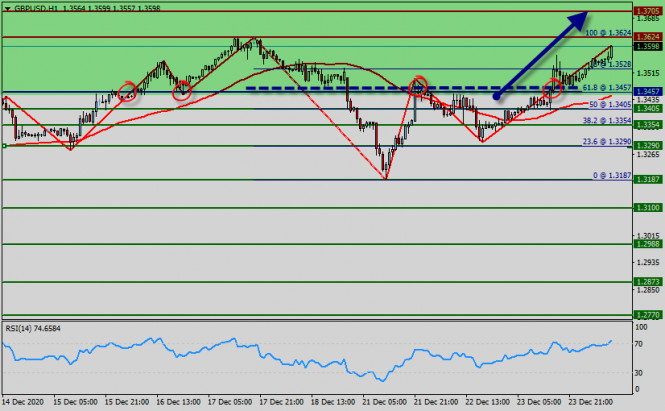

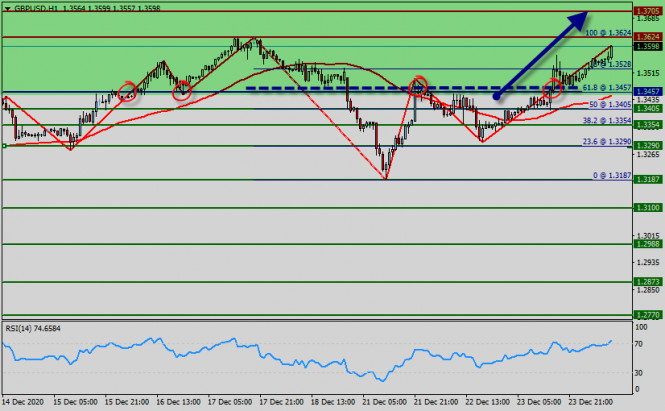

| Technical analysis of GBP/USD for December 24, 2020 2020-12-24  Overview : British Pound / U.S. Dollar The momentum seems strong enough to push the pair further beyond the 1.3624 mark, towards testing last week's swing highs, around the 1.3624 region. The market called for a very bullish price action. Overall bullish market about to rush towards previous highs. Further close above the high end may cause a rally towards 1.3624. Nonetheless, the weekly resistance level and zone should be considered. The GBP/USD pair continues to move upwards from the level of 1.3457. Today, the first support level is currently seen at 1.3457, the price is moving in a bullish channel now. Besides, the price has set above the strong support at the level of 1.3457, which coincides with the 61.8% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend. According to the previous events, we expect the GBP/USD pair to trade between 1.3457 and 1.3705. So, the support stands at 1.3457, while daily resistance is found at 1.3624. Therefore, the market is likely to show signs of a bullish trend around the spot of 1.3528. As result, the price spot of 1.3457/1.3528 remains a significant support region. Consequently, there is a possibility that the GBP/USD pair will move upside and the structure of a fall does not look corrective. In order to indicate the bearish opportunity above the levels of 1.3457 and 1.3528, buy above below 1.3457 or 1.3528 with the first target at 1.3624 in order to test last week's top. Additionally, if the GBP/USD pair is able to break out the top at 1.3624, the market will decline further to 1.3705 so as to test the weekly resistance 21 in coming 48 hours. However, if the GBP/USD pair fails to break through the resistance level of 1.3624 today, the market will decline further to 1.3457. EUR/USD. December 24. COT report. Trump vetoes defense budget and refuses to sign economic aid package 2020-12-24 EUR/USD – 1H.

