| Editor's Note: In September, the major market averages experienced their biggest one-month drop in over 20 years. It was a bloodbath. Everywhere you looked, you saw losses. Big losses. Everywhere except The War Room, that is. In September, we hit winners on 29 out of 34 total trades. That's a remarkable 85.29% win rate - all while most buy-and-hold investors were getting their faces ripped off. My friends, this is why it's time for you to "level up." No matter whether the markets bounce, continue to crater or even flatline (not likely), you need guidance to get you through with profits in hand - and that's exactly what Karim and I deliver. To start your journey with us, I invite you to review Karim's urgent message, titled "America's Reckoning." In it, he explains why you should move into a key $3 asset before October 7. Timing Is Critical, so I Urge You to Check It Out Now

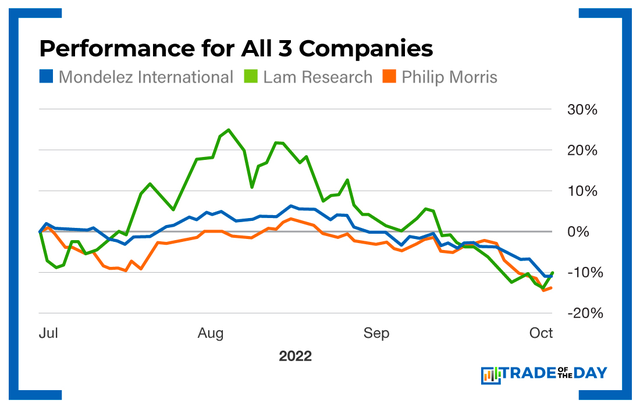

Bryan Bottarelli, Head Trade Tactician, Monument Traders Alliance Today, we're going to discuss three casualties of the strong U.S. dollar. You've surely heard about the strength of the dollar. The downside is that a strong dollar erodes overseas revenue for U.S. companies with major international divisions. Why? Well, if you're a company that is getting paid primarily in foreign currencies, those currencies are now weaker compared with the strong dollar - which negatively impacts your earnings potential. For instance, say you're getting paid for your products in a foreign currency. You sell a widget overseas that cost you $5 to make for $10 worth of a foreign currency. That's a great profit margin, right? Not so fast. When you go to convert what was originally $10 in foreign currency into U.S. dollars a couple of months later, you may get back only $7 or $8. In other words, when you convert a weaker foreign currency into stronger U.S. dollars, you'll get fewer dollars back - which reduces your sales numbers. This situation is great for travel companies such as Delta Air Lines (NYSE: DAL), United Airlines (Nasdaq: UAL) and American Airlines (Nasdaq: AAL) - which stand to benefit from Americans wanting to travel more. They can use their strong dollars to get more buying power overseas. |

No comments:

Post a Comment