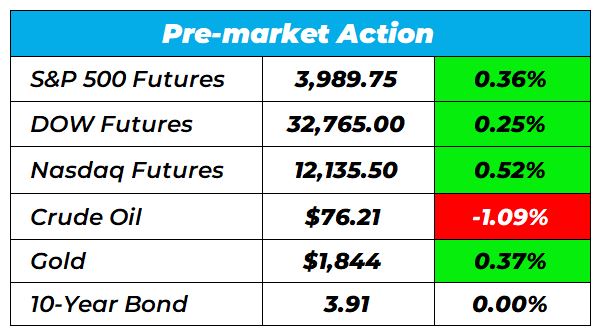

| Good morning Wake-Up Watchlisters! While you're sipping coffee you'll see stock futures rose on Wednesday to kick off March. Traders are looking to recover their footing after a losing last month. Right now the markets are rising due to a few factors, one being the current economic data out of China, which showed manufacturing PMI rose to 52.6 in February – a high not seen since April 2012. With the markets still in flux to start 2023, it's crucial to use the best strategies to make gains. We use what we call "The Perfect Timing" pattern in the War Room. This simple chart can be learned in under a day, yet it's proven to help traders feel more confident in their trading. Click here to see how this pattern works. Here's a look at the top-moving stocks this morning. Novavax (Nasdaq: NVAX) Novavax is down 24.41% premarket after the vaccine maker warned of "substantial doubt" it can stay in business through next year. Novavax's stock lost 93% of its value as the company faced manufacturing issues last year. Sales from its latest quarter totaled $357 million, with an adjusted loss per share of $2.28. Top and bottom line results missed analysts expectations. If a company is in serious jeopardy, it's crucial to know why. It's also crucial to learn which stocks actually have a chance of increasing value over time. Right now there's a company that our Head Fundamental Tactician Karim Rahemtulla is calling "The Last Great Value Stock." It recently developed an incredible new tech that powers 1 million homes, and its currently trading at under $1. Click here to see why this company is a potential great value play. Sarepta Therapeutics (Nasdaq: SRPT) Sarepta Therapeutics is up 20.24% premarket after topping revenue estimates. The biomedical company posted revenues of $258.43 million for the quarter ending in December 2022, surpassing the Zacks Consensus Estimate by 3.63%. This compares to year-ago revenues of $201.46 million. But overall, shares of Sarepta Therapeutics have lost about 8.8% since the beginning of the year versus the S&P 500's gain of 3.7%. Cutting edge health companies are constantly looking to create the next big breakthrough in medical science. Our friend Alexander Green wants readers to know about this one company. Its already seen over $400 million in investments from the Bill & Melinda Gates Foundation and Fidelity. Plus, Elon Musk recently sent its device into orbit. Click here to discover this under $3 medical device company. |

No comments:

Post a Comment