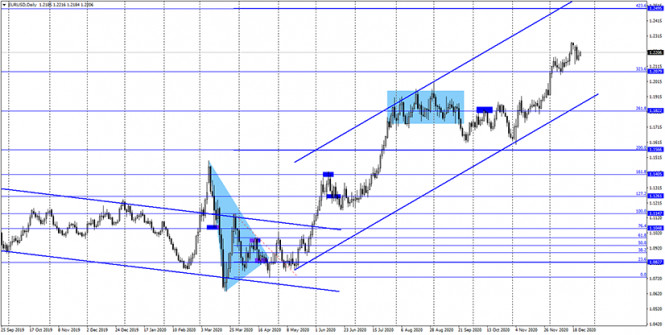

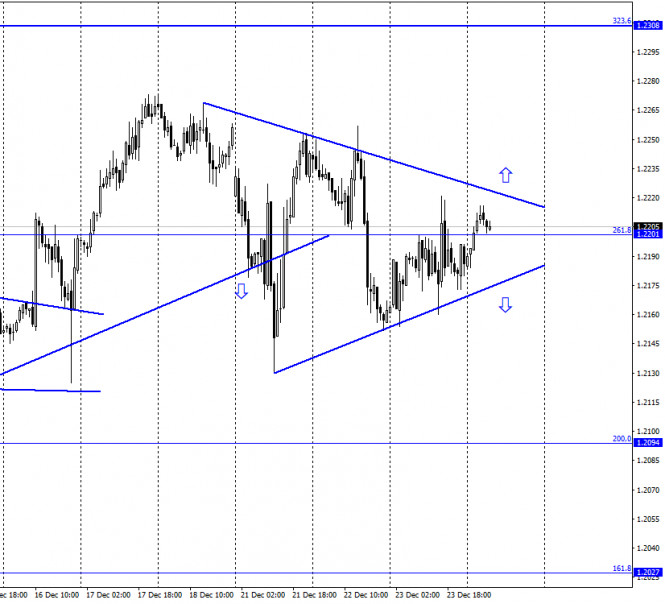

On December 24, the EUR/USD pair performed a rebound from the lower trend line, a reversal in favor of the European currency, and began a new growth process in the direction of the upper trend line. The rebound of quotes from this line will work in favor of the US dollar and some fall back to the lower trend line. Fixing the pair's rate above the upper trend line will increase the probability of further growth in the direction of the corrective level of 323.6% (1.2308). Meanwhile, the Christmas and New Year holidays are approaching, so there is less news, and there will be no economic reports at all today or tomorrow. Perhaps the most interesting and significant event of recent days was the refusal of Donald Trump to sign a package of assistance to the American economy totaling $ 900 billion. The US President called the amount of assistance to American citizens and the unemployed in this package "pathetic" and demanded to increase payments from $ 600 to 2 or even 4 thousand dollars. It is not yet known whether the Democrats will make such concessions, although most likely they will not. Let me remind you that in the fall, Democrats and Republicans discussed the aid package for several months, and then the Democrats insisted on a larger package of measures, totaling more than $ 2 trillion. Now, Donald Trump is pushing for an increase in the aid package. It's all like a political game. Also, Donald Trump blocked the US defense budget, which provides for an increase in salaries for military personnel and 740 billion for various military programs and construction. EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the European currency, but in general, they are trading between the corrective level of 200.0% (1.2353) and the upward trend line, which keeps the current mood of traders "bullish". Thus, on this chart, it is impossible to conclude the end of the upward trend. I believe that it is better now to analyze an hourly schedule, where you can track changes more quickly. EUR/USD – Daily.

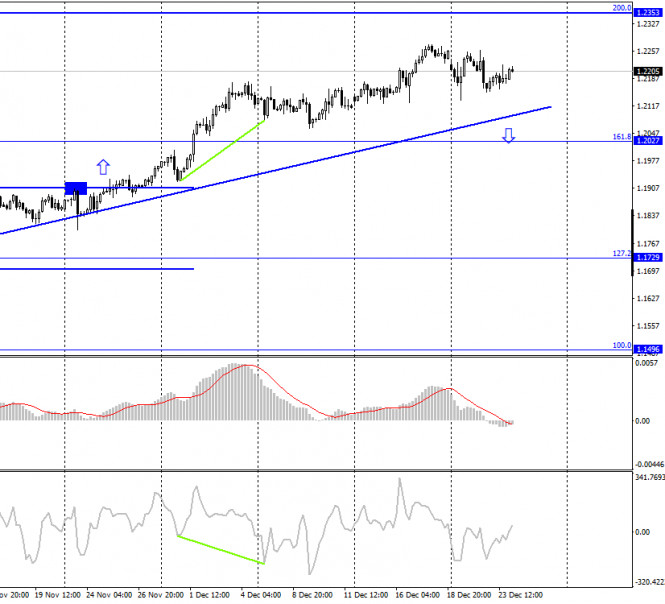

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are still high chances of growth. EUR/USD – Weekly.

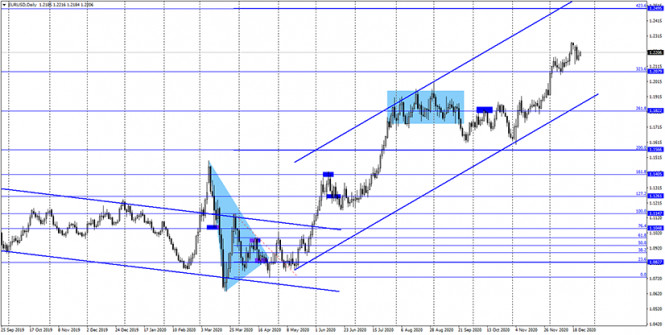

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term. Overview of fundamentals: On December 23, a report on orders for durable goods was released in the United States, which slightly exceeded traders' expectations. The report on applications for unemployment benefits also turned out to be better than traders expected. However, the US currency is still growing with great difficulty. News calendar for the United States and the European Union: On December 24, there will be no reports and news in America and the European Union. The information background will be absent today. Many institutions go on Christmas holidays. COT (Commitments of Traders) report:

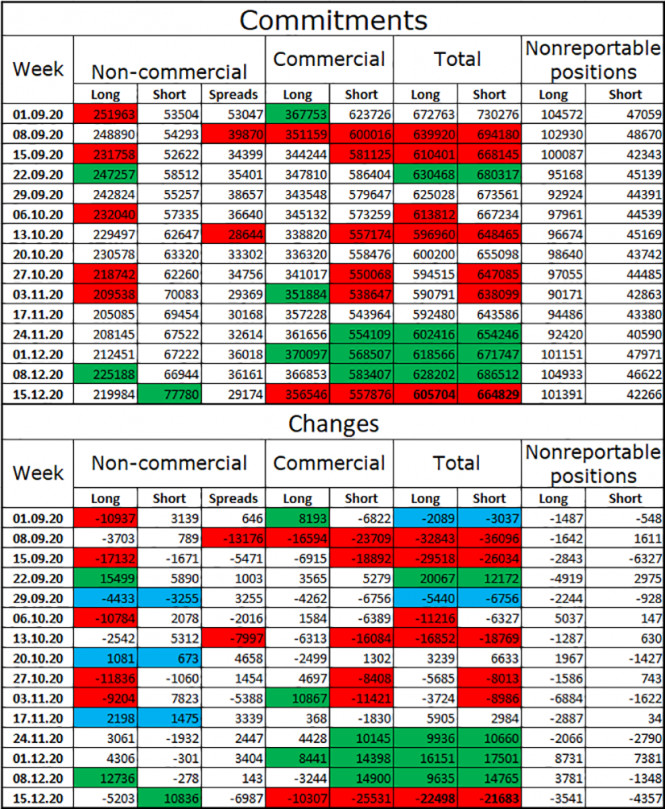

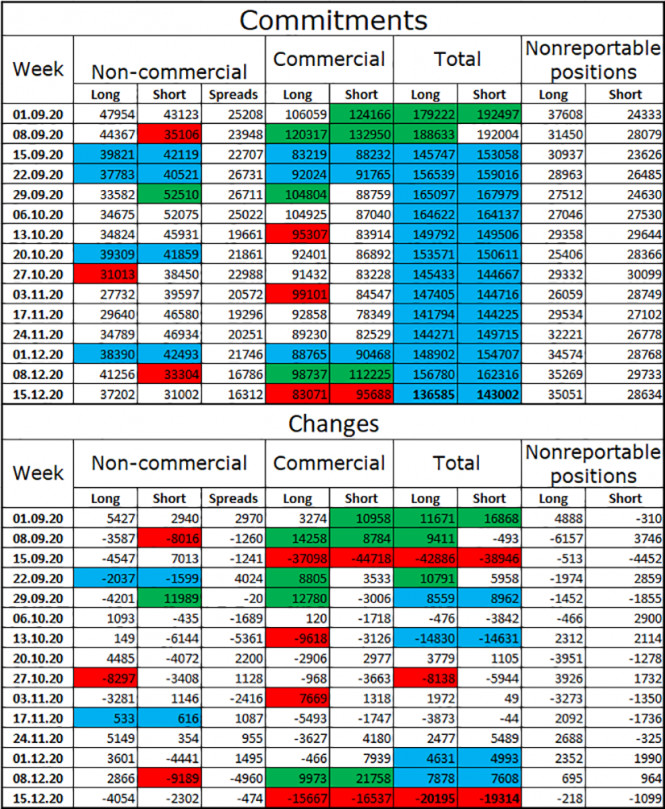

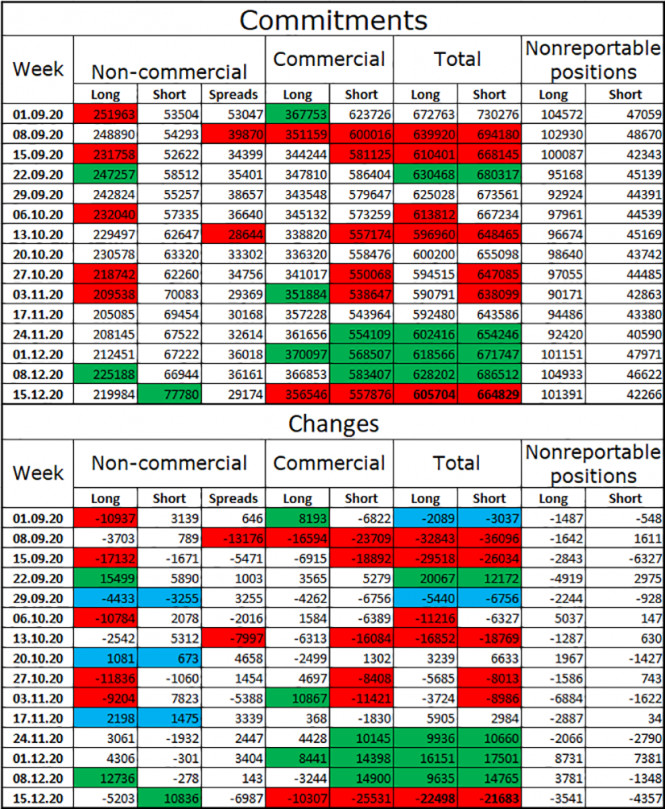

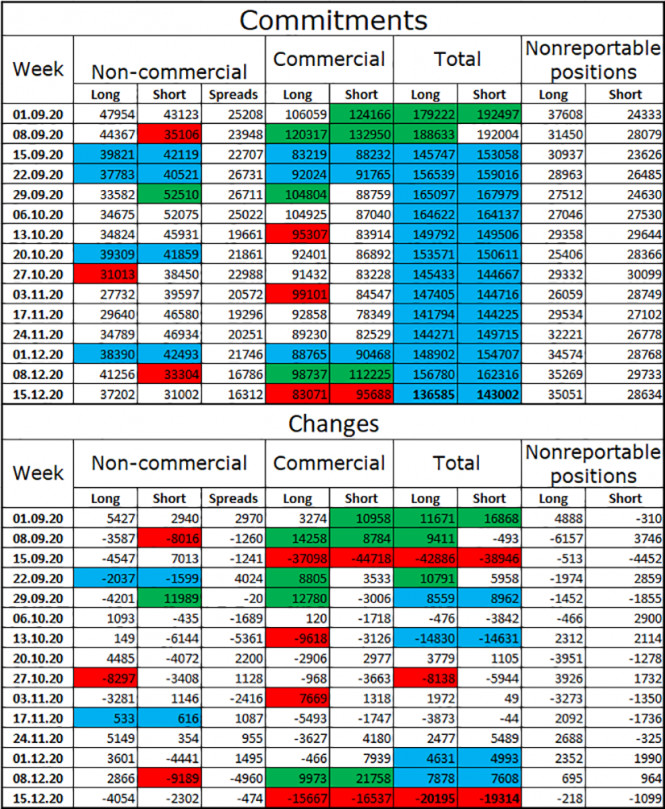

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was indicated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately fall. The latest COT report shows that speculators are once again preparing for the fall of the euro currency, or at least for the end of its growth. EUR/USD forecast and recommendations for traders: Today, I recommend selling the euro in case of a rebound from the upper trend line or in case of consolidation under the lower trend line on the hourly chart. New purchases of the pair can be opened with a target of 1.2308 when the quotes are fixed above the descending trend line on the hourly chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. GBP/USD. December 24. COT report. Traders react to information about the signing of the agreement and wait for official confirmation 2020-12-24 GBP/USD – 1H.

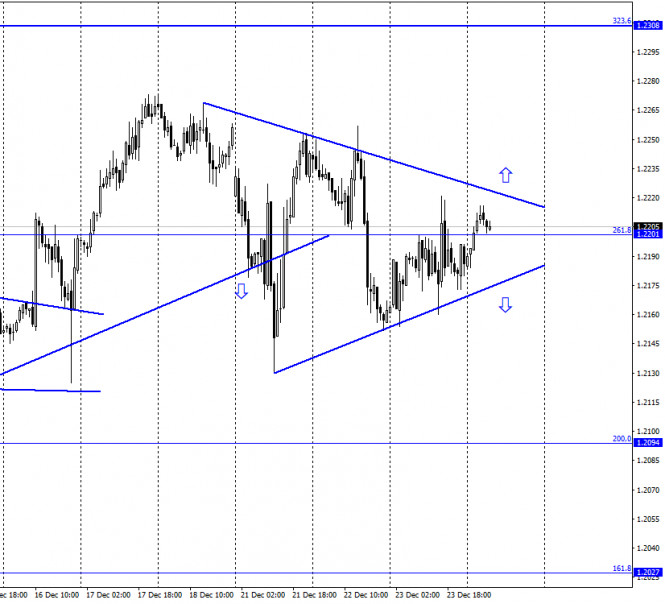

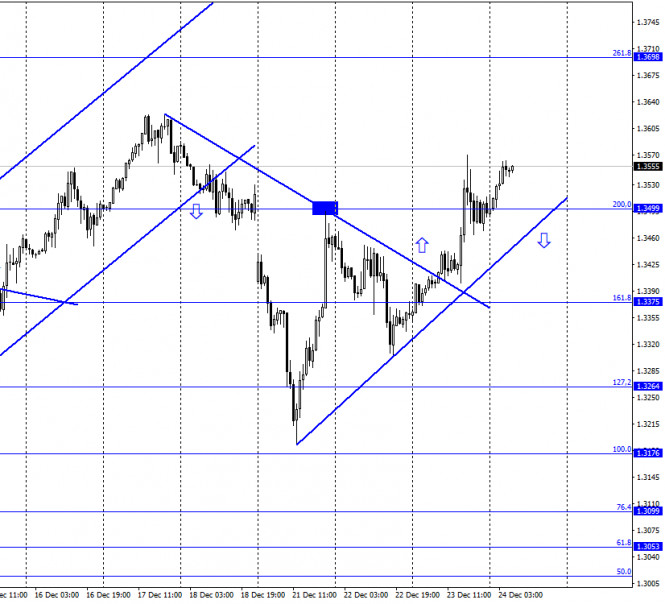

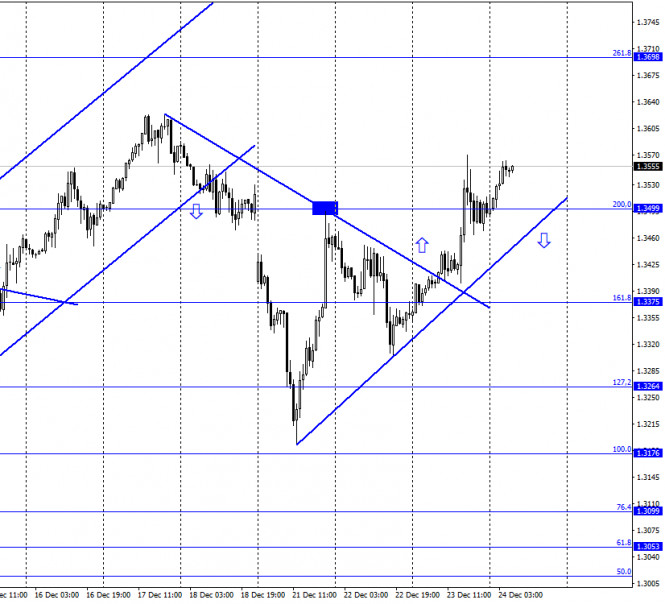

According to the hourly chart, the quotes of the GBP/USD pair continue the growth process and have consolidated above the corrective level of 200.0% (1.3499). Thus, the growth process can be continued in the direction of the next corrective level of 261.8% (1.3698). The upward trend line keeps the current mood of traders "bullish". Meanwhile, London and Brussels seem to have finally agreed on the terms of the UK's withdrawal agreement. At least in the course of yesterday, information was received from two sources at once that the parties had agreed that the deal was ready. However, there is still no official information confirming this. No comment from Ursula von der Leyen or Boris Johnson. It should also be noted that information about the agreement was received from journalists, and everyone knows that this kind of information is not always true. Nevertheless, traders believed it, and the British dollar is growing again. "It looks like the agreement pretty much exists. The question is, when will it be announced, today or tomorrow?" said an unnamed senior official in the European Union. I want to remind you that only the negotiating teams and the head of the European Commission with the British Prime Minister know all the terms of the deal. Thus, possibly, the current version of the deal will not suit someone in the European Union or the UK Parliament, which blocked the agreement with the EU three times during the time of Theresa May. Now the composition of the Parliament is different, the majority in it are conservatives, so if the deal suits Johnson, then the Parliament will vote for it. GBP/USD – 4H.

