| | | | | | | Presented By Koch Industries | | | | Pro Rata | | By Dan Primack ·Nov 30, 2020 | | 🖥️ Join Axios tomorrow at 12:30pm ET for a World AIDS Day and Giving Tuesday virtual event featuring Every Mother Counts founder Christy Turlington Burns, ONE Campaign CEO Gayle E. Smith and Yoram Siame of the Churches Health Association of Zambia. Register here. | | | | | | Top of the Morning |  | | | Illustration: Annelise Capossela/Axios | | | | The 2020 IPO market is going out with a bang, but you ain't seen nothing yet. - Driving the news: DoorDash this morning disclosed IPO terms, and we're also expecting roadshow setters from Airbnb, Affirm, Roblox and Wish.

What's next: There are over 500 "unicorns," more than half of which are based in the United States. Around two dozen of them are valued at more than $5 billion. - Among some of the better known names are ByteDance, SpaceX, Instacart, Compass, Epic Games, Coinbase and Stripe.

- Not all of them will IPO next year, but lots will.

"The real story of 2020 is that it's just the preview for 2021, especially if there's a vaccine and the economy roars back," a tech IPO banker tells me. - Another banker, this one based in San Francisco, adds that he regularly participates in multiple "bake-offs" on the same day for large tech IPOs.

And then there's the recent SPAC boom, which will bring lots of companies public in 2021 that otherwise might have waited. The bottom line: There used to be only a handful of unicorn IPOs per year, due to a limited pipeline, making each one a major Wall Street event. Those days are over. |     | | | | | | While you were feasting... | | Vista Equity Partners made its split with president Brian Sheth official, via a press release timed to Thanksgiving dinner. - Between the lines: This was not an amicable breakup. But now it's done, with Robert Smith maintaining control of the massive private equity firm and Sheth retaining a share of economics and eventually planning to hang his own shingle.

- Go deeper: Sheth spoke to Forbes about his departure, including how he negotiated part of his exit while hospitalized for COVID-19.

• CFIUS again kicked the can on ByteDance/TikTok/Oracle, pushing back last Friday's "deal or die" deadline by another week. • Expect to begin hearing a lot about private equity firm Pine Island Capital Partners, as its partners include Tony Blinken (Biden's Sec of State nominee, now on leave from Pine Island) and Michèle Flournoy (Biden's possible Def Sec nominee). - What to know: Pine Island was formed in 2018 by former CIT Group and Merrill Lynch CEO John Thain, former Goldman Sachs buyout big Phil Cooper, and ex-Coca-Cola exec Clyde Tuggle. It focuses on mid-market companies in a variety of sectors, including aerospace and defense.

- To date, it's operated as a fundless sponsor, buying two companies that rely in large part on government contracts. It also formed a SPAC and does have eventual plans to raise a traditional private equity fund.

- Details: Pine Island has an informal relationship with WestExec Advisors, a consulting firm whose co-founders include Blinken and Flournoy. A Pine Island spokesman says no money ever changed hands between the two shops.

- Between the lines: Obviously there's a D.C. revolving door issue here, although its importance is subjective rather than statutory. But don't be surprised if Senate Republicans demand information on Pine Island's investors, some of whom might be covered by confidentiality agreements.

|     | | | | | | The BFD |  | | | Illustration: Aïda Amer/Axios | | | | S&P Global (NYSE: SPGI) agreed to buy IHS Markit (NYSE: INFO) in an all-stock deal valued at $44 billion (including $4.8b of assumed debt). - Why it's the BFD: This would be the largest corporate merger of 2020 and creates a financial data powerhouse.

- Details: IHS Markit shareholders would hold 32.25% of the combined company, and receive 0.2827 shares of S&P common stock (4.3% premium over Friday's closing price for IHS Markit shares).

- The bottom line: "The deal would combine one of the oldest names in financial markets with a relative newcomer. S&P traces its roots to an 1860 compendium of information for railroad investors and is best known for its bond ratings and its iconic stock-market indexes. … IHS Markit, formed in 2016 by the merger of two smaller players... owns software that big Wall Street banks use to underwrite corporate stock and bond offerings, and tracks transportation and energy data, the latter of which could pair with S&P's commodities business, Platts." — Cara Lombardo & Liz Hoffman, WSJ

|     | | | | | | A message from Koch Industries | | Unleashing every person's potential | | |  | | | | Every individual has unique talents and gifts that, when unleashed, can make life better and work more meaningful. Charles Koch and SHRM CEO Johnny Taylor go deep in a new video on the role business leaders play in empowering employees to maximize their potential. Watch their full discussion. | | | | | | Venture Capital Deals | | 🐼 HungryPanda, a food delivery service for Chinese expat communities, raised $70 million in Series C funding. Kinnevik led, and was joined by 83North, Piton Capital, Burda Principal Investments and Felix Capital. http://axios.link/NM2n • PureFacts Financial Solutions, a Toronto-based provider of wealth management softwarte, raised C$20 million from Scotiabank and Round 13 Capital. www.purefacts.com 🚑 Endomag, a British provider of breast cancer screening tech, raised £15 million in Series D funding. Draper Esprit led, and was joined by Sussex Place Ventures. www.endomag.com • Aphea.Bio, a Belgian agtech focused on fungal control and reducing fertilizer use, raised €14 million in Series B funding led by Astanor Ventures. http://axios.link/K1zj • Primer, a London-based online checkout API, raised £14 million in Series A funding. Accel led, and was joined by Balderton, SpeedInvest, Seedcamp and RTP Global. http://axios.link/3FrK |     | | | | | | Private Equity Deals | | 🚑 Advanz Pharma, a British drugmaker that was delisted in 2018 as part of a debt restructuring, hired Jefferies to find a buyer, per Reuters. The deal could fetch upwards of $2 billion, with interested suitors including The Carlyle Group, Nordic Capital and TDR Capital. http://axios.link/VSKe • Albert Bridge Capital, the largest outside shareholder in British roadside recovery group AA (LSE: AA), said it will oppose a £219 million takeover offer for AA from Warburg Pincus and TowerBrook Capital Partners. Albert Bridge holds just under a 20% stake. http://axios.link/mcJ1 • Francisco Partners agreed to buy the EMEA and Asia business of auto retail software firm CDK Global (Nasdaq: CDK) for $1.45 billion. www.cdkglobal.com |     | | | | | | Public Offerings | | • DoorDash, a San Francisco-based restaurant meal delivery service, set IPO terms to 33 million shares at $75-$85. It would have a fully diluted market cap of $30.8 billion, were it to price in the middle. http://axios.link/iEfK 🚑 908 Devices, a Boston-based maker of mass spectrometry devices for scientific research, filed for a $75 million IPO. It plans to trade on the Nasdaq (MASS) with Cowen as left lead underwriter, and reports a $2.6 million net loss on $21 million in revenue for the first nine months of 2020. The company raised nearly $90 million from firms like Arch Venture Partners (23.2% pre-IPO stake), Razor's Edge Ventures (8.3%), Saudi Aramco Energy Ventures (5.4%) and UTEC (5.1%). http://axios.link/25Pr • C3.ai, a Redwood City, Calif.-based enterprise AI SaaS company led by Tom Siebel, set IPO terms to 15.5 million shares at $31-$34. It would have an initial market cap of $3.15 billion, were it to price in the middle, and also agreed to $150 million in concurrent private placements to Koch Industries ($100m) and Microsoft ($50m). The company raised over $360 million from backers like TPG (22.6% pre-IPO stake), Baker Hughes (15.1%), BlackRock, Sutter Hill Ventures, Breyer Capital, Interwest Partners, Makena Capital Management and Wildcat Venture Partners. http://axios.link/4EnV 🚑 Kinnate Biopharma, a San Diego-based oncology biotech, set IPO terms to 10 million shares at $16-$18. It would have an initial market cap of $756 million, were it to price in the middle, and plans to list on the Nasdaq (KNTE) with Goldman Sachs as lead underwriter. The pre-revenue company raised nearly $200 million from Foresite Capital (33.3% pre-IPO stake), OrbiMed (10.5%), RA Capital Management (10%), Nextech (8.9%) and Vida Ventures (7.9%). http://axios.link/KXs1 • Royole, a Chinese maker of flexible displays, shelved U.S. IPO plans and instead will seek to list on Shanghai's STAR Market with a valuation north of $8 billion, per Bloomberg. It's raised around $1.3 billion in private funding from backers like Warmsun Holding Group, IDG Capital, Shenzhen Capital Group and CITIC Capital. http://axios.link/EY5T 🚑 Seer, a Redwood City, Calif.-based developer of proteograph products for biomedical research, set IPO terms to 8.8 million shares at $16-$18. It would have a fully diluted market cap of $1.1 billion, were it to price in the middle, and raised over $100 million from firms like Maverick Capital (16.5% pre-IPO stake), Invus (15.6%), aMoon (15.6%), Fidelity (9.6%), Emerson Collective (7.7%) and T. Rowe Price (7.5%). Seer also secured a concurrent and contingent $135 million private placement from Fidelity, SoftBank, T. Rowe Price and aMoon. http://axios.link/Toet 🚑 Sigilon Therapeutics, a Cambridge, Mass.-based cell therapy company, set IPO terms to 5.6 million shares at $17-$19. It would have a fully diluted market cap of $573 million, were it to price in the middle, plans to list on the Nasdaq (SGTX) with Morgan Stanley as lead underwriter, and raised $180 million from Flagship Pioneering (48.3% pre-IPO stake), Eli Lilly (11.4%), CPP Investments, Longevity Vision Fund and BlackRock. http://axios.link/sr8X 🚑 Silverback Therapeutics, a Seattle-based developer of immune-modulating drug conjugates, set IPO terms to 7 million shares at $17-$19. It would have a fully diluted market cap of $566 million, were it to price in the middle, and raised $228 million from firms like OrbiMed (35% pre-IPO stake), USVP (10.1%), Hunt Tech Ventures (6.7%), Nextech Invest (7.8%), Pintifax (5.8%) and EcoR1 Capital (5.5%). http://axios.link/2tES |     | | | | | | SPAC Stuff | | • 2MX Organic, a SPAC led by French telecom billionaire Xavier Niel and former Lazard banker Matthieu Pigasse, plans to raise €250 million to acquire a European consumer goods company. http://axios.link/FdMp • CBRE Acquisition Holdings, a SPAC sponsored by commercial real estate giant CBRE, cut its IPO size from $400 million to $350 million. http://axios.link/NyPs • Marquee Raine Acquisition, a TMT-focused SPAC formed by The Raine Group and Chicago Cubs owner Tom Ricketts, filed for a $325 million IPO. http://axios.link/6UYR |     | | | | | | Liquidity Events | | • Advent International plans to revive the sale process for Dutch enterprise software firm Unit4, after receiving takeover interest from SPACs, per Bloomberg. The company could fetch upwards of €2 billion. http://axios.link/XprS • ServiceNow (NYSE: NOW) agreed to buy Element AI, a Montreal-based platform for companies to build AI solutions. Element AI had raised $257 million from firms like DCVC, Real Ventures, BDC, Fidelity Investments Canada, Hanwha Investment, Intel Capital, Microsoft Ventures, National Bank of Canada, NVIDIA, Tencent and unidentified sovereign wealth funds. http://axios.link/bMGS |     | | | | | | More M&A |  | | | Illustration: Sarah Grillo/Axios | | | | • Salesforce (NYSE: CRM) reportedly is in advanced talks to buy Slack (NYSE: WORK) for more than $20 billion, in what could be the largest software merger in years. - Thought bubble: Salesforce has pulled the trigger on several big deals (e.g., Tableau, MuleSoft, etc.), but just as often flirts with household names that remain independent (Twitter) or end up elsewhere (LinkedIn). Slack also has been tied before to large acquirers, most notably Amazon.

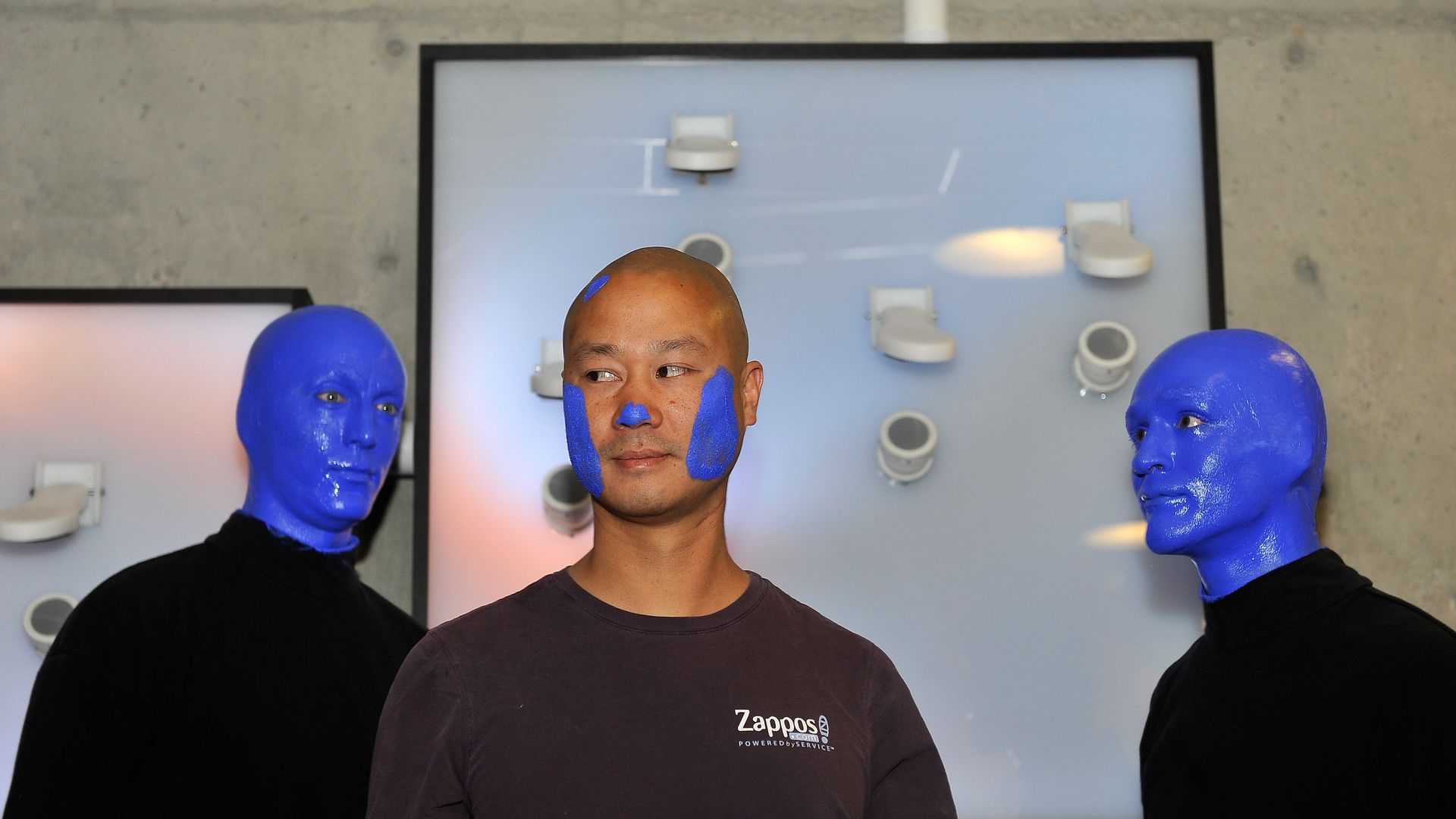

• Axa (Paris: CS) agreed to sell its Persian Gulf unit for $269 million to Kuwait-based Gulf Insurance Group. http://axios.link/TtBA • The Blackstone Group agreed to buy DCI, a quant credit investing firm with $7.5 billion in AUM. www.blackstone.com • General Motors (NYSE: GM) said it will no longer take a $2 billion equity stake in electric truck-maker Nikola (Nasdaq: NKLA). http://axios.link/z0pa • GlobalWafers, a Taiwanese chipmaker, plans to make a $4.5 billion takeover bid for Germany's Siltronic. http://axios.link/svir • SVB Financial Group (Nasdaq: SIVB) agreed to acquire the debt fund business of Seattle's WestRiver Group. www.wrg.vc • Suning.com, a listed Chinese retailer, is considering the sale of a stake in its e-commerce business, per Bloomberg. http://axios.link/iqbE • Vienna Insurance Group agreed to buy the Central and Eastern European business of Dutch insurer Aegon for €830 million. http://axios.link/nFns |     | | | | | | Fundraising | | • Buckley Ventures of San Francisco is raising up to $200 million for a second fund, per an SEC filing. • Firstminute Capital, a London-based VC firm, raised £87 million for its second fund. http://axios.link/t0ak |     | | | | | | It's Personnel | | • Sanjiv Kalevar joined OpenView Venture Partners as a partner. He previously was with Battery Ventures. www.openviewpartners.com • Erica Sunkin joined venture firm NEA as senior manager of communications and marketing. She previously was with Edelman. www.nea.com |     | | | | | | In Memoriam |  | | | Photo by David Becker/Getty Images | | | | Tony Hsieh, founder and CEO of online shoe retailer Zappos, passed away on Friday after being injured in a Connecticut house fire. He was just 46 years old. Tony was, in a word, adored. |     | | | | | | A message from Koch Industries | | Unleashing every person's potential | | |  | | | | Every individual has unique talents and gifts that, when unleashed, can make life better and work more meaningful. Charles Koch and SHRM CEO Johnny Taylor go deep in a new video on the role business leaders play in empowering employees to maximize their potential. Watch their full discussion. | | | | ✔️ Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and unicorn wranglers to sign up. | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment