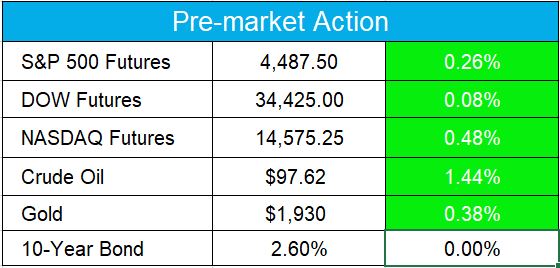

Berkshire Continues To Focus On Technology Sector With 11% Stake Reveal Good morning Wake-Up Watch Listers! While you're sipping that first cup of coffee you'll see stock futures rose slightly as the market tries to recover from back-to-back losing sessions. The Fed released the minutes from its march meeting yesterday, showing they plan to reduce their trillions in bond holdings by about $95 billion. There's also antipication they will raise interest rates as early as May. With uncertainty over upcoming fed decisions, expect the markets to remain volatile but also provide many dip-buying opportunities. Here's a look at the top-moving stocks this morning. HP Inc. (NYSE: HPQ) HP Inc. is up 14.58% premarket after Warren Buffet's Berskhire Hathaway revealed an 11% stake in the company. The stake was valued at more than $4.2 billion. Berkshire now owns about 121 million shares of the laptop maker. Buffet has been leaning more into the technology sector as of late. In 2021, he built up a $161 billion stake in Apple, Inc. (Nasdaq: APPL). HP, Inc. is a stock to keep an eye on. Paysafe (NYSE: PSFE) Paysafe is up 4.56% premarket after the payment company announced it will expand its partnership with betPARX, a Pennsylvania-based gaming company. Paysafe will also provide payments for betPARX mobile apps in Pennsylvania and New Jersey. This expansion makes Paysafe a stock to take notice of. Cleveland Cliffs (NYSE: CLF) Cleveland Cliffs is up 2.83% premarket and surged 44% overall in the month of March. The steelmaker's stock boost comes from steel and iron price increases due to the war in Ukraine. Both Russia and Ukraine are major steel exporters, and the lack of supply from those countries is likely to impact the industry. We've been trading Cleveland Cliffs long before the crowd. Our first trade on them was in 2019. And last month, Karim used his cluster buying strategy to help Trade of the Day Plus members record 50% gains. See how by clicking here. To unlock more picks like this, and get Karim's top value stock play trading for under $2 - click here. Discovery Inc. (NYSE: DISCA) Discovery Inc. is up 2.97% premarket as analysts are increasingly bullish due to the AT&T (NYSE: T) Warner Bros. merger. The telecom giants recently issued a special dividend to shareholders where they could decide whether to own just AT&T, the soon-to-be Warner Bros. Discovery or both. Discovery is a stock gaining momentum as the streaming industry goes through a restructure. Wayfair Inc. (NYSE: W) Wayfair Inc. is down 3.71% premarket after the ecommerce company saw revenue drop more than 11% year over year. The company has struggled to maintain sales through the shifting COVID-19 pandemic. Their Class A shares have posted returns of -67% over the past year, making it one of the worst performing mid-cap stocks in that period. Investors should adjust accordingly. Those are the top market movers today. Happy trading! The Wake-Up Watchlist Research Team |

No comments:

Post a Comment