| |

| |

| |

| Presented By American Petroleum Institute (API) |

| |

| Axios Generate |

| By Ben Geman and Andrew Freedman · Jan 20, 2023 |

| 🍺Yes. Friday. Today's newsletter has a Smart Brevity count of 1,106 words, 4.5 minutes. 🎸Rest in peace to rock great David Crosby, who died this week at 81 but lives on with this week's final intro tune... |

| |

| |

| 1 big thing: Grappling with transferred emissions |

|

|

| Illustration: Annelise Capossela/Axios |

| |

| As large oil and gas companies increasingly take on climate change commitments, a unique barrier to achieving actual emissions reductions has emerged, Andrew writes. - Some are selling off assets — often carbon or methane-intensive facilities — to companies that lack environmental targets and in many cases are privately owned, with fewer incentives to cut their emissions.

Why it matters: A result of such mergers and acquisitions is that high-emitting assets can simply change hands, rather than be retired. The big picture: A new report out from the Environmental Defense Fund, an environmental group, and Ceres, a sustainable investment advocacy group, recommends that companies take climate goals into consideration during the negotiations process. - The report, published Thursday, calls for putting the onus on the companies selling assets to ensure their deals teams take climate and sustainability concerns into account when negotiating terms.

How it works: One proposal is ensuring that public reporting of emissions and other environmental impacts continues after a transaction closes, even if an asset goes to a private company with more limited disclosures. - The series of voluntary principles says buyers should also plan ahead for the decommissioning of transferred assets, such as natural gas wells, including the costs and liability issues.

Context: Research EDF published last year examined 3,000 deals between 2017 and 2021 and found that public-to-private transfers of fossil fuel assets have comprised a growing majority of deals. - In addition, deals have increasingly moved fossil fuel assets away from companies that have environmental targets, said Andrew Baxter, a report coauthor and director of climate transition at EDF, in an interview.

- An example of this is BP's 2019 sale of its Alaska assets to Hilcorp.

- "Business as usual M&A is threatening to stall out global greenhouse gas emission reductions, potentially," Baxter said.

- "We're not assuming nefarious intent behind any of these transactions," he noted, saying the problem instead is a lack of environmental risk controls.

Yes, but: One potential stumbling block to incorporating climate risk into deals is the incentive structure for M&A teams. - "The deals teams within these companies are incentivized to do them quickly and to extract as much value as possible," he said.

Our thought bubble: Including the climate ramifications of a transaction on a deal sheet may not be an easy sell, but it could pay off over the long term. |

