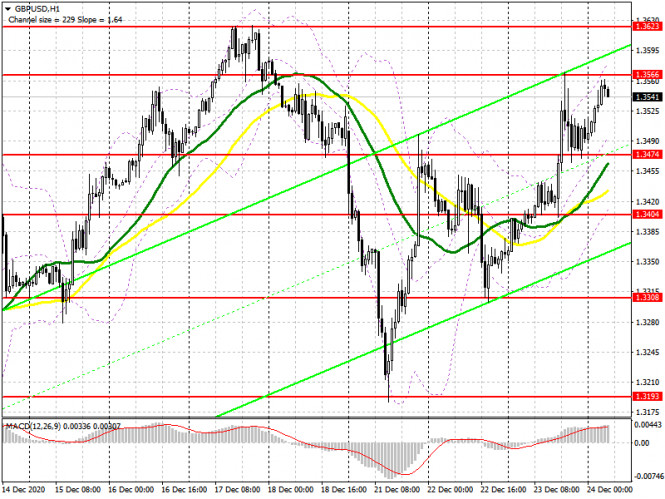

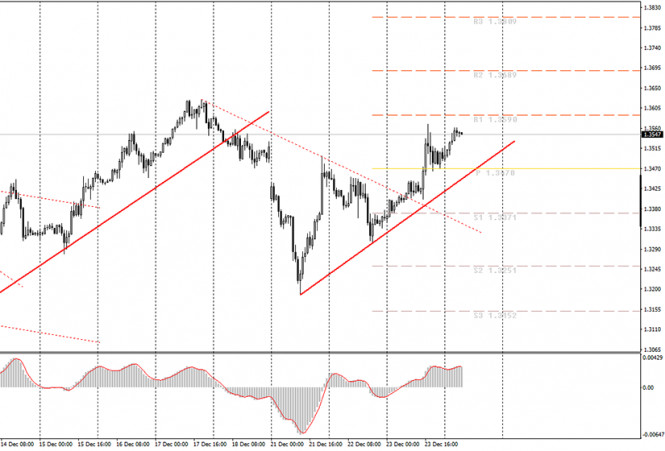

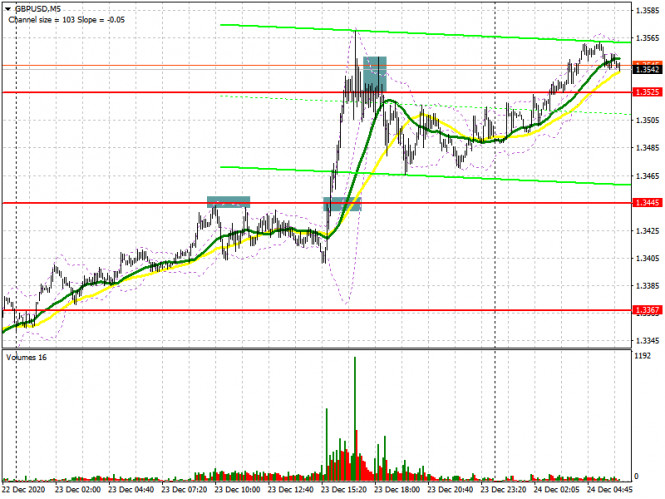

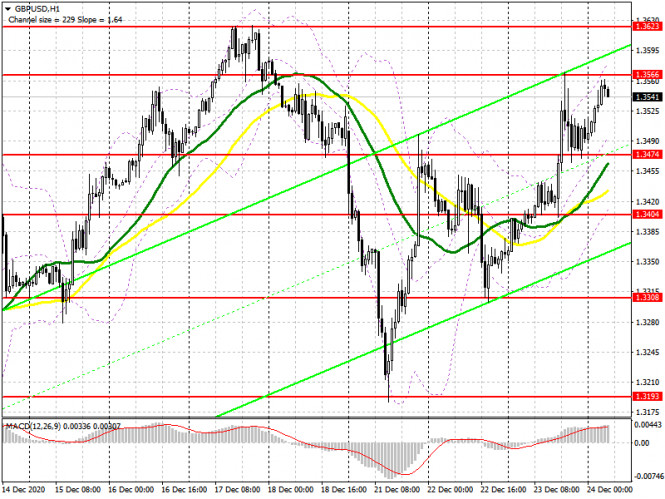

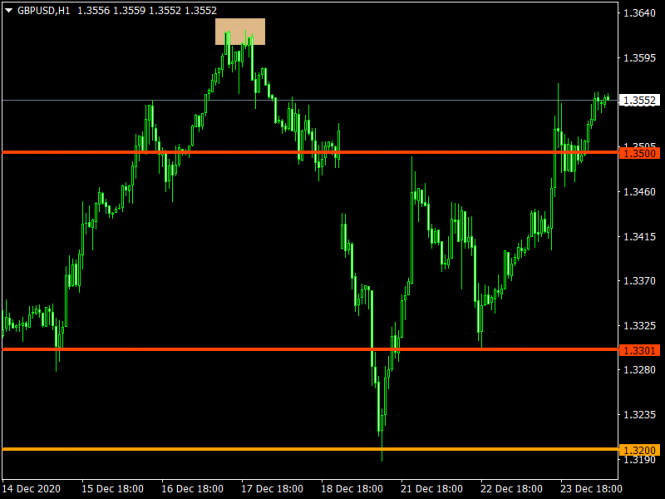

GBP/USD: plan for the European session on December 24. COT reports. Britain and EU ready to sign a historic trade agreement. Pound buyers aim to surpass 1.3566 2020-12-24 To open long positions on GBP/USD, you need: Yesterday there was news that the UK and the EU were on the verge of signing an agreement, which resulted in strengthening the British pound. As for the deals, let's look at the 5-minute chart and talk about where you can and should enter the market. A signal to sell the pound from the 1.3445 level appeared in the first half of the day. However, you should pay attention to the fact that there was no false breakout of the 1.3445 level, and if you missed this deal, then it's okay. The downward movement was around 40 points. Brexit news caused the pound to sharply rise, but after surpassing the 1.3445 level, I did not wait for a correction, so I was forced to miss such a large movement. However, it turned out pretty good to make money after the pair returned to the 1.3525 level in the afternoon. Testing it from the bottom up created a convenient entry point for short positions, and the downward movement was over 40 points.

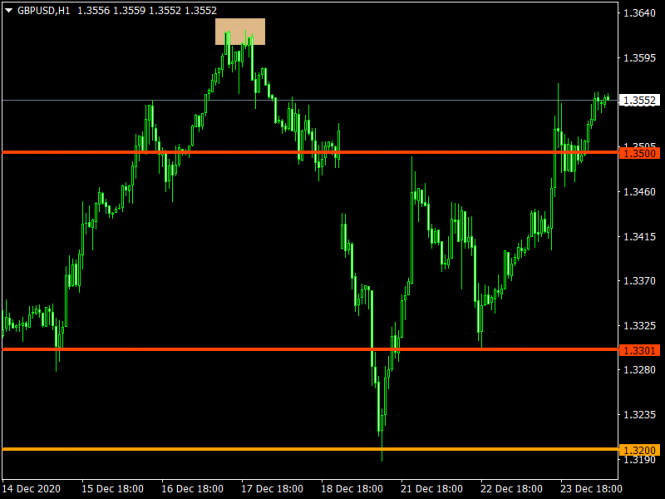

