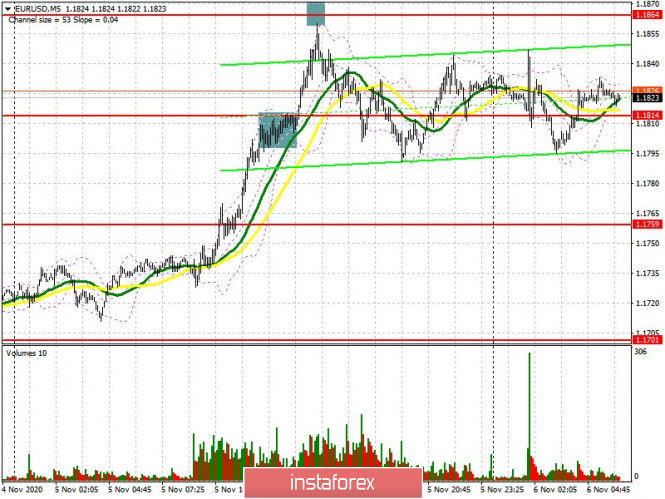

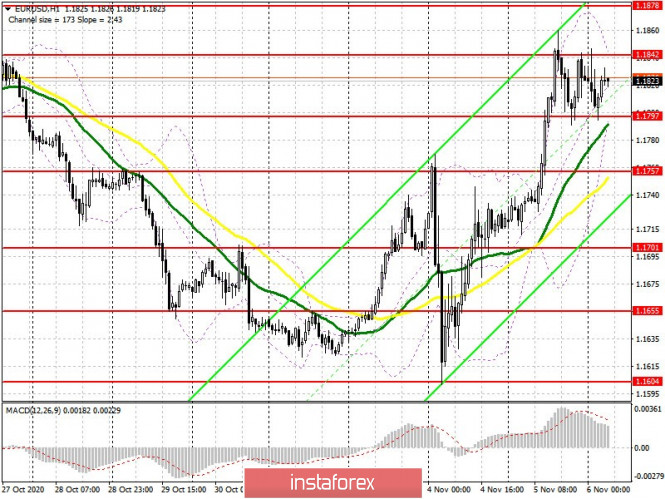

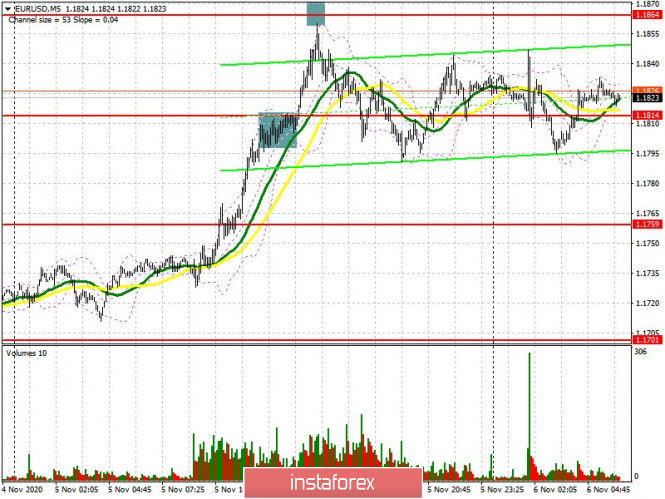

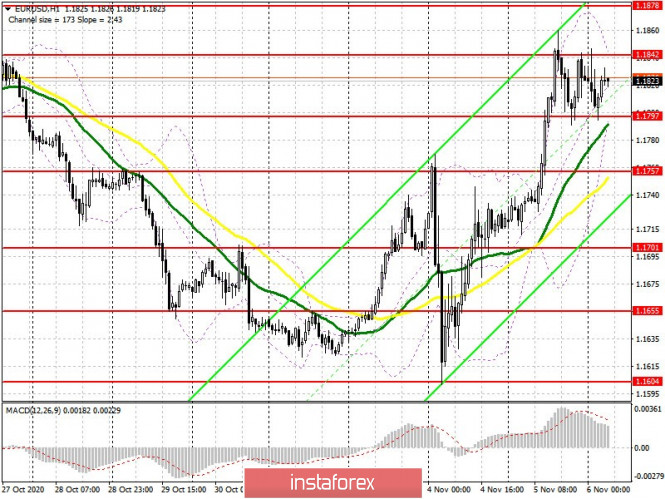

| EUR/USD: plan for the European session on November 6. COT reports. Euro buyers have reached very important levels 2020-11-06 To open long positions on EUR/USD, you need: I mentioned placing buy positions above 1.1814 and selling from a large high yesterday afternoon, which is what happened. Let's take a look at the 5-minute chart and break down the entry points. After the pair began to slowly exert pressure on the 1.1814 level in the afternoon, its breakdown took place, which caused EUR/USD to rise by 60 points. We had the same signal in the morning after the breakout of 1.1765. Short positions immediately on the rebound from the resistance of 1.1864 were also absolutely correct. But the pair was just a couple of points short of reaching this high, so I personally missed this deal.  Buyers are currently focused on going beyond the 1.1842 high and there are plenty of reasons for that today. The intrigue of winning the US presidential election remains, but Biden has an advantage, so a breakout and getting the pair to settle above 1.1842 is a signal to open long positions in hopes of reaching highs of 1.1878 and 1.1915, where I recommend taking profits. The US labor market report will be released in the afternoon, which could return the demand for the US dollar. Therefore, in case the pair falls, a false breakout in the support area of 1.1797, where the moving averages pass playing on the side of buyers, will be a signal to open long positions. I advise you to buy EUR/USD immediately on a rebound only from a low of 1.1757, counting on a rebound of 15-20 points within a day. To open short positions on EUR/USD, you need: Sellers need to protect resistance at 1.1842, as well as the larger level of 1.1878, when tested, a divergence may form on the MACD indicator, which will lead to forming a downward correction for the pair. Forming a false breakout at 1.1842 will also be a signal to open short positions. A more important task for euro sellers is to go beyond and settle below support at 1.1797. Testing it from the other side forms a fairly good sell signal in hopes to fall to a low of 1.1757. Support at 1.1701 will be the next goal, which is where I recommend taking profit. Many important fundamental reports will be released today, including the data that everyone is waiting for - the results of the US elections, so volatility promises to be very large. So don't forget to place stop orders.  