Editor's Note: Today, we've got an important guest article from our friend Marc Lichtenfeld, Chief Income Strategist at The Oxford Club. Marc has been studying Dividend Aristocrats for years. Dividend Aristocrats are S&P 500 companies that have increased their dividends each year for at least the last 25 years. And now Marc is coining a new term: " Earnings Aristocrats." Earnings Aristocrats are companies that have beaten earnings estimates for 25-plus straight quarters. And in Marc's latest presentation, he reveals just how powerful - and profitable - Earnings Aristocrats can be. In fact, Marc believes some Earnings Aristocrats could double your investment in less than 24 hours. But you'll have to act fast. The deadline to join - before Marc's earnings season kicks off - is at midnight ET tonight. So get in now before it's too late! Click here to see Marc's Earnings Aristocrats presentation.

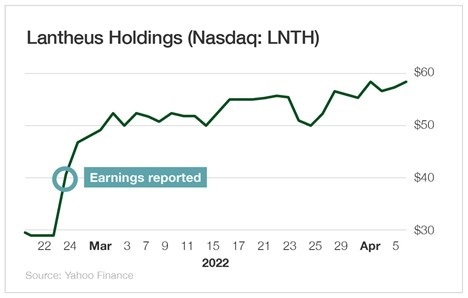

Marc Lichtenfeld, Chief Income Strategist, The Oxford Club There's a big difference between trading and investing. When you invest in a stock, you should be going in with a long-term view. You can certainly change your opinion as time goes on if events warrant it. But you shouldn't plan to hold a stock for years and then get spooked by one bad earnings report (unless something extraordinary happens, like fraud). Trading is different. A trader is often looking for a specific catalyst. Oftentimes, traders view earnings reports as important catalysts. It's not uncommon to see a stock surge after reporting a quarterly earnings beat. TransMedics Group (Nasdaq: TMDX) recently surged more than 30% in one day after reporting stronger-than-expected results for the fourth quarter of 2021. The stock is now 114% higher than it was the day before earnings were announced. In February, Lantheus Holdings (Nasdaq: LNTH) spiked 39% in one day after reporting stronger-than-expected earnings. The stock has now more than doubled from its pre-earnings price. Lululemon (Nasdaq: LULU) did it twice in the past three quarters, jumping 11% in September and 10% in March on better-than-expected earnings results. It's important to have near-term catalysts for your stock. Otherwise, you have no reason to believe the price will quickly move higher - other than "It's a good stock," which isn't a valid rationale at all. Without a reason to expect a stock to jump in the near term, your investment could be dead money. It could just sit there, doing nothing. If you're putting your money to work in the market in the short term, you want the trade to be completed fairly and quickly. Make your money, get out and move on to the next one. |

No comments:

Post a Comment