Are You Standing on the Sidelines for This Brand-New Bull Market?| By Whitney Tilson |  |

MAJOR BUY ALERT: EVs/Wall Street/Gains Enrique Abeyta spent 25 years on Wall Street, where he managed several billion-dollar hedge funds. The Wall Street Journal, CNBC, Barron's, Institutional Investor, Forbes, Business Insider, and Bloomberg all have his number on speed dial. But once they get a load of what he's discovered, his phone will be ringing off the hook! If you buy just one stock in 2022... it should be this one. |

|

If you watch the news, you've no doubt been hearing about inflation... If you watch the news, you've no doubt been hearing about inflation...

If you go to the grocery store, you've no doubt been noticing inflation... But the place where Americans see inflation more than anywhere else is at the gas pump. And while the other areas might come and go – the media might change its focus to the next news story of the day, and food prices might fluctuate – we think that the higher energy prices are here to stay. We are in a bull market for energy.  Looking at oil specifically, today's bull market in the commodity can trace its origins to the last one... Looking at oil specifically, today's bull market in the commodity can trace its origins to the last one...

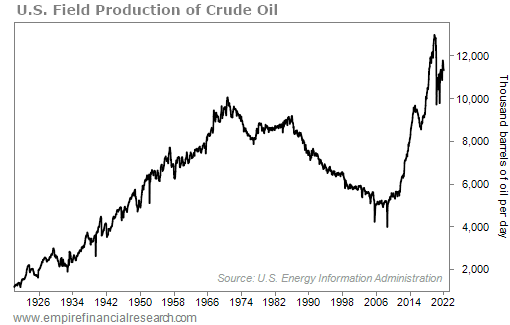

After decades of decline, U.S. oil production started to grow strongly beginning in 2010, nearly doubling from 5 million barrels a day to almost 10 million per day over the next five years. Like many industries that see such enormous growth, it was driven by technological innovation – in this case, fracking and horizontal drilling. While both had been around for decades, it wasn't until 1998 that the two were used in tandem by Mitchell Energy, which was able to get at what most thought was an unreachable deposit of natural gas in the Barnett Shale in Dish, Texas. Even better, it was economical – costing just $600,000 to $700,000. It proved harder to get oil out of shale deposits using this new technique... but oil companies were persistent. In 2008, they figured out how to use fracking and horizontal drilling to get previously untouchable deposits of oil out of the ground too.  The timing was fortunate, as the global financial crisis led to ultra-low interest rates... The timing was fortunate, as the global financial crisis led to ultra-low interest rates...

With virtually free money widely available, the executives of oil and gas companies borrowed massive amounts of money to drill as fast as they could. Growth at all costs became the rallying cry of the industry. Sure enough, production soared, but this sowed the seeds of the industry's demise... By late 2014, the supply of oil began to surpass demand and the price fell 20% to $100. At this price, however, most oil and gas companies were still quite profitable and able to service their large debt loads.  But things got worse later that year... But things got worse later that year...

OPEC, the world's largest oil cartel, refused to give up more market share to the Americans, so its members kept drilling at elevated rates. Unsurprisingly, global supply soon overwhelmed demand – sending oil prices into a free fall in late 2014 and early 2015. When oil fell to $60 per barrel, it put the U.S. oil and gas industry in a precarious position. Many new wells drilled in the U.S. were no longer profitable, which meant that many companies were struggling to service their debt loads.  Things then went from bad to worse in late 2015... Things then went from bad to worse in late 2015...

China, the largest driver of incremental demand for oil, saw economic growth slow. Oil prices crashed further, hitting $40 per barrel. While they soon rebounded a bit, they stayed around $60 for most of 2016 and 2017. At these price levels, many American companies went bankrupt... and others were forced to consolidate.  While painful, it also set the stage for today's bull market... While painful, it also set the stage for today's bull market...

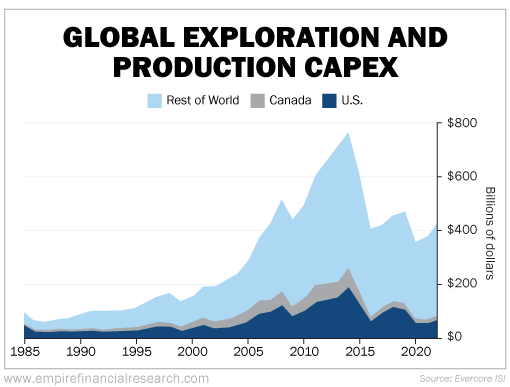

Companies greatly reduced spending on drilling new wells, as you can see in this chart of capital expenditures ("capex"): By 2019, things were looking up for the U.S. oil and gas industry. The supply-demand imbalance had eased, the price of oil averaged $70 per barrel in 2018 and 2019, and companies were able to reduce their debt loads.  But then the pandemic hit... But then the pandemic hit...

Demand plunged almost overnight, taking the price of oil with it. At one point, it actually turned negative. More companies filed for bankruptcy and the survivors were bruised and scarred. A second horrific bear market in five years catalyzed change in the industry. By the end of 2020, almost every company had turned over its management team at least once in the previous five years. The disastrous performance of nearly every stock in the sector also meant that shareholders (i.e., owners) changed as well. Gone were the "growth at any cost" investors, replaced by bottom-fishing value investors urging conservatism, restraint, cash generation, and payouts to investors. New management teams – eager to please their shareholders – eschewed new drilling and instead looked to milk existing wells, pay down debt, and return any excess cash to shareholders via stock buybacks and variable dividends. This constrained supply picture, combined with the world reopening last year driving demand, sent the price of oil soaring. From a low of $40 per barrel in October 2020, prices rose to near $100 per barrel earlier this year.  And then Russia invaded Ukraine... And then Russia invaded Ukraine...

Western nations responded by placing embargoes on Russian commodities. With Russia being the third-largest producer of oil globally, the embargo on its oil sent the price of oil to nearly $130 per barrel at one point. We think much of the latest spike will prove to be temporary... But we also think that high oil prices are here to stay... Oil and gas companies are much more disciplined about drilling now, which means supply will remain tight. And with the world not fully reopened – and renewables not yet developed enough to stop global oil demand from growing – demand will continue to grow, keeping oil prices high. Additionally, Russia's invasion of Ukraine has fundamentally changed the demand picture for oil... Western countries now realize that they can't rely on unfriendly trading partners for their energy needs. This is great news for the U.S. oil and gas industry, which should find many eager buyers to drive demand going forward.  This year, we took advantage of the bull market in oil by launching Energy Supercycle Investor... This year, we took advantage of the bull market in oil by launching Energy Supercycle Investor...

It's a fully allocated portfolio of 10 oil stocks ranging from exploration and production companies and liquefied natural gas companies to oilfield services and rig and frack operators. With energy stocks up 61% over the past year – by far the best-performing sector in the stock market – you might think you've already missed the boat. But that's not the case... We believe we're experiencing a structural shift so profound that it will change how the world operates. And we're only in the first inning. Normally, we'd charge you as much as $5,000 to access our Energy Supercycle Investor portfolio. But right now, you can read and even print out every issue and special report we've published on the bull market in energy and watch our six-part Master Class video series... for a small fee of $99. Of course, we can't keep this offer open for long. In fact, it expires at midnight tonight. So if you want to take advantage of it, simply click here. Best regards, Whitney Tilson

November 28, 2022

If someone forwarded you this e-mail and you would like to be added to the Empire Financial Daily e-mail list to receive e-mails like this every weekday, simply sign up here. |

No comments:

Post a Comment