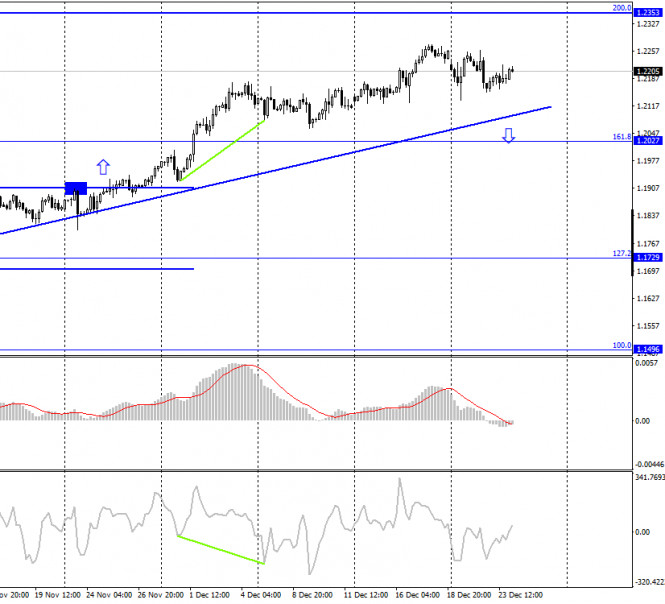

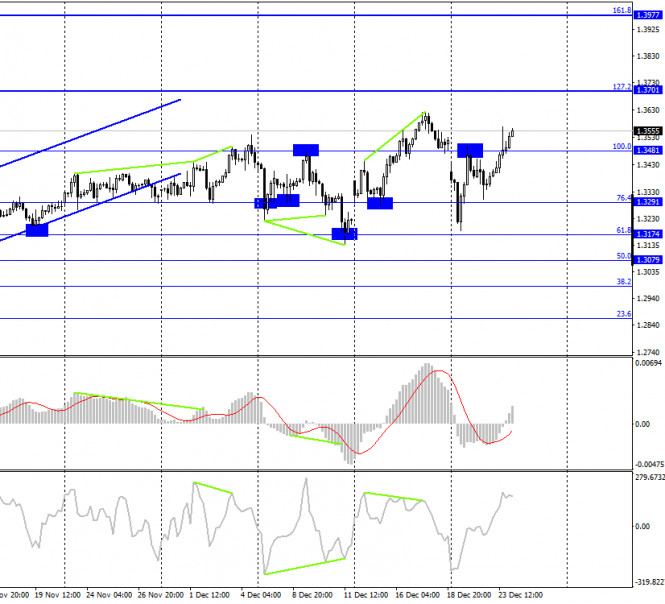

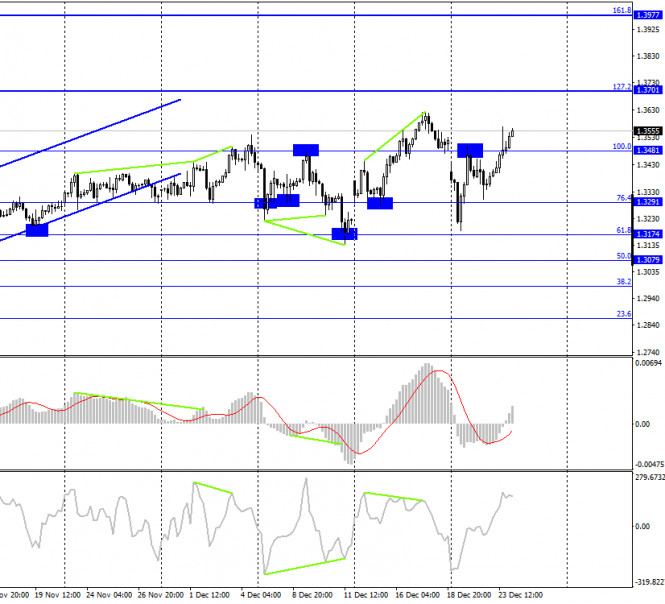

On the 4-hour chart, the GBP/USD pair has consolidated above the corrective level of 100.0% (1.3481) and continues the growth process in the direction of the next Fibo level of 127.2% (1.3701). Today, the divergence is not observed in any indicator. GBP/USD – Daily.

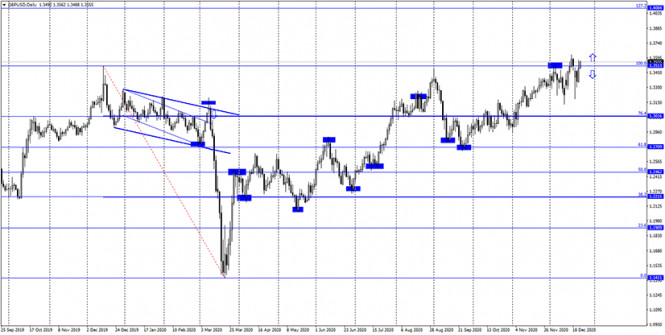

On the daily chart, the pair's quotes performed a consolidation under the corrective level of 100.0% (1.3513), which now increases the probability of a new fall with the goal of the Fibo level of 76.4% (1.3016). Fixing above the level of 100.0% will again work in favor of the British currency. GBP/USD – Weekly.

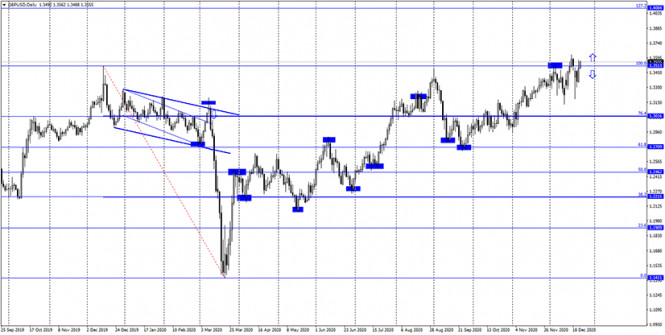

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes. News overview: There were no economic reports in the UK on Wednesday, however, the pound continued the growth process. The economic calendar for the US and the UK: On December 24, the calendar of economic events in the UK and the US is empty, however, the information background will still be strong, as today or tomorrow the achievement of a free trade agreement between the UK and the European Union may be officially announced. COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. This again suggests that traders are afraid of the British and the information background. It is extremely difficult to predict what will happen to the UK economy in 2021. Therefore, the "Non-commercial" category of traders prefers to close trades rather than open new ones. This time, speculators closed 4 thousand long contracts and 2.5 thousand short contracts. Thus, the mood of speculators has become much less "bullish". At the same time, the British continued the growth process, thus, I can draw the same conclusion as for the euro. Major traders are preparing for a new fall in the pound sterling. GBP/USD forecast and recommendations for traders: Purchases of the British dollar could be opened by fixing quotes above the descending trend line on the hourly chart, now the target has changed - the level of 1.3698. I recommend selling the pound sterling when it is fixed under the ascending trend line on the hourly chart with a target of 1.3375. "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. Trading plan for the EUR/USD pair on December 24. Markets are closing tomorrow. 2020-12-24

