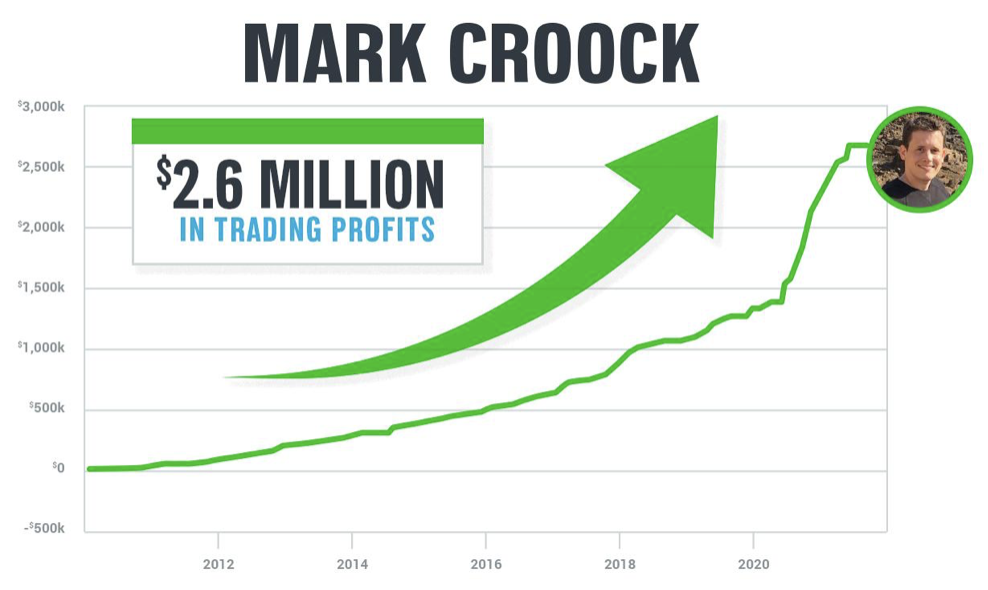

| The below offer is brought to you by Evolved Trader Trader, Options. Everyone and their mother wants to learn how to make boatloads of cash trading options. The options frenzy even grabbed one of my top students, Mark Croock. Mark started out as my student. He made his first million trading penny stocks with my strategies. But like so many, he was tempted by the lure of options trading. And get this... It took Mark 7 years to make his first million in the stock market. Then, he made a little change to his strategy... Basically, he took my million dollar penny stock strategies and combined them with his own options strategy... And can you guess what happened? Well, the results speak for themselves:

(By clicking the link above, you'll be opted-in to Evolved Trader's free e-letter and related content from marketing partners.) Thanks to his genius strategy combo, Mark is averaging around $1 Million Dollars a year in trading profits. With that said... If you MUST venture into the world of options trading, listen carefully to what I'm about to say...  Do not place a single trade until you grab Mark's "Ultimate Options Trading Blueprint for Small Accounts."

(By clicking the link above, you'll be opted-in to Evolved Trader's free e-letter and related content from marketing partners.) I'm serious. Forget about the YouTubers. Forget about Options books from Amazon. Read Mark's blueprint. Read it 10 times! Keep it next to the desk where you trade. From here on out, make this blueprint your trading bible. Because here's the thing... Mark has been known to use this strategy to pocket gains of 85%, 138%, and even 183% - Sometimes overnight. I know, I know. If you thought I was a quick profit sniper, Mark is on a different level. And if you've ever had thoughts about trading options, grab your FREE copy of his blueprint before he marks up the price.

(By clicking the link above, you'll be opted-in to Evolved Trader's free e-letter and related content from marketing partners.) Now, before you go, I should let you know... Don't get me wrong, of course, his options strategy is absurdly powerful on its own. But if you combine his Options blueprint with my penny stock strategies? Stuff like THIS can happen: "I've had 100k days with Mark's help. He is the mr. Miyagi of stock options." - Tim M. 100k days are not typical. But imagine just grabbing a sliver of that potential... -Tim Sykes

Founder, Millionaire Publishing |

No comments:

Post a Comment