The Commitment of Traders (COT) report for October 27 showed a reduction in both long and short positions. Despite this, buyers of risky assets believe that the bull market will continue and so they prefer to act with caution. Thus, long non-commercial positions fell from 229,878 to 217,443, while short non-commercial positions also fell to 61,888 from 63,935. The total non-commercial net position decreased to 155,555 from 165,943 a week earlier. However, the bullish sentiments for the euro remains rather high in the medium term. The more the euro will decline against the US dollar at the end of this year, the more attractive it will be for new investors, especially following the US presidential elections, when additional pressure on the market on this issue eases. Indicator signals: Moving averages Trading is carried out above 30 and 50 moving averages, which indicates continued growth in the euro. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the upper border of the indicator around 1.1845 will lead to a new wave of euro growth. A breakout of the lower border of the indicator around 1.1797 will increase the pressure on the pair. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

Technical Analysis of GBP/USD for November 6, 2020 2020-11-06 Technical Market Outlook: The GBP/USD pair keeps making the up and down swings inside of the trading range as the votes of the presidential elections in the USA are still being collected. Nevertheless, the outlook is now leaning towards bullish side as the recent local top was made at the level of 1.3155, just below the technical resistance located at 1.3169. The momentum is strong and positive, so it supports the short term bullish outlook. On the other hand, only a sustained violation of the long-term trend line will indicate more bearish pressure that can push the prices to the level of 1.2868, 1.2848 or even 1.2816. Weekly Pivot Points: WR3 - 1.3236 WR2 - 1.3153 WR1 - 1.3037 Weekly Pivot - 1.2956 WS1 - 1.2835 WS2 - 1.2757 WS3 - 1.2653 Trading Recommendations: The GBP/USD pair is in the down trend on the monthly time frame, but the recent bounce from the low at 1.1411 made in the middle of March 2020 looks very strong and might be a reversal swing. In order to confirm the trend change, the bulls have to break through the technical resistance seen at the level of 1.3518. All the local corrections should be used to enter a buy orders as long as the level of 1.2674 is not broken.

