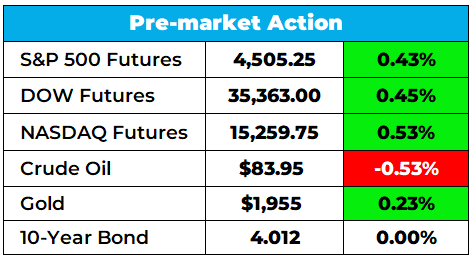

| Good morning, Wake-Up Watchlisters! Whether it's a cold brew or a hot cup of matcha, grab whatever puts a perk in your step and let's get into it. Disney didn't blow it! The mouse posted pretty good earnings, raised streaming prices, and threatened to crack down more on password sharing. The indices are green across the board, and all eyes are now on July's CPI numbers coming out this morning (probably right after you read this). Expectations are that while inflation is still growing, the rate of growth has slowed dramatically and in general is cooling off. Here's a look at the top-moving stocks this morning. Capri Holdings Capri Holdings (CPRI) was up 58.91% premarket after reports that Tapestry (TPR), which owns Coach, was in talks to buy Capri, the parent company of Versace, Michael Kors, and Jimmy Choo. The companies have apparently been in talks for months, and a formal deal could be announced today. This $8.5 billion-dollar deal would be a huge break for Capri shareholders and would bring Tapestry closer to rival LVMH Moët Hennessy (LVMUY) which is still by far the biggest company in space with a market cap over $400 billion. Plug Power Plug Power Inc. (PLUG) was down 9.67% in premarket trading. The hydrogen fuel-cell company missed earnings with second-quarter losses of 35 cents a share, more than the expected 28 cents. While revenue is up over 70% to $260.2 million from $151.3 million a year earlier, shareholders are still looking to see the company find ways to secure more funding and ramp up sales volume in the coming years. Hydrogen fuel-cells are still largely unproven tech, and investors are unsure of the potential value. Our Lead Fundamental Tactician Karim Rahemtulla has identified a different cutting-edge tech stock that he's calling "Tesla on steroids" because it has a foothold in several breakthrough technologies with proven results. Click here to discover "The Last Great Value Stock." AppLovin AppLovin (APP) was up 23.94% premarket after posting a great earnings report. The EPS of $0.22 a share represents a 175% surprise over analysts' expectations. The software company just rolled out its latest set of software which leverages artificial intelligence to help its customers better market their products. Nothing is hotter than AI on the market, and while investors and analysts alike are clamoring over who will benefit most from the tech, AppLovin is clearly the winner today. Speaking of AI, The Monument Traders Alliance has developed a brand-new AI trading tool to get almost INFINITE W and M patterns. We're talking potential gains as high as 513%... 1,085%... even 1,367%! In just one day! Click here for more info on how to improve your trading with AI! Certara Inc. Certara Inc. (CERT) was down 14.40% premarket after missing on EPS and revenue. The Princeton based biotech software company blamed regulation and cautious spending in the sector on its poor results. Certara has over 2,000 biotech customers who have come to rely on its biosimulation software to speed up their new drug development and testing process. However, VC funding, long the lifeblood of biotechs, is drying up. Certara and its shareholders are reliant on smaller biotechs finding new ways to generate funds in these ever changing market conditions. Those are the top market movers this morning! Happy trading! The Wake-Up Watchlist Research Team |

No comments:

Post a Comment