Buyers are currently focused on resistance at 1.3566. A breakout and getting the pair to settle at this level while testing it from top to bottom creates a good entry point into sustaining the bull market, especially if it is officially announced that the UK and the EU have signed a trade deal. In this case, we can expect a larger upward movement to the high of 1.3623 and its update, with an exit to the area of 1.3690 and 1.3750, where I recommend taking profits. If the pound is under pressure in the morning, and today is a shortened trading day since it is Christmas Eve, then it is best to open long positions only after a false breakout is formed in the support area of 1.3474, where the moving averages also pass, playing on the side of the pound buyers. I recommend buying GBP/USD immediately on a rebound only from a low of 1.3404, counting on an upward correction of 35-40 points within the day. To open short positions on GBP/USD, you need: It is best not to rush to sell the pound today, as talk about a trade deal is more real than ever. Forming a false breakout in the resistance area of 1.3566, similar to yesterday's sales, will return the pressure to the pair and result in a downward correction to the support area of 1.3474, which will be quite difficult to surpass without bad news. Going beyond this level and testing it from the bottom up creates a good signal to open short positions in sustaining the downward trend, while aiming to fall to lows of 1.3404 and 1.3308, where I recommend taking profits. In case the pound grows further after news on the trade deal, I recommend not rushing to sell, but wait until new annual highs around 1.3690 and 1.3750 have been updated, where you can open short positions for a rebound, counting on a decline of 20-30 points within the day. The 1.3623 area will also be the intermediate resistance, which you should pay attention to.

