Editor's note: It's time to prepare for the next phase of this bull market... Investors who hid their money on the sidelines in 2023 to avoid today's market uncertainty could be tempted to reenter the market as inflation gradually cools down throughout 2024. But with the presidential election looming over the economy, many folks remain unsure about what to do with their money right now... That's why Vic Lederman – editorial director of our corporate affiliate Chaikin Analytics – believes it's crucial for investors to understand how this upcoming election could open the door for myriad buying opportunities moving forward. In today's Masters Series, adapted from the January 4 and February 13 issues of the Chaikin PowerFeed e-letter, Vic discusses a change to Meta Platforms' apps that could impact coverage of the presidential election... details how history shows the market is poised for a bullish run as the election plays out... and reveals how investors can position themselves to profit from this unique setup...

Don't Let Politics Scare You Out of This Bull Market By Vic Lederman, editorial director, Chaikin Analytics Folks, Meta Platforms (META) just made an interesting business decision... This year, the social media titan doesn't want you fighting over politics with people you don't know. At least, not on its platforms. And it's making major changes to make this a reality. You likely already know that Meta is the parent company behind Facebook. It also owns messaging app WhatsApp, photo- and video-sharing service Instagram, and Threads – a relatively new competitor to X (formerly known as Twitter). That easily makes Meta the largest social media company in the world. And it's estimated that nearly 247 million Americans accessed Facebook last year. In other words, darn near every American uses one of the Meta-owned apps. So this politics change is a big deal. After all, we're heading into what will likely be a very loud, contentious election cycle this year. And for some reason, Meta is making a change. Let's take a closer look at that today. And we'll also check up on Meta in the Power Gauge...

| Recommended Links: | |  Airing Now: A Stunning 90% Win Rate Our friend and Wall Street legend Marc Chaikin's Power Gauge issued buy signals on 90% of the top 50 stocks of 2023 and at least nine out of 10 top stocks of every single year going back to 2016. Now, he's revealing a little-known market event he has never shared before – one he can predict with 90% accuracy. Find out more when you join him at his latest market broadcast (and get his two recommendations for free). Get the details here. |  |

Warning From a New York One Percenter If you've ever suspected the market might be rigged against you... you're right. There's a simple trick the rich and powerful use to fix the market in their favor, and make millions whether stocks rise or fall. Today, a multimillionaire former hedge-fund manager – known as the best-connected man on Wall Street – is stepping forward to reveal how it works. Get the full story here. |  | |

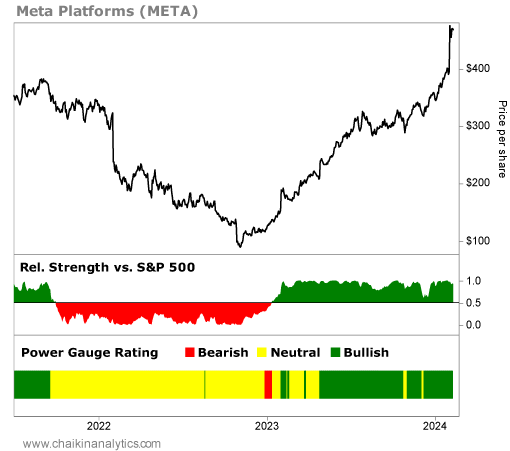

Don't worry – Meta isn't banning politics on its platforms... or anything quite so absurd. But it is making a change that could have major implications for its business... You see, Meta will no longer "push" political posts from accounts that users aren't currently following. The biggest change is coming to Instagram and Threads, with plans to roll out the same control on Facebook in the future. There's no question this will reduce user engagement... The company learned long ago that negative emotional reactions to posts get attention. And for years, it has "rage baited" users into spending more time on its platforms. So it's unquestionable that this change will likely lead to lower "time on site" numbers. But that might be good for Meta in the long run. In fact, the company has already worked on cooling the political heat on Facebook in recent years. Here's how Meta puts it on the "Transparency Center" section of its corporate website... People have told us they want to see less political content, so we have spent the last few years refining our approach on Facebook to reduce the amount of political content – including from politicians' accounts – you see in Feed, Reels, Watch, Groups You Should Join, and Pages You May Like. These changes aren't getting in the way of the company's stock. As you can see in the chart below, Meta is soaring to new highs... You can also see in the chart that Meta has blown past its previous 2021 high. And the Power Gauge caught the turn near perfectly. Today, our system gives Meta a "very bullish" rating. And based on the stock's relative strength versus the S&P 500 Index, Meta has been outperforming the broad market. In fact, the stock has soared about 72% over the past six months. The S&P 500 is only up around 15% over that same time frame. Sure, Meta dialing back on promoting political content will probably lower user engagement on its apps. But it's not stopping the stock from soaring. Personally, I welcome the change. Nearly all of us interact with the company's products... like it or not. I'd rather spend my time focused on the markets than reacting to a stranger's political opinion I didn't need to know in the first place. So now, the question is... Does that mean stocks can't catch up as this election year plays out? No, of course not. Even better, the data tells us to overcome any fears... I recently looked at all the S&P 500's bull markets since 1957. And based on the numbers, the bull market we're in right now still has a long way to go... Over the past 67 years, the S&P 500 has experienced 11 other bull markets. The shortest one only lasted a handful of months from September 2001 to January 2002. The S&P 500 climbed 21% over that span. Meanwhile, the longest bull market stretched from December 1987 to March 2000. That's more than 12 years. And it resulted in an incredible 582% gain for the index. Even if we remove those two outliers, the data is still in our favor. The nine remaining bull markets lasted an average of 55 months. And they delivered an average gain of 140%. To put those numbers in perspective, let's turn back to the current bull market... It's only 16 months old. And again, the S&P 500 is only up 32% from its low. That means selling today or choosing to stay on the sidelines is a mistake. If you're scared of the market's current heights, you could be leaving a lot of money on the table. If you want one more piece of proof, look at the Power Gauge... Regular readers know we track the S&P 500 through the SPDR S&P 500 Fund (SPY). And as you can see in the following screenshot, our system remains "bullish" on SPY right now... Put simply, history tells us that this bull market is still in its early stages. And the Power Gauge agrees, regardless of this year's bleak political backdrop. So don't fear new highs. And don't let little dips on the way up shake you out of the market. Good investing, Vic Lederman

Editor's note: Chaikin Analytics founder Marc Chaikin believes the election could have a bigger impact on the markets than most investors expect. He stresses that the volatility of the 2024 presidential election could result in a seismic shift with a 90% chance of hitting stocks after the Super Tuesday primaries... That's why he recently hosted an online presentation to reveal the No. 1 move you need to make with your money right now in order to protect your wealth. Click here to catch up on the full details... |

No comments:

Post a Comment