|  | |  Good morning. We've looked at the U.S. Treasury curve before. That's because the curve has been inverted for several months. Historically, every recession since the end of World War II has seen a recession 12-18 months after the yield curve inverts. More importantly, there have been no false positives – times when the curve has inverted but there hasn't been a recession. Good morning. We've looked at the U.S. Treasury curve before. That's because the curve has been inverted for several months. Historically, every recession since the end of World War II has seen a recession 12-18 months after the yield curve inverts. More importantly, there have been no false positives – times when the curve has inverted but there hasn't been a recession.

Could this time be different? The yield curve isn't just inverted right now – it's now at its steepest point since 1981, during a short but steep recession that occurred to help crush the inflation of the 1970s. And this time around, inflation was fueled in part by a series of stimulus payments during the pandemic and after.

With the job market holding up well, and the housing market adjusting to higher mortgage rates, chances are we may not see a big recession, if at all. However, traders should still heed the warning, and have a plan in place for the sudden emergence of a sudden market drop. After all, the yield curve inversion in late 2019 came just ahead of the Covid crash in early 2020, even before the first case of Covid developed.

Now here's the rest of the news: | |  | |  |  |

|  |  |  | DOW 35,227.69 | +0.01% |  | |  | S&P 4,536.34 | +0.03% |  | |  | NASDAQ 14,032.81 | -0.22% |  | |  | | *As of market close |  | | • | Markets closed mixed on Friday, but still logged gains for the week. |  | | • | Oil rallied 1.7 percent, closing at $76.94 per barrel. |  | | • | Gold dipped 0.3 percent, last going for $1,964 per ounce. |  | | • | Cryptocurrencies traded flat, with bitcoin at $29,874 at the stock market close. |  |  | |  | | | |