The Commitment of Traders (COT) reports for December 15, there is a decrease in interest in the British pound for both buyers and sellers. Long non-commercial positions decreased from 39,344 to 35,128. At the same time, short non-commercial positions decreased from 33,634 to 31,060. As a result, the non-commercial net position, although it remained positive, dropped to 4,068, against 5,710 versus a week earlier. All this suggests that traders are taking a wait-and-see attitude, although a small preponderance of buyers, even in the current situation, continues to be observed. Given that the UK has imposed tough quarantine measures due to a new strain of coronavirus that has gotten out of control and for which there is no vaccine yet, then expecting the pound to strengthen further at the end of this year will not be the right decision. Only good news on Brexit can bring new players back into the market, betting on GBP/USD growth. Indicator signals: Moving averages Trading is carried out above 30 and 50 moving averages, which indicates the pound's succeeding growth in the short term. Note: The period and prices of moving averages are considered by the author on the H1 chart and differs from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the upper border of the indicator around 1.3570 will lead to a new wave of growth for the pound. In the event of a decline, support will be provided by the lower border of the indicator at 1.3415. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

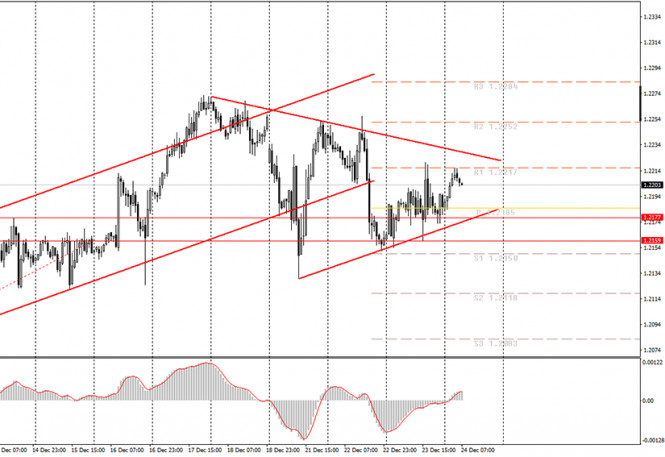

GBP/USD: Pound felt a rush while waiting for Brexit decision 2020-12-24  The British currency has repeatedly felt nervous at the end of the current week, impatiently waiting for a decision on Brexit. Nevertheless, hopes for a successful conclusion with the signing of agreement between the UK and EU help the pound increase. The global stock market, along with the British one, is also focused on the result of negotiations between London and Brussels. Currently, discussions between the UK and the European Union are continuing, despite the end of the transition period, which ends before the New Year. According to The Sun, citing sources in the EU, negotiations are in the final stages. At the end of this week, the UK is ready to concede to the European Union on some points of the trade deal. The possibility of a close and relatively positive conclusion to the Brexit negotiations positively affects the market. Therefore, traders and investors are looking forward to the positive outcome of the prolonged discussions between London and Brussels. On this wave, the British currency also rose. Investors were afraid of its excessively sharp movements, but this did not happen. On the morning of December 24, the price of the pound rose against the US dollar, which fell due to the deteriorating demand for defensive assets. The indicated currency is now gaining impulse, in anticipation of the result of trade deals between the UK and the EU after the Brexit transition period. So, Thursday started with the pound rising to $ 1.3551, higher than the previous close of $ 1.3492. In the morning, the GBP/USD pair continued to trade in the range of 1.3550-1.3551, trying to further grow.  A day earlier, MUFG Bank's analysts noted that the signing of a trade deal between the parties is unlikely to provoke a significant growth in the pound. A sharp price increase is only possible if a grace period for customs checks is introduced in the UK. According to experts, it is the minimum customs inspections during the first six months of 2021 that will help London adapt to the new conditions. MUFG Bank believes that entering into a trade deal without a grace period for customs inspections will push the GBP/USD pair down to the level of 1.2500. Such a collapse will be quick if London and Brussels fail to agree on their actions in emergency circumstances. It should be recalled that negotiations between the parties on a number of points of the trade agreement after Brexit dragged on for several months. Unsurprisingly, the market is looking forward to its end. However, the fishing issue remains to be a hindrance between London and Brussels. The British authorities insisted on maintaining sovereignty over certain fishing zones, while the European authorities fought for the rights of fishermen of some EU countries to fish in these areas. Still, experts do not rule out that this issue will be resolved, and the parties will come to a compromise. Indicator analysis. Daily review for the EUR/USD pair on 12/24/20 2020-12-24 Trend analysis (Fig. 1) Today, the market from the level of 1.2186 (closing of yesterday's daily candle) will try to continue moving upwards to the target of 1.2234 – the historical resistance level (blue dotted line). After testing this level, the upward movement may continue to the next target of 1.2274 – the pullback level of 85.4% (yellow dashed line).

