ONE ordinary trade on ONE extraordinary stock — TSLA (From WealthPress)

3 Options Strategies to Protect Your Stocks in a Falling Market

While the stock market is near all-time highs again, not all stocks are experiencing the same bullish sentiment. You have probably noticed that a portion of your portfolio underperforming the benchmark indexes. Stocks that underperform when the market rises tend to sell off harder when the markets fall. Even the strongest stocks will eventually sell off either from profit-taking or a trend reversal. If you want to protect your stocks in a falling market, you can use stock options for that purpose. Here are 3 options strategies to protect your stocks in a falling market. There’s (Almost) No Such Thing as a Perfect Hedge You've probably heard that there's really no such thing as a perfect hedge. This is mostly true. The only way to perfectly hedge a stock position is to short-sell the position in another account. Even then, you're paying margin interest on the short position. Our Guinea Pig Applied Micro Devices Stock For each strategy, we’ll use a computer and technology sector stock, semiconductor giant Applied Micro Devices Inc. (NASDAQ: AMD), as an example.

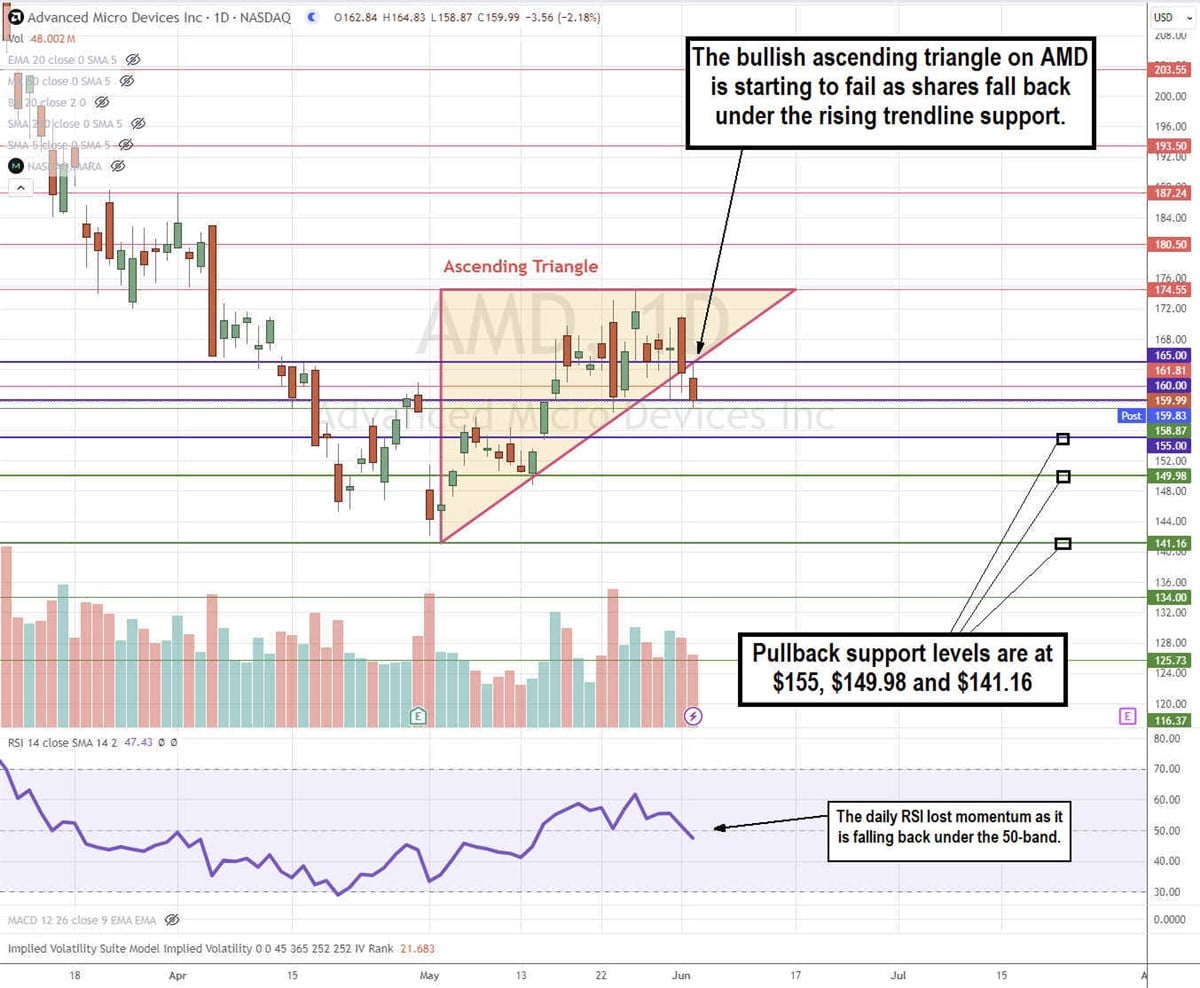

AMD is trading at $160 on June 4, 2024. The daily candlestick chart appeared to form a bullish ascending triangle but is starting to break down as shares fell under the ascending trendline. The daily relative strength index (RSI) has also turned down through the 50-band. Let’s assume you own 100 shares of AMD stock long-term but want to protect yourself from a sell-off in the event that AMD breaks down. We'll use the July 3, 2024, expiration 31 days out. Here are 3 options and strategies to consider. I learned about these explosive stocks during my two decades on Wall Street…

And used them to help grow my old hedge fund from just a few million to over $700 million dollars*.

So it's safe to say… these bad boys work.

What's the secret behind these special trades?

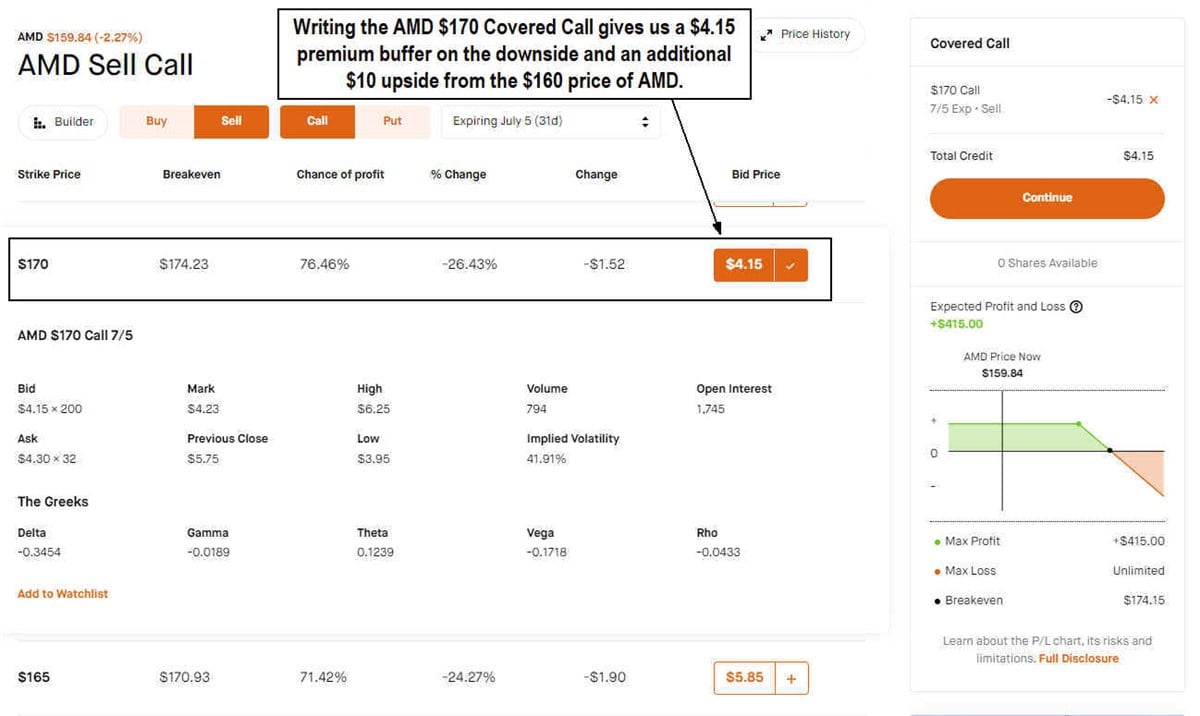

Well, right now, I'm going public with the unique strategy behind these "Calendar Stocks"… Go here to see how you can exploit my next "Calendar Stock". Strategy #1: Write a Covered Call Writing a covered call is also referred to as selling a covered call. It's not selling a call but selling/writing a covered call, which means you already own the stock in the event it gets assigned. This strategy is similar to collecting rent on your stocks. A covered call strategy protects a portion of the downside since you collect a premium upfront. However, there is a risk of having to sell your position at the selected strike price if the underlying shares surge above it on expiration.

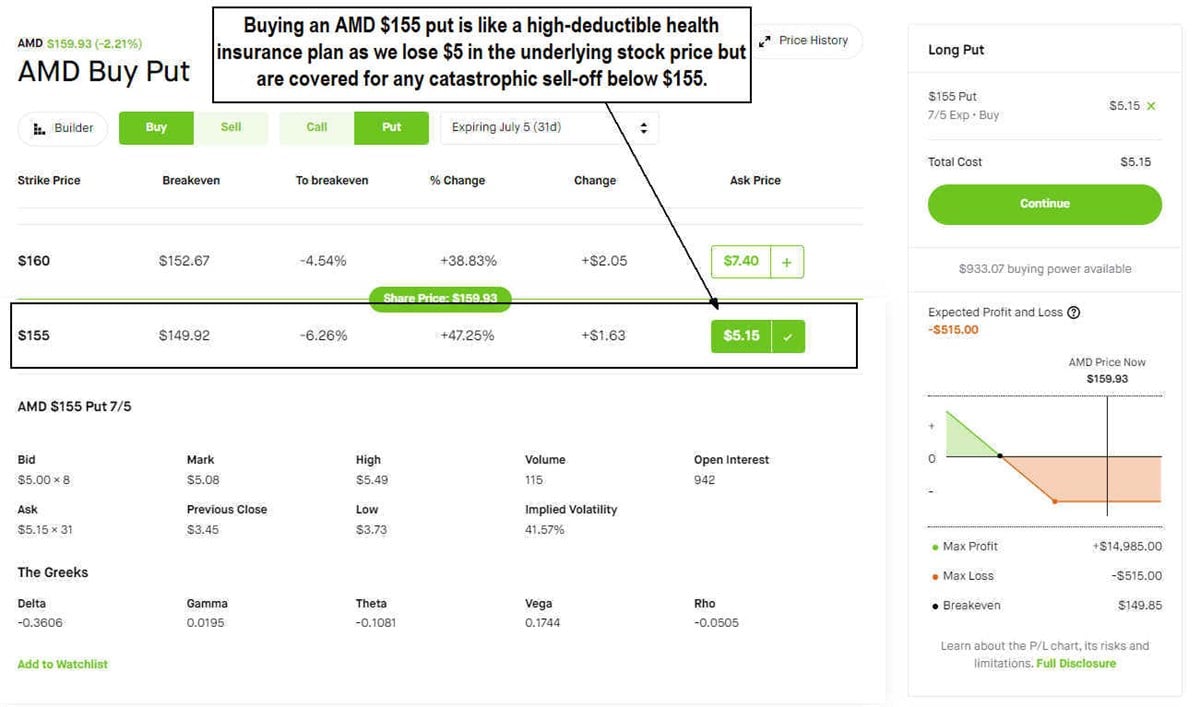

Let's select the 70-strike price. This would give us a $4.15 premium, which covers our downside on AMD to $155.85, which is just above the $155 support level. It also enables us to profit an additional $10 if AMD rises to $170 or higher by the July 5, 2024, expiration. Strategy #2: Buy a Protective Put If AMD could get into a serious breakdown, we can take on an insurance policy by buying a protective put. A long put will cost us money out of pocket, like an insurance policy. If AMD doesn't fall, then we lose that money. However, our upside isn't limited like a covered call in the case that AMD surges higher. The put option rises in value as AMD falls under the strike price. We can select that strike price level since $155 is the next support. Since it's an out-of-the-money (OTM) option, our premium will be cheaper, as a $160 put would cost us $7.40. Remember, AMD is a long-term hold in the portfolio, so we want to get some protection in the near term.

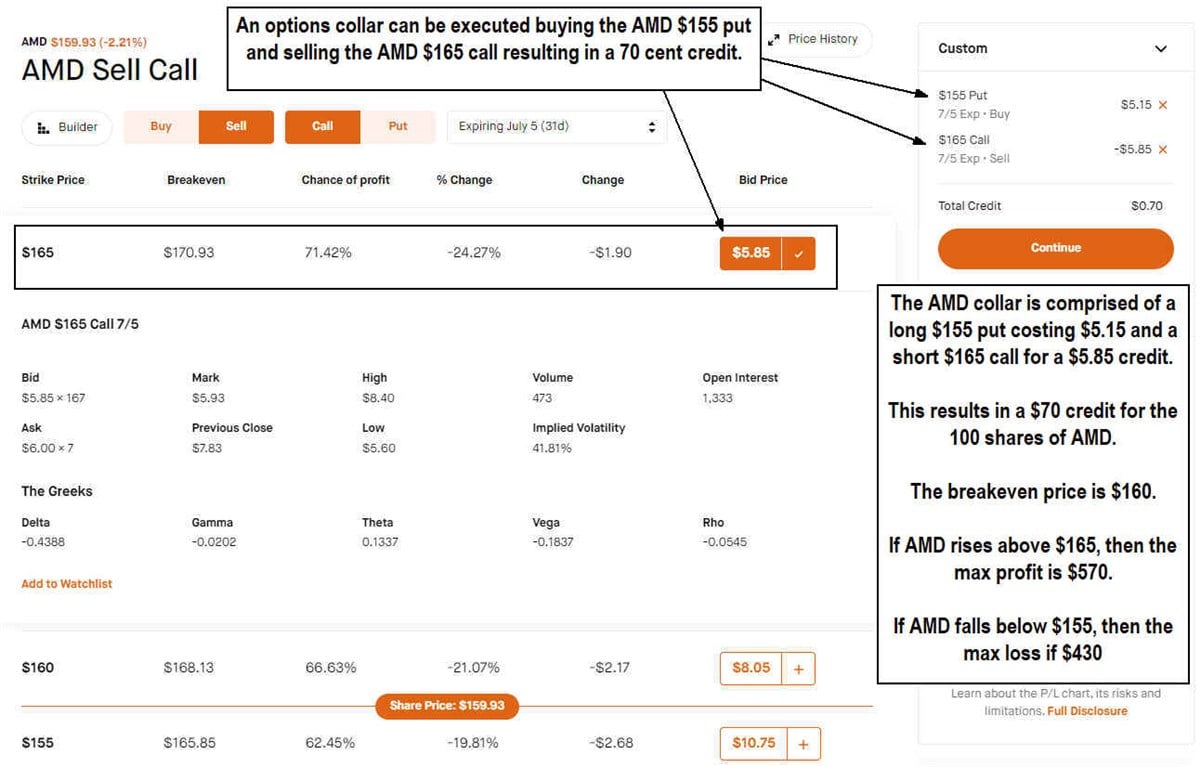

We would buy the AMD for $155 Put for $5.15. This provides us protection if AMD falls below the $155 support level. Technically, AMD could fall to zero, and we would be protected from $155 down. AMD would need to fall to $149.55 for the put option to reach breakeven. We would still be down the $5 we are willing to stomach on the long-term hold. It's like a high-deductible health insurance plan where the $5 is the deductible, but we are covered for anything after that. Strategy #3: Implement an Options Collar An options collar is a way to lower the cost of the insurance. Rather than pay $5.15 for a $155 put, we can add one more leg (trade) by selling a higher strike call to collect a premium and lower the trade cost. The flip side is that we can get called out at $165, so we would have to sell the shares at $165 for a $5 upside in addition to whatever credit we may receive on the collar.

To execute a collar, we would buy the AMD $155 Put for $5.15 like we did for the protective put but also sell/short the AMD $165 call for $5.85. This results in a 70-cent credit, which is paid to us upfront. The cost of the trade is not only free but results in a $70 credit. If AMD falls to $155 or below, then we are protected, and the max loss is $430, comprised of $500 minus the $70 credit. If AMD rises to $165 or higher, our max profit is $570, comprised of $500 plus the $70 credit. Options Provide You with Options on Your Hedge There is no perfect hedge; however, options can help buffer your downside. If you're holding stocks in a portfolio long or medium-term, these 3 strategies can help smoothen the ride when it gets bumpy. As with all options trades, holding the positions is not required until expiration. You can cut the cord anytime before expiration when you feel the coast is clear or if you don’t want to have your shares assigned. You can also roll your positions to extend the protection. We’ll go into those strategies in future articles. Written by Jea Yu Read this article online › Recommended Stories: |

Post a Comment

0Comments