|

You've probably heard rumors about softening demand for electric vehicles.

Some of it is driven by higher prices. Some of it is due to garbage automotive products. But there's no doubt that the renewable energy sector is in for a rough road ahead.

You might remember those tariffs Donald Trump slapped on Chinese solar panels.

Joe Biden never lifted those.

And there's a good chance a second Trump term would all but ensure they never make it into the United States again.

The knock-on effects are likely to hit broader durable goods as well. But the industry we see as a sleeper problem is aerospace and defense.

While the majority of these products are made at home, the increasing complexity of these systems relies on components and raw materials from China and a myriad of other countries.

China knows this. And the Chinese are more than willing to flex their muscles when and where they see fit.

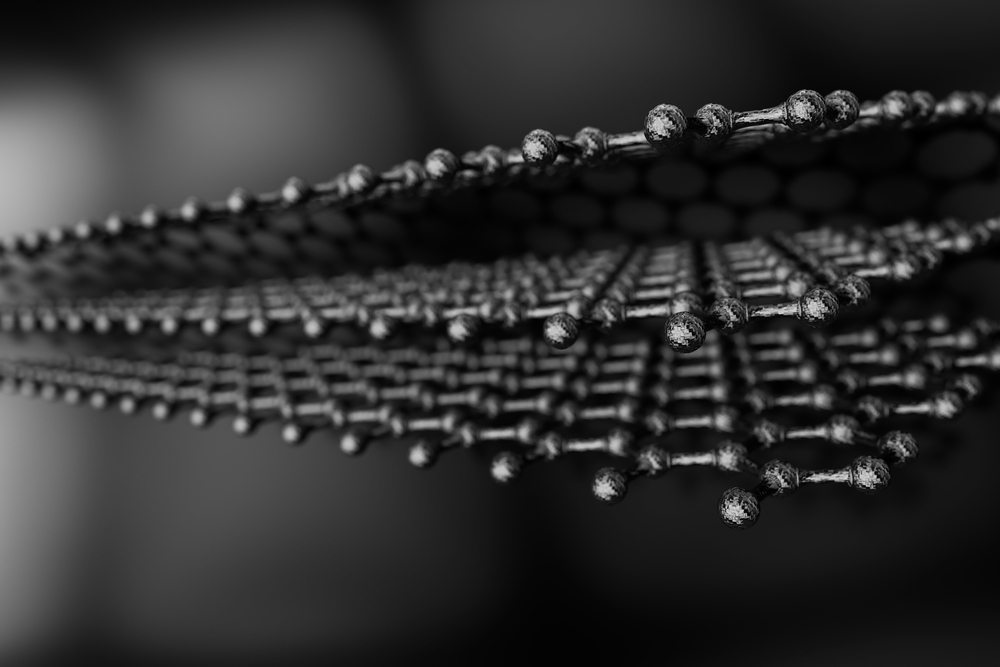

Rare earth metals are a particular risk that could upend defense products from missiles to lasers, as well as vehicle-mounted systems like tanks.

Right now, we have no replacements. If China cuts us off, we're screwed.

Thankfully, there's a clear way to turn this chaos into cash. | | |

Believe it or not, there's a way to know what direction a stock is poised to go over a period of time…

I'm talking about a technical trading technique that lets you know whether a stock is going up…or whether it's going down within a rough time frame.

I personally use this technique to consistently make profitable stock market trades…

And I've put together a short presentation with details on how you can start taking advantage of this technique today.

Click this link to view the presentation. | | | |

No comments:

Post a Comment