Figure 1 (daily chart) Comprehensive analysis: - Indicator analysis - up

- Fibonacci levels - up

- Volumes - up

- Candlestick analysis - down

- Trend analysis - up

- Bollinger lines - up

- Weekly chart - up

General conclusion: Today, the market from the level of 1.2186 (closing of yesterday's daily candle) will likely continue rising to the target of 1.2234 – the historical resistance level (blue dotted line). Upon testing this level, the upward movement may continue to the next target of 1.2274 – the pullback level of 85.4% (yellow dashed line). An alternative scenario: the market from the level of 1.2198 (closing of yesterday's daily candle) may continue to move upwards and reach the target of 1.2234 – the historical resistance level (blue dotted line). After testing this level, a downward pullback is possible towards the target of 1.2177 – a pullback level of 14.6% (red dotted line). Analytics and trading signals for beginners. How to trade EUR/USD on December 24? Plan for opening and closing deals on Thursday 2020-12-24 Hourly chart of the EUR/USD pair

The EUR/USD pair did not make any attempt to settle above the downward trend line or below the rising trendline last night. Thus, the quotes remained within these two trend lines, and it was inconvenient to trade between them. We are still leaning towards the return of the downward trend, since a downward trend line was formed earlier and is much stronger. But at the same time, overcoming it will pave the way for the euro to rise. In general, novice traders are encouraged to wait until the pair surpasses one of the two trend lines. The MACD indicator may create a new sell signal in the near future, as it has sufficiently discharged to the upside last night. And we would also recommend trying to work out this signal. Another important assumption is a possible flat (mostly sideways movement). There have been such situations more than once where the price has been in a narrow price range or channel and everyone is waiting for a clear exit from it. However, in practice, the price simply moves sideways and formally overcomes the range, but this is not the way out of it, which we are talking about. There should be a clear movement that will lead the quotes out of the triangle. If the pair leaves it by moving sideways, then no signal will be generated. No major report or any other event scheduled in America or the EU today. Thus, novice traders will have nothing to pay attention to. Of course, we could receive sudden news at any time (as was the case on Monday with a new strain of coronavirus), but it will not be possible to predict when it would appear for obvious reasons. Since we can say that the holidays are already starting on the sly, the markets may not start moving quite normally. Although, in the context of 2020, nothing was normal at all. Sometimes during the holidays, volatility rises and movements can be erratic, sometimes volatility falls. This point also needs to be clearly defined in order to answer the question, does it make sense to enter the market at all? Possible scenarios for December 24: 1) Long positions are currently irrelevant, since there is a downward trend line. Thus, we would recommend opening buy positions only when the price has settled above this trend line with targets at the resistance levels of 1.2252 and 1.2284. The trend line is close to the price, so this option is possible today. 2) Trading for a fall looks more appropriate now. The MACD indicator is discharged and may turn down in the near future. The first target in this case will be an upward trend line, which can offer resistance to sellers in their intention to take the pair down. But if this line is crossed, then it will be possible to trade down while aiming for 1.2150 and 1.2118. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. Analytics and trading signals for beginners. How to trade GBP/USD on December 24? Plan for opening and closing deals on Thursday 2020-12-24 Hourly chart of the GBP/USD pair