EUR/USD. USD rate decline, as Biden's victory is likely 2020-11-06 The US dollar index continues to decline for three consecutive days, showing the strong decline since the huge sell-off of the USD during spring, when COVID-19 started to spread in the US. The price of the US dollar are directly relative to Mr. Biden's likelihood of winning the presidential race. So, the clearer the victory of the Democratic leader becomes, the more the US dollar declines. The point here is not that dollar bulls have any "personal claims" to Biden (it's too early to say), it's just that market participants overthink too much about possible political disputes and a prolonged political crisis before the elections. Nevertheless, it looks like the uncertainty period will be relatively temporary, as the Democrat's victory becomes more clear.

On the other hand, Mr. Trump's reaction is predictable: he continues to file lawsuits in district courts, claiming that they cheated their way to the White House. However, his steps have yet to succeed: there are at least two state courts (Georgia and Michigan) that have already rejected his claims to suspend the counting of votes. In this regard, Republican lawyers are now preparing for litigation at the Federal level, but many observers believe that this initiative is also unpromising. Experts say that possible violations (even if they are established in court) are not systemic and so, cannot distort the results of the expression of will. In short, most lawyers are sure that Trump will not be able to repeat the legal move of his fellow party member Bush Jr., who won the presidential race 20 years ago with the help of the US Supreme Court. In the meantime, votes are still counted in the so-called "wavering" States. According to the election campaign staff, the determination of the final election results may take several days. There are around 285 thousand ballots which are not yet counted. The major share of them (205 thousand) are ballots that came by mail. According to the FOX News channel, J. Biden needs only six electoral votes to win, while Trump needs 56 electors. There are no clear favorites in the wavering states – Biden and Trump go head-to-head. However, the currency market has already made its own conclusions, appointing Mr. Biden as the next US president. These conclusions are not illogical. First, based on the calculations of FOX News, Biden only needs just 6 votes in just one state (except Alaska) to be elected. For example, he is in the lead in both states of Arizona and Nevada, where 90% of the votes have already been counted, and victory in only one of them will lead to a complete victory. Secondly, a large number of uncounted "mail votes" speak in favor of Biden. According to American sociologists, the majority of supporters of the Democratic Party took advantage of remote voting, so the remaining ballots can only strengthen Joe Biden's position. In view of such conclusions, the price of the US dollar continues to decline, as traders saw how the situation will end, and the period of political uncertainty was not so long. As soon as Biden reaches the "270" mark, the USD will receive an additional impulse to its decline, which will affect the key currency pairs of the "major group". Moreover, its devaluation is also due to a widespread decline in Treasury yields, with the spread between benchmark 10-and 2-year debt narrowing to the narrowest level in the past month. The November Fed meeting remained in the shadow of high-profile political disputes. Although in this case, the market's weak reaction is quite justified: this year's penultimate meeting turned out to be ignored. Many points made were already said at previous meetings, while Mr. Powell did not give any specifics about the future prospects for monetary policy. The regulator o focused on the weakening pace of the US economic recovery again, linking this to the increase in the number of cases of COVID-19 in the US. In this context, Jerome Powell noted the high uncertainty for the economy. The Fed also hinted at further easing of monetary policy, however, without specifying any details. They only said that all opportunities to support the economy are not used up. At the same time, he again called the attention of congressmen to adopt a new package of measures to stimulate the economy. In other words, Powell's rhetoric at the November meeting was almost the same to his previous statements.

