| | Andy Snyder

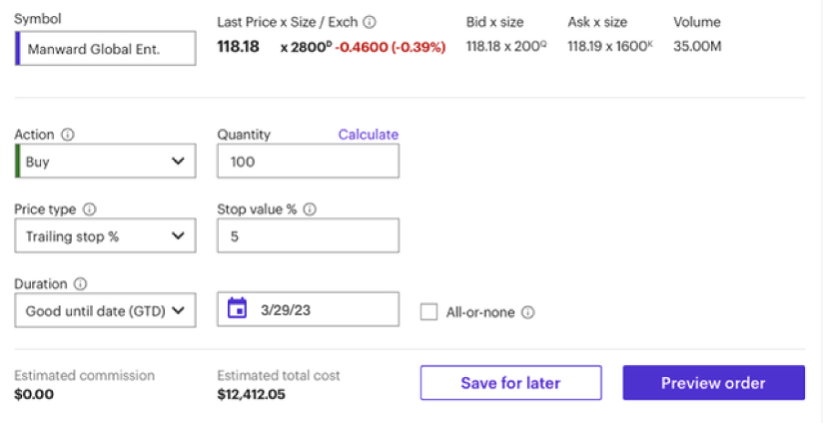

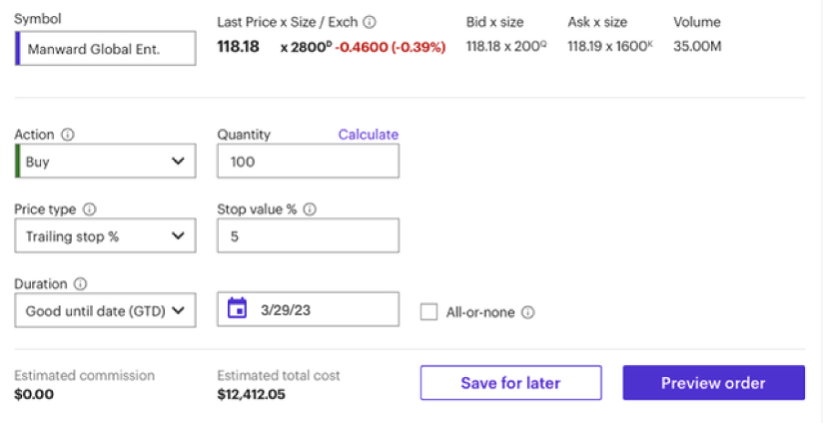

Founder | Stock market sell-offs hurt. They can be swift and painful. But they don't need to be. We'll let somebody else spew the same old tripe that sell-offs are buying opportunities. You already know that. It's been made quite clear in recent years that buying on dips is an easy way to boost your profits. What few folks will tell you, though, is exactly when to buy. [Do you own gold? Click here for details on a brand-new way to invest in gold.] How in the world can we know when we've reached a bottom? How can we know when the rush of selling has stopped and the buyers are back? We can't, of course. Nobody can. But there's a trick you can use that will help put the odds significantly in your favor. You've probably already heard of it... but we bet you've never thought of using this trick in quite this way. Rebound Confirmed If you've hung around long enough, you've heard us mention trailing stops. They're an ideal - and fairly popular - tool for helping to limit risk while maximizing reward. But most folks don't know that trailing stops work on the buying side as well as on the selling side. If you're the kind of person who drools over a market crash... you're going to like this. It's pretty simple to understand... and even simpler to put to use. You see, when we look to buy into big market corrections, we don't look to buy right at the bottom. It'd be nice, but trying to predict such things is dangerous. You'll be wrong far more often than you're right. That's why we look for some sort of confirmation signal. You can use a host of technical indicators. We do. But you can also use - you guessed it - trailing stops. Again, they're not just for selling. Here's how it works... Break It Down, Andy The key to understanding trailing stops is to lock in on the idea of the "best price." On the selling side, a stock's best price is the highest price it hits while you own it. But on the buying side, a stock's best price is its lowest price. For example, let's say Manward Global Enterprises is selling for $100 per share... but then we go and accidently insult some nut who gets offended and wants to "cancel" us. Suddenly, our share price goes to $90... then $85... then $80. We're sweating... but you know our mission is too strong to be stopped. You decide you want to buy shares while they're cheap. But you want to buy only when it's clear we haven't insulted anybody else. You would do that by setting a trailing stop that automatically buys once the stock has rebounded by, let's say, 5%. (You could use any percentage, but 5% is a strong rebound indicator after a sizable dip.) As the stock falls, the trailing stop moves with it. At $90, for instance, it would trigger a buy only if the stock rose back to $94.50. If shares kept falling to $85, the trailing stop order would also drop... to $89.25. If the stock hit $80, the buy price would be $84. But as shares start to rebound and the bulls come back, that low of $80 becomes the "best price." It's what controls the stop, which now doesn't move. So as the price rises to $81... then $82... then $83, the buy order remains at $84. When the stock hits $84, it will have risen 5% from its lows, and you'll know it's likely in the midst of a recovery. You can jump in and ride the stock all the way back up to $100 per share... at which point we'll likely say something to get ourselves in trouble again. E.A.S.Y. These sorts of trades are simple to make. You can see what the trade would look like in an E-Trade account right here...

View larger image Again... nice and simple. Just select the trailing stop percentage, enter the number you're comfortable with, and then be sure to set the trade's duration to "good 'til canceled" (GTC) or set an appropriate date a few weeks out. (It's unlikely you'll want to keep the order for only a day or two.) And remember, this is the sort of entry you want to make only when the market is in a bit of a panic. It's not for everyday trades. It's an ideal way to keep emotion out of your trading and ensure you enter good stocks at good prices, at points when they're likely to start climbing their way back up. Try it... It'll give you a good reason to look forward to a nasty correction. Be well, Andy | Knowing when to sell a stock is just as important as knowing when to buy one. Watch this video to learn how to set a trailing stop in three of the most popular brokerage platforms. | | | Want more content like this? | | | | | Andy Snyder | Founder Andy Snyder is the founder of Manward Press, the nation's premier source of unfiltered, unorthodox views on money and what it means for a free society. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. He's been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms. | | | |

No comments:

Post a Comment