The upward trend resumed last night for the GBP/USD pair. The price failed to correct to the trend line, and the MACD indicator failed to discharge to the zero level. Thus, a new buy signal was formally created, but novice traders were advised to not work it out, which we talked about in yesterday's article. At the moment, the markets are moving the pound/dollar pair based on their own expectations related to the end of the negotiation process between London and Brussels. Judging by the quotes' movement, everyone believes that the deal will be achieved, which is why the pound is rising. Thus, if the euro/dollar pair can trade in a flat or swing mode in the final week of the outgoing year, then the pound can renew its annual and 2.5-year highs, it can continue an upward trend, or it can start a landslide fall. if there is no deal in the end, and the UK and the EU will start trading with each other on January 1 then it will be according to WTO rules. Therefore, the British pound can still expect sharp and strong movements, despite the semi-holiday status of the next few days. Everything will depend on what kind of news we receive from Brussels and London. The macroeconomic calendar for Thursday does not include any important reports or events. As we mentioned, the holidays begin and there will be little news and reports for all currencies except the pound. The fate of the UK's future relationship with the European Union continues to be decided. Recall that on January 1, Brexit will officially be completed after four years of ordeal and negotiations. Therefore, the parties have a week to agree on a deal and have a vote for it by their respective parliaments. There are few chances for its success, and there is too little time left. Nevertheless, the news that might come in the final days of the outgoing year is important to us. After all, they can cause the strongest spikes in volatility for the pound/dollar pair. So far, the pound is rising as markets continue to believe that the groups of Michel Barnier and David Frost will reach an agreement. But this does not mean that the parliaments will have time to vote, and starting on January 1 this deal will come into force. Possible scenarios for December 24: 1) Buy orders are now relevant, as a new upward trend has been formed. So now novice traders can wait for a new buy signal. It is still necessary for the MACD indicator to discharge to the zero level or the price to fall to the trend line and rebound from it. Without these signals, the upward movement can also continue because there are recoilless movements, but we remind you to be very careful and trade according to strong and clear signals. Aim for levels of 1.3590 and 1.3689. 2) Selling is now impractical as the downward trend has been canceled. So now you need to wait for the quotes to settle below the upward trend line and only after that should you sell the pair while aiming for the support levels of 1.3371 and 1.3251. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. Trading plan for EUR/USD and GBP/USD on 12/24/2020 2020-12-24 There is no doubt that a script about a Brexit movie is being written somewhere in Hollywood. In particular, the endless negotiations on a trade agreement. It's been several years of negotiations, with unending postponements of deadlines, abrupt changes in the positions of the parties, attempts at blackmail, and more. In addition, Great Britain changes its prime minister several times and the fate of millions of people on both sides of the English Channel is at stake – literally life or death of both simple workers and pampered managers of multinational corporations depends on the results of all this, but that's just the surface. There is more to it than that if you catch up with the drama. But most importantly, there are unconfirmed rumors that the negotiations finally ended successfully. It seems that London and Brussels have come to a compromise. The final stage of this whole saga should be the press conference of Boris Johnson and Ursula von der Leyen, which may take place today in the first half of the day. A successful completion of the negotiations is expected to be announced, although the approval of the House of Commons and the parliaments of the European Union countries is still needed. Nonetheless, it is unlikely that the Hungary parliament will act as an evil genius and ruin the results of many years at the very last moment, considering how long everything was agreed upon. This will be a plot twist if it happens. In general, the market is only busy waiting for the announcement of the successful conclusion of Brexit since the opening of the US session. After all, rumors began to appear just then and it was not just that the negotiations was announced to last all night. In short, we are waiting for the planned press conference, after which, the pound and the euro may well break annual records and increase.