|

| |

| |

| 2. The debt crisis is a climate crisis |

|

|

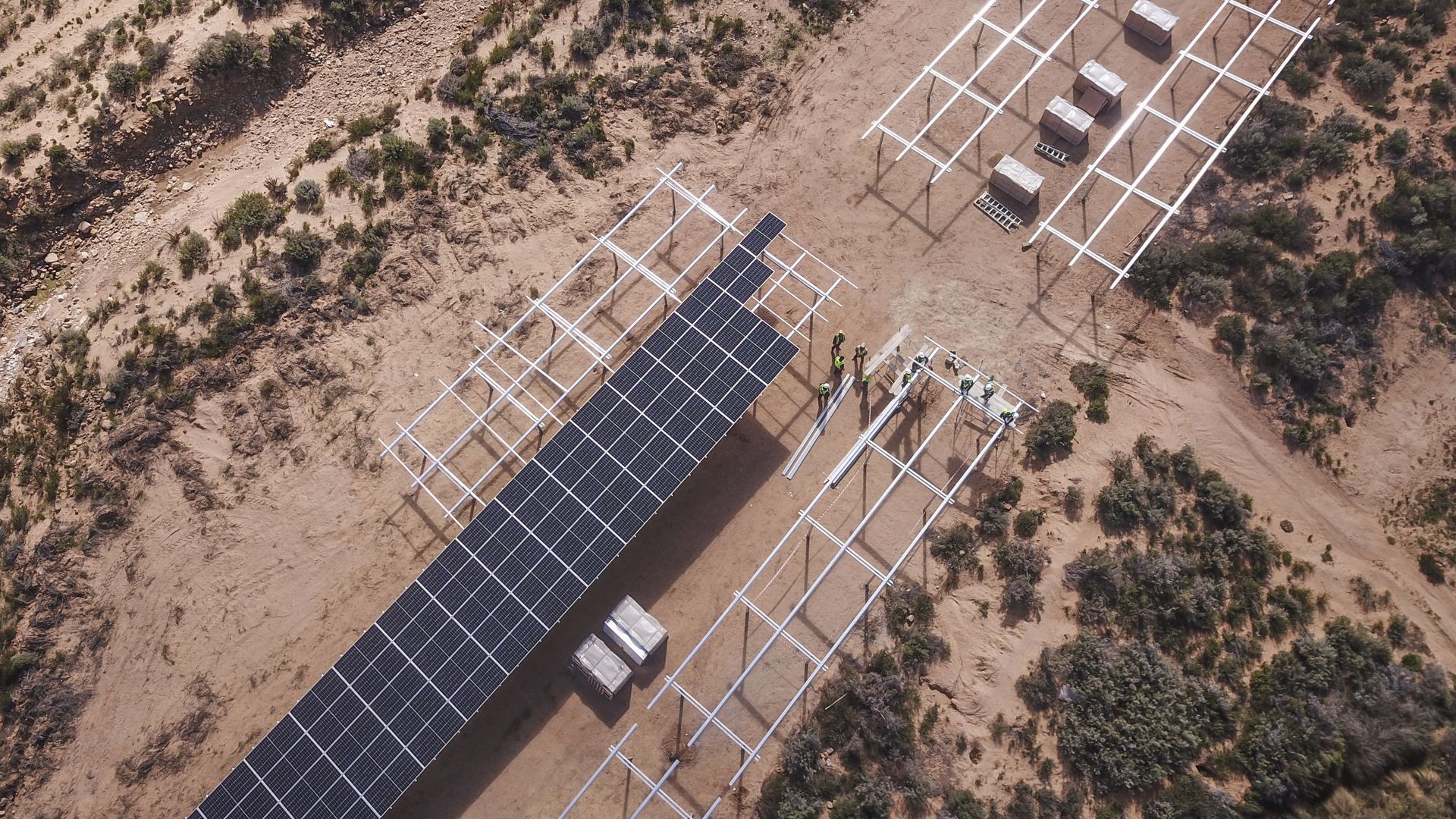

| Workers install solar panels in Groenfontein, South Africa, in 2022. Photo: Guillem Sartorio/Bloomberg via Getty Images |

| |

| The global energy transition was near the top of the agenda this week in Davos — especially tensions between the U.S. and Europe over climate-related subsidies, Axios World's Dave Lawler writes. Yes, but: The debt crisis in the developing world was less discussed in the halls and sessions Axios attended. But the link between those two issues will have lasting ramifications. State of play: 54 developing countries, accounting for half the world's population, face such high debt burdens that without relief they have little hope of financing an energy transition, per the UN Development Program (UNDP). - Many of those countries are in Africa. "The continent will connect another 1.4 billion to 1.6 billion people to the global electricity matrix by 2050," UNDP administrator Achim Steiner told Axios in an interview.

- That's a good thing. "Electricity is the fundamental driving variable of development," Steiner said. But many developing countries are likely to struggle to supply sufficient energy of any sort in the coming decades.

Threat level: Developed nations' decisions can exacerbate the challenge. - Europe's scramble to secure enough energy for winter drove up prices in developing countries.

- Some of the same countries that reverted to coal in 2022 have committed not to fund new fossil fuel projects overseas.