Therefore, the US elections remain to be the focus. If the chances of Biden's election continue to grow, the US dollar will continue to decline. On the contrary, if Trump begins to close the gap, the same currency will rise again. If we talk directly about the EUR/USD pair, then long positions are still a priority. The pair broke through the resistance level of 1.1780 yesterday (the upper limit of the Kumo cloud, coinciding with the middle line of the Bollinger Bands indicator on the daily TF), and the Ichimoku indicator, in turn, formed a bullish "Parade line" signal, confirming the strength of the upward impulse. The main goal to rise is the level of 1.1900, which is the Bollinger Bands line in the same time frame. Technical Analysis of EUR/USD for November 6, 2020 2020-11-06 Technical Market Outlook: The US presidential elections result is still uncertain and the volatility on all US Dollar pairs has increased. After the EUR/USD pair had made another local low at the level of 1.1602, the price bounced towards the new local high seen at the level of 1.1744, broke this level and went higher towards the next target at 1.1822. This level was violated as well and the new local high was made at 1.1859. The market is now consolidating the recent gains in a Triangle pattern. The momentum is positive and the market conditions at the H4 time frame chart are bouncing from the extremely oversold levels, so please keep an eye on the up trend continuation after the Triangle breakout. The next technical resistance is seen at the level of 1.1879. Weekly Pivot Points: WR3 - 1.1974 WR2 - 1.1916 WR1 - 1.1756 Weekly Pivot - 1.1698 WS1 - 1.1531 WS2 - 1.1471 WS3 - 1.1314 Trading Recommendations: Since the middle of March 2020 the main trend is on EUR/USD pair has been up, which can be confirmed by almost 10 weekly up candles on the weekly time frame chart and 4 monthly up candles on the monthly time frame chart. The recent correction towards the level of 1.1612 seems to be completed and now market is ready for another wave up. This means any local corrections should be used to buy the dips until the key technical support is broken. The key long-term technical support is seen at the level of 1.1445. The key long-term technical resistance is seen at the level of 1.2555.

Indicator analysis. Daily review on GBP/USD for November 6, 2020 2020-11-06 Trend analysis (Fig. 1). Today, the market from the level of 1.3148 (closing of yesterday's daily candlestick) will make an attempt to start moving down with the goal of 1.3104 - a pullback level of 14.6% (red dotted line). Upon reaching this level, the price can continue to move up with the goal of 1.3177 - the upper fractal (candle from 21.10.2020).

Figure 1 (Daily chart). Comprehensive analysis: - Indicator analysis - up;

- Fibonacci levels - up;

- Volumes - up;

- Candlestick analysis - down;

- Trend analysis - up;

- Bollinger bands - up;

- Weekly chart - up.

General conclusion: Today, the price from the pullback level of 14.6% - 1.3104 (red dotted line) will try to continue moving up with the goal of 1.3177 - the upper fractal (candle from 21.10.2020). Upon reaching this level, work upward to the goal of 1.3310 - the historical resistance level (blue dotted line). Unlikely scenario: from the level of 1.2929 (closing of yesterday's daily candlestick), the price will start moving down to reach the pullback level of 23.6% - 1.3058 (red dotted line). When testing this level, the price will continue moving down to the next target of 1.2985 - a pullback level of 38.2% (red dotted line). Trading plan for the EUR/USD pair on November 6. New record highs in COVID-19 incidence, growth in the European currency. 2020-11-06