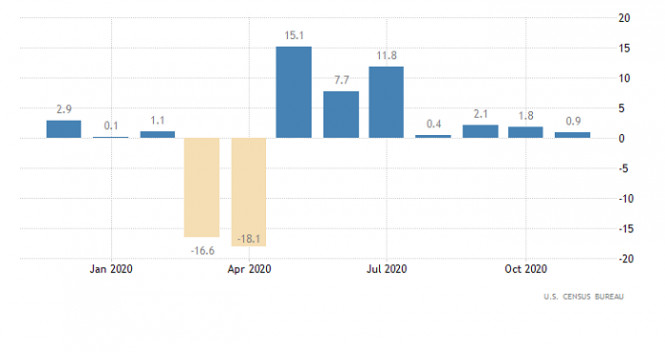

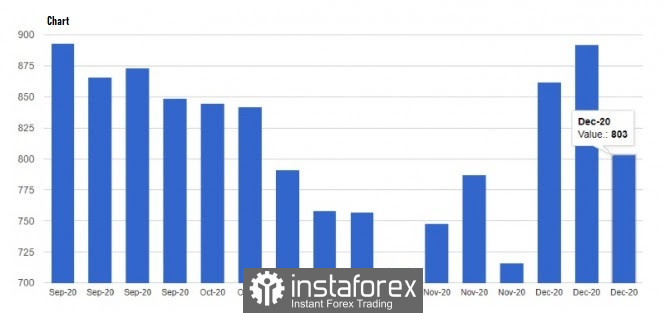

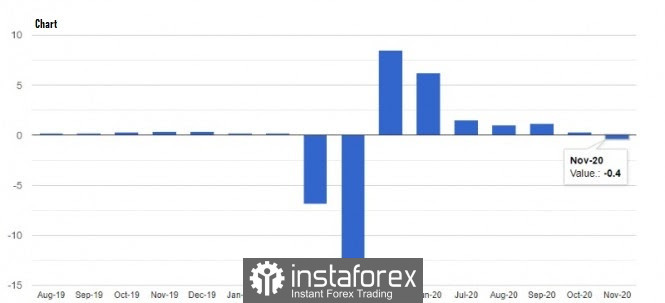

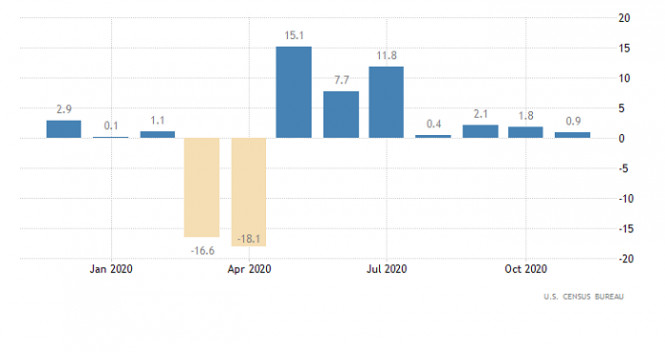

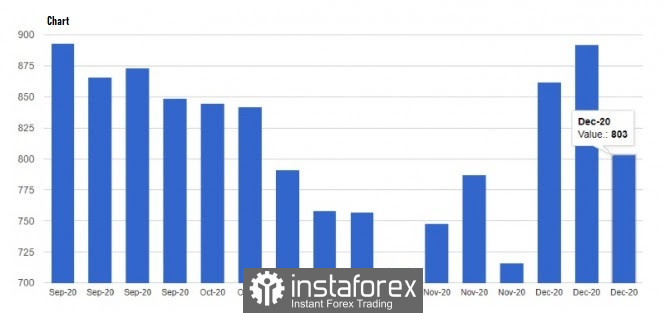

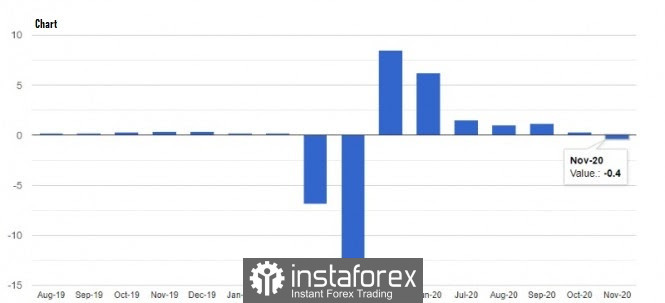

Some macroeconomic data in the United States were published yesterday, but no one is interested. However, these data are actually not to be ignored, as they are very significant. Let's take orders for durable goods as an example, which suddenly rose by 0.9%, against the forecasted growth of 0.6%. Their growth clearly indicates a further growth in retail sales, and hence inflation. On the other hand, the labor market, which has been causing more concern lately, is not slowing the pace of recovery. So, the number of initial applications for unemployment benefits declined from 892 thousand to 803 thousand, although an increase is forecasted to 905 thousand. At the same time, the number of repeated applications, which should have declined from 5,507 thousand to 5,490 thousand, fell to 5,337 thousand. In other words, the labor market is still recovering, which means there is no reason to expect stagnation. Durable Goods Orders (United States):

The GBP/USD pair showed high activity due to the information flow. As a result, the quote soared above the level of 1.3550. The market is filled with speculative hype and it can be assumed that we will continue to follow the Brexit noise, where more impulse surge in the market will appear depending on the nature of the incoming information.

The EUR/USD pair shows less activity, but still follows the information flow. Based on the recent fluctuations, a full-fledged correctional movement was not observed in the market, instead there are outlines of a slowdown that can go into the flat range of 1.2150/1.2275.

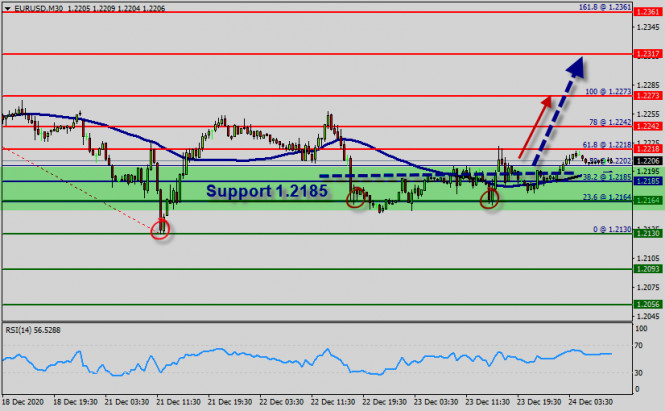

Technical analysis of EUR/USD for December 24, 2020 2020-12-24  Overview : - Key : Pressure of holiday trading.

- Zone : Europ.

- Pair : EUR/USD.

- Pivot : 1.2185.

