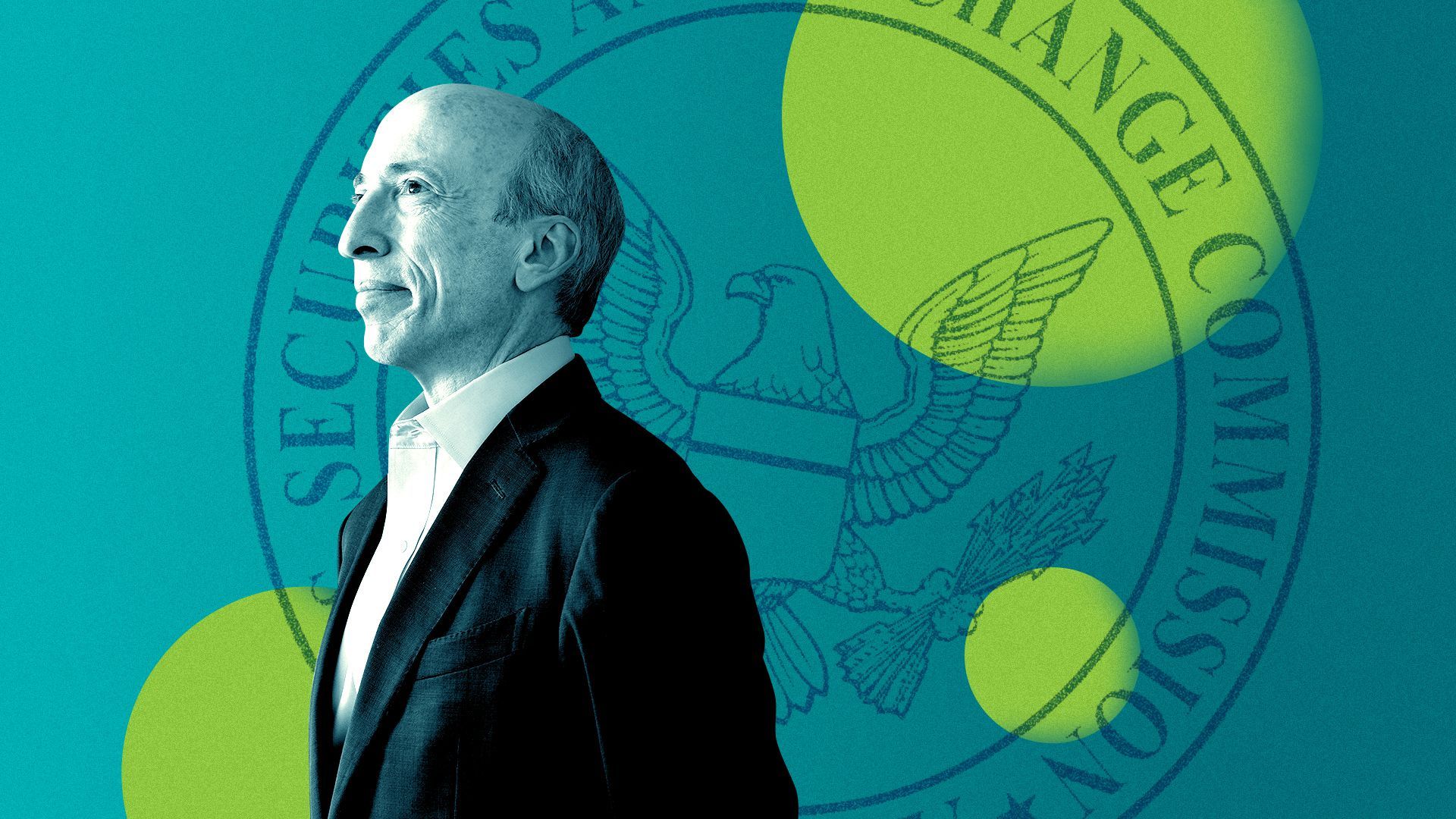

| SEC chair Gary Gensler had a big day yesterday, as his agency proposed a new level of transparency for private market funds, new rules around cybersecurity reporting, and announced it was considering a change in "market plumbing," a direct response to last year's meme stock mania, Emily and Matt write. Why it matters: Gensler's moves are just the latest sign that the former banker isn't letting up on his efforts to police the markets; with 50 new rule proposals expected this spring. - It's the largest regulatory push in decades, as CNBC noted.

Driving the news: The agency proposed new rules requiring private equity firms and hedge funds to issue detailed quarterly statements to investors, disclosing fees, as Axios' Dan Primack reported. What they're saying: Hedge funds and private equity firms, which are subject to far less scrutiny than public companies, point out their investors are sophisticated — e.g., "leave us alone," Primack explains. - "We are concerned that these new regulations are unnecessary and will not strengthen pension returns or help companies innovate and compete in a global marketplace," Drew Maloney, CEO of American Investment Council, a private equity trade group, said in a statement.

- The FT editorial board welcomed the news, PE is too important to be this opaque, it said.

Gensler also said the agency is considering shortening trade settlement times to just one day, or T+1, as Emily reported. - This is partly a response to last year's meme stock frenzy. Back then, Robinhood actually blamed T+2 for forcing it to curtail meme stock trading — though Axios' Felix Salmon explained why that excuse was a bit dodgy.

- The move to shorten trade times is less controversial and more welcomed but won't go into effect until 2024. There are a lot of players involved behind the scenes when a trade is executed — retail brokerages, intermediaries and clearinghouses.

"It's like a Broadway musical where you have to have all the dancers kicking at the same time," said James Angel, a finance professor at Georgetown University. Flashback: It's a year and change since Robinhood CEO Vlad Tenev asked for shorter trade settlement times (on Twitter, of course). What we're watching: It's going to be a busy spring for SEC watchers. Gensler's looking at regulations in ESG, insider trading, executive compensation, board diversity and more. |

No comments:

Post a Comment