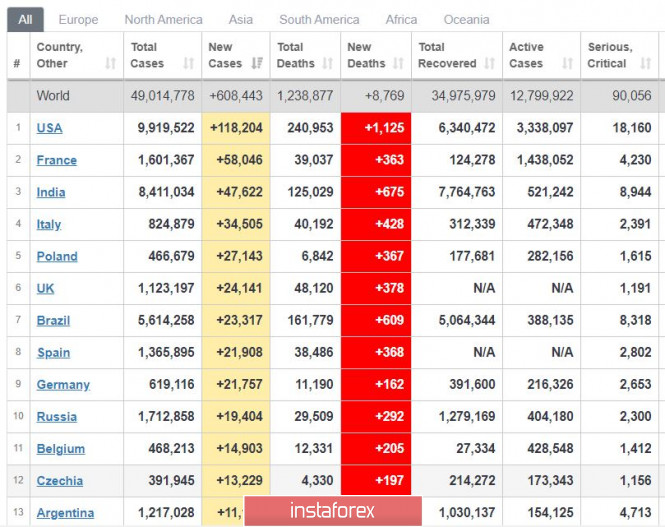

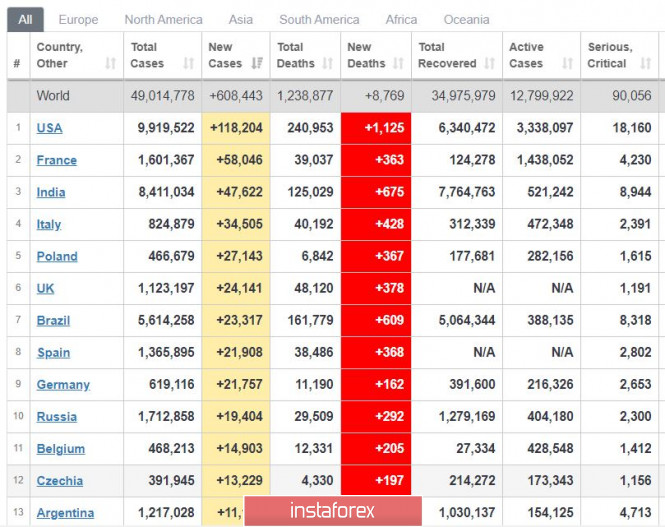

A new peak in COVID-19 incidence is recorded, around 608 thousand a day. About 118 thousand from it were from the United States, while 58 thousand were from France. As for the fatality rate of the virus, about 9 thousand deaths are recorded every day. Because of this, new lockdowns were imposed in Europe, however, it did not negatively affect the position of the European currency in the market. US elections: The counting of votes is ongoing. Joe Biden now only needs to win in Nevada in order to ultimately win the presidential race. As of this moment, Biden is leading by 0.9%, but if he really wins, Trump will most likely appeal in court.