Short-term technical outlook : From a technical sight, the pair, so far, has managed to defend the daily pivot point, currently near the 1.2185 area. This is closely followed by the 1.2185 - 1.2164 congestion zone, Due to the upcoming holidays (24 and 25 of December 2020), the trading working hours of many major financial centers was changed, which affected the trading of the EUR/USD pair notably, because the market was not stable and the trend was not clear. Consequently, the market will probably start showing the signs of tight sideways range on December 24, and 25 of 2020. Thus, the EUR/USD pair will be restricted by the levels of 1.2164 and 1.2317. So it is of the foresight to pay attention to this area. Therefore, try to buy at a lower price around the weekly pivot point at the price of 1.2185 with a first target of 1.2242 and it willl climb towards 1.2273. On four-hour chart, the EUR/USD pair is continuing in a bullish market from the supports of 1.2164 and 1.2185. Also, it should be noted that the current price is in a bullish channel. Equally important, the RSI is still signaling that the trend is upward as it is still strong above the moving average (100) since yesterday. Immediate support is seen at 1.2164 which coincides with a major ratio (38.2% of Fibonacci). Consequently, the first support sets at the level of 1.2164. Hence, the market is likely to show signs of a bullish trend around the spot of 1.2164 and 1.2185. As a result; buy orders are recommended above the major ratio (38.2% of Fibonacci) with the first target at the level of 1.2242, then continue towards the top point 1.2273. Furthermore, if the trend is able to break through the first resistance of 1.2273, it may resume to 1.2317. On the other hand, stop loss should always be in account, consequently, it will be of wholesome to set the stop loss below the support 2 at the price of 1.2130. GBP/USD and EUR/USD: The issue on fishing rights has been resolved, so a Brexit trade agreement may be signed soon. 2020-12-24 The British pound grew on the news that a Brexit trade agreement may be signed soon.  At the moment, the deal is being finalized at the European Commission headquarters in Brussels, and later today, UK Prime Minister Boris Johnson is scheduled to hold a press conference, during which he can reveal the details of the negotiations. Yesterday, Johnson had a phone call with European Commission President Ursula von der Leyen, and that allowed the conclusion to take place. Although the details of the conversation were not revealed, one thing is clear: the issue on fishing rights has been resolved, and a Brexit trade agreement may be signed soon. After the European Commission signs the agreement, the final document will go to the UK, and then to the EU Parliament for approval. It was rumored that the UK made concessions so that a deal can be concluded. Johnson was said to have agreed that the EU's production cut will only amount to 25% over the next five years, much lower than the initial reduction the UK first proposed (80% in over three years). The EU also rejected the UK's latest proposal, which was to decrease production by 25%. The bloc said it was very difficult to accept, even to countries such as France and Denmark. The UK's concessions on the issue are understandable, especially since now, they need to solve more serious problems. The introduction of tough quarantine measures in the country amid the new strain of coronavirus is pushing the economy down even further, and the absence of a trade agreement with the EU would deal an equally big blow to the prospects for recovery in the next 3-5 years. But if an agreement is signed, it will ease the burden on the Bank of England, as well as on the budget deficit, which has grown to massive figures this year. Anyhow, this good news proved to be very favorable for the British pound, though the market reacted very calmly as if it already expected that an agreement would be concluded at the last moment. Nonetheless, if news emerged that a deal was signed today, the pound could break above 1.3565, which will make it easier for the quote to reach the 37th figure, in particular, price levels 1.3750 and 1.3810. A decline in the pound is not expected, but if it happens, GBP / USD might return to 1.3475, and then go below 1.3475. In such a case, the closest support levels will be 1.3310 and 1.3190.  EUR: The latest data on US jobless claims were not much different from the figures last week, which confirms that economic recovery in the country is slowing. The report released by the US Department of Labor said initial jobless claims for the week of December 13-19 was 803,000, up from 892,000 in the previous week. It is clear that the new restrictions that state authorities have implemented are negatively affecting the state of the US labor market. With regards to the highly-anticipated bailout bill, yesterday, Donald Trump did not sign it, and instead called on lawmakers to increase the amount of direct benefits to $ 2,000. He said the $ 600 that the Congress has approved is absurdly small and needs to be increased to 2,000 per person, or 4,000 per couple. Legislators were clearly not prepared for this, which led to the strengthening of the US dollar against the euro and the British pound.  House Speaker Nancy Pelosi was quick to respond to this call, however, according to House Minority Leader Kevin McCarthy, the attempt to pass such a legislation will fail. And if the attempt to raise benefits is unsuccessful, then, most likely, a new bill will be brought up for discussion. The new law will provide for larger incentive payments. However, its introduction does not ensure its approval. In another note, a report on the personal spending of Americans was released yesterday, which fell much more than economists expected. It seems that this November, US households were more cautious about their spending, thereby leading to reduced spending for the first time in six months. Household incomes also fell sharply. According to the data, personal spending fell 0.4% in November, and at the same time, household incomes dropped by 1.1%. This low consumer spending will surely affect the growth prospects of the US economy negatively, as they are the main driver of its growth.  Consumer sentiment in the US also declined, dropping to only 80.7 points in December, lower than its preliminary value of 81.4 points. Economists expected the final reading to be 81.0. Sales in the US primary housing market also fell, decreasing by 11.0% and amounting to 841,000 homes per year. Meanwhile, economists expected an increase to 990,000. As for the technical picture of the EUR / USD pair, the situation has not changed much, but the breakout of 1.2175 is likely to increase pressure on risky assets, as such would form a new downward wave and completely reverse the current upward trend. In addition, there is a high chance that traders will take profits at the end of this year, so the euro may collapse further to 1.2080 and 1.2040. EUR / USD will grow only if the quote consolidates above 1.2220, after which it will head to 1.2260 and 1.2310. EUR/USD. Waiting for denouement: focus on Johnson's press conference 2020-12-24 The euro-dollar pair continues to hold the defense on the eve of the Christmas weekend, clinging to the 22nd figure. By and large, traders found themselves in a stalemate against the background of an extremely contradictory fundamental picture. On one side of the scale – optimism about the prospects of Brexit and weak US macroeconomic reports, on the other side – Trump's obstinacy regarding the new stimulus package, new strains of coronavirus and low market liquidity. On the one hand, all these fundamental factors do not make it possible for EUR/USD buyers to bring back the growth trend, on the other hand, it also does not allow sellers to go below the 1.2100 level. As a result, the pair is marking time on the border of 21 and 22 figures. The dollar index is still staying above the 90th mark, but dollar bulls are no longer showing the same ambitions that they had at the beginning of this week. Market participants are not ready to invest in the dollar, considering the greenback as a temporary ally in troubled times. Moreover, the latest macroeconomic reports leave much to be desired.