Read the whole story |

|

| |

| |

| 3. Climate fuels trade tensions and new ties |

| Speaking of Davos, news from the conference shows how climate is bringing both new trade tensions and hope for collaboration, Ben writes. Driving the news: Officials from across the world on Thursday launched the "The Coalition of Trade Ministers on Climate," one of several initiatives unveiled there. - Goals include the promotion of trade and investment policies that foster the "uptake of goods, services and technologies" that support emissions-cutting and adaptation.

- Members include EU nations, the U.S., African nations including Angola and Kenya, Japan, Colombia, Australia and more. Full list

Yes, but: The conference comes amid friction between the U.S. and EU over big new U.S. subsidies for low-emissions energy manufacturing and projects. Go deeper: The Clean Tech Arms Race has Begun (Bloomberg) |

|

| |

| |

| A message from American Petroleum Institute (API) |

| Make, move and improve American energy |

| |

|

| |

| With global uncertainty, Washington must prioritize American natural gas and oil as a long-term strategic asset. Here's how: - Make: Increase U.S. energy development.

- Move: Permit infrastructure.

- Improve: Enable innovation to lower CO2 emissions.

The solution is here in America. |

| |

| |

| 4. New phase of the power mix evolution |

|

|

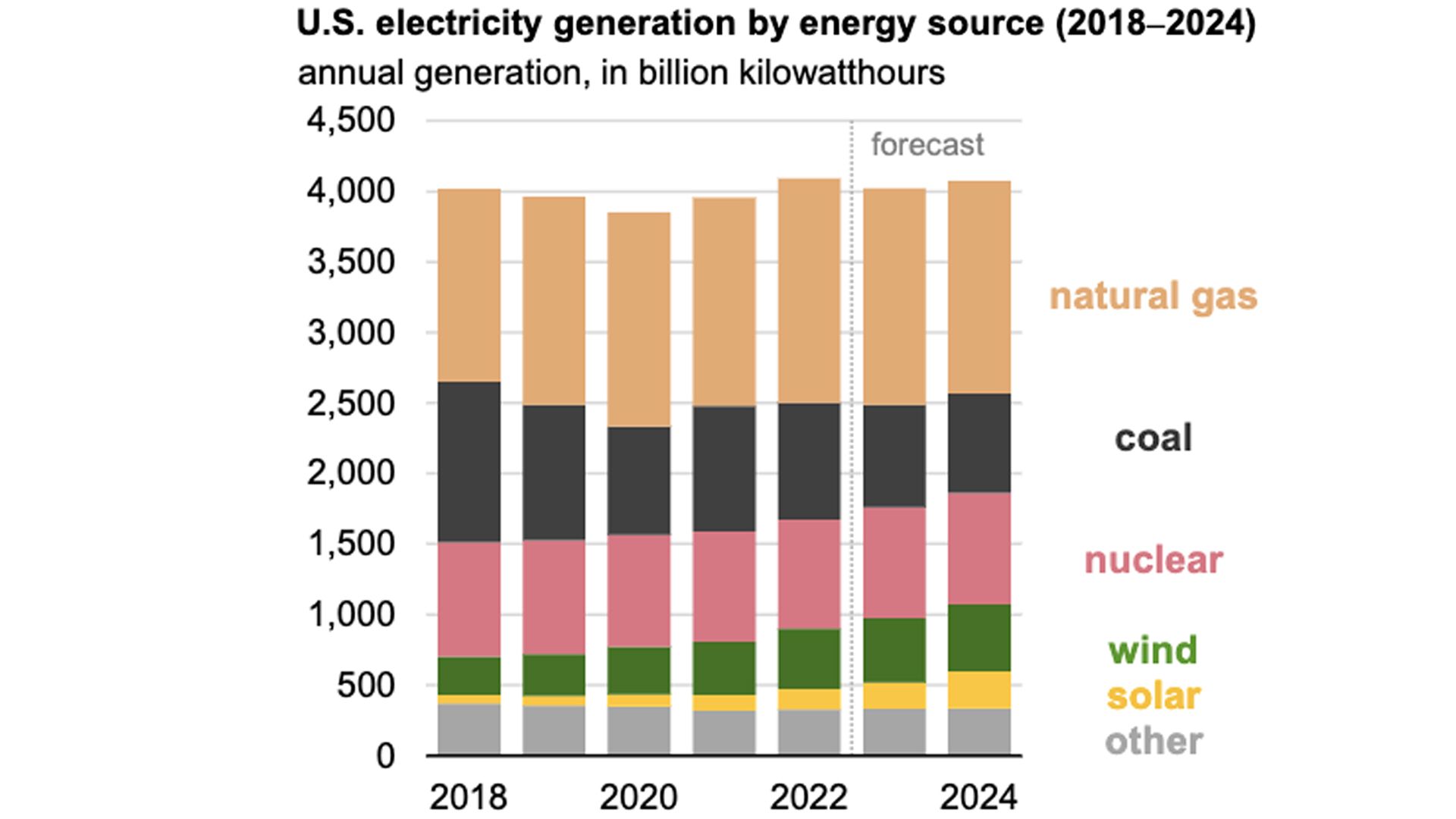

| Image via the Energy Information Administration |

| |