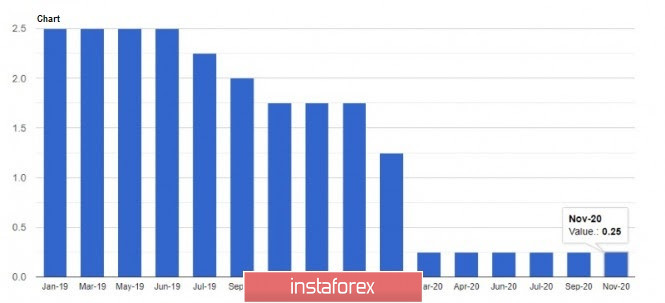

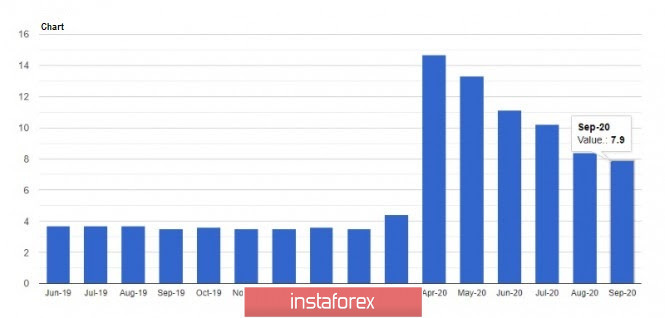

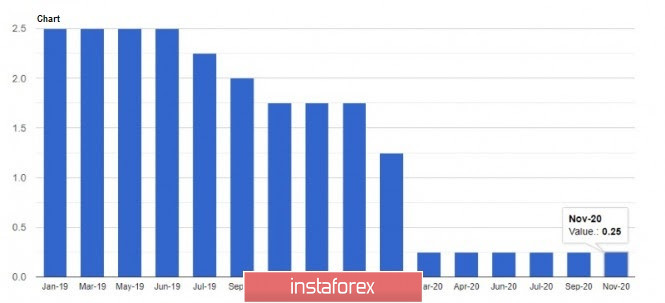

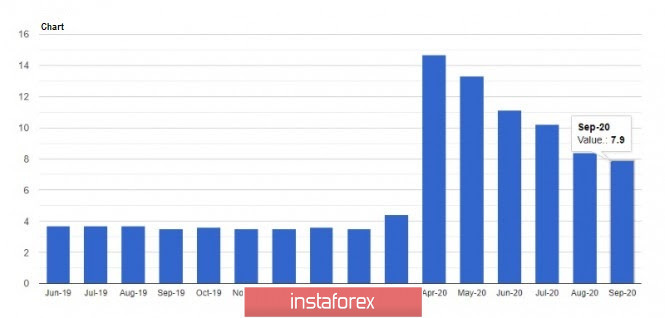

EUR / USD - The euro is showing a consistent growth in the market. However, this will be limited by the strong resistance at 1.1850 - 1.1900. Open long positions from 1.1750, or on a pullback from 1.1780. Longs can be opened as well at 1.1860. EUR/USD and AUD/USD: The Fed seems to be waiting as well on the final results of the US elections. The US labor market is on track for good recovery. 2020-11-06 The market was rather calm yesterday, even amid the Federal Reserve's meeting, at which the central bank's monetary policy was left completely unchanged.  Interest rates remain between 0.00% to 0.25%, as have the existing asset purchase programs of the central bank. The meeting mainly focused on inflation in the United States, where it was decided that even if its value slightly exceeds the target 2.0%, an increase in rates is unlikely to happen. The Fed also pointed to the fact that although the economy continues to recover, the level of activity remains lower than before the pandemic. The outlook of the economy depends on the development of the situation with the coronavirus, so the Fed will continue to adhere to the new leading indication regarding the timing of keeping low interest rates. During his speech, Fed Chairman Jerome Powell also did not say anything new that could affect the markets. Instead, he reiterated that economic recovery has slowed down, thus, the path is covered with uncertainty. And since the recession that was observed during the first wave of the pandemic hit very unevenly, the Fed's policy will continue to remain soft until the targets for employment and inflation are achieved. Powell also said that the central bank will continue to buy assets at its current pace, but will likely need further monetary and fiscal support.  With regards to economic statistics, the latest data on jobless claims in the US were published yesterday, but it did not affect the market much. This is because the figures were not really different from the record last week. The report from the US Department of Labor said the number of initial applications for the week of October 25 to 31 fell by only 7,000, amounting to 751,000. Despite the stubborn increase of coronavirus infections, the latest figure is the lowest level seen since March, and the data for the previous week was revised upward by 7,000 to 758,000. As for the unemployment rate, a decline is expected for October this year. There will also be monthly data on the number of people employed in the non-agricultural sector, but no major changes are expected there either. In that regard, only a strong divergence in one direction will lead to a surge in market volatility.  And if long positions increase further in the European currency, the quote may reach the 19th and 20th figures. However, a strong bullish impulse may not emerge even amid Biden's victory, since there is still the possibility that his party will not be able to get a majority in the Congress and the Senate. It is also another matter if Trump wins the election, because on that, the EUR / USD pair will collapse quite strongly, since everyone is betting on his loss. From a technical point of view, a breakout from the resistance level of 1.1880 will lead to a strong upward move towards 1.1960 and 1.2050. But if Trump wins, the quote may breakout from 1.1760 and move down to the 16th figure. AUD / USD The Australian dollar continues to rebound strongly against the US dollar after the Reserve Bank of Australia announced that it would not consider further rate cuts. They said that interest rates are currently lowered as much as it makes sense, and little can be gained from the introduction of negative rates. Thus, the RBA believes that a policy of negative interest rates is extremely unlikely, and for an increase to happen, inflation has to reach the target level of 2-3%. The technical picture of the AUD / USD pair indicates that in order to see a more steady rise towards price levels 0.7340 and 0.7400, the quote needs to break above 0.7160 and 0.7285. As for a bearish move towards 0.7130 and 0.7070, the quote has to fall below the level of 0.7205.

Author's today's articles: Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Irina Manzenko  Irina Manzenko Irina Manzenko Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Mihail Makarov  - - Pavel Vlasov  No data No data

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu  Irina Manzenko

Irina Manzenko  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  -

-  No data

No data

No comments:

Post a Comment