For example, yesterday, the core PCE Price Index was published during the US session, which measures the core level of spending and indirectly affects the dynamics of US inflation. It is believed that the members of the Federal Reserve carefully monitor this indicator. On a monthly basis, it fell to zero (the worst result since April this year), and on an annual basis – slowed to 1.4% (with a forecast of growth to 1.6%). The level of income of the population also fell to -1.1% in November (a three-month low). All of the above indicators came out in the red zone, falling short of the forecast values. The rate of initial applications for unemployment benefits continues to disappoint. This weekly indicator steadily declined from the beginning of September to November, reflecting the healthy trends in the US labor market. However, against the background of the second wave of the coronavirus crisis, the number of applications for benefits began to grow – since the beginning of December, this figure has been kept above the 800,000 mark. All this suggests that the final Nonfarm report for this year will be a complete disappointment. The Philadelphia Fed Manufacturing Index for December, published on Tuesday, was not impressive either. The indicator, which is based on a survey of manufacturing companies in the region, came out at around 19 points with the forecast of growth to the 21st. Bad news also came from the US real estate market: home sales in the primary market plummeted 11% in November - the worst result since March, when the United States saw the peak of the coronavirus crisis. In the secondary market, sales fell to -2.5% (an increase of 4.4% was recorded in October). Analysts expected negative dynamics (the forecast was at the level of -1.1%), but the real figures turned out to be worse than expected - at a half-year low. In other words, the latest macroeconomic reports have once again reminded traders of the consequences of the second wave of the coronavirus pandemic in the United States. The above-mentioned releases weighed on the US currency. Optimism regarding the prospects for Brexit is also weighing on the dollar. According to rumors, the parties still came to a compromise solution and are ready to conclude a trade deal today. Against the background of such prospects, investors' interest in protective assets has significantly decreased. However, at the moment, no one can speak with certainty about how the Brexit epic will end. Today, at approximately 11:00 (London time), British Prime Minister Boris Johnson will make a statement on the results of the latest round of negotiations. We do not know whether he will announce a deal or admit to a fiasco. The ongoing intrigue does not allow either the bulls or the bears to feel confident.

The prospects for a new aid package for the US economy also remain uncertain. The fact is that Donald Trump said that he would not sign the bill on measures to support the population, previously approved by the US Congress, if it is not amended. He called the document itself a "disgrace" and demanded a three-fold increase in the amount of social payments. By the way, Trump vetoed the bill on the military budget (worth $740 billion), despite the significant support of this document in Congress. In response to this decision, the speaker of the House of Representatives said that the presidential veto would be overcome by a second vote. However, the same maneuver with a new package of incentives, most likely, will not work: there will not be enough votes. Therefore, the situation will float around until the beginning of next year: Trump will leave office on January 20, when president-elect Joe Biden will be sworn in. This factor keeps dollar bulls in good shape. Thus, the fundamental background for EUR/USD is contradictory. Trading decisions on the pair can only be made based on the results of today's press conference by Boris Johnson. Despite the optimistic expectations, no one can say with certainty in which direction the pendulum will swing (according to rumors, the negotiations continued all night and are currently ongoing). If the parties manage to conclude a deal, then the euro will receive significant support against the dollar – we can talk about reaching the resistance level of 1.2277 (2.5-year high reached last week). Otherwise, bears of the pair will seize the initiative again, pulling down the price to a low of 1.2130 (the middle line of the Bollinger Bands on the daily chart).

Author's today's articles: Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. l Kolesnikova  text text Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Stanislav Polyanskiy  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Alexandr Davidov  No data No data Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Pavel Vlasov  No data No data Irina Manzenko  Irina Manzenko Irina Manzenko

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.  text

text  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.

Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.  No data

No data  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). No data

No data  Irina Manzenko

Irina Manzenko

No comments:

Post a Comment