| For many years natural gas and renewables gained market share in U.S. power at coal's expense, but renewables are now growing enough to change that equation, Ben writes. Driving the news: The federal Energy Information Administration projects that increased renewables output, mostly wind and solar, will reduce both coal and gas-fired generation's share in 2023 and 2024. Zoom in: EIA's latest outlook sees wind and solar together rising to 16% of the U.S. power mix this year, while gas and coal's market share decline slightly to 38% and 18%, respectively. The trend is expected to continue in 2024. Yes, but: What actually happens depends on the weather and other forces. What we're watching: Even more aggressive deployment of renewables and other zero-carbon sources will be needed to meet the White House goal of 100% carbon-free power by 2035. |

|

| |

| |

| 5. A new startup wants to turn your food waste into chicken feed |

|

|

| Mill's food waste bin. Photo courtesy Mill |

| |

| A new green tech startup wants us to rethink what we do with our banana peels, pepper tops and other kitchen scraps, Axios' Alex Fitzpatrick reports. Why it matters: Scraps that are thrown away in the regular trash often wind up in landfills, where they generate methane, a greenhouse gas. - Landfills account for nearly 15% of human-related methane emissions, per the U.S. Department of Agriculture.

How it works: The company, called Mill and launched Tuesday, is part hardware startup, part subscription service. - Customers are sent a bin for their kitchen scraps. The bin — which must be plugged in — dehydrates and mashes food scraps into a substance, not unlike ground coffee.

- When the bin is full, subscribers can empty the contents into a prepaid mailing box to be sent back to Mill.

What's next: Mill is working with regulators on plans to turn the resulting material into a chicken feed ingredient — keeping it in the food cycle and out of landfills. Read the whole story |

|

| |

| |

| 6. California's astounding snowfall totals |

|

|

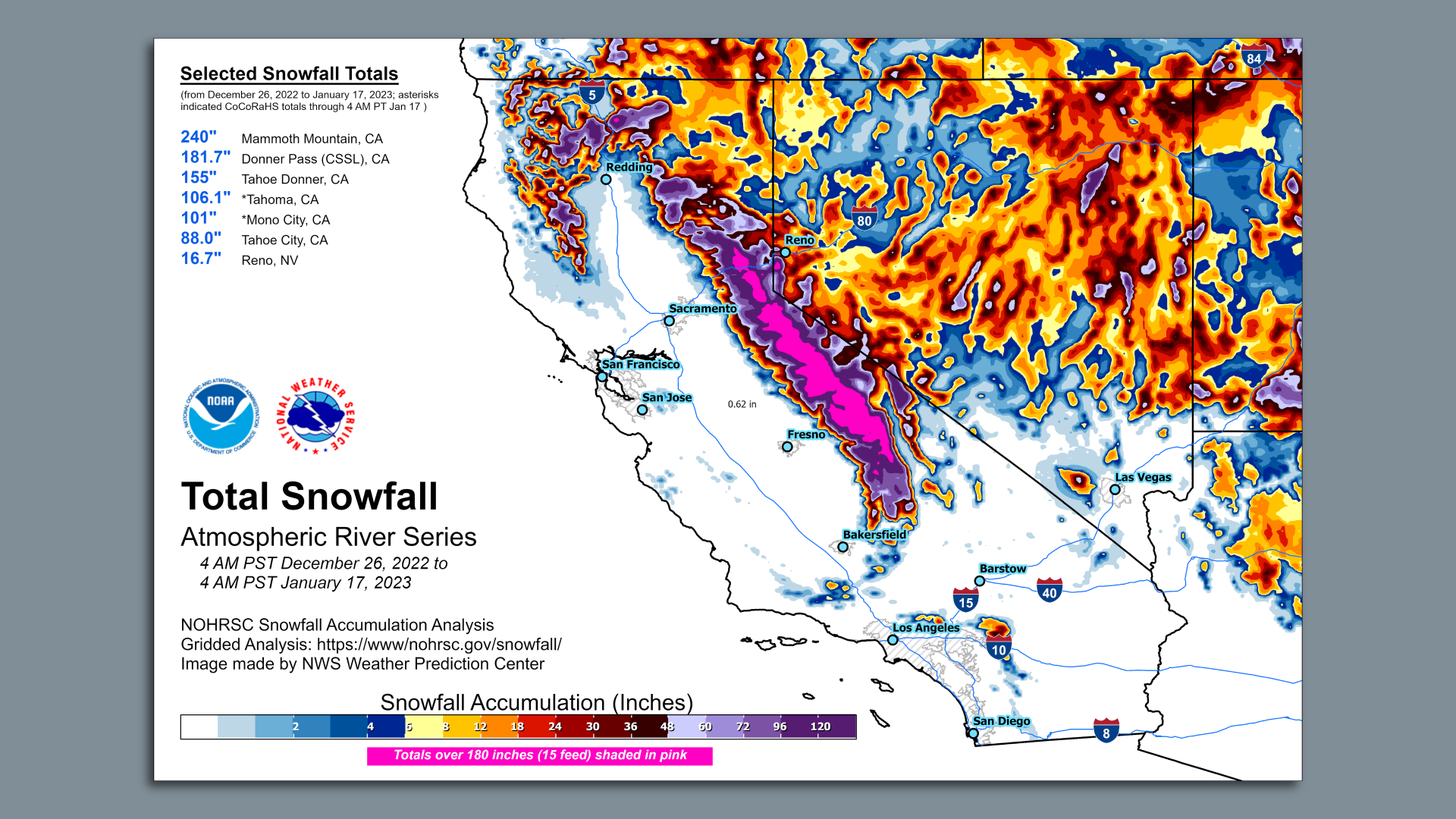

| Image: NWS Weather Prediction Center |

| |

| California's mountains saw up to 15 feet of snow during the atmospheric river events between Dec. 26 and Jan. 17. This brings the statewide average snow depth to 245% of average for this time of year, Andrew writes. Why it matters: The mountain snowpack is a crucial source of water for drinking and agriculture during the dry season in lower elevations of the state. By the numbers: Mammoth Mountain saw 240 inches, according to NOAA, with 181.7" at Donner Pass. |

|

| |

| |

| A message from American Petroleum Institute (API) |

| Make, move and improve American energy |

| |

|

| |

| With global uncertainty, Washington must prioritize American natural gas and oil as a long-term strategic asset. Here's how: - Make: Increase U.S. energy development.

- Move: Permit infrastructure.

- Improve: Enable innovation to lower CO2 emissions.

The solution is here in America. |

| |

| 📬 Did a friend send you this newsletter? Welcome, please sign up. 🙏 Thanks to Mickey Meece and David Nather for edits to today's edition. Have a great weekend! |

| | Your personal policy analyst is here. | | |

No comments:

Post a Comment