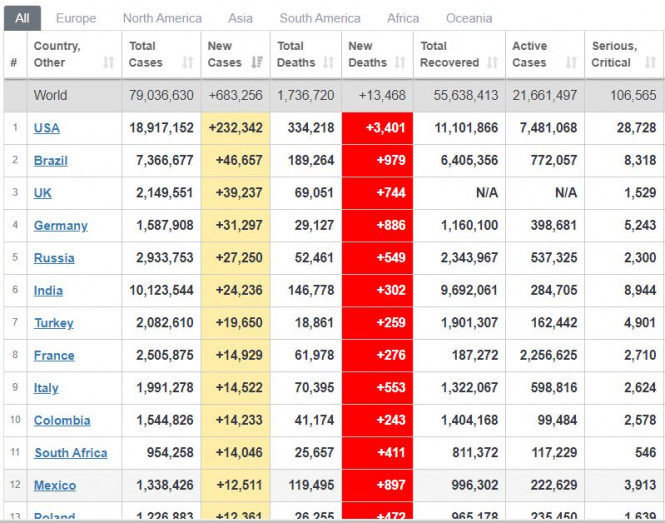

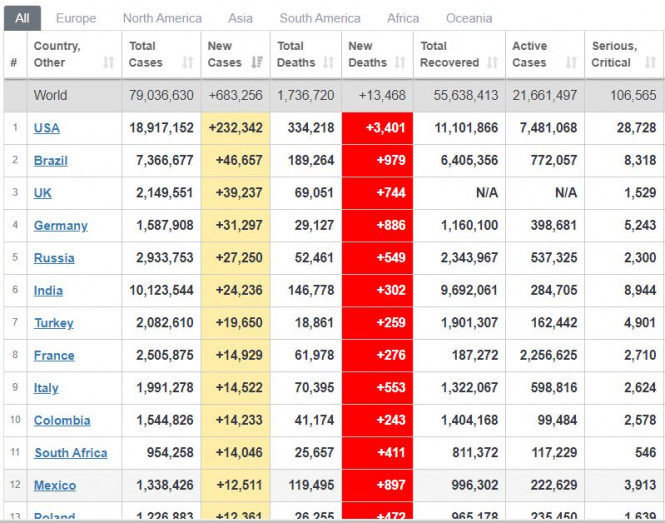

Once again, global COVID-19 incidence increased, reaching 683,000 yesterday, but is below the recorded peak, which is somehow a good sign. In the United States, new cases to 232,000, while deaths hit 3.4 thousand. Growth was observed in Europe as well, with the UK listing 39,000 new cases, followed by Germany who recorded 31,000 new infections. Sadly, an increase occurred even amid tougher quarantine measures. Nonetheless, vaccinations are active both in the US and the UK, and Europe will soon begin mass vaccinations (on December 27).

EUR/USD - markets are closed on December 25 (Christmas Day). Yesterday, economic reports from the US came out weak: employment slowed to 200,000, while revenues dropped by 1.1%. Inflation, meanwhile, came out at 0%. Open long positions from 1.2190. Open short positions from 1.2130. Trading idea for gold 2020-12-24  Gold has stopped at a very interesting level , that is, in 1854, where gold bulls have placed their stop orders.  Taking this into account, the most profitable transactions in the market are short positions, as such would bring the quote down towards our target price level.  In particular, sell gold from 1885, in order to get a price drop to 1854. Such is a classic trap that traders occasionally set up, which you shouldn't miss the chance to make profit, especially since it has a risk/profit ratio of 3:1. Of course, traders have to closely monitor the risks to avoid losing money. Trading in this market is precarious, but also very profitable as long as you use the right approach. Price Action and Stop Hunting were used for this trading strategy. Good luck! EUR/USD analysis for December 24 2020 - Risin trendline and potential for the rally towards 1.2215 2020-12-24 Brexit: Still waiting on a deal to be announced Not much else happening at this point as the UK and EU are still finalising a Brexit trade agreement No change to the narrative besides some last-minute hitch to fisheries, but that will surely be resolved one way or another as the political will is certainly there. Both sides will want to get this out of the way before the Christmas break and hopefully before the evening today but there's no promises for how long this "delay" may be. The announcement is imminent and the pound is looking a little anxious, though thinner market conditions may also be a factor. Cable still sitting around 1.3585 after testing 1.3600 earlier, trading up by nearly 100 pips on the day currently. I'll stick around for a bit more in case there's anything but if not, I'd like to wish everyone a Merry Christmas and happy holidays! To those already off on an extended break, I wish you a very happy new year as well and may 2021 promise to be a better year! Further Development