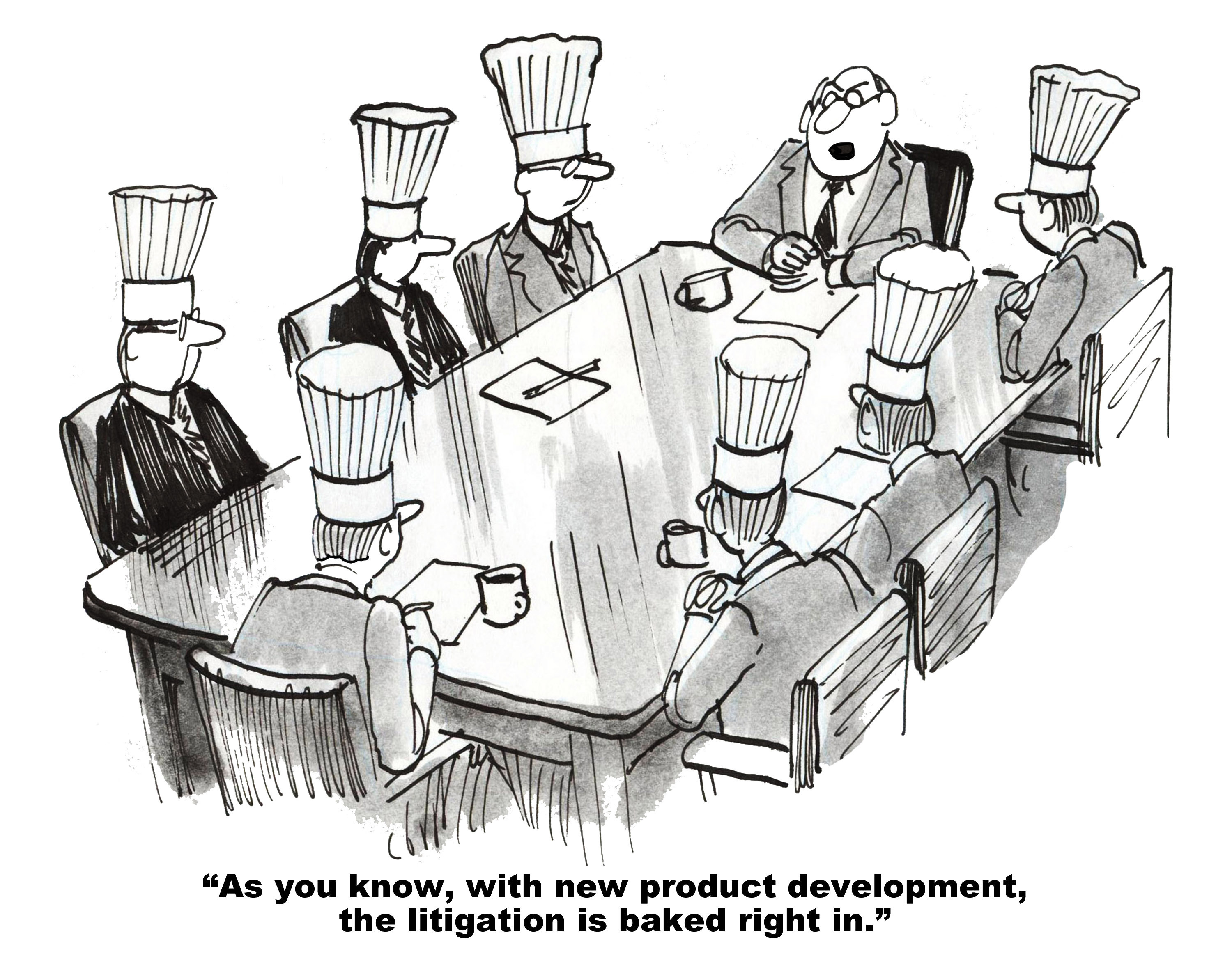

|  | | Litigation Fears Can Create Buying Opportunities |  |  |  | The threat of a big lawsuit can cause a company's valuation to tank. In an extreme case, like the tobacco companies in the 1990s, it can create an exceptional value, even at the risk of a further potential loss.

Likewise, even companies that have made positive moves towards resolving big litigation can get a reasonable value. That's because lawsuits take time to play out, as do the settlements for such lawsuits.

» FULL STORY |  | | |  |

|  | Insider Activity Report: Fastenal (FAST) |  |  |  | Michael Ancius, a director at Fastenal (FAST), recently bought 500 shares. The buy increased his holdings by 1 percent, and came to a total cost of $28,765.

This is the first insider buy of the year. Several insiders were buyers last year, including multiple directors, an EVP, and the company CEO. This year has seen a number of sellers, mostly following the exercise of stock options.

» FULL STORY |  | | |  |

|  | Unusual Options Activity: EnLink Midstream (ENLC) |  |  |  | Oil and gas midstream firm EnLink Midstream (ENLC) have risen over 30 percent since their May lows. One trader sees shares continuing higher in the coming weeks.

That's based on the September $12 calls. With 52 days until expiration, 13,412 contracts traded compared to a prior open interest of 579, for a 23-fold rise in volume on the trade. The buyer of the calls paid $0.35 to make the bullish bet.

» FULL STORY |  | | |  |

|  | • | AI Companies Make Voluntary Safety Commitments

Industry leaders met at the White House last week, and came out with a non-binding agreement to pursue shared safety and transparency goals with regard to the rollout of artificial intelligence software. The terms include sharing information with government agencies, academia, and others on AI risk mitigation techniques, as well as watermarking AI content. |  |  |  | • | Housing Market Holds Up Strong

High mortgage rates are keeping potential homeowners from moving to new homes, but it's also keeping the supply of homes for sale low. However, demand for housing remains robust, and a rise in new building permits indicates that the residential housing market is on track for growth in the third quarter. |  |  |  | • | India Imposes Rice Export Ban

India has ordered a halt to exporting non-basmai white rice, following heavy monsoon rains in the country have caused damage to the crops. That could lead to soaring rice prices globally, as India accounts for 40 percent of the world's rice airports. Parboiled rice is not included in the ban, which accounted for about one-third of India's rice exports last year. |  |  |  | • | American Express Warns on Rising Defaults

Credit card company American Express (AXP) reported a slowdown in activity. The issuer also continues to expect an increase in defaults on debt. That report is in-line with prior data on slowing consumer spending, and American Express tends to cater to higher-end consumers. |  |  |  | • | Amazon to Develop Satellite Processing Facility at Kennedy Space Center

Tech giant Amazon (AMZN) is investing $120 million to develop a satellite processing facility at Kennedy Space Center in Florida. The facility will further the company's plan to build a network of satellites capable of providing high-speed internet across the world. |  |  |

|  |  | | TOP |  | | ZTS | 6.719% |  |  | | DHR | 4.865% |  |  | | TMO | 4.689% |  |  | | ETSY | 4.287% |  |  | | BIO | 3.807% |  |  | | BOTTOM |  | | IPG | 12.344% |  |  | | SIRI | 9.603% |  |  | | ZION | 4.723% |  |  | | OMC | 4.633% |  |  | | AXP | 3.8% |  |  | |  |

|  |  |  | | Home sales fell, but home prices have held firm in most parts of the country. Limited supply is still leading to multiple-offer situations, with one-third of homes getting sold above the list price in the latest month. |  | - Lawrence Yun, chief economist for the National Association of Realtors, on why the lack of homes on the market are leading to low inventory, few sales, and relatively strong prices given existing demand for homes. |  |

|

No comments:

Post a Comment