|

|

|

Good afternoon! |

This morning, I introduced you to my latest "Bright Idea" stock – Modular Medical (MODD). |

The stock has already been in a strong uptrend, as I noted. MODD is up over 80% from the lows in November last year. |

Today, the stock is tacking on another (roughly) 12% move higher so far on the day (at the time of writing!). |

The main reason that I can see is breaking news on their insulin delivery device (you can read the news here). |

This device has incredible potential, and I am really rooting for MODD to be a huge success! |

I think this device has the potential to dramatically affect the lives of countless people who suffer from diabetes. |

As I have been digging into the insider ownership of MODD today, I have found some fascinating details. |

The CEO, Jeb Besser is only taking a $1 a year salary. He also owns around 15% of the company, so he is perfectly aligned with shareholders to see maximum value. |

Overall, top shareholders own over 30% of the company, and have been adding to their holdings over the last year. Pretty incredible stuff! |

When I see management committed to a company like this, I just can't help but love them even more! |

MODD is having a great day today, and seriously outperforming the market. |

If you haven't taken a look into it yet – what are you waiting for? |

Pull up MODD on your screen right now and see what you think about it. |

If you missed the email I sent out this morning, I put the highlights of it below. Take a few minutes and read through it, I think you'll find this a fascinating opportunity! |

_______________________________ |

This week, I have an idea that is very personal to me. I think this stock could truly revolutionize care for diabetes — a disease that's near to my heart since my mother died mainly of the disease 10 years ago. |

I'm happy to support any company that can save or prolong the lives of people with diabetes, but this company could have the potential to really change the game. |

Besides saving lives, I think the stock itself has enormous potential right now. |

With that said, here's the ONE company that I think deserves your attention today. |

So, clear your plate of all other distractions and focus on just this one stock today: |

Modular Medical, Inc. (Nasdaq: MODD) |

This development-stage insulin-delivery company has been on a tear the last two months… rocketing over 60%... and for good reason… |

The California-based company has been trading on Nasdaq for nearly two years and is now on the cusp — this month! — of submitting its pioneering device for FDA clearance. |

Let me explain why I think MODD merits a close look… |

First, let's start with the stock chart. |

As I have been surfing charts lately, I had to take a step back and say, "WHOA!" |

You know I love using my "Gamma Trigger" set up along with "GO" signals from the AI trading indicators I use. |

When I see both of those in play, the stock gets my immediate attention. |

Right now, here is what I am seeing…. |

|

This doesn't take a lot of explanation. |

In the last couple of months, we have seen some breakout moves higher following the "GO" signals. |

We are seeing the same thing right now, but MODD hasn't made a big move (yet). |

I see this as an amazing risk/reward opportunity. |

Consider what the downside looks like, versus what you see in the chart above when things work out. |

Does it get any better than that? |

I could stop right here and you have enough to make a decision… "but wait, there's more!" |

(Very) Big Market Opportunity |

You're probably aware that diabetes is a big deal in the medical industry — affecting a ton of people and costing a ton of money. But let's look at some of the numbers… |

The American Diabetes Association says that "In 2021, 38.4 million Americans, or 11.6% of the population, had diabetes." It released a report in 2022 that estimated the annual cost of diabetes to be $412.9 billion. |

"People with diagnosed diabetes now account for one of every four healthcare dollars spent in the U.S.," the report noted. |

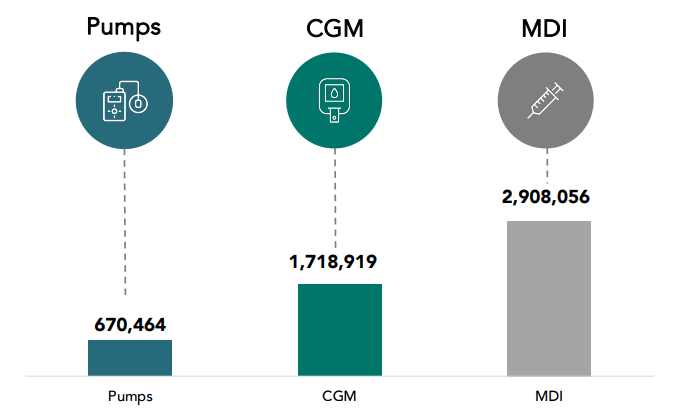

Citing 2020 data from the Centers for Disease Control and Prevention, MODD points out that 3.6 million Americans require daily insulin — that includes 2.9 million who use multiple daily injections (MDI) and 670,000 who use insulin pumps: |

| (CGM stands for 'continuous glucose monitors') |

|

Of those who use MDI, research firm Seagrove Partners has found that about 25% are "almost pumpers" — "meaning that they have considered going on a pump, understand pump therapy benefits, but want something simpler that doesn't have all the 'bells and whistles'." |

That's where MODD expects to come in. The company believes that existing insulin pumps are geared toward "superusers" and are "prohibitive for many to learn and manage." |

The pumps have too many complicated features that most diabetics don't need. This increases costs and puts them out of reach for many. As the tagline on MODD's website reads, it aims to provide "diabetes care for the rest of us." |

That hit home with me because my Mom really needed daily insulin, she just couldn't get over the thought of needles and insulin pumps weren't on her radar. An affordable and intuitive pump could possibly have made a real difference for her. |

Great Timeline and Vision |

Modular Medical calls its candidate device "MODD1" and says it will provide "insulin delivery for Almost Pumpers." Here is a diagram: |

|

MODD says this simple design will enable "automated, high volume manufacturing" at a fraction of competitors' costs. It will also be simple and easy to learn for providers and their patients. |

For MODD1 to make it to market, it first must receive FDA clearance. MODD's first FDA meeting was in Nov. 2019; its second was in Mar. 2020. The company went public in Feb. 2022. |

For all this time, investors have been on standby as the product was developed and tested. |

However, according to a December investor presentation — and this is why I'm bringing MODD to your attention now — the company is expecting to submit its MODD1 device for FDA clearance this month. |

Here is its projected timeline for 2024: |

|

Folks, if all goes well, MODD1 could be launched commercially before year's end, but any of these events could be catalysts for major stock-price action. |

And the company doesn't plan to stop there… |

It's already 50% through the development phase of "MODD1+" which will be a cellphone-controlled version of the device that can integrate with CGMs for algorithm-adjusted dosages. |

After that, it plans to launch what it calls the "future of care": MODD2. Here's how the investor presentation describes it: |

|

The goal is for the device to effectively be an "artificial pancreas." |

No human intervention required? Ask anyone who uses regular insulin, and they'll tell you this – it would completely revolutionize their treatment and dramatically improve their lives. |

But it's one thing to dream big. The question is whether MODD has the team in place to make such dreams a reality, and that's what I find most encouraging about this company… |

Leadership Team |

Modular Medical was founded by Paul DiPerna, who now serves as the company's chairman and CTO. |

Mr. DiPerna has led over 10 projects to FDA approval, including the t:slim insulin pump — a leading pump for type 1 diabetes — which he designed and took the lead in developing. |

The t:slim pump is produced by Tandem Diabetes — a company Mr. DiPerna founded and served as CEO of. It currently has a market cap of nearly $1.7 billion. |

I guess you could say Mr. DiPerna knows a thing or two about starting a successful company! |

In July, the company announced another all-star, Duane DeSisto, would be joining its lineup: |

Mr. DeSisto served as President and CEO of Insulet from 2001 to 2014, where he led the creation and commercial adoption of the Company's debut product, OmniPod, the world's first tubing-free disposable insulin pump. Under Mr. DeSisto, Insulet grew from an early-stage company to a market cap of more than $2 billion and was nationally recognized for its technology design and rapid growth, including being listed fourth on Forbes' "Most Innovative Growth Companies" in 2014 with five-year average sales growth of 47 percent. |

Mr. DeSisto retired in 2014 but is now serving on MODD's board. Per Mr. DiPerna, "I am excited to have Duane join our board, as I believe his strategic leadership and market development expertise, and our combined experience leading the commercialization of the two industry-leading pumps will create tremendous momentum for Modular Medical." |

I have to say: It inspires a lot of confidence that two long-time industry leaders who developed billion-dollar insulin pump companies are serving at the helm of MODD. |

Wrapping Up |

I found the fundamentals of MODD very auspicious, but I have to say, the technicals are looking great, too. |

The stock price has spiked as much as 120% since mid-November but is now floating about 80% higher than that mid-November price as investors await news about the application for FDA clearance. |

For their part, insiders have done nothing but buy, buy, buy over the past 12 months: |

|

All in all, this pioneering company appears to be on the cusp of a major breakthrough in diabetes care. Investors seem to be taking notice recently, and if the medical device does get FDA clearance, this stock and company could see increased attention and interest & positive action may develop in the stock price. |

As always, though, you need to do your own homework. |

I was pleasantly surprised with the company website and investor presentation. Normally healthcare-related companies publish only impenetrable jargon, but I found MODD's materials very readable and compelling (that alone makes it stand out as a company!). |

Be sure to study the stock chart in detail as well, and consult any other resources at your disposal. |

I think this company has a ton of potential. See if you agree. Until then… |

To Your Success, |

|

Jeff Bishop |

*Paid advertisement. This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results. |

|

Questions or concerns about our products? Email Support@ragingbull.com © Copyright 2022, RagingBull |

|

DISCLAIMER | *PAID ADVERTISEMENT. Raging Bull has currently been paid twelve thousand five hundred dollars from Sica Media who was compensated by a third party not affiliated with the Company for advertising Modular Medical, Inc. from a period beginning on January 19, 2024. The third party, Company, or their affiliates may own and likely wish to liquidate shares of the Company at or near the time you receive this advertisement, which has the potential to hurt share prices. This advertisement and other marketing efforts, including alerts, may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Modular Medical, Inc., increased trading volume, and possibly an increased share price of Modular Medical, Inc.'s securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in Modular Medical, Inc., though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication. | FOR COMMERCIAL AND INFORMATIONAL PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for commercial and informational purposes only. A portion of our business is engaged in the promotion, marketing, and advertising of companies including public companies. A portion of Raging Bull's business model is to receive financial compensation to promote public companies, conduct investor relations advertising and marketing, and publicly disseminate information regarding public companies through our websites email, SMS, and push notifications among other methods of communication. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. All material information contained in this advertisement is based on information generally available to the public, including information released to the public or filed by the Company with applicable regulators which public information is believed to be reliable and accurate. Nevertheless, Raging Bull cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company's financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision. | SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments. Never invest in any stock featured in this advertisement, on our site or emails unless you can afford to lose your entire investment. | NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. | USE OF FORWARD-LOOKING STATEMENTS. Our advertisements including this advertisement and related emails, reports and alerts may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information in this advertisement, related emails, reports or alerts or on our website or media webpage. This information is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as "believes," "anticipates," "estimates," "expects," "projects," "intends," or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https:// www .sec .gov/edgar/ searchedgar/company search | TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied. | WE MAY HOLD SECURITIES DISCUSSED. Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication. |

|

|

|

No comments:

Post a Comment