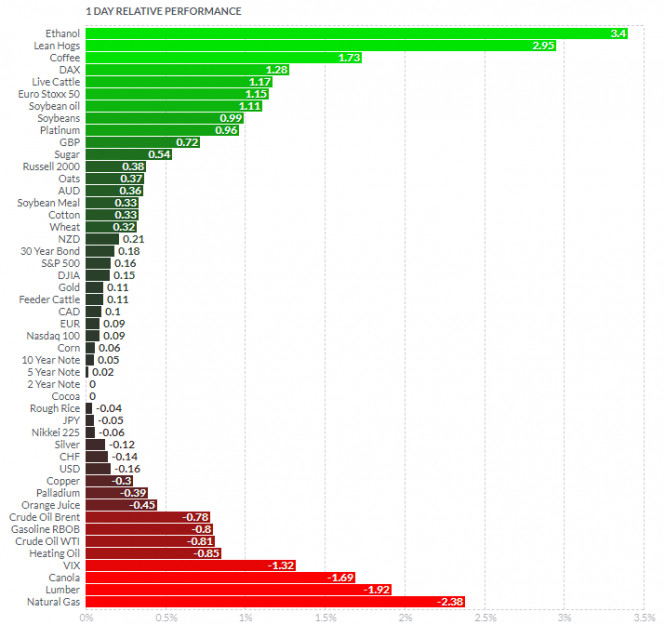

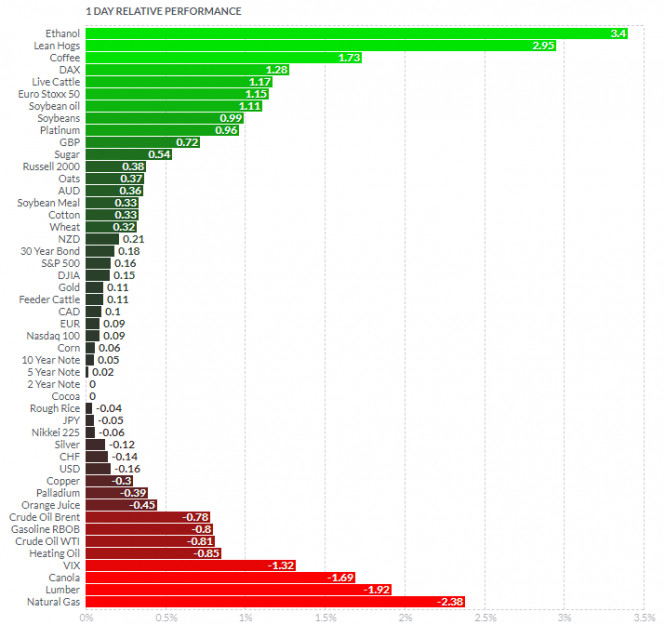

Analyzing the current trading chart of EUR/USD, I found that there is the rising treeline active and potential for the bullish flag pattern to complete, which is sign for the further potential rise.... 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lean Hogs today and on the bottom Natural Gas and Lumber. EUR is slightly positive for today.... Key Levels: Resistance: 1,2215 and 1,2254 Support levels: 1,2173 and 1,2160 Analysis of Gold for December 24,.2020 - Successful Test of the rising trendline and potetnial for the rally towards $1.906 2020-12-24 BOJ's Kuroda: Don't see need to change yield curve control in upcoming policy examination If there is room for improvement in making policy more effective and sustainable, we will put such steps into place - BOJ will examine whether various tools, including YCC operation and asset purchases, are having their intended effects

- Hopes to conduct policy examination in a forward-looking manner and find ways to more effectively achieve economic and price stability

Much like what the ECB is doing with its strategic review, the BOJ will also undergo a thorough examination of its policy framework and release its findings in March next year. That said, I wouldn't expect any major change to follow - particularly since they have already expressed clearly their 'overshoot' commitment (similar to the Fed).

Further Development

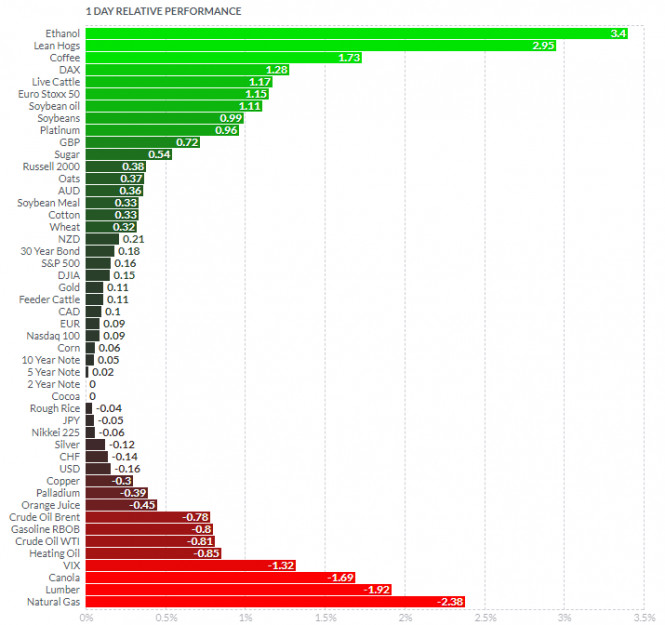

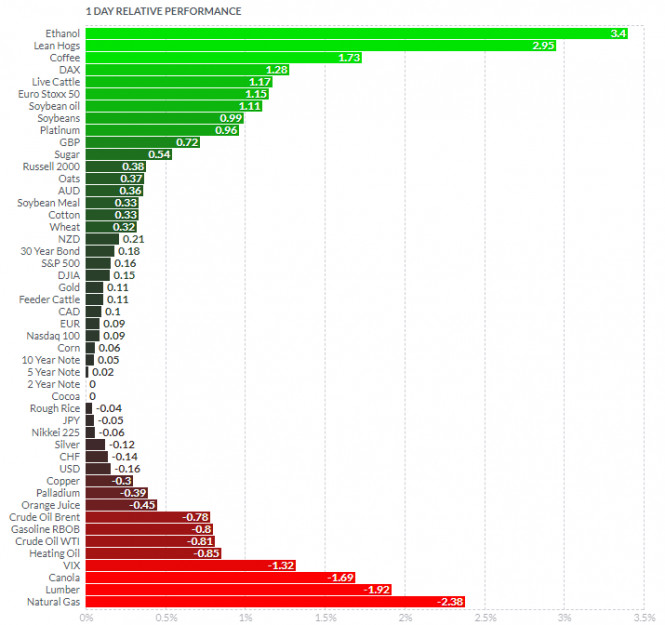

Analyzing the current trading chart of Gold, I found that there is the rising ttrendline active and potential for the bullish continuation as I wrote yesterday. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lean Hogs today and on the bottom Natural Gas and Lumber. Gold is slightly positive for today.... Key Levels: Resistances: $1,884 and $1,906 Support levels: $1,860 and $1,855

Author's today's articles: Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Grigory Sokolov  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Mihail Makarov  - - Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker

Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker  -

-  Andrey Shevchenko

Andrey Shevchenko  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment