| | Alex Moschina

Publisher | Our editors have been on a roll this week... Defending TikTok against government overreach... Issuing warnings for the Fed... And making the case for crypto. Are Manward's Libertarian roots showing? Of course, our contributors would tell you that none of these are meant to be political statements. (That's not our arena and there are plenty of options out there for that sort of thing if you want it.) They're really just common sense... Something that seems woefully lacking in today's economic landscape. Take the long-brewing debt crisis, for instance... [The Next Big Short Is Here! Go here now for your shot at a historic opportunity. ] ] BNPL (Not to Be Confused With BTNT) We've been tracking the story closely since last summer. Back in July, total auto loan and credit card debt sat around $1.56 trillion and $0.99 trillion, respectively. Today, according to the latest figures from the Federal Reserve Bank of New York, auto loan debt has increased to $1.61 trillion... and credit card debt is up to $1.13 trillion. That's a combined increase of nearly $200 billion.

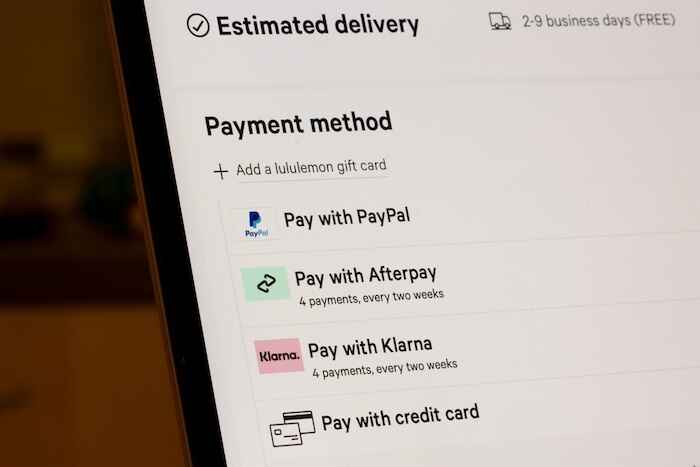

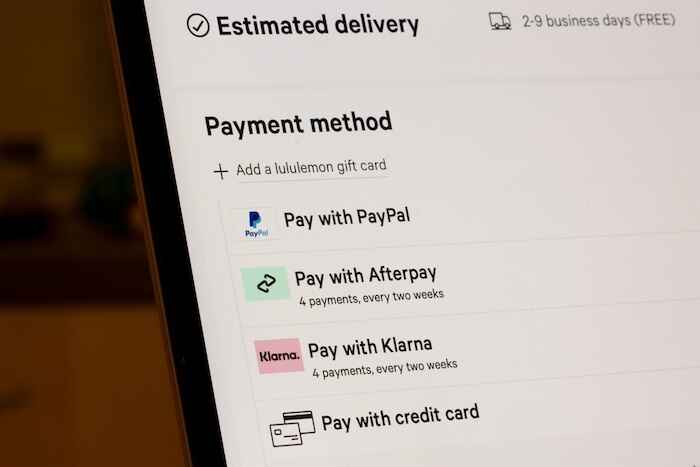

View larger image It's clear that Americans' appetite for new stuff is bigger than their collective wallet. And as the free market is wont to do, it's created the perfect solution in the form of "buy now, pay later" (BNPL) options for consumers. The concept has really taken off. With online shoppers eager to load up on the latest must-have items - regardless of affordability - we've seen the recent launch of numerous BNPL service providers. And as Shah is wont to do, he looked at several of these companies - including the biggest dog of them all, Affirm Holdings (AFRM) - for this week's Buy This, Not That. We may not be able to do anything about Americans' reckless spending habits... but in The Age of Narrative, we can always find a way to play the situation. And speaking of capitalizing on an explosive situation... Bitcoin's Big Moment Is Just Days Away The long-awaited fourth Bitcoin halving is almost here. If you've been reading along, you know that Robert - along with many high-profile crypto analysts and institutions - believes this will throw gasoline on the already white-hot cryptocurrencies market. Past halvings have led to huge bull runs in Bitcoin... and even bigger gains among smaller altcoins.

View larger image But it's important to note that the upcoming halving will occur under far different circumstances from past halvings. As Robert wrote in March... | As we look forward to the next halving, it's essential to consider the broader context of the crypto market and global economy. Several factors could create more demand for Bitcoin. I'm talking about increasing institutional interest, the proliferation of crypto financial products, and greater public awareness and adoption. And the ongoing search for inflation hedges and digital gold may further spark interest in Bitcoin. This is especially relevant in the face of uncertain monetary policies. | | | There's simply too much for us to cover in a single essay or even a series. The Bitcoin halving has the potential to be the most important catalyst for crypto over the next 18 months... and it's approaching FAST. So, here's what we're doing... On April 11 at 2 p.m., ET, Robert and Shah will host a free live crypto event for Manward subscribers. They're going to talk through everything that's happening - the opportunities, the risks, and the pitfalls to avoid - and even share an exclusive crypto pick with attendees. All you have to do to attend is sign up here. It should take you less than a minute to register. And again... it's free. I hope to see you there. In the meantime... Catch up on everything we've published this week below. We'll be back on Monday. Have a great weekend, Alex The Clear Winner in a Spectacular Quarter  An action-packed first quarter had markets buzzing with excitement... and handed committed investors gains worthy of their dyed-in-the-wool bullishness. But one sector handily beat out the competition... Keep reading. A Warning for the Fed  As the Fed continues to hint at rates cuts at some point this year... it might itself between a rock and a hard place... having fueled expectations it cannot meet. There's danger ahead. Keep reading... Buy This, Not That: Will This Spending Spree Pay Off Later?  Consumers are certainly buying now... but will they pay later? See what BNPL stocks Shah thinks are a BUY... and which are NOT. Watch this week's video (with transcript). The Altcoin Every Investor Should Own  As the crypto market takes a breather, now is a great time to buy or add to one of Robert's favorite crypto positions. See what it is here. Monday Takeaways: Sky-High FOMO  Momentum is in our favor... as these investors chase the best-performing stocks. Plus, as China's economy picks up... there's one sector that all investors should keep an eye on. Check it all out here...

Want more content like this? | | | | | Alex Moschina Alex Moschina is the Publisher of Manward Press. A gifted writer, editor and financial researcher, Alex's career in publishing began more than a decade ago when he worked at one of the world's leading providers of academic research and reference materials. Alex first cut his teeth in the realm of investing when he joined the team at White Cap Research in 2010. There he was charged with covering emerging market trends and investment opportunities. A stint as senior managing editor and editorial director at the prestigious Oxford Club followed. A frequent speaker at conferences and events, Alex has led educational workshops across the U.S. and Canada. | | | |

